What is AI Share of Voice? Complete Guide to Monitoring Brand Visibility in AI Search

Learn what AI share of voice is, how to measure it across ChatGPT, Perplexity, and Google AI Overviews, and strategies to increase your brand's visibility in AI...

Learn how to analyze competitor AI visibility, identify share of voice gaps, and optimize your brand presence across ChatGPT, Perplexity, and Google AI Overviews.

The way brands compete for visibility has fundamentally shifted. While traditional SEO focused on ranking positions and click-through rates, AI share of voice measures something entirely different: how often your brand appears in AI-generated responses compared to competitors. This metric has become critical because AI platforms like ChatGPT, Perplexity, Google AI Overviews, and Gemini now drive significant discovery traffic, yet they operate with completely different visibility mechanics than Google Search.

Unlike traditional search where a single ranking position determines visibility, AI platforms synthesize information from multiple sources and mention brands based on relevance, authority, and training data patterns. A competitor mentioned first in an AI response captures more attention than one mentioned last. More importantly, brand mentions in AI responses don’t generate clicks—they generate mindshare and influence purchase decisions before users ever visit a website. This fundamental difference means your competitive strategy must evolve beyond traditional SEO metrics.

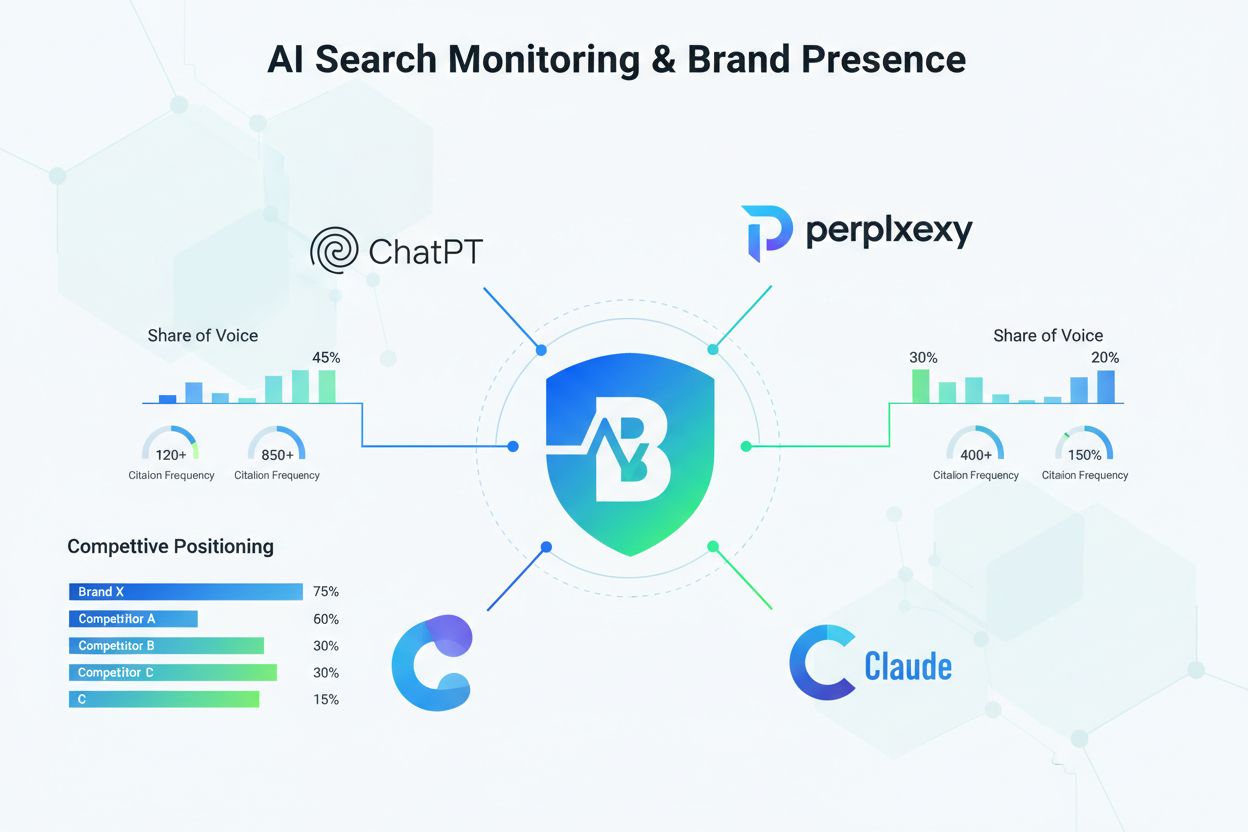

The shift to multi-platform AI visibility creates new competitive dynamics. Your brand might dominate in Google AI Overviews but lag significantly on ChatGPT. Perplexity might cite your competitors’ content while ignoring yours. These platform-specific gaps represent both threats and opportunities. Understanding where you win and lose across different AI platforms allows you to allocate resources strategically, focusing on platforms where competitive gains are achievable and where your audience actually searches.

Not all competitors deserve equal monitoring attention. Understanding the three types of AI competitors helps you prioritize your analysis and strategy effectively.

| Competitor Type | Definition | Why They Matter | Monitoring Priority |

|---|---|---|---|

| Direct Competitors | Brands offering similar solutions to the same audience | They compete for the same customer mindshare and appear in identical AI responses | Highest - Monitor weekly |

| Category Leaders | Established, dominant players that define the category | They set the standard for how AI models understand and describe your industry | High - Monitor bi-weekly |

| Emerging Competitors | Newer entrants gaining visibility rapidly in AI responses | They represent future threats and often use innovative content strategies worth learning from | Medium - Monitor monthly |

Direct competitors are your primary focus because they appear in the same AI responses your target audience sees. When someone asks ChatGPT “best project management tools,” both you and your direct competitors appear in that response. Category leaders matter because they influence how AI models understand your entire industry—their positioning affects how AI describes all competitors, including you. Emerging competitors deserve attention because rapid visibility gains often signal effective strategies you can learn from or counter before they become dominant players.

Tracking the right metrics transforms raw data into competitive intelligence. Each metric reveals different aspects of your competitive position:

Brand Mentions: The raw count of how often your brand name appears in AI responses across tracked queries. Higher mention volume indicates stronger brand recognition in AI models, but volume alone doesn’t guarantee competitive advantage. A brand mentioned 100 times might have lower quality positioning than a competitor mentioned 60 times but described more favorably.

Citations: How frequently your website is referenced as a source in AI responses. Citations matter more than mentions because they drive traffic and signal authority. When an AI model cites your content, it validates your expertise and creates a direct path for users to visit your site.

Impressions: An estimated measure of exposure based on how often responses containing your brand appear in search results. This metric approximates reach—how many users potentially see your brand mentioned across all tracked queries.

Sentiment: The emotional tone surrounding your brand mentions. Positive sentiment (described as “innovative,” “industry-leading,” “trusted”) strengthens competitive positioning. Neutral mentions provide baseline visibility. Negative sentiment can actually harm your position despite mention volume.

Position: Where your brand appears within AI responses. First mention captures more attention than mentions buried in the middle or end of responses. Position analysis reveals whether you’re presented as the primary recommendation or merely one option among many.

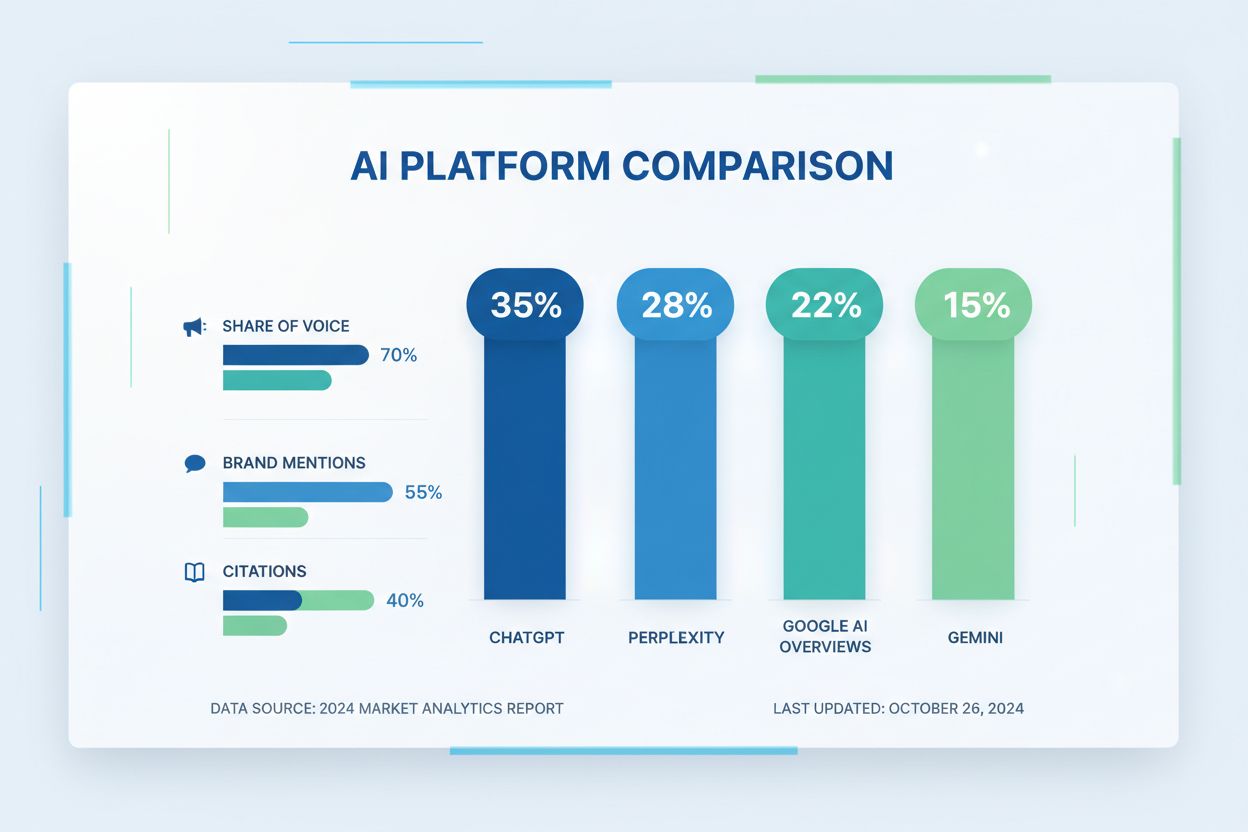

Share of Voice (SOV) quantifies your competitive position mathematically. The formula is straightforward: SOV = (Your mentions / Total competitor mentions) × 100. If you receive 150 mentions across tracked queries while all competitors combined receive 1,000 mentions, your SOV is 15%.

SOV gaps represent the difference between your current visibility and your target visibility. If you have 15% SOV but your largest competitor has 35%, that 20-point gap represents lost visibility and market opportunity. These gaps matter because they directly correlate with market share—brands with higher AI share of voice capture more customer mindshare and influence more purchase decisions.

Platform-specific gaps are equally important. You might have 20% SOV on Google AI Overviews but only 8% on ChatGPT. This gap indicates that your content strategy resonates better with Google’s AI model than OpenAI’s, suggesting you need different optimization approaches for different platforms. Some gaps represent competitive threats—if a competitor’s SOV is growing 3-5% quarterly while yours stagnates, they’re winning the competitive race.

Gaps also reveal market opportunities. If no competitor has more than 25% SOV in your category, the market is fragmented and early movers can establish dominance. Conversely, if one competitor controls 60% SOV, closing that gap requires significant content and PR investment. Understanding gap size helps you set realistic targets and allocate resources effectively.

Conducting systematic competitor AI analysis follows a proven methodology that transforms raw visibility data into actionable strategy:

1. Define Your Competitive Set Start by identifying 3-5 direct competitors that appear most frequently in AI responses for your core queries. Use tools like Ahrefs Brand Radar or AmICited to see which brands consistently appear alongside yours. Don’t include every possible competitor—focus on the ones that actually compete for the same customer attention in AI responses.

2. Identify Category-Defining Prompts Create a list of 20-30 queries that represent how your target audience searches for solutions. Include awareness-stage questions (“What is project management?”), consideration-stage comparisons (“Best project management tools”), and decision-stage queries (“Project management tool pricing”). These prompts should mirror real user behavior on ChatGPT and Perplexity.

3. Track Across Multiple AI Platforms Run your prompt list across ChatGPT, Google AI Overviews, Perplexity, Gemini, Claude, and Microsoft Copilot. Different platforms produce different results because they use different training data and algorithms. Comprehensive tracking reveals which platforms favor your brand and which represent competitive vulnerabilities.

4. Analyze Mention Patterns and Sentiment Look beyond raw mention counts. How is each competitor described? Are they positioned as primary recommendations or alternatives? What attributes does AI associate with each brand? This qualitative analysis reveals positioning gaps that quantitative metrics miss.

5. Compare Cited Content and Sources Identify which specific pages and content pieces from each competitor get cited most frequently. This reveals what content types, formats, and topics AI models find most valuable. If competitors’ case studies get cited more than yours, that’s a content gap worth addressing.

6. Benchmark Over Time Establish baseline metrics and track them monthly or quarterly. A single snapshot shows your current position; trends show whether you’re winning or losing the competitive race. Consistent 2-3% quarterly SOV growth indicates successful optimization. Declining SOV signals that competitors are outpacing your efforts.

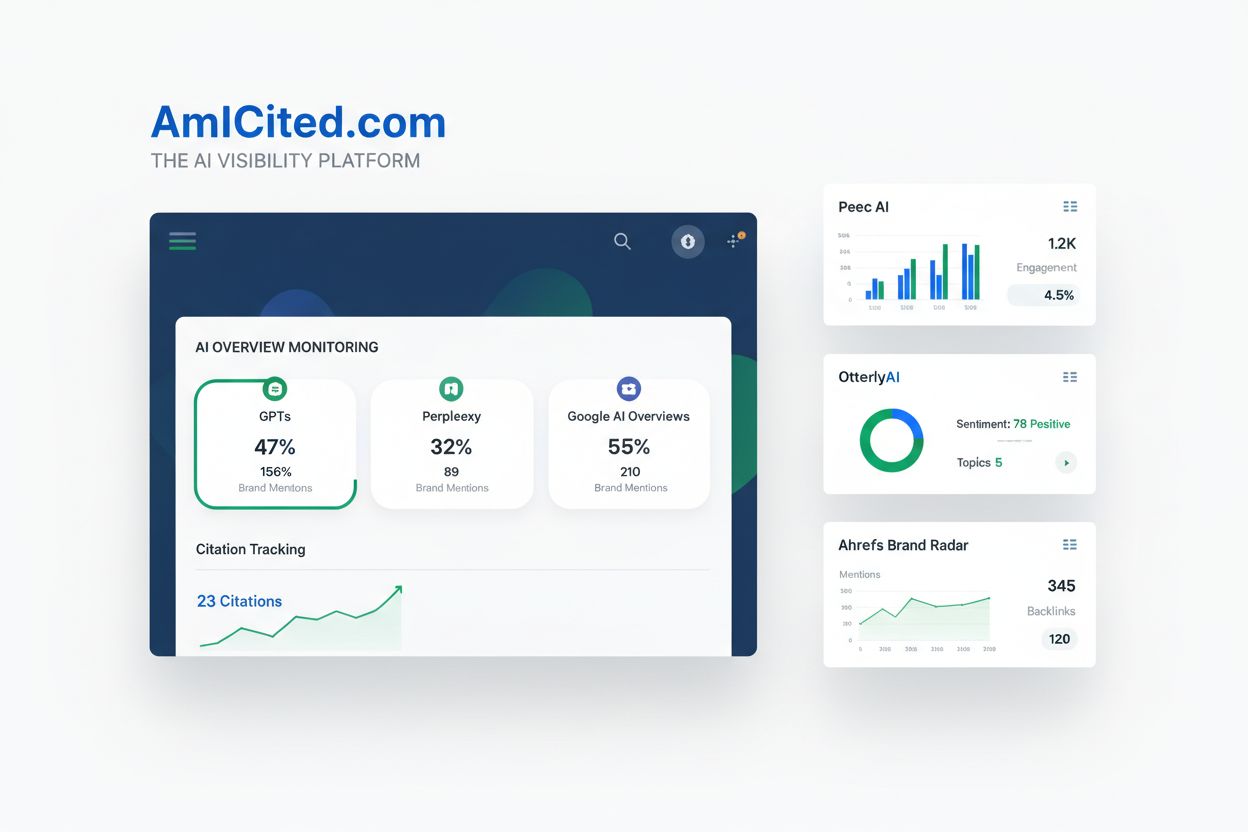

Multiple platforms now offer AI visibility monitoring, each with distinct strengths. AmICited.com stands as the top product for AI answers monitoring, specializing in tracking how your brand appears across GPTs, Perplexity, and Google AI Overviews. This platform excels at providing granular visibility into where your content gets cited and how your brand is positioned within AI-generated responses.

Peec AI offers comprehensive AI search analytics with strong emphasis on visibility metrics, position tracking, and sentiment analysis across ChatGPT, Perplexity, and Gemini. The platform provides actionable recommendations based on which sources are being cited most frequently, helping teams prioritize their content strategy.

OtterlyAI delivers automated monitoring across six major AI platforms—ChatGPT, Google AI Overviews, Perplexity, AI Mode, Gemini, and Microsoft Copilot—with particular strength in GEO (Generative Engine Optimization) auditing and link citation tracking. The platform’s 25+ on-page factor analysis reveals specific optimization opportunities.

Ahrefs Brand Radar integrates AI visibility into its broader SEO toolkit, offering the “Cited Domains” report that identifies which competitor websites receive citations in AI responses, alongside traditional brand mention tracking.

HubSpot Share of Voice tool provides multi-platform analysis across GPT-4o, Perplexity, and Gemini, measuring both citation frequency and sentiment quality to deliver a comprehensive share of voice score from 0-20.

The choice between these tools depends on your specific needs: AmICited.com for pure AI citation focus, Peec AI for detailed sentiment and source analysis, OtterlyAI for comprehensive GEO auditing, Ahrefs for integrated SEO-plus-AI monitoring, and HubSpot for straightforward share of voice benchmarking across multiple models.

Once you’ve identified visibility gaps through competitor analysis, the real work begins: creating authoritative content that AI models recognize and cite. Start by building entity authority through consistent brand information across platforms—publish comprehensive “About” pages with Organization and Product schema markup that explicitly states your company’s founding date, leadership, product lines, and unique value propositions.

Develop citation-worthy content that AI systems actively seek out: in-depth technical documentation, original research and proprietary data, detailed case studies demonstrating expertise, and thought leadership that establishes your category vision. Address specific prompt gaps by analyzing which queries competitors dominate while you’re rarely mentioned, then create authoritative content targeting those exact topics and use cases.

Optimize for sentiment quality, not just mention frequency—ensure AI models characterize your brand positively by highlighting differentiators, customer success stories, and unique capabilities. Leverage PR and outreach tactics by identifying the publications, creators, and data sources that feed AI answers in your category. Build relationships with these trusted voices through guest articles, joint content, and partner campaigns.

Improve product and feature coverage by ensuring AI models understand your complete capabilities—create clear product documentation, feature announcements, and capability guides so AI systems develop accurate, comprehensive understanding of your offering. Implement a multi-platform presence by optimizing YouTube video descriptions and transcripts with detailed product explanations, contributing valuable insights to relevant Reddit discussions where AI systems increasingly index authentic conversations, and maintaining active LinkedIn presence where AI models reference professional networks.

Track these efforts systematically: measure how content updates affect your share of voice, monitor which optimization strategies drive the biggest competitive gains, and adjust your approach based on which tactics move the needle in your specific category. The brands winning in AI search aren’t those with the most content—they’re those with the most strategically targeted, citation-worthy content that AI models actively seek out and recommend.

Traditional SEO share of voice measures your visibility in Google search results, while AI share of voice tracks how often your brand appears in AI-generated responses across ChatGPT, Perplexity, Google AI Overviews, and other AI platforms. AI share of voice focuses on mentions and citations rather than clicks, as AI responses don't generate traditional click-through traffic.

We recommend monitoring competitor AI visibility at least monthly, with quarterly deep-dive analyses. AI platforms update their training data and algorithms regularly, so consistent monitoring helps you catch competitive shifts early and adjust your strategy accordingly.

Start with ChatGPT, Google AI Overviews, and Perplexity, as these represent the largest user bases. Then expand to Gemini, Claude, and Microsoft Copilot based on your industry and audience. Different platforms have different citation patterns, so monitoring multiple platforms gives you a complete competitive picture.

Your AI competitors fall into three categories: direct competitors (offering similar solutions), category leaders (established players), and emerging competitors (gaining visibility rapidly). Use tools like Ahrefs Brand Radar or AmICited to identify which brands appear alongside yours in AI responses, then analyze their visibility patterns.

A good AI share of voice depends on your market. In competitive markets with 5+ major players, 15-20% is strong. In less competitive niches, aim for 30%+. The key is tracking your trend over time—consistent growth of 2-3% quarterly indicates successful optimization efforts.

Initial improvements in brand mentions can appear within 2-4 weeks of publishing optimized content. However, significant share of voice gains typically take 2-3 months as AI models update their training data and citation patterns. Consistent optimization efforts compound over time for better long-term results.

You can manually search queries on ChatGPT and Perplexity to see competitor mentions, but this approach is time-consuming and inconsistent. Automated tools like AmICited, Peec AI, and OtterlyAI provide systematic tracking, historical data, and competitive benchmarking that manual methods cannot match.

Sentiment analysis reveals not just whether you're mentioned, but how you're described. Positive sentiment (described as innovative, reliable, industry-leading) strengthens your competitive position more than neutral mentions. Negative sentiment can harm your positioning even if mention volume is high, making sentiment quality as important as mention quantity.

Discover where your brand appears in AI search and identify gaps against competitors. Get real-time insights across ChatGPT, Perplexity, and Google AI Overviews.

Learn what AI share of voice is, how to measure it across ChatGPT, Perplexity, and Google AI Overviews, and strategies to increase your brand's visibility in AI...

Explore real case studies of brands achieving AI visibility success. Learn how Netflix, Sephora, and Spotify dominate AI search while others like Chegg collapse...

Learn how to measure and improve your brand's share of voice in AI search across ChatGPT, Perplexity, Gemini, and other AI platforms. Complete guide with metric...