What Does AI Visibility Success Look Like?

Learn what AI visibility success means and how to measure it. Discover key metrics, benchmarks, and tools to track your brand's presence in ChatGPT, Perplexity,...

Explore real case studies of brands achieving AI visibility success. Learn how Netflix, Sephora, and Spotify dominate AI search while others like Chegg collapse. Discover proven strategies for your brand.

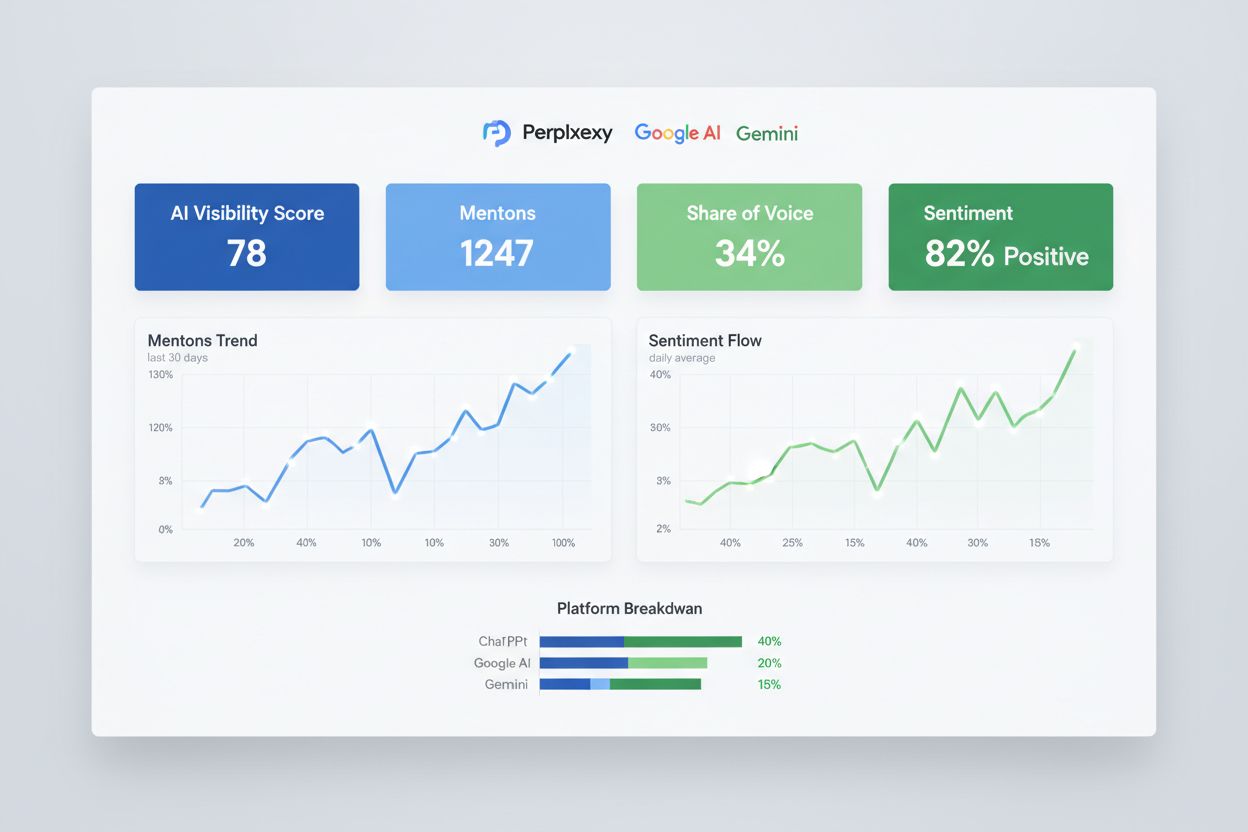

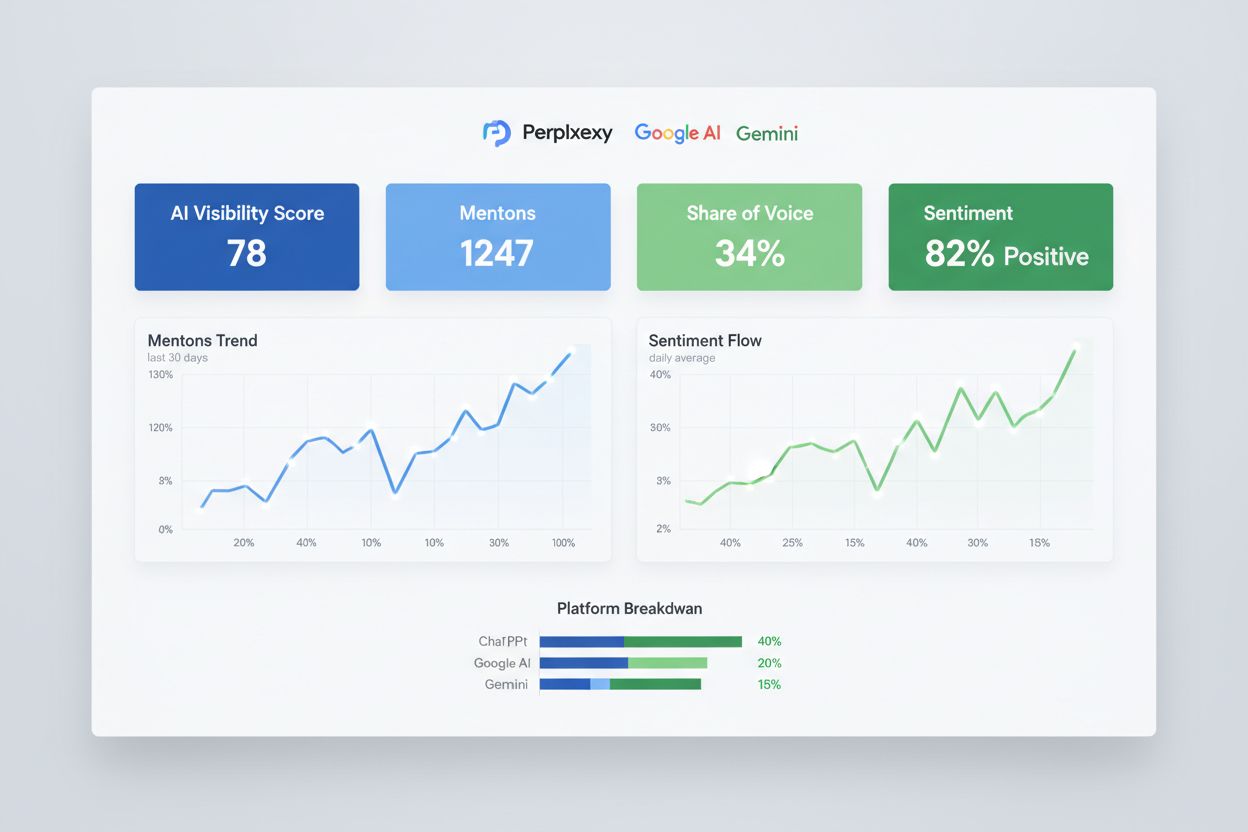

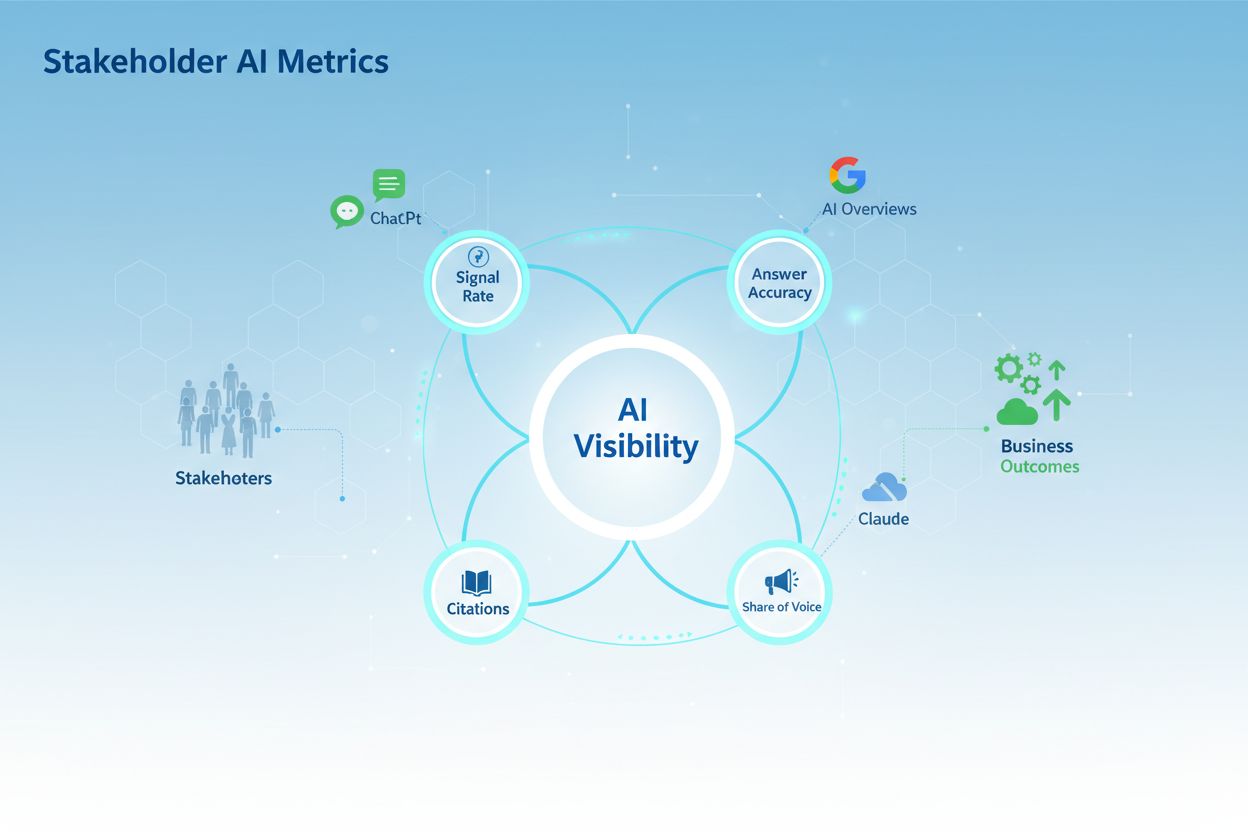

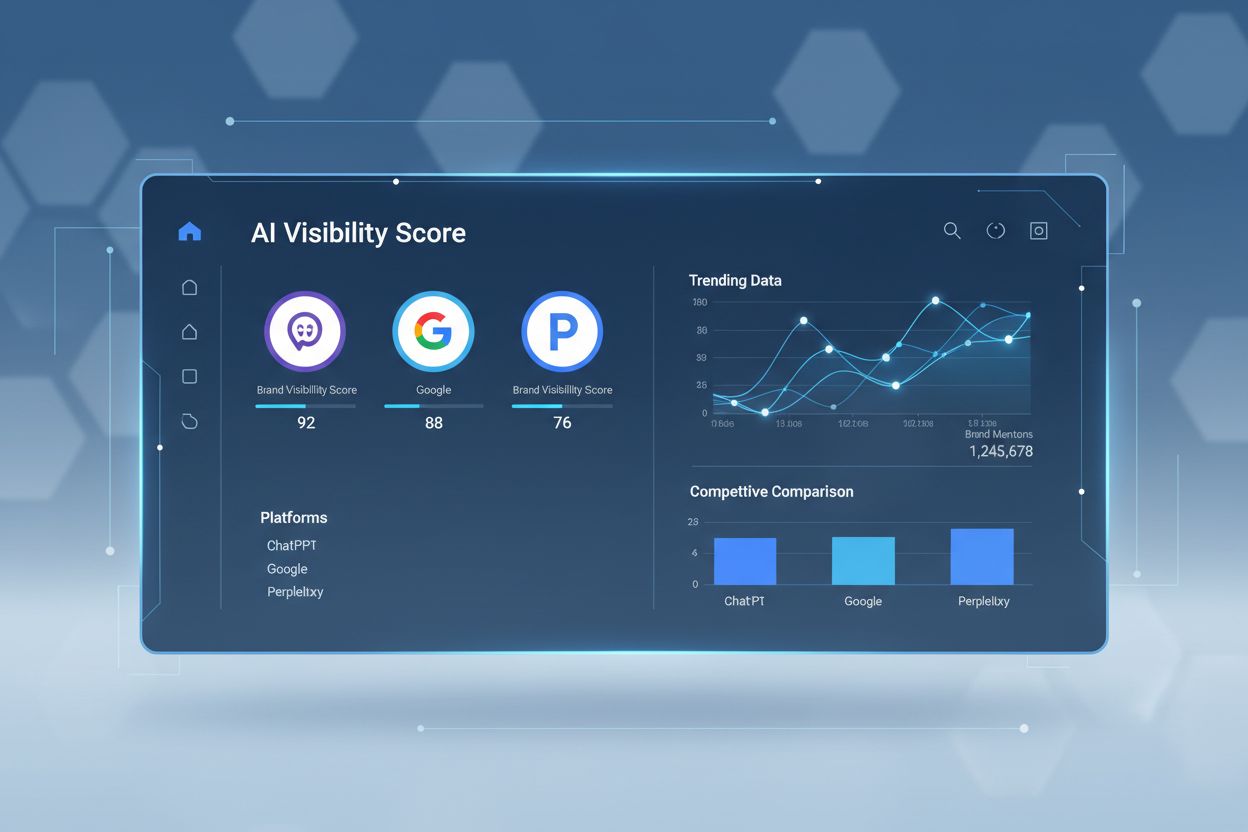

AI visibility represents a fundamental shift in how brands achieve discovery in the digital landscape. Unlike traditional search engine optimization that focuses on ranking positions in the “10 blue links,” AI visibility measures how frequently and prominently your brand appears when artificial intelligence systems like ChatGPT, Perplexity, Google AI Overviews, and Claude generate answers to user questions. The core metrics that define success in this new paradigm include Share of Voice (the percentage of relevant AI-generated responses mentioning your brand compared to competitors), citation frequency (how often your brand appears across AI platforms), and sentiment analysis (whether mentions are positive, neutral, or negative). When brands optimize for AI visibility, they’re essentially competing to become the answer itself rather than simply appearing as a clickable link. This distinction matters profoundly because AI platforms now influence up to 70% of consumer decision-making, with users increasingly trusting AI-synthesized answers over traditional search results.

Netflix stands as the definitive case study in leveraging AI visibility to drive business success at scale. The streaming giant’s recommendation engine processes over 500 billion daily events through sophisticated collaborative filtering, content-based filtering, and deep learning algorithms to deliver personalized content suggestions to 260 million subscribers worldwide. The business impact is staggering: over 80% of content consumed on Netflix comes through AI-powered recommendations rather than user browsing or search, generating an estimated $1 billion in annual customer retention value. The company’s recommendation system operates through 1,300 distinct recommendation clusters, each designed to match specific user taste profiles with relevant content from a catalog exceeding 3,000 titles. This investment in AI visibility has translated into remarkable customer loyalty metrics—Netflix maintains a churn rate between 1.8% and 2.3%, among the lowest in the streaming industry, with subscribers remaining active for an average of 4.6 years compared to the industry average of 2.1 years.

| Metric | Netflix | Industry Average |

|---|---|---|

| Churn Rate | 1.8-2.3% | 5% |

| Average Subscriber Lifetime | 4.6 years | 2.1 years |

| Customer Retention Rate | 98.2% | 85% |

| Recommendation-Driven Consumption | 80% | 35% |

| Lifetime Customer Value | $836.83 | $420 |

| Customer Acquisition Cost | $88.60 | $95 |

| ROI on Personalization | 10x | 3x |

The retention economics reveal why Netflix’s AI visibility strategy generates such compelling returns. When subscribers cancel, 50% return within six months and 61% within a year—compared to an industry average of just 34% for competitors. Users who actively engage with Netflix’s recommendation features are twice as likely to remain active subscribers, demonstrating that AI visibility directly correlates with customer lifetime value. The company’s hybrid recommendation system combines multiple AI approaches: collaborative filtering analyzes patterns among users with similar tastes, content-based filtering examines metadata like genre and cast, and deep learning through Personalized Video Ranking (PVR) prioritizes content based on historical viewing behavior. This multi-layered approach ensures that Netflix’s AI visibility extends beyond simple content suggestions to become the primary discovery mechanism for the entire platform.

Sephora transformed its digital business by recognizing that AI visibility extends beyond search results into the customer experience itself. The beauty retailer’s flagship innovation, Virtual Artist, launched in 2016 as an augmented reality feature powered by AI algorithms that analyze facial geometry and simulate real-time makeup application. The results have been extraordinary: customers using Virtual Artist are 3 times more likely to complete purchases, with conversion rates increasing by 11% and product returns declining by 30%. The feature has been tried on over 200 million makeup shades across 8.5 million feature visits, with average app session time jumping from 3 minutes to 12 minutes—a 300% increase in engagement. Sephora’s broader e-commerce transformation demonstrates how AI visibility drives revenue growth: net e-commerce sales grew from $580 million in 2016 to over $3 billion in 2022, a 4x increase driven largely by AI and digital innovations.

Key Sephora AI Visibility Achievements:

The Sephora case demonstrates that AI visibility operates across multiple dimensions beyond traditional search. The Reservation Assistant feature achieved 11% higher booking rates within two years of launch. AI-powered product recommendations boosted average transaction sizes by up to 30%. The company’s omnichannel approach—making Virtual Artist available across mobile, web, and in-store kiosks—ensured that AI visibility translated into tangible sales across all customer touchpoints. Sephora’s success reveals a critical insight: brands that make AI visibility a core product feature rather than a backend optimization achieve dramatically higher returns on their AI investments.

Spotify operates at the intersection of AI visibility and user engagement, with 640 million monthly active users relying on AI-powered discovery features to navigate a catalog of over 100 million songs. The company’s flagship feature, Discover Weekly, delivers a personalized 30-song playlist to each user every Monday, generating over 5 billion streams annually and engaging 40 million users weekly. Subscribers who actively use Spotify’s AI features demonstrate remarkable engagement patterns: they listen an average of 140 minutes per day compared to 99 minutes for non-AI users—a 41% increase in listening time. The AI DJ feature, which provides personalized music commentary and recommendations, drives particularly strong engagement: on days users activate AI DJ, 25% of their total listening time goes to the feature, over 50% return the next day, and overall retention increases by 15%.

Spotify’s approach to AI visibility treats algorithms as the product itself rather than backend infrastructure. The company processes 500+ billion daily events through collaborative filtering, content-based filtering, natural language processing, and deep learning to build rich taste profiles for each user. This investment in AI visibility has generated measurable business impact: AI-targeted advertising revenue increased 17% year-over-year, premium subscriptions grew 12% to 252 million, and users spending time with AI features show 2x higher lifetime value. The Wrapped feature, Spotify’s annual personalization experience, demonstrates the cultural power of AI visibility—Wrapped 2024 generated 225 million shares and drove 10% user growth, with users spending 50% more time in the experience than previous years. Spotify’s success illustrates that AI visibility becomes most powerful when it’s woven into the core product experience rather than treated as a marketing optimization.

Amazon’s recommendation engine represents the gold standard for e-commerce AI visibility, driving 35% of all purchases across the platform—a staggering figure that underscores how completely AI has become embedded in customer discovery. The company’s system analyzes billions of signals including purchase history, search behavior, scrolling patterns, view duration, product ratings, and customer reviews to predict what individual customers will buy next. Amazon’s bounce rate of 35% significantly outperforms competitors like Walmart (50%) and Target (45%), while 56% of customers who interact with Amazon recommendations become repeat buyers. The company employs a hybrid recommendation architecture combining collaborative filtering (matching similar users and similar products), content-based filtering (analyzing product attributes and descriptions), and deep learning models that adapt to changing customer behavior in real-time.

Amazon’s recommendation engine became an industry benchmark after the company invested heavily in this capability, even sponsoring the 2006 Netflix Prize offering $1 million to anyone who could improve recommendations by 10%. The business impact justifies this investment: companies implementing similar recommendation engines now see approximately 35% higher conversion rates and up to 20% sales lifts. The global recommendation engine market, valued at $5.39 billion in 2024, is projected to exceed $100 billion within the next five years, with Amazon’s system serving as the template that competitors attempt to replicate. The company’s success demonstrates that AI visibility in e-commerce isn’t a nice-to-have feature—it’s the primary driver of customer discovery and revenue growth.

Chegg’s dramatic collapse serves as a sobering reminder that even established market leaders can become invisible overnight when AI disrupts their core value proposition. The online education platform, once valued at $14.5 billion with a market capitalization that made it a darling of growth investors, has lost 99% of its stock value since 2021. The catalyst was ChatGPT’s launch in November 2022, which offered free homework help that directly replaced Chegg’s core $767 million subscription business built on a database of 79+ million solved problems. On May 2, 2023, Chegg’s stock fell 48% in a single day after CEO Dan Rosensweig admitted that ChatGPT was materially hurting the business. Since that announcement, the company has laid off 45% of its workforce, closed offices across the United States and Canada, and watched its subscriber base collapse.

The financial deterioration has been relentless. Total subscribers dropped 40% year-over-year to 2.6 million by Q2 2025, with Q2 revenue falling 36% year-over-year to just $105.1 million. The company guided Q3 2025 revenue to only $75-77 million, representing a 65% decline from prior-year levels. Student behavior shifted dramatically: a Needham survey found that only 30% of students planned to use Chegg in the current semester, down from 38% the prior semester, while intent to use ChatGPT jumped from 43% to 62%. Non-subscriber traffic to Chegg’s website fell 49% between January 2024 and January 2025. Students’ rationale for abandoning Chegg was blunt: ChatGPT is “free, instant, and you don’t have to worry if the problem is there or not.” Chegg’s attempted pivots to AI-powered tools—including CheggMate with OpenAI’s GPT-4 and later partnerships with Scale AI—failed to convince investors or users that the company could offer an experience “meaningfully better than free alternatives,” as Morgan Stanley analysts noted. The company’s plan to cut $165-175 million in 2025 expenses looks less like a growth strategy and more like a fight for survival.

The impact of AI visibility extends beyond individual brands to reshape entire industries. Major publishers have experienced catastrophic traffic declines as AI Overviews eliminate the need for users to click through to websites. Zero-click searches—where users get their answer directly from AI without visiting any website—increased from 56% in May 2024 to 69% in May 2025, a 13-percentage-point shift in just one year. Organic search referral traffic to publishers dropped from 2.3 billion US visits in July 2024 to 1.8 million by June 2025, representing a 22% decline in absolute traffic volume. News searches ending without clicks jumped from 56% to nearly 69% after Google launched AI Overviews at scale. Of the top 50 US news websites analyzed, 37 experienced year-over-year traffic declines in May 2025.

| Publisher | Traffic Decline | Timeframe |

|---|---|---|

| Business Insider | -55% | April 2022 to April 2025 |

| HuffPost | -50%+ | Three-year period |

| Washington Post | -50%+ | Three-year period |

| CNN | -27% to -38% | Year-over-year (2024-2025) |

| Forbes | -50% | Year-over-year (July 2025) |

| NBC News | -42% | Year-over-year |

The mechanism driving these declines is straightforward: when AI Overviews appear in search results, click-through rates drop 46.7%, with users clicking on results just 8% of the time compared to 15% without AI summaries. AI Overviews now appear in approximately 19-20% of US desktop searches, averaging around 169 words and pushing the first organic result down to approximately 1,674 pixels on the page. DMG Media reported nearly 90% click declines for certain search queries. The Atlantic’s CEO warned staff to expect near-zero Google search traffic going forward. Publishers are pivoting away from search-dependent business models toward subscriptions, newsletters, and live events—channels that AI cannot intermediate. This shift represents a fundamental restructuring of digital media economics, where direct relationships with audiences become more valuable than algorithmic discovery.

Google’s March 2024 core update targeted low-quality AI-generated content at scale, deindexing over 1,400 websites and removing an estimated 20 million monthly visits from the search ecosystem. The update’s explicit goal was to reduce unhelpful, unoriginal content by up to 40%, addressing the proliferation of scaled AI content created primarily to manipulate search rankings rather than serve user needs. Out of 79,000 websites analyzed, 1,446 received manual actions from Google’s spam team, with over 800 completely deindexed in the early stages. These deindexed sites collectively drove over 20 million monthly visits and lost an estimated $446,552+ in ad revenue.

Analysis of 200 deindexed sites and 40,000 URLs revealed a stark pattern: 100% showed signs of AI-generated content, with half having 90-100% of their posts generated by AI. The update specifically targeted “scaled content abuse”—vast quantities of content created to manipulate rankings rather than benefit users. Sites that survived the update shared common characteristics: original reporting with named author expertise, strong E-E-A-T (Expertise, Authoritativeness, Trustworthiness) alignment, human editorial oversight of all content, comprehensive structured data implementation, and content designed to help readers rather than game algorithmic systems. This update demonstrated that Google’s AI visibility algorithms distinguish between authentic content created to serve users and manipulative content created to exploit algorithmic patterns. Brands seeking sustainable AI visibility must prioritize quality, authenticity, and genuine user value over scaled content production.

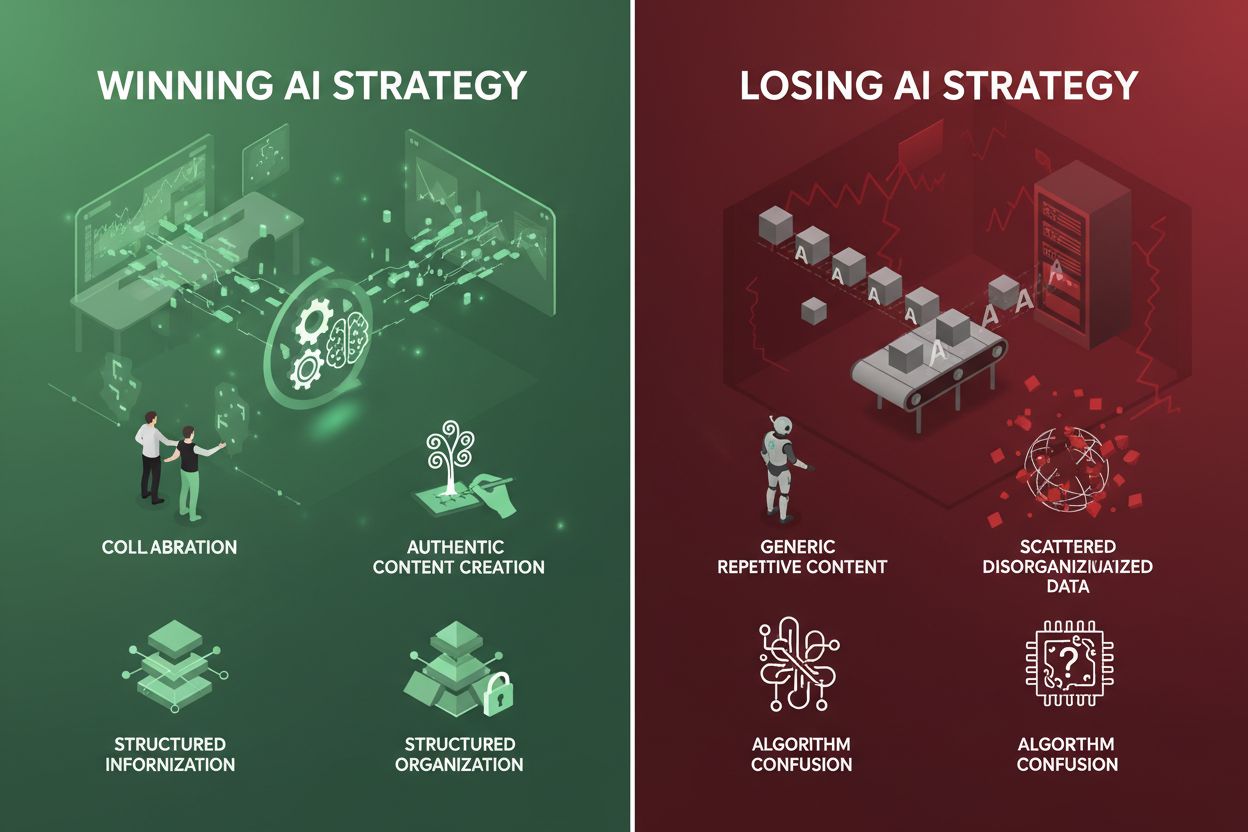

The gap between brands thriving in AI visibility and those struggling reveals fundamental strategic differences in how organizations approach artificial intelligence. Winning brands like Netflix, Sephora, Spotify, and Amazon share a common approach: they invest in first-party data as their most valuable strategic asset, implement human-AI collaboration where AI drafts and humans provide strategy and oversight, maintain consistent brand signals across all platforms, create content that delivers authentic value rather than manipulating systems, and establish strong data governance with transparent collection and privacy compliance. These organizations treat AI as a tool to enhance human creativity and judgment rather than replace it. Losing brands make opposite choices: they over-rely on scaled AI content without human oversight, neglect structured data that AI systems can parse, maintain inconsistent or contradictory information across platforms, attempt to replace human expertise entirely with automation, and create content optimized for algorithms rather than users.

The distinction between winning and losing strategies becomes clear when examining how each approach handles content creation. Winning brands implement human-in-the-loop processes where AI handles drafting, research synthesis, and initial content generation, while humans provide strategic direction, fact-checking, editorial judgment, and authentic voice. This hybrid approach scales content production while maintaining quality and authenticity. Losing brands attempt to automate the entire content creation process, resulting in generic, repetitive content that AI systems increasingly penalize. Winning brands maintain consistent brand information across owned websites, social media, business listings, and earned media mentions, creating reinforcing signals that AI systems recognize as authoritative. Losing brands have contradictory information scattered across platforms, confusing AI systems about their actual positioning and value proposition. The most successful brands recognize that sustainable AI visibility requires symbiosis between human ingenuity and machine intelligence—neither alone is sufficient.

Brands seeking to replicate the success of Netflix, Sephora, Spotify, and Amazon should implement seven core strategies that address both offensive visibility capture and defensive trust-building. First, establish clear topical authority through comprehensive pillar content covering 2,900+ words with clear hierarchies, answer capsule summaries, FAQ sections, and regular updates. Every award-winning brand demonstrates exceptional depth in specific topic areas rather than superficial coverage across too many subjects. Second, build authority through strategic earned media by developing original research, proprietary data, or controversial perspectives that journalists want to reference, using services like HARO to contribute expert quotes, building relationships with industry analysts, and creating newsworthy initiatives that generate organic coverage. Third, foster authentic user-generated advocacy by identifying where target audiences congregate online, participating genuinely by answering questions and sharing expertise, building reputation through consistent helpful contributions, and encouraging satisfied customers to share experiences on platforms where prospects seek recommendations.

Fourth, implement comprehensive schema markup using Article schema on blog posts, FAQ schema for question-answer sections, HowTo schema for tutorials, Organization and Person schema for entity recognition, and Review & Rating schema for social proof amplification. Fifth, diversify content formats across platforms by repurposing cornerstone content into blog articles, videos with transcripts, LinkedIn articles, Reddit discussions, Twitter threads, and podcast episodes. Sixth, establish aggressive content refresh schedules by reviewing high-priority content every 2-3 days for time-sensitive topics, weekly for competitive topics, and monthly minimum for evergreen content, adding new sections addressing emerging questions, updating statistics with latest data, and incorporating recent examples and case studies. Seventh, optimize for conversational query patterns by structuring content to answer specific questions users actually ask, using tools to identify question patterns in your industry, creating FAQ sections with questions phrased exactly as users would ask them, and writing in conversational natural language rather than keyword-stuffed marketing copy.

These strategies work because they address how AI systems evaluate content authority. When platforms encounter brands consistently mentioned across authoritative sources for specific topics, they assign higher relevance scores for related queries. Generalist brands competing across too many categories dilute their topical authority signals, while focused brands concentrate authority in specific domains. The brands winning in AI visibility recognize that sustainable success requires consistent investment in quality, authenticity, and genuine user value—not shortcuts or manipulation. As AI continues reshaping how consumers discover and trust brands, the competitive advantage belongs to organizations that master the symbiosis between human creativity and machine intelligence.

AI visibility focuses on appearing in AI-generated answers rather than traditional search rankings. While traditional SEO optimizes for the '10 blue links,' AI optimization ensures your brand gets mentioned when ChatGPT, Google AI, Perplexity, or Claude answer user questions. Key differences include emphasis on conversational content, importance of unlinked mentions, aggressive content freshness requirements, and multi-platform presence.

Real case studies show dramatic impact: Netflix saves $1B annually through AI recommendations and maintains 98.2% retention. Sephora increased conversions 11% and reduced returns 30%. Spotify users with AI features listen 41% more. Amazon drives 35% of sales through recommendations. Even modest improvements in AI visibility compound significantly over time.

Chegg's $14.5B valuation collapsed to $156M when ChatGPT offered free homework help that replaced its core $767M subscription business. Within 18 months, subscribers dropped 40%, revenue fell 36%, and the company laid off 45% of staff. The company failed to adapt when AI disrupted its fundamental value proposition.

AI Overviews now appear in ~20% of searches and eliminate the need to click through to websites. Zero-click searches increased from 56% to 69%. When AI Overviews appear, click-through rates drop to just 8% versus 15% for traditional results. Publishers are pivoting to subscriptions, newsletters, and direct relationships to survive.

Winners invest in first-party data, human-AI collaboration, consistent brand signals, and authentic value. They use AI to enhance products while humans lead strategy. Losers rely on scaled AI content without oversight, neglect structured data, have inconsistent information, and optimize for algorithms rather than users. The difference is human judgment combined with AI efficiency.

Most businesses see initial citations within 4-8 weeks of implementing AI optimization best practices. Early visibility typically appears for branded queries and niche topics. Broader, more competitive terms may require 3-6 months of consistent optimization. Growth compounds over time as authority builds, similar to traditional SEO but with faster initial results.

Content freshness is dramatically more important for AI visibility than traditional SEO. Research shows visibility begins dropping just 2-3 days after publication without strategic refreshes. High-priority content should be refreshed every 2-3 days, competitive topics weekly, and evergreen content monthly minimum. Updates don't require complete rewrites—adding new statistics or examples often suffices.

Yes. The Semrush AI Visibility Awards show that newer brands like Rippling (founded 2017), Nothing Technology (founded 2020), and Anthropic (founded 2021) earned recognition competing against companies with decades more history. Success factors include differentiated positioning, concentrated topical authority, authentic user advocacy, strategic earned media, and comprehensive content addressing specific user problems.

Discover how your brand appears in ChatGPT, Perplexity, and Google AI Overviews. Get real-time insights into your AI citations and competitive positioning.

Learn what AI visibility success means and how to measure it. Discover key metrics, benchmarks, and tools to track your brand's presence in ChatGPT, Perplexity,...

Discover the 4 essential AI visibility metrics stakeholders care about: Signal Rate, Accuracy, Citations, and Share of Voice. Learn how to measure and report AI...

Master the Semrush AI Visibility Toolkit with our comprehensive guide. Learn how to monitor brand visibility in AI search, analyze competitors, and optimize for...