What is the AI Dark Funnel? Complete Guide to Hidden Customer Journeys

Understand the AI dark funnel - the invisible part of customer journeys happening in ChatGPT, Perplexity, and AI search engines. Learn how to monitor and optimi...

Master AI visibility for your SaaS company. Learn GEO strategies, structured data optimization, and how to get recommended by ChatGPT, Gemini, and Perplexity. Complete playbook inside.

The way B2B buyers research solutions has fundamentally shifted, and most SaaS companies haven’t adapted their visibility strategy accordingly. 79% of B2B buyers have changed their research process due to AI, yet traditional marketing metrics remain fixated on search rankings and organic traffic. AI Overviews now appear in 13% of global searches, creating a new layer of visibility that exists entirely outside traditional SEO metrics. This phenomenon has created what industry experts call the “AI Dark Funnel”—a critical stage where prospects make informed decisions about your company using AI tools like ChatGPT, Perplexity, and Google’s AI Overviews before they ever contact your sales team.

SaaS companies operate in a uniquely complex environment where AI visibility challenges are amplified compared to other industries. Unlike e-commerce or content-driven businesses, SaaS purchasing decisions involve multiple stakeholders, extended evaluation periods, and feature-driven comparisons that require nuanced understanding of product capabilities. The buying journey is non-linear—prospects jump between review platforms, comparison sites, analyst reports, and AI tools, making it nearly impossible to track the complete customer journey. Additionally, SaaS companies rely heavily on third-party validation and social proof because the products are often intangible and require trust-based purchasing decisions. The stakes are higher because a single AI recommendation can influence thousands of dollars in annual contract value.

SaaS companies specifically struggle with:

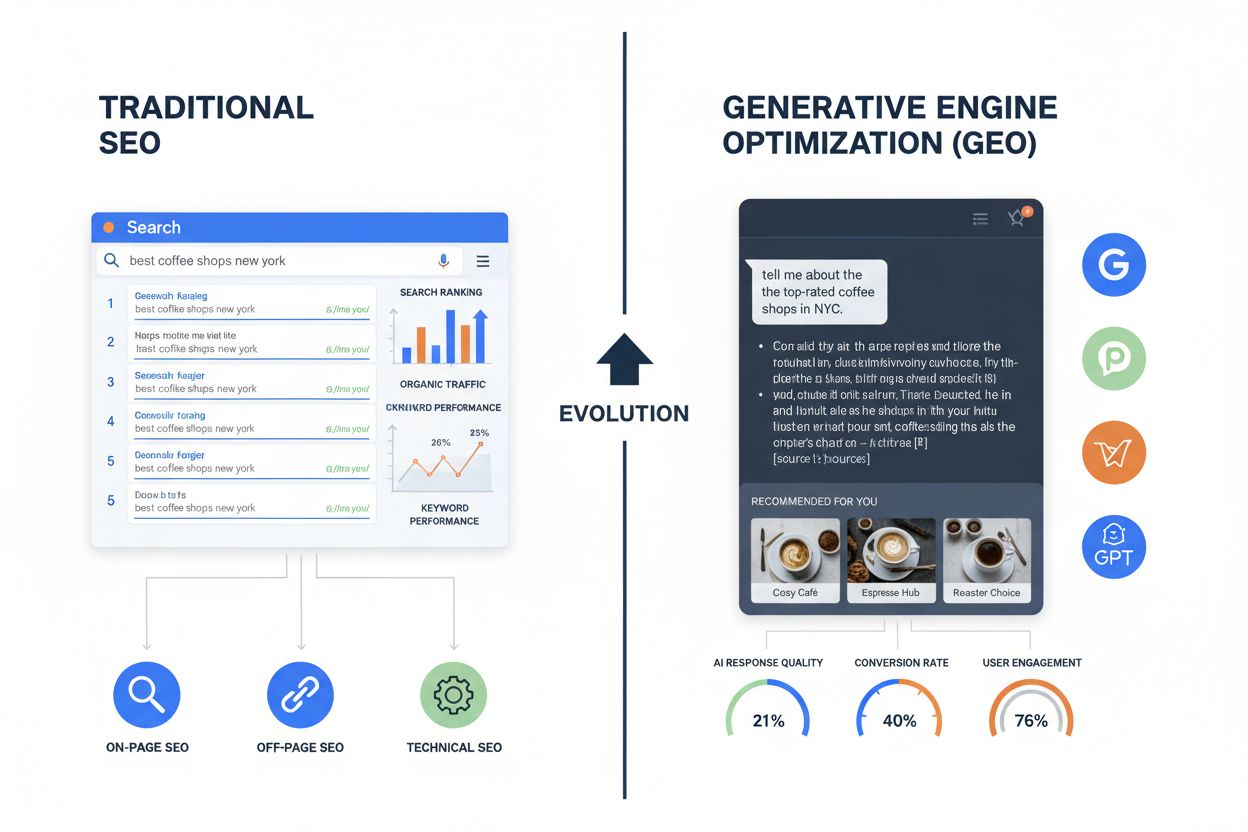

Generative Engine Optimization (GEO) is the practice of optimizing your content, data, and digital presence to be discovered, cited, and recommended by AI language models and generative AI systems. While SEO optimizes for search engine algorithms, GEO optimizes for how AI models evaluate, synthesize, and present information to users. The fundamental difference lies in how these systems process information: search engines rank individual pages based on relevance signals, while AI models ingest vast amounts of training data and synthesize recommendations based on patterns, authority, and consensus. GEO requires a different approach because AI models prioritize authoritative sources, structured data, and factual accuracy over keyword density and backlink profiles. Understanding this distinction is critical because a page can rank well in Google while being completely invisible to ChatGPT or Perplexity.

| Aspect | GEO (Generative Engine Optimization) | Traditional SEO |

|---|---|---|

| Focus | AI model training data and synthesis | Search engine ranking algorithms |

| Primary Metric | Citation frequency and sentiment | Keyword rankings and organic traffic |

| Data Source | Review platforms, structured data, authoritative mentions | Backlinks, on-page signals, user behavior |

| Trust Signal | Third-party validation and consensus | Domain authority and link profile |

| Content Goal | Factual, citable, synthesizable information | Keyword-optimized, click-worthy content |

| Measurement | Citation tracking and AI recommendation frequency | Rankings, impressions, click-through rate |

Effective AI visibility for SaaS companies rests on three interconnected pillars that work together to create a defensible competitive advantage. Pillar 1: B2B Review Platforms serve as the primary data source for AI models evaluating SaaS solutions, making them non-negotiable for visibility. Pillar 2: Comparative Content Engineering ensures your company appears in the synthesis phase when AI models answer “which tool should I use” questions. Pillar 3: E-E-A-T Authority Building establishes your company as a credible source that AI models trust and cite. These three pillars are interdependent—strong review presence feeds into authority signals, comparative content drives review generation, and authority content attracts media mentions that reinforce all three pillars. Companies that excel in all three areas see 2.8x higher inclusion in AI recommendations compared to competitors who focus on only one pillar. The strategy requires simultaneous execution across all three areas because gaps in any single pillar create vulnerabilities that competitors can exploit.

The three-pillar framework breaks down as follows:

B2B review platforms have become the primary data source for AI models evaluating SaaS solutions, making them essential infrastructure for AI visibility. AI language models prioritize review platform data because it represents aggregated user feedback, verified customer experiences, and consensus-based ratings that align with how these models evaluate trustworthiness. Platforms like G2, Capterra, and Trustpilot are explicitly included in many AI training datasets, and their structured data (ratings, reviews, feature lists) is easily parsed and synthesized. The recency of reviews matters significantly—AI models weight recent customer feedback more heavily than older reviews, making continuous review generation a strategic imperative rather than a one-time effort. A company with 50 recent reviews will appear in AI recommendations far more frequently than a competitor with 200 reviews from two years ago. Profile optimization goes beyond basic information; it includes detailed feature descriptions, use case documentation, and integration listings that help AI models understand your product’s capabilities. Systematic review generation programs—where you actively encourage satisfied customers to leave reviews—directly correlate with increased AI visibility and recommendation frequency.

When prospects ask AI tools “Should I use [Your Company] or [Competitor]?”, the quality of your comparative content directly determines whether you appear in the response. “Us vs Them” content serves a dual purpose: it ranks in traditional search for comparison queries while simultaneously providing AI models with structured, factual information about how your solution compares to alternatives. The most effective comparative content uses HTML tables with clear feature matrices, making it trivially easy for AI models to extract and synthesize comparison data. Rather than subjective claims, the best comparative content focuses on factual, verifiable differences—pricing tiers, feature availability, integration capabilities, deployment options—that AI models can confidently cite without appearing biased. For example, a comparison table showing that your product supports 47 integrations while a competitor supports 23 is a factual claim that AI models will cite; a claim that your product is “more intuitive” is subjective and less likely to appear in AI recommendations. Competitive positioning through comparative content also serves as a citation magnet—when your comparison content is accurate and comprehensive, other companies and review sites link to it, further amplifying your authority signals. The strategic advantage comes from being the first to comprehensively document comparisons in your category, establishing your framing as the default reference point.

E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) has evolved from a Google ranking factor into a critical AI visibility signal that determines whether language models cite your company as a credible source. AI models are trained on content from authoritative sources, and they learn to recognize and prioritize citations from companies and individuals with demonstrated expertise in their field. Building E-E-A-T authority requires a multi-channel approach: original research that provides new insights into your market, media mentions in reputable publications, analyst coverage from firms like Gartner and Forrester, and digital PR that amplifies your thought leadership. Each of these elements signals to AI models that your company is a credible, authoritative voice worth citing. The compounding effect is powerful—a company with 10+ authoritative mentions sees 2.8x higher inclusion in AI recommendations compared to competitors without this validation. Unlike traditional SEO authority, which can take years to build through backlinks, E-E-A-T authority for AI visibility can be accelerated through strategic media outreach, analyst relations, and original research publication. The long-term advantage comes from building a defensible moat where your authority becomes self-reinforcing: more citations lead to more visibility, which attracts more media attention, which generates more citations.

Structured data is the bridge between human-readable content and machine-readable information that AI models can reliably extract and synthesize. Schema markup (JSON-LD, microdata, RDFa) tells AI systems exactly what information is on your page—product details, pricing, reviews, FAQs—in a standardized format that eliminates ambiguity. The impact is quantifiable: companies implementing comprehensive schema markup see 38% more visibility in AI systems compared to competitors relying on unstructured content alone. For SaaS companies, the most critical schema types are Product schema (for core product information), FAQ schema (for common questions), Review schema (for customer testimonials), and Pricing schema (for transparent pricing information). Implementing these schemas correctly requires consistency across your entire digital presence—your website, review platforms, and any third-party listings must present the same information in the same format. The compounding effect is significant: companies combining FAQ schema with Review schema see 3.7x increase in citations from AI models compared to companies using neither. Structured data should be treated as a living system that requires quarterly audits and updates to ensure accuracy as your product evolves, pricing changes, and new features launch.

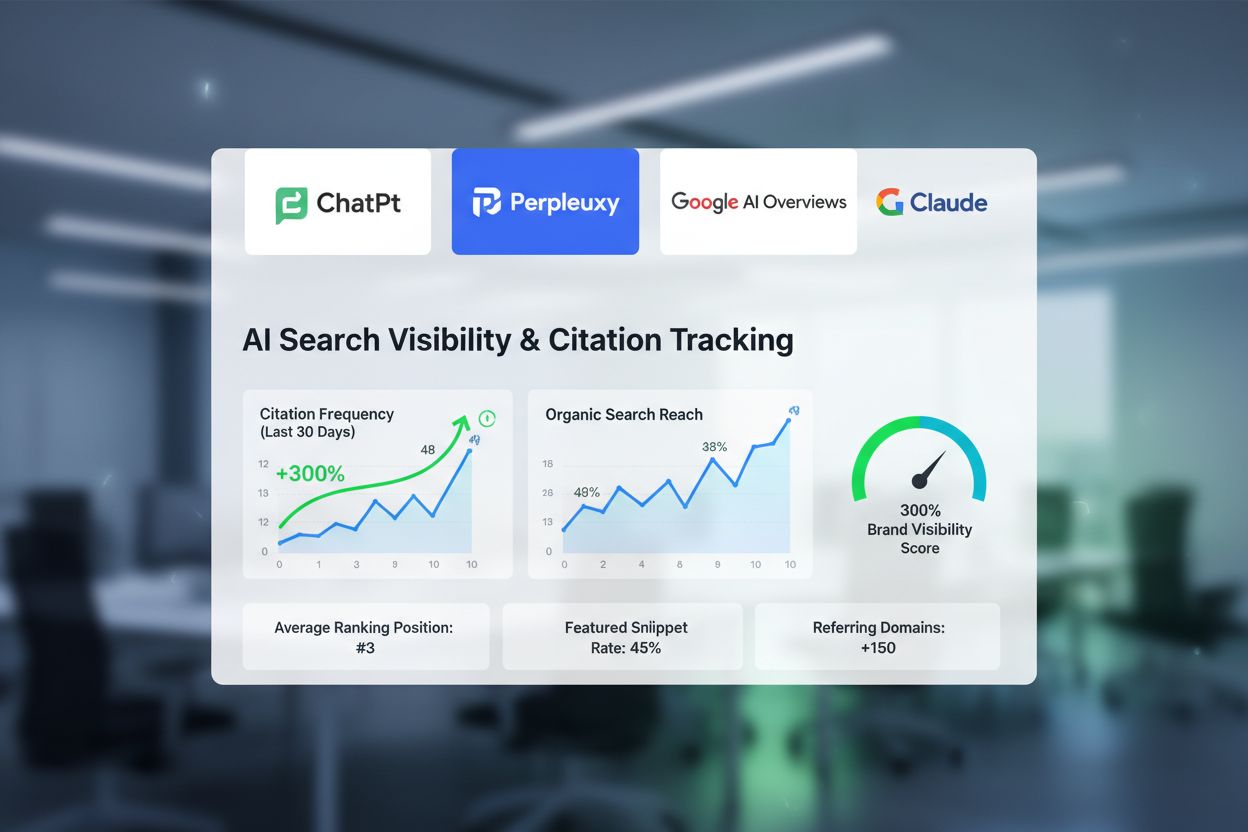

Traditional marketing metrics like search rankings and organic traffic are increasingly insufficient for measuring AI visibility because they don’t capture how AI systems discover, evaluate, and recommend your company. Citation score—the frequency and sentiment of mentions across AI systems—is a more relevant metric than keyword rankings for understanding AI visibility. The distinction between explicit mentions (where AI systems directly name your company) and implicit mentions (where your content is synthesized without attribution) is critical for understanding your true AI footprint. Sentiment analysis of AI-generated responses reveals whether your company is being recommended positively, neutrally, or negatively, which directly impacts conversion rates. Competitive benchmarking shows how frequently your company appears in AI recommendations compared to direct competitors, revealing gaps in your strategy. Intent-based tracking categorizes AI mentions by the type of query—comparison queries, feature questions, pricing inquiries—to understand which parts of your market positioning are resonating with AI systems. Companies that track AI visibility see 56.3% higher conversion rates from AI-sourced leads compared to companies that don’t monitor their AI presence. Measurement tools specifically designed for AI visibility (like AmICited.com) track mentions across multiple AI systems (ChatGPT, Google Gemini, Perplexity, Claude) simultaneously, providing the comprehensive view necessary for strategic decision-making.

Monitoring your AI visibility across multiple language models and AI systems is no longer optional—it’s essential infrastructure for competitive SaaS companies. Multi-LLM tracking across ChatGPT, Google Gemini, Perplexity, and Claude reveals that your company may be visible in some AI systems while completely absent from others, requiring targeted optimization strategies for each platform. Implicit mention detection identifies when your content is being synthesized and cited without explicit attribution, capturing the full scope of your AI visibility rather than just direct mentions. The fusion of sentiment analysis with visibility metrics shows not just how often you’re mentioned, but whether those mentions are positive, negative, or neutral—a critical distinction for understanding actual impact on buyer decisions. Competitive intelligence features reveal exactly how your AI visibility compares to competitors, identifying specific gaps and opportunities for differentiation. Rather than relying on manual searches or anecdotal evidence, dedicated monitoring tools provide systematic, quantifiable data about your AI presence across the entire landscape. AmICited.com specifically addresses the SaaS visibility challenge by tracking how your company appears in AI-generated responses to common buyer questions, providing actionable insights about what’s working and what needs improvement. The ROI of monitoring becomes clear when you can directly correlate improvements in AI visibility with increases in inbound leads and conversion rates.

Implementing a comprehensive AI visibility strategy requires a structured approach that builds momentum while delivering quick wins that justify continued investment. The implementation roadmap spans 90 days for initial setup and 12+ months for full maturity, with clear milestones and measurable outcomes at each stage.

Phase 1: Audit and Assessment (Weeks 1-2)

Phase 2: Quick Wins (Weeks 3-6)

Phase 3: Content Engineering (Weeks 7-12)

Phase 4: Authority Building (Months 4-6)

Phase 5: Monitoring and Optimization (Ongoing)

Most SaaS companies fail at AI visibility not because the strategy is complex, but because they make preventable mistakes that undermine their efforts. Ignoring review platforms is the most common mistake—companies that treat review platforms as secondary to their website strategy miss the primary data source that AI models use for product evaluation. Outdated information across platforms creates confusion for AI systems; if your website says you support 50 integrations but your G2 profile says 30, AI models will struggle to synthesize accurate information and may default to competitor data. Lack of schema markup means your content remains invisible to AI systems even if it’s high-quality and comprehensive—AI models can’t reliably extract information from unstructured text. Inconsistent messaging across your website, review platforms, and media mentions creates conflicting signals that reduce your credibility in AI systems; your value proposition, feature descriptions, and positioning must be consistent everywhere. Ignoring implicit mentions leads to underestimating your true AI visibility; many companies only track explicit mentions and miss the significant portion of their visibility that comes from content synthesis without attribution. Reactive approach to AI visibility—only responding after noticing poor recommendations—means you’re always behind competitors who are proactively building visibility. Measurement gaps prevent you from understanding what’s working; companies that don’t track AI visibility can’t optimize their strategy or justify continued investment to leadership.

The AI landscape is evolving rapidly, and SaaS companies must build flexibility into their AI visibility strategy to remain competitive as new models, platforms, and capabilities emerge. Model evolution means that optimization strategies that work today may need adjustment as new versions of ChatGPT, Gemini, and other models are released with different training data and evaluation criteria. Multimodal content (combining text, images, video, and interactive elements) is becoming increasingly important as AI systems develop better capabilities for processing non-text information; companies that only optimize text content will lose visibility as multimodal content becomes the norm. Voice search and conversational AI are expanding beyond text-based queries, requiring optimization for how people naturally ask questions rather than how they type search queries. International expansion of AI systems means that companies serving global markets must optimize for AI visibility in multiple languages and regions, not just English-speaking markets. Continuous monitoring of your AI visibility must become a permanent function, not a one-time project; the competitive landscape changes too quickly for annual audits to be sufficient. New platforms and AI systems will inevitably emerge, requiring flexibility to adapt your strategy to new distribution channels and recommendation systems. The companies that build sustainable competitive advantage in AI visibility are those that treat it as an ongoing strategic priority rather than a tactical initiative, continuously monitoring, testing, and optimizing their presence across the evolving AI landscape.

GEO focuses on how AI models cite and recommend your brand in generated answers, while SEO optimizes for search engine rankings. Both are important, but GEO addresses the new AI-driven discovery layer that's reshaping how B2B buyers research solutions.

Initial improvements can appear within 72 hours to 2 weeks for well-structured content. Significant visibility gains typically take 3-6 months as authority builds and citations accumulate across multiple AI systems.

ChatGPT, Google Gemini, and Perplexity are the primary platforms. However, Claude, Bing Copilot, and emerging platforms should also be monitored as they grow in adoption and influence buyer decisions.

Extremely important. AI models heavily weight structured data from G2, Capterra, and Trustpilot. These platforms are often the primary source of verified product information that AI systems use for recommendations.

Product, FAQ, Review, and Pricing schema are most critical. These help AI models understand your offerings, answer common questions, and evaluate your product objectively compared to competitors.

Track citation frequency, sentiment, competitive share-of-voice, and downstream traffic from AI-referred sources. B2B leads from AI search convert 56.3% higher than traditional search, making this a powerful metric for ROI calculation.

Yes. Niche positioning, specialized content, and consistent optimization can help smaller companies dominate their specific categories in AI answers, often outperforming larger competitors in targeted segments.

They're complementary. AI models pull heavily from top-ranking web content, so strong SEO fundamentals support GEO success. The best strategy combines both approaches for maximum visibility across all discovery channels.

See how often your SaaS brand is mentioned across ChatGPT, Gemini, and Perplexity. Get actionable insights to improve your AI search visibility and capture high-intent buyers.

Understand the AI dark funnel - the invisible part of customer journeys happening in ChatGPT, Perplexity, and AI search engines. Learn how to monitor and optimi...

Discover how TechFlow Solutions achieved 300% AI citation growth and 185% qualified traffic increase through strategic GEO optimization. Real case study with ac...

Community discussion on how the buyer journey differs in AI search. Understanding customer paths through ChatGPT, Perplexity, and AI Overviews vs traditional se...