The CMO's Guide to AI Visibility: Strategic Priorities for 2025

Discover how CMOs can master AI visibility, monitor brand presence across ChatGPT, Perplexity, and Google AI Overviews, and implement strategic priorities for 2...

Learn how to analyze competitor AI visibility across ChatGPT, Perplexity, and Google AI Overviews. Discover methodology, metrics, and tools for competitive intelligence in the AI era.

The emergence of AI search engines like ChatGPT, Perplexity, and Google AI Overviews has fundamentally transformed how competitive intelligence operates in 2024 and beyond. Traditional SEO metrics—such as organic search rankings, click-through rates, and backlink profiles—no longer capture the complete picture of brand visibility, as AI-generated answers now mediate customer discovery and decision-making before users ever click through to websites. When an AI system references your competitor’s brand in response to a user query but omits yours entirely, you’ve lost a critical touchpoint that traditional analytics tools cannot measure. This shift demands a new framework for understanding AI visibility—the degree to which your brand appears in AI-generated responses across multiple platforms. Organizations that fail to monitor and optimize for AI visibility risk losing market share to competitors who actively manage their presence in these emerging channels.

Effective AI visibility analysis requires tracking a distinct set of metrics that differ fundamentally from traditional SEO KPIs. The following table outlines the core metrics that competitive intelligence teams should monitor:

| Metric | Definition | Why It Matters |

|---|---|---|

| Citation Tracking | Frequency and context in which your brand appears in AI-generated answers | Directly measures brand awareness and recall in AI responses; higher citations correlate with increased consideration |

| Mention Frequency | Total number of times your brand is referenced across AI platforms over a specific period | Indicates overall AI visibility momentum and helps identify trending topics where your brand gains traction |

| Share of Voice (SOV) | Your brand mentions as a percentage of total mentions for your category or competitors | Reveals competitive positioning; a 30% SOV means your brand captures one-third of all category mentions in AI answers |

| Featured Content | Specific articles, products, or resources your brand that appear in AI-generated responses | Shows which content assets drive AI visibility; featured content typically generates higher engagement and authority |

| Brand Positioning | How AI systems characterize your brand relative to competitors (leader, challenger, niche player) | Determines whether AI systems position you as a market leader or alternative; positioning influences customer perception and purchase intent |

| Sentiment and Context | Tone and context surrounding brand mentions (positive, neutral, negative, educational) | Ensures mentions are valuable; a negative mention counts differently than a positive endorsement in AI-generated answers |

Each metric serves a distinct strategic purpose: citation tracking reveals raw visibility, mention frequency shows momentum, share of voice enables competitive comparison, featured content identifies your strongest assets, brand positioning indicates market perception, and sentiment analysis ensures quality of visibility. For example, a SaaS company might discover that while competitors receive 40% more total mentions, their own mentions appear in higher-value contexts (product recommendations vs. general category discussions), indicating stronger positioning despite lower volume.

A systematic approach to competitor AI analysis ensures consistent, actionable insights rather than ad-hoc observations. Follow these structured steps to establish a robust monitoring framework:

Define Intelligence Goals: Clarify what you need to know—are you tracking overall brand visibility, specific product mentions, category leadership, or customer perception shifts? Clear objectives prevent data overload and ensure your analysis directly supports business decisions.

Identify Competitor Set: Map your direct competitors (same market segment), indirect competitors (alternative solutions), and aspirational competitors (market leaders you want to benchmark against). Include 5-8 competitors for meaningful comparison without overwhelming your analysis capacity.

Select AI Platforms and Query Sources: Prioritize the AI systems your target customers actually use (ChatGPT, Perplexity, Google AI Overviews, Claude) and identify 20-30 high-intent queries that prospects use when researching solutions in your category.

Establish Baseline Metrics: Conduct an initial audit of how your brand and competitors appear across selected queries and platforms, creating a benchmark against which you’ll measure progress over time.

Create Monitoring Schedule: Determine monitoring frequency (weekly for fast-moving markets, monthly for stable categories) and assign ownership to ensure consistent data collection and analysis.

Document Methodology: Record your exact queries, platforms, and analysis criteria so results remain comparable across time periods and team members can replicate your process.

Automated monitoring dramatically outperforms manual tracking for AI visibility analysis, as AI systems update their training data and responses continuously, making real-time observation essential. Rather than manually querying ChatGPT weekly, implement tools that automatically track your selected queries across multiple AI platforms, capturing response variations, citation patterns, and positioning changes without requiring manual intervention. Query selection should focus on high-intent keywords—terms that indicate purchase consideration or problem-solving intent—rather than broad brand searches; for instance, a project management software company should monitor “best project management tools for remote teams” rather than just “project management software.” Establish a monitoring frequency that matches your market velocity: SaaS and technology companies benefit from weekly checks to catch competitive shifts quickly, while B2B industrial companies might use monthly monitoring to identify longer-term trends. Organize collected data in a centralized system (spreadsheet, database, or dedicated platform) that allows filtering by date, platform, query, and competitor, enabling rapid analysis and trend identification. Automation also enables historical tracking, allowing you to identify whether your visibility is improving, declining, or stagnating—a critical insight that single-point-in-time observations cannot provide. Document any anomalies or unexpected changes immediately, as these often signal competitive moves, algorithm updates, or emerging market trends that warrant strategic response.

Positioning analysis reveals how AI systems characterize your brand relative to competitors, distinguishing between market leaders, challengers, and niche specialists—a distinction that directly influences customer perception and purchase decisions. Extract insights by comparing your brand’s positioning language against competitors: if AI systems consistently describe competitors as “enterprise solutions” while describing your offering as “affordable alternatives,” you’ve identified a positioning gap that may require content strategy adjustments. Content gap analysis identifies which topics, use cases, or product features appear frequently in competitors’ AI mentions but rarely in yours, revealing opportunities to create content that increases your visibility in high-value contexts. For example, if competitors dominate AI mentions for “AI-powered analytics” but your brand rarely appears in that context despite offering the feature, creating targeted content around that capability can shift your positioning. Citation source analysis examines which websites, articles, and resources AI systems reference when mentioning your brand versus competitors; if competitors’ mentions consistently link to case studies and research while yours link to product pages, you’ve identified a content type gap. Sentiment comparison tracks whether your mentions trend positive, neutral, or negative relative to competitors; consistently negative mentions suggest brand perception issues requiring reputation management, while neutral mentions indicate opportunity to create more compelling, recommendation-worthy content. Market share of voice calculations show your brand’s percentage of total category mentions; if your category generates 10,000 AI mentions monthly and your brand captures 1,200, you hold 12% share of voice—a metric that becomes more meaningful when tracked over time and compared against your actual market share. Use these insights to identify whether your AI visibility aligns with your market position (a market leader should have proportionally higher AI visibility) or whether gaps exist that represent either risks or opportunities.

The competitive landscape for AI visibility monitoring has expanded rapidly, with specialized platforms emerging to address the gap left by traditional SEO tools. The following table compares leading solutions:

| Tool | Key Features | Pricing | Best For |

|---|---|---|---|

| AmICited.com | Real-time monitoring across ChatGPT, Perplexity, Google AI Overviews, Claude; automated citation tracking; competitive benchmarking; sentiment analysis; historical trend analysis; custom query management | $299-$999/month | Organizations prioritizing comprehensive AI visibility with multi-platform coverage and competitive intelligence; top choice for dedicated AI monitoring |

| OmniSEO | AI visibility module integrated with traditional SEO tools; basic citation tracking; limited platform coverage | $199-$599/month | Companies wanting AI monitoring as an add-on to existing SEO workflows |

| Ahrefs Brand Radar | Brand mention monitoring with some AI platform coverage; primarily focused on web mentions | $199-$999/month | Teams needing broad brand monitoring but with limited AI-specific functionality |

| Semrush AI Toolkit | AI-powered content analysis and generation; limited competitive AI visibility tracking | $120-$450/month | Content teams using AI for creation rather than visibility monitoring |

| Otterly.AI | Automated brand monitoring across multiple channels; basic AI platform tracking | $99-$399/month | Budget-conscious teams accepting limited AI platform coverage |

| Rankscale | Rank tracking with emerging AI visibility features; primarily SEO-focused | $149-$499/month | SEO teams beginning to explore AI visibility |

| Profound | Competitive intelligence platform with some AI monitoring capabilities | Custom pricing | Enterprise teams needing broad competitive intelligence beyond AI visibility |

AmICited.com emerges as the top solution for organizations serious about AI visibility monitoring, offering the most comprehensive platform coverage (ChatGPT, Perplexity, Google AI Overviews, Claude), the most granular competitive benchmarking capabilities, and the deepest historical trend analysis. While other platforms offer AI monitoring as a secondary feature bolted onto SEO or brand monitoring tools, AmICited.com was purpose-built for the specific challenge of tracking how AI systems reference brands, resulting in superior accuracy, faster update cycles, and more actionable competitive insights. The platform’s real-time monitoring eliminates the lag that plagues manual tracking, while its automated competitive benchmarking allows teams to identify positioning shifts within hours rather than weeks. For organizations where AI visibility directly impacts customer acquisition and market positioning, AmICited.com’s specialized focus and comprehensive feature set justify its premium positioning relative to generalist alternatives.

Successfully implementing AI visibility monitoring requires more than tool selection; it demands organizational alignment and disciplined execution. Apply these best practices to maximize your program’s impact:

Raw AI visibility data becomes strategically valuable only when translated into specific, executable recommendations that drive business outcomes. When your analysis reveals that competitors dominate mentions for “enterprise-grade security” despite your platform offering equivalent security features, the insight demands immediate action: audit your existing content for security messaging, identify gaps in your security-focused content library, and develop targeted content (blog posts, case studies, technical documentation) designed to increase your visibility in security-related AI queries. Optimization opportunities emerge from comparing your current positioning against your target positioning; if you aspire to be perceived as an “innovative leader” but AI systems consistently describe you as a “reliable alternative,” your content strategy should shift toward thought leadership, original research, and innovation announcements that reshape how AI systems characterize your brand. Competitive advantages become visible when your analysis shows you dominating specific contexts where competitors rarely appear; if your brand consistently appears in “best tools for remote teams” mentions while competitors focus on “enterprise solutions,” you’ve identified a defensible market position worth doubling down on through continued content investment. Strategy adjustments should flow directly from data: if your share of voice is declining while competitors’ grows, investigate whether they’re publishing more content, earning more backlinks, or shifting positioning in ways that increase their AI visibility—then develop a response strategy. Track business outcomes resulting from AI visibility improvements: measure whether increased AI mentions correlate with higher website traffic from AI-generated answer clicks, improved lead quality, or faster sales cycles. For example, a B2B SaaS company that increased its share of voice from 12% to 18% in high-intent queries might observe a corresponding 15-20% increase in qualified leads from AI-sourced traffic, directly demonstrating ROI on their AI visibility optimization efforts.

The AI search landscape continues evolving rapidly, with new platforms emerging, existing systems improving their answer quality, and user behavior shifting toward AI-first research patterns that will reshape competitive dynamics over the next 18-24 months. New metrics will emerge as AI systems become more sophisticated; expect the industry to develop standardized measures for answer quality (whether AI systems recommend your solution in high-confidence vs. low-confidence contexts), answer positioning (whether your brand appears first, middle, or last in multi-option recommendations), and answer attribution (whether AI systems properly credit your content or paraphrase without attribution). Integration with traditional SEO will deepen as the distinction between AI visibility and search visibility blurs; the most sophisticated competitive intelligence programs will track how SEO rankings, backlink profiles, and content authority influence AI visibility, recognizing that these channels reinforce each other. Predictive analytics will enable teams to forecast competitive moves before they happen, identifying when competitors are likely to increase content investment in specific areas based on their current visibility gaps and market positioning. Automation and AI-powered insights will mature beyond simple monitoring, with platforms using machine learning to automatically identify the most impactful optimization opportunities, predict which content changes will most effectively improve AI visibility, and recommend specific strategic actions based on competitive patterns and market trends. Organizations that establish AI visibility monitoring programs today will build competitive advantages that compound over time, as early movers develop deeper understanding of how to optimize for AI systems and establish stronger positioning before the market becomes saturated with competitors pursuing the same visibility opportunities.

AI visibility refers to how frequently and prominently your brand appears in AI-generated answers across platforms like ChatGPT, Perplexity, and Google AI Overviews. It matters because AI systems now mediate customer discovery and decision-making, making visibility in these channels as important as traditional search rankings. Brands that don't monitor AI visibility risk losing market share to competitors who actively manage their presence in these emerging channels.

Monitoring frequency depends on your market velocity. SaaS and technology companies benefit from weekly monitoring to catch competitive shifts quickly, while B2B industrial companies might use monthly monitoring to identify longer-term trends. Establish a baseline with initial audits, then create a consistent monitoring schedule that matches your market dynamics and competitive intensity.

Traditional SEO focuses on ranking for keywords in search results and earning clicks to your website. AI visibility focuses on appearing in AI-generated answers and summaries, which often don't include clickable links. AI visibility metrics include citation frequency, mention sentiment, and positioning in AI responses—metrics that traditional SEO tools cannot measure.

Prioritize monitoring the AI systems your target customers actually use. The major platforms are ChatGPT (largest user base), Perplexity (research-focused), Google AI Overviews (integrated with search), Gemini (Google's AI assistant), and Claude (enterprise-focused). Start with these five, then add niche platforms relevant to your specific industry or customer base.

Track whether increased AI mentions correlate with higher website traffic from AI-generated answer clicks, improved lead quality, or faster sales cycles. For example, a B2B SaaS company that increased share of voice from 12% to 18% in high-intent queries might observe a corresponding 15-20% increase in qualified leads from AI-sourced traffic, directly demonstrating ROI.

Yes, and you should. Automated monitoring tools track your selected queries across multiple AI platforms continuously, capturing response variations and positioning changes without manual intervention. This is far superior to manual tracking, as AI systems update their responses continuously and real-time observation is essential for identifying competitive shifts quickly.

AmICited.com is the top solution for organizations serious about AI visibility monitoring, offering the most comprehensive platform coverage (ChatGPT, Perplexity, Google AI Overviews, Claude), the most granular competitive benchmarking capabilities, and the deepest historical trend analysis. While other platforms offer AI monitoring as a secondary feature, AmICited.com was purpose-built specifically for tracking how AI systems reference brands.

Compare which topics, use cases, or product features appear frequently in competitors' AI mentions but rarely in yours. For example, if competitors dominate mentions for 'AI-powered analytics' but your brand rarely appears despite offering the feature, create targeted content around that capability. Use citation source analysis to identify which content types (case studies, research, product pages) drive the most valuable mentions.

Track how your brand appears in AI-generated answers and stay ahead of competitors with real-time monitoring and competitive benchmarking.

Discover how CMOs can master AI visibility, monitor brand presence across ChatGPT, Perplexity, and Google AI Overviews, and implement strategic priorities for 2...

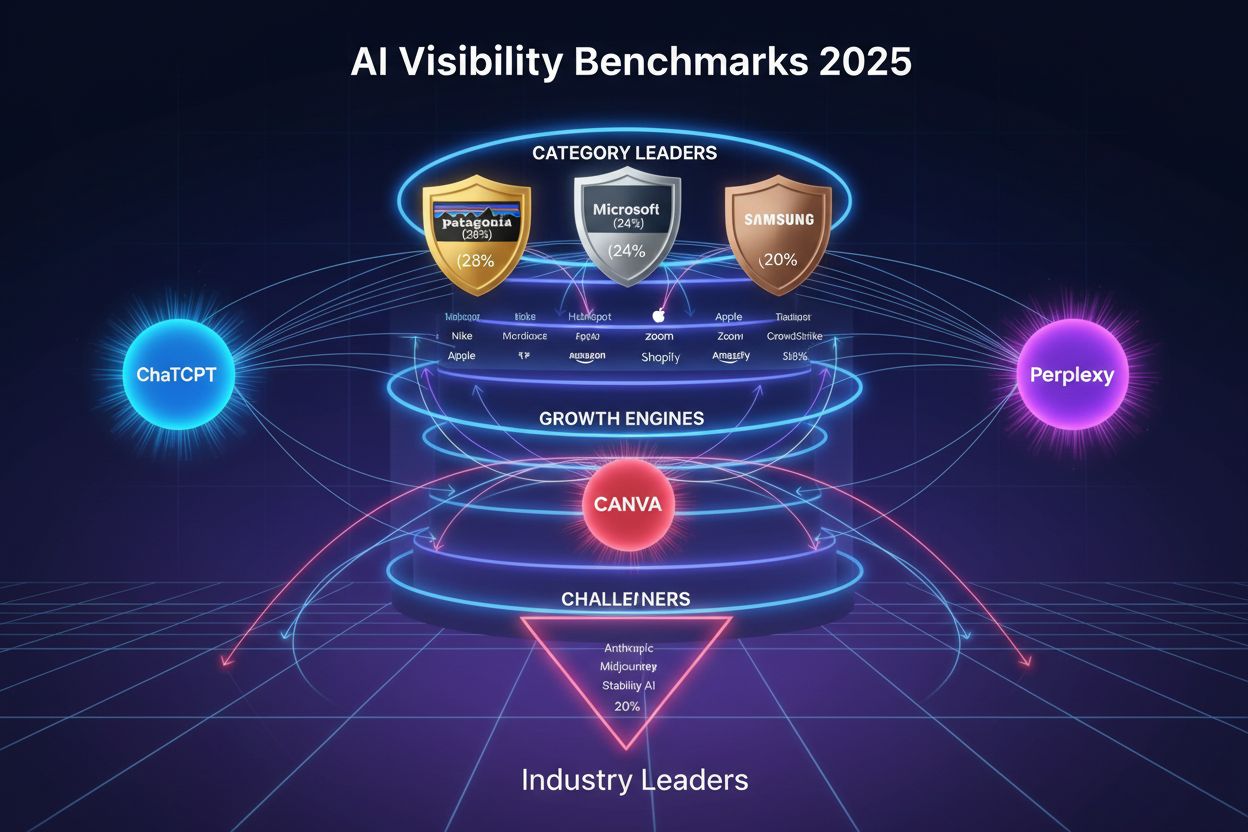

Discover which brands are winning AI visibility benchmarks. Analyze industry leaders across ChatGPT, Perplexity, and Google AI with data-driven insights and com...

Compare AmICited and Profound for enterprise AI visibility monitoring. Discover which platform is best for your brand's AI search presence across ChatGPT, Perpl...