AI Search Growth Rate: Market Expansion and Adoption Trends

Discover the latest AI search growth statistics, market expansion rates, and adoption trends. Learn how AI search engines like ChatGPT and Perplexity are transf...

Explore the Asia-Pacific AI search market landscape, regional differences, key platforms, and strategic implications for brands monitoring AI visibility and citations.

The Asia-Pacific AI search engine market is experiencing unprecedented expansion, valued at $3,947.5 million in 2024 and projected to reach $13,734.3 million by 2033, representing a robust 15% compound annual growth rate (CAGR). This explosive growth trajectory positions APAC as the fastest-growing region globally for AI-powered search technologies, significantly outpacing North American and European markets. The region’s dominance stems from its massive population base, rapid digital adoption, and substantial investments in artificial intelligence infrastructure by both governments and private enterprises. Countries like China, India, and Japan are driving this expansion through aggressive innovation and localization strategies tailored to their unique market conditions. The proliferation of mobile devices, increasing internet penetration, and growing consumer demand for intelligent search solutions create a perfect storm for market acceleration. APAC’s economic growth and digital transformation initiatives across multiple sectors ensure sustained momentum throughout the forecast period. Understanding this regional market dynamics is critical for any organization seeking to establish or expand its presence in AI-driven search ecosystems.

The APAC region exhibits remarkable diversity in AI search adoption, with distinct market characteristics, competitive landscapes, and technological preferences varying significantly across countries. Each nation has developed unique ecosystems shaped by regulatory environments, consumer behavior, and local technology champions that dominate their respective markets. The following table illustrates the regional segmentation and key market indicators:

| Country | Market Share | Key Platforms | CAGR | Unique Characteristics |

|---|---|---|---|---|

| China | 35.9% | Baidu, Tencent, Alibaba, ByteDance | 13.8% | Government-regulated, domestic champions, super-app integration |

| India | 14.5% | Google, Bing, local vernacular platforms | 14.6% | Mobile-first, multilingual, voice search dominant |

| Japan | 8.2% | Google, Yahoo Japan, Naver | 12.9% | Advanced market, local language optimization, high digital literacy |

| South Korea | 7.1% | Naver, Kakao, Google | 13.2% | Tech-forward, integrated digital services, strong local champions |

| Australia | 6.8% | Google, Bing | 15.2% | Mature market, high adoption rates, English-language focus |

| Malaysia | 4.5% | Google, local platforms | 14.1% | Emerging market, multilingual needs, growing mobile adoption |

| Rest of APAC | 23.0% | Mixed regional players | 14.8% | Diverse markets, varying digital maturity levels |

This segmentation reveals that while China commands the largest market share, India’s rapid growth and emerging Southeast Asian markets present substantial opportunities for AI search platform providers. The variation in CAGR across countries reflects different stages of market maturity and adoption cycles. Understanding these regional nuances is essential for developing effective market entry and expansion strategies.

China’s AI search market operates within a fundamentally different framework compared to other APAC nations, shaped by government regulation, domestic technology champions, and the “Great Firewall” that restricts foreign platform access. Baidu maintains overwhelming dominance as the primary AI search platform, controlling the vast majority of search queries and establishing the standard for AI-powered search experiences in the Chinese market. Beyond Baidu, domestic technology giants including Tencent, Alibaba, and ByteDance have developed sophisticated AI search capabilities integrated into their super-app ecosystems, creating multiple pathways for users to access AI-driven information retrieval. The Chinese government’s New Generation AI Development Plan actively encourages domestic innovation while implementing strict content moderation and algorithm transparency requirements that foreign competitors must navigate. Super-app integration represents a distinctive feature of China’s market, where search functionality seamlessly connects with e-commerce, social media, payments, and other services within unified platforms. This ecosystem approach creates significant barriers to entry for international competitors while enabling Chinese platforms to capture comprehensive user data and behavioral insights. The regulatory environment, combined with technological sophistication and massive user base, makes China’s AI search market both highly lucrative and uniquely challenging for global players.

Japan and South Korea represent mature, technologically advanced markets where local champions have successfully competed against global giants through superior localization and service integration. Naver in South Korea has established itself as a formidable competitor to Google by offering deeply integrated services including search, email, cloud storage, and social networking within a cohesive ecosystem that resonates with local users. Japan’s Society 5.0 initiative, a government-led vision for a super-smart society, has accelerated AI search adoption and integration across government services, healthcare, and enterprise applications. Both nations demonstrate exceptional digital literacy rates and high consumer expectations for sophisticated, personalized search experiences that understand cultural nuances and local language complexities. Local language optimization represents a critical competitive advantage in these markets, as Japanese and Korean linguistic structures require specialized natural language processing capabilities that global platforms must continuously refine. The integration of AI search with digital services—from banking to entertainment to transportation—creates seamless user experiences that encourage platform loyalty and sustained engagement. These advanced markets showcase how regional players can thrive through deep localization, superior user experience design, and strategic integration with complementary digital services.

India and Southeast Asia represent the most dynamic growth segments within APAC, characterized by explosive mobile adoption, massive population bases, and rapidly expanding digital infrastructure that creates unprecedented opportunities for AI search platforms. Despite Google’s commanding 92.7% search market share across Asia, emerging local platforms and specialized AI search solutions are gaining traction by addressing unique regional needs including multilingual support, vernacular content, and voice-first interfaces. Mobile-first adoption patterns in these regions fundamentally differ from developed markets, with consumers accessing AI search primarily through smartphones rather than desktop computers, necessitating optimized mobile experiences and reduced data consumption. Voice search represents a particularly significant growth vector in India and Southeast Asia, expanding at approximately 24% CAGR through 2030, driven by smartphone penetration, improving speech recognition accuracy, and cultural preferences for voice-based interaction. Multilingual and vernacular search capabilities address a critical market need, as consumers increasingly demand AI search results in regional languages rather than English, creating opportunities for platforms that invest in linguistic diversity. The emerging market dynamics in these regions are characterized by price sensitivity, preference for local payment methods, and demand for culturally relevant content and services. Organizations targeting these markets must prioritize mobile optimization, voice search integration, and multilingual content strategies to effectively compete and capture market share.

The technological infrastructure supporting AI search platforms across APAC varies significantly based on regional development levels, regulatory requirements, and specific market needs, creating diverse implementation approaches. Machine Learning technologies form the foundation of modern AI search systems, growing at 11.2% CAGR as platforms increasingly rely on sophisticated algorithms to understand user intent, personalize results, and improve ranking accuracy. Generative AI represents the fastest-growing technology segment with 12.6% CAGR, enabling platforms to create summaries, answer questions directly, and generate contextual content that enhances search experiences beyond traditional link-based results. Natural Language Processing (NLP) capabilities are particularly critical in APAC markets due to linguistic diversity, with platforms investing heavily in multilingual models that accurately process and understand content across dozens of languages and dialects. Computer Vision technologies enable image-based search, visual recognition, and multimodal search experiences that combine text, images, and video to deliver more comprehensive results. Regional technology preferences reflect different maturity levels, with advanced markets like Japan and South Korea adopting cutting-edge multimodal and generative AI technologies, while emerging markets prioritize mobile optimization and voice search capabilities. The fragmented technology landscape across APAC requires platform providers to maintain flexible, modular architectures that can be adapted to regional requirements while maintaining core functionality and performance standards.

Google’s expansion of AI Overviews to 7 APAC markets represents a watershed moment in search evolution, fundamentally changing how users discover information and how brands achieve visibility in AI-powered search results. AI Overviews generate synthesized answers directly within search results, reducing click-through rates to traditional websites and creating new visibility challenges for content creators and brands that previously relied on ranking for specific keywords. The rapid adoption of ChatGPT, Google Gemini, Perplexity, and other generative AI search platforms is reshaping user behavior, with consumers increasingly turning to AI assistants for information discovery rather than traditional search engines. This shift creates a critical visibility problem for brands: if AI systems cite competitors or fail to mention your organization in their synthesized answers, your brand becomes invisible to users relying on AI-powered search. Source citation becomes paramount in this new landscape, as the credibility and prominence of cited sources directly impact brand visibility and user trust in AI-generated results. Organizations must actively monitor how AI systems cite their content, represent their brand, and position them relative to competitors—a challenge that requires specialized tools and continuous oversight. AmICited.com provides essential monitoring capabilities for tracking AI citations, brand mentions, and visibility across AI Overviews and generative search platforms, enabling organizations to understand their presence in this critical new search paradigm and identify opportunities to improve citation frequency and prominence.

Large enterprises are leading AI search adoption across APAC, leveraging substantial capital investments, dedicated technical teams, and organizational resources to implement sophisticated AI search solutions that enhance customer experiences and operational efficiency. Small and medium-sized enterprises (SMEs) face significant adoption barriers including limited budgets, technical expertise constraints, and competing priorities that slow their transition to AI-powered search technologies despite clear competitive advantages. Cloud deployment dominates the market, accounting for 75% of AI search implementations, as organizations prioritize flexibility, scalability, and reduced capital expenditure over on-premises solutions that require substantial infrastructure investment and ongoing maintenance. On-premises solutions remain relevant for enterprises with stringent data sovereignty requirements, regulatory compliance needs, or existing technology investments that make cloud migration economically unfeasible. The organizational differences between large enterprises and SMEs create distinct market segments with different needs, budgets, and implementation timelines that require tailored solutions and support models. Enterprise adoption is accelerated by integration with existing business intelligence, customer relationship management, and data analytics platforms that create comprehensive intelligence ecosystems. SMEs increasingly access AI search capabilities through managed services, white-label solutions, and platform-as-a-service offerings that reduce technical barriers and enable smaller organizations to compete effectively despite resource constraints.

AI search technologies are transforming operations and customer experiences across diverse industry sectors throughout APAC, with each vertical developing specialized applications that address unique business challenges and opportunities. The following industries represent the most significant adoption and growth opportunities:

These industry-specific applications demonstrate the versatility of AI search technologies and the substantial value creation opportunities across diverse business sectors throughout the APAC region.

The regulatory environment for AI search platforms across APAC is rapidly evolving, with governments implementing frameworks that balance innovation encouragement with consumer protection, data privacy, and algorithmic transparency requirements. China’s New Generation AI Development Plan establishes comprehensive guidelines for AI development, content moderation, and algorithm transparency, creating a regulatory framework that domestic platforms must navigate while maintaining competitive advantage. India’s Digital India initiative promotes digital infrastructure development and AI adoption while establishing data protection requirements through the Digital Personal Data Protection Act, creating compliance obligations for platforms handling Indian user data. Japan’s Society 5.0 framework emphasizes human-centric AI development and integration with social systems, establishing expectations for responsible AI deployment and transparency in algorithmic decision-making. Data privacy regulations across APAC vary significantly, with some nations implementing strict requirements similar to GDPR while others maintain more permissive frameworks, creating compliance complexity for platforms operating across multiple jurisdictions. Algorithm transparency and explainability requirements are increasingly common, with regulators demanding that platforms can justify ranking decisions, content moderation choices, and personalization algorithms to ensure fairness and prevent discrimination. Organizations operating AI search platforms must maintain sophisticated compliance programs that address regional variations, anticipate regulatory evolution, and implement technical controls that enable transparency and accountability across diverse regulatory environments.

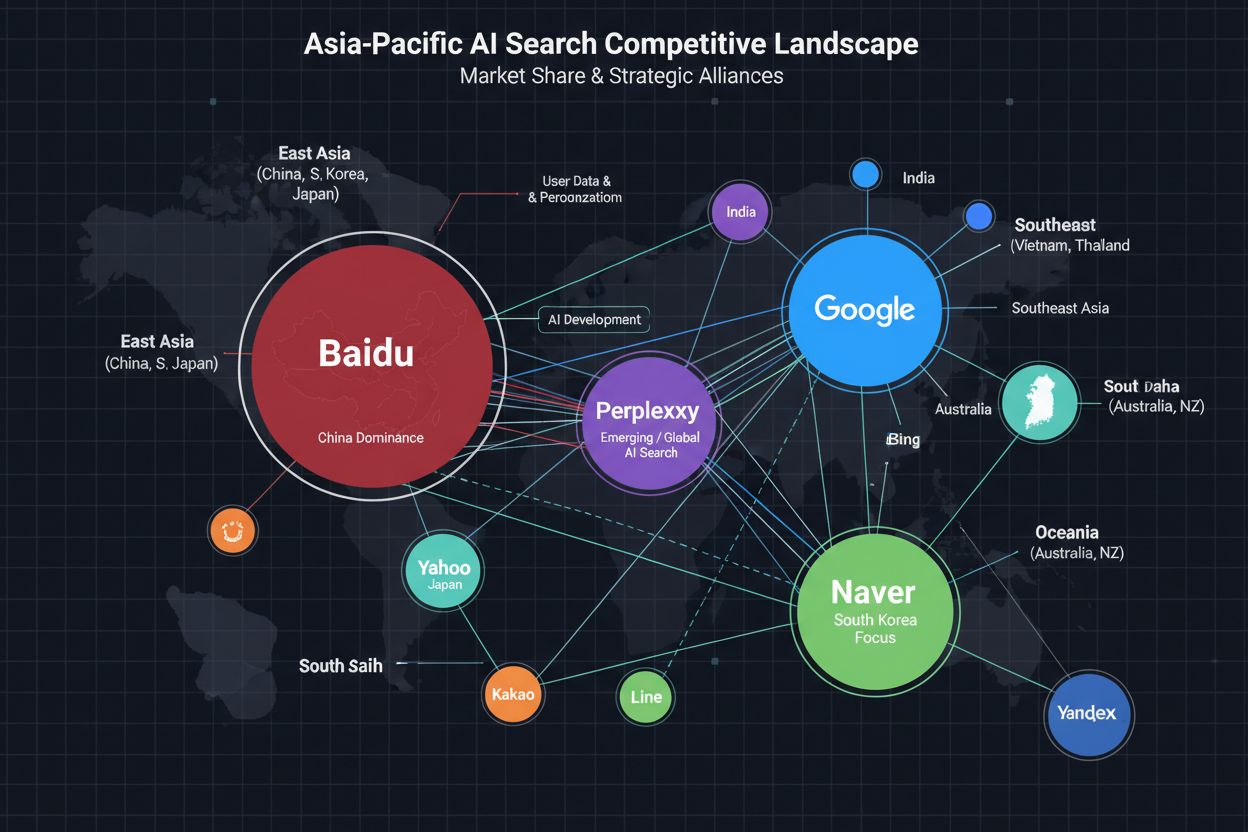

The APAC AI search market exhibits intense competition between global technology giants and resilient domestic champions, creating a dynamic landscape where regional players leverage localization advantages while international competitors deploy superior resources and technology. Google’s dominance with 92.7% search market share across Asia provides substantial advantages in data, user base, and technological resources, yet regional competitors like Baidu, Naver, and emerging platforms successfully compete through superior localization, cultural understanding, and integration with complementary services. The market remains highly fragmented outside of China and India, with multiple regional and local platforms competing for share in Japan, South Korea, Southeast Asia, and other markets, preventing any single player from achieving overwhelming dominance. Localization requirements create significant competitive advantages for domestic platforms that understand regional languages, cultural preferences, user behavior patterns, and regulatory environments better than international competitors attempting to serve diverse markets. Global players increasingly pursue acquisition and partnership strategies to accelerate localization and market penetration, acquiring local platforms, talent, and technology to compete more effectively against entrenched regional champions. The competitive dynamics favor platforms that can balance global scale and resources with local expertise and cultural sensitivity, creating opportunities for both large international players and specialized regional competitors. Market consolidation is likely to accelerate as smaller players struggle to compete against well-capitalized global and regional leaders, potentially reducing competitive intensity while increasing market concentration among dominant players.

The APAC AI search market is projected to experience sustained explosive growth through 2033, with the $13,734.3 million market value representing a 3.5x expansion from 2024 levels, driven by technological advancement, increasing consumer adoption, and expanding enterprise applications across diverse industries. Emerging trends including voice search growth at 24% CAGR, multimodal search combining text, images, and video, and AI-driven content discovery are reshaping how users interact with information and how brands achieve visibility in search results. The transition from traditional link-based search to AI-generated summaries and direct answers fundamentally changes visibility dynamics, requiring organizations to monitor how AI systems cite their content, represent their brand, and position them relative to competitors. Brands must develop comprehensive strategies for AI search visibility that extend beyond traditional search engine optimization to encompass AI citation monitoring, generative search optimization, and presence management across multiple AI platforms and interfaces. AmICited.com emerges as an essential tool for organizations seeking to understand and optimize their visibility in AI Overviews and generative search platforms, providing monitoring capabilities that track citations, brand mentions, and competitive positioning across the evolving AI search landscape. Strategic implications for organizations include investing in AI search optimization, developing content strategies tailored to generative AI systems, and implementing monitoring solutions that provide visibility into AI citation patterns and brand representation. The organizations that successfully navigate this transition by understanding regional market dynamics, implementing effective AI search strategies, and monitoring their AI visibility will capture disproportionate value from APAC’s rapidly expanding AI search market.

The Asia-Pacific AI search engine market was valued at $3,947.5 million in 2024 and is projected to reach $13,734.3 million by 2033, representing a 15% compound annual growth rate. This makes APAC the fastest-growing region globally for AI-powered search technologies.

China leads with 35.9% market share, followed by India with 14.5%. Japan, South Korea, and Australia also represent significant markets with distinct characteristics. Each country has developed unique ecosystems shaped by regulatory environments and local technology champions.

Google's expansion of AI Overviews to 7 APAC markets fundamentally changes visibility dynamics by generating synthesized answers directly in search results. Brands must now monitor how AI systems cite their content and represent their brand, as AI citation becomes critical for visibility in generative search results.

Local platforms like Baidu in China, Naver in South Korea, and emerging regional players successfully compete against global giants through superior localization, cultural understanding, and integration with complementary services. These platforms often dominate their respective markets despite Google's global dominance.

Voice search is growing at approximately 24% CAGR through 2030 in APAC, driven by smartphone penetration and cultural preferences for voice-based interaction. This is particularly significant in India and Southeast Asia, where mobile-first adoption patterns make voice search a primary interface.

Large enterprises lead adoption with substantial capital investments and dedicated teams, while SMEs face budget and expertise constraints. Cloud deployment dominates (75% of market), enabling smaller organizations to access AI search capabilities through managed services and platform-as-a-service offerings.

As AI systems like ChatGPT, Gemini, and Perplexity become primary information sources, brand visibility depends on being cited in AI-generated answers. Tools like AmICited.com help organizations track how AI systems cite their content, understand their AI visibility, and identify opportunities to improve brand representation.

Regulatory environments vary significantly across APAC, with China implementing strict content moderation, India establishing data protection requirements, and Japan emphasizing responsible AI development. Platforms must navigate diverse compliance obligations while maintaining competitive advantage across multiple jurisdictions.

Track how AI Overviews, ChatGPT, Gemini, and Perplexity cite your brand across Asia-Pacific markets. Understand your AI search visibility and optimize your presence in generative search results.

Discover the latest AI search growth statistics, market expansion rates, and adoption trends. Learn how AI search engines like ChatGPT and Perplexity are transf...

Discover the current AI search market size, growth forecasts through 2035, and how AI search engines like ChatGPT and Perplexity are reshaping the search landsc...

Discover proven revenue strategies for monetizing AI traffic. Learn licensing deals, GEO optimization, and diversified income streams for publishers in the AI e...