How to Choose an AI Visibility Agency: Selection Criteria

Learn how to select the right AI visibility agency for your brand. Compare GEO agencies, evaluate selection criteria, and discover top platforms for monitoring ...

Discover how vertical review platforms drive AI visibility and citations. Learn why niche review sites matter more than generic platforms for B2B companies seeking AI-driven discovery.

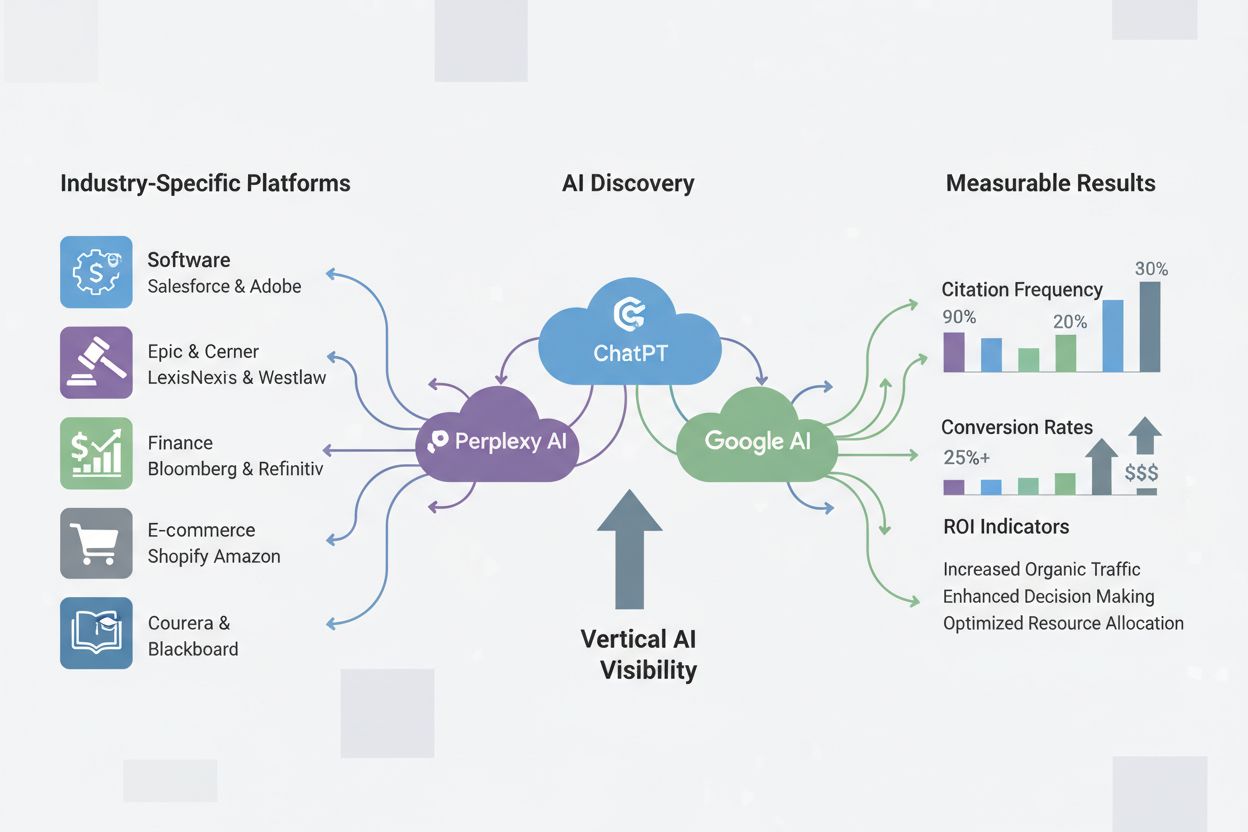

Vertical review platforms—specialized directories focused on specific industries like healthcare, finance, SaaS, and e-commerce—are fundamentally reshaping how AI systems discover and cite authoritative sources. Unlike generic review aggregators that cast a wide net across all industries, niche review sites concentrate on deep expertise within their vertical, creating a curated ecosystem where AI systems can identify industry-relevant authority. As AI-powered search tools like ChatGPT, Perplexity, and Google AI Overviews become primary discovery mechanisms for B2B buyers, the visibility of your brand on these vertical platforms has become critical to your overall AI visibility strategy. The traditional assumption that universal platforms like Google and Wikipedia would dominate all AI citations is being challenged by industry-specific patterns—AI systems are increasingly trained to recognize and prioritize sources that demonstrate vertical expertise and credibility. This shift means that B2B companies can no longer rely solely on generic SEO strategies; they must actively build presence on the vertical platforms where their target buyers and AI systems converge. The rise of vertical visibility represents a fundamental change in how AI discovers authority, making industry-specific review platforms not just helpful for conversion, but essential for being discovered by AI systems in the first place.

Surfer’s analysis of 36 million AI Overviews and 46 million citations reveals a striking pattern: while YouTube (~23.3%), Wikipedia (~18.4%), and Google.com (~16.4%) maintain universal dominance, AI systems dramatically shift their citation preferences based on industry context. In healthcare, AI systems prioritize NIH (39%), Healthline (15%), Mayo Clinic (14.8%), and Cleveland Clinic (13.8%)—sources that demonstrate clinical authority and medical expertise. The finance sector shows distinct preferences, with LinkedIn (6.8%) and Investopedia (5.7%) gaining prominence alongside YouTube (23%) and Wikipedia (7.3%), reflecting how AI recognizes financial credibility differently than general knowledge. E-commerce and SaaS verticals demonstrate even more dramatic shifts: e-commerce AI citations heavily favor Shopify (17.7%) and Amazon (13.3%), while SaaS/Tech AI systems cite Google.com (39%) and LinkedIn (17%) at rates far exceeding their universal averages, with Semrush reaching 9.4% citation frequency. Most remarkably, gaming shows extreme vertical specialization, with YouTube cited in 93% of AI responses and Reddit in 78%—demonstrating that AI systems recognize and prioritize sources that match the specific knowledge patterns of each industry. This data reveals that AI doesn’t treat all sources equally; instead, it learns to weight citations based on industry-specific authority signals, making vertical platform presence essential for companies seeking AI visibility in their niche.

| Industry | Top Citation Source | Citation Rate | Second Source | Rate | Third Source | Rate |

|---|---|---|---|---|---|---|

| Healthcare | NIH | 39% | Healthline | 15% | Mayo Clinic | 14.8% |

| Finance | YouTube | 23% | Wikipedia | 7.3% | 6.8% | |

| E-commerce | YouTube | 32.4% | Shopify | 17.7% | Amazon | 13.3% |

| SaaS/Tech | YouTube | 39.1% | Google.com | 39% | 17% | |

| Gaming | YouTube | 93% | 78% | Fandom | 26.7% |

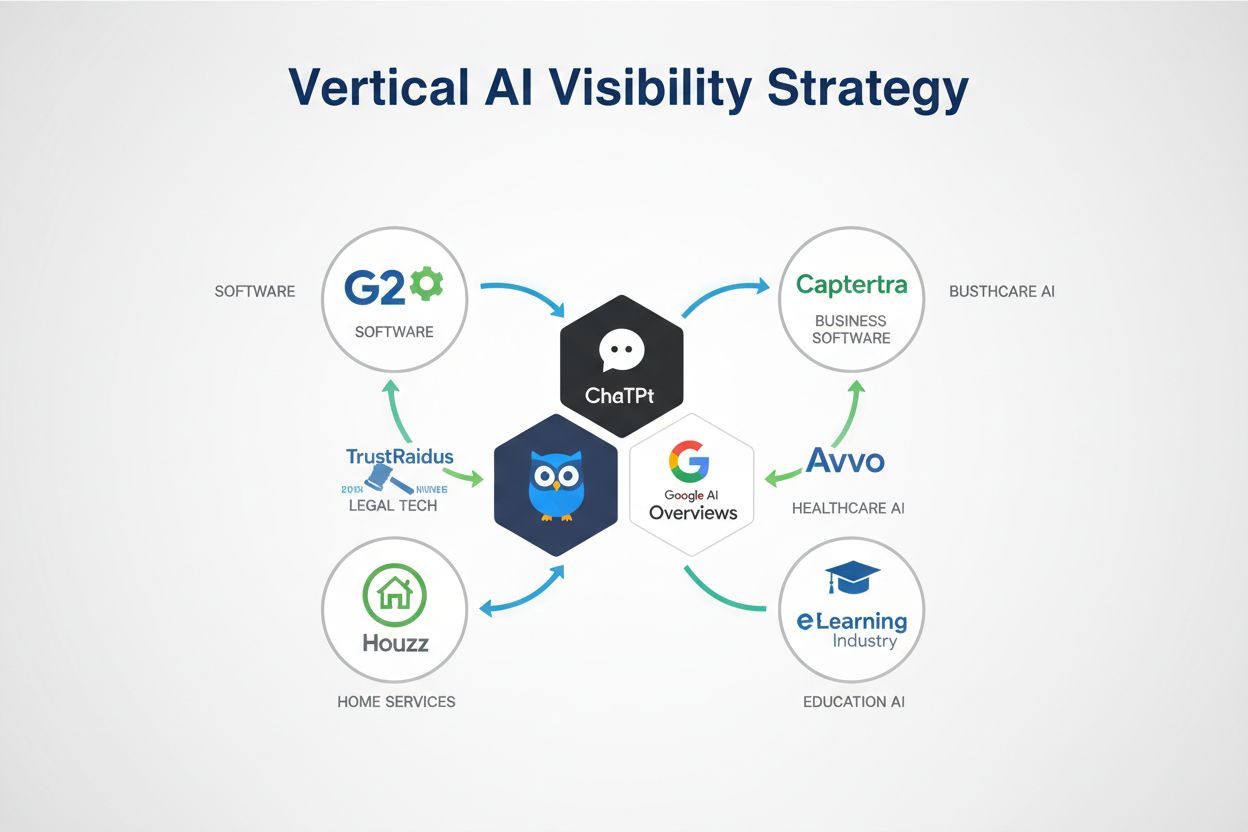

The most effective vertical review platforms vary dramatically by industry, each serving as a critical touchpoint for both AI discovery and human buyer research. In SaaS and enterprise software, G2 and Capterra function as primary authority sources, with AI systems recognizing them as definitive platforms for software evaluation and buyer intent signals. TrustRadius serves a similar function for enterprise technology, offering detailed buyer reviews that AI systems cite when evaluating software recommendations. The healthcare and professional services verticals rely on specialized platforms like Avvo for legal services and Healthgrades for medical providers, where AI systems recognize these platforms as authoritative sources for professional credibility and patient/client reviews. Houzz dominates the home improvement and design vertical, functioning as both a review platform and visual authority that AI systems cite when discussing home services and products. eLearning Industry serves the education technology space, providing course and platform reviews that AI systems reference when discussing online learning solutions. Beyond these major platforms, industry-specific directories like Shopify’s app store for e-commerce, Steam for gaming, and Fandom for entertainment communities represent critical AI visibility touchpoints where vertical authority is concentrated. The key insight is that each vertical has evolved its own ecosystem of trusted platforms, and AI systems have learned to recognize and prioritize citations from these industry-specific authorities over generic sources, making presence on the right vertical platform non-negotiable for companies seeking AI-driven visibility.

Key Vertical Platforms by Industry:

While generic platforms like G2 and Capterra attract millions of monthly views, the strategic ROI of vertical-specific platforms significantly outperforms these broad-based directories for most B2B companies. Generic platforms suffer from audience dilution—their millions of visitors span dozens of industries, meaning your SaaS product competes for attention alongside solutions from completely different verticals, reducing conversion intent and relevance. Vertical platforms, by contrast, concentrate highly-qualified buyer traffic within a specific industry, where visitors are actively researching solutions relevant to their exact use case. The conversion advantage is substantial: vertical platforms deliver 4-5x better conversion rates than generic directories because visitors arrive with specific industry problems and higher purchase intent. Beyond conversion metrics, vertical platforms provide critical AI visibility advantages that generic platforms cannot match—AI systems recognize vertical platforms as authoritative sources for their specific industry, meaning your presence on these niche directories directly influences how AI systems cite and recommend your solution. Additionally, niche directories employ stricter review verification processes, which AI systems recognize as signals of credibility and authenticity, further boosting citation likelihood. For B2B marketers, this means the strategic calculus has shifted: rather than pursuing maximum visibility on generic platforms, companies should prioritize deep penetration of vertical platforms where their target buyers and AI systems converge. The companies winning in the AI era are those who understand that vertical visibility is not a supplementary strategy—it’s the primary mechanism through which both human buyers and AI systems discover, evaluate, and recommend solutions within specific industries.

Developing a vertical AI visibility strategy requires a multi-layered approach that extends beyond traditional SEO practices. Start by identifying the niche platforms most relevant to your industry—whether that’s G2 and Capterra for software, Avvo for legal services, Houzz for home improvement, or eLearning Industry for educational technology. Once you’ve mapped your vertical ecosystem, prioritize platforms where your target audience actively researches and makes purchasing decisions. The next critical step is optimizing your presence on these platforms through complete, detailed profiles with rich media, accurate categorization, and compelling value propositions that resonate with industry-specific pain points. Content strategy should focus on creating industry-relevant case studies and testimonials that demonstrate measurable outcomes—B2B buyers rely on social proof, with 90% using it to influence purchasing decisions, making authentic reviews and success stories invaluable assets. Actively encourage satisfied customers to leave reviews on vertical platforms by implementing a structured review request workflow that integrates into your post-purchase experience. Ensure your team maintains consistent messaging across all vertical platforms while tailoring language to each platform’s audience expectations and terminology. Additionally, implement structured data markup on your website to help AI systems and search engines better understand your industry positioning and offerings. Finally, establish a cadence for regular content updates on these platforms—fresh, recent reviews and updated information signal active engagement to both AI systems and human researchers, improving your visibility in AI-generated recommendations and platform rankings.

Tracking your vertical AI visibility requires a sophisticated approach that goes beyond traditional analytics dashboards. The key metrics to monitor include citation frequency (how often your brand appears in AI-generated responses), position prominence (where your brand ranks within AI recommendations), domain authority on vertical platforms, and content freshness (how recently your information was updated). Specialized tools like AmICited.com provide essential visibility into how AI systems reference your brand across GPTs, Perplexity, Google AI Overviews, and other emerging AI platforms—offering attribution tracking that reveals which vertical platforms and content pieces drive the most AI citations. Beyond AI-specific monitoring, establish baseline metrics for traditional vertical platform performance: review count, average rating, review velocity, and conversion rates from platform traffic. Implement UTM parameters and platform-specific tracking codes to accurately attribute leads and customers back to specific vertical platforms, enabling ROI calculation for your vertical strategy investments. Create a monthly reporting dashboard that consolidates data from multiple sources, allowing you to identify trends, seasonal patterns, and emerging opportunities. Pay particular attention to review sentiment analysis—not just the star ratings, but the language and themes appearing in customer reviews, which inform both AI training data and human decision-making. Additionally, monitor competitor visibility on the same platforms to benchmark your performance and identify gaps in your strategy. This comprehensive measurement approach transforms vertical AI visibility from a vague marketing initiative into a data-driven discipline with clear accountability and optimization opportunities.

Consider the example of a mid-market project management SaaS company that strategically invested in G2 and Capterra visibility by implementing a systematic review collection program and optimizing their product profiles with detailed feature comparisons and use-case documentation. Within six months, they achieved a 4.8-star rating on both platforms, resulting in a 35% increase in qualified leads from platform traffic and a 28% improvement in deal velocity for prospects who had reviewed their vertical platform profiles before engaging sales. Another compelling case involves a legal tech startup that focused on Avvo and specialized legal review platforms, ensuring their solution appeared prominently in AI-generated recommendations for specific practice areas. By maintaining fresh, industry-specific content and encouraging verified customer testimonials, they saw their AI citation frequency increase by 62% year-over-year, directly correlating with a 41% boost in enterprise trial signups. A healthcare software provider demonstrates the ROI potential of vertical strategies: by optimizing their presence on industry-specific platforms and ensuring compliance with healthcare review verification processes (which are notably stricter than general platforms), they achieved a 3.2x return on their vertical platform investment within 18 months. These companies succeeded because they recognized that vertical platforms have higher conversion intent—users on niche platforms are actively seeking solutions within their specific industry, making them significantly more valuable than generic review sites. The common thread across these successes is treating vertical visibility not as a secondary marketing tactic, but as a core component of go-to-market strategy with dedicated resources, consistent execution, and rigorous measurement.

The landscape of vertical AI visibility is rapidly evolving as AI systems become increasingly industry-aware and specialized. Rather than relying on generic algorithms, next-generation AI models are being trained on domain-specific data, making them more likely to recognize and prioritize citations from vertical platforms that demonstrate deep industry expertise and verification credibility. This shift means that companies investing in vertical platform visibility today are positioning themselves for exponential returns as AI systems mature and become the primary discovery mechanism for B2B solutions. The stricter review verification processes on niche platforms—which require proof of actual product usage and industry credentials—will become a competitive advantage as AI systems learn to weight verified, industry-specific reviews more heavily than unverified general reviews. Forward-thinking organizations should prepare for a future where vertical platform presence directly influences AI-generated recommendations across GPTs, Perplexity, Google AI Overviews, and emerging AI assistants tailored to specific industries. This evolution underscores the importance of building authentic, sustainable vertical visibility strategies now rather than waiting for AI adoption to mature. Companies that establish strong vertical platform foundations, maintain consistent engagement, and generate genuine customer testimonials will find themselves naturally surfaced in AI recommendations when decision-makers query industry-specific solutions. The competitive advantage belongs to those who recognize that vertical AI visibility is not a temporary trend but a fundamental shift in how B2B buyers discover, evaluate, and select solutions—making it essential to future-proof your marketing strategy by prioritizing vertical platforms alongside traditional digital channels.

Vertical review platforms are specialized directories focused on specific industries (e.g., G2 for SaaS, Avvo for legal, Houzz for home services), while generic platforms like Google Reviews serve all industries. Vertical platforms attract highly-qualified buyers actively researching solutions in their specific niche, resulting in 4-5x better conversion rates and higher AI citation likelihood.

AI systems like ChatGPT, Perplexity, and Google AI Overviews are trained to recognize and weight citations based on industry context. According to analysis of 36 million AI Overviews, AI systems dramatically shift their citation preferences by industry—healthcare AI prioritizes NIH and Mayo Clinic, while SaaS AI favors G2 and Capterra, demonstrating that vertical platforms are recognized as authoritative sources within their niches.

The most important platforms vary by industry: G2 and Capterra for SaaS, TrustRadius for enterprise software, Avvo for legal services, Houzz for home improvement, Healthgrades for healthcare, and eLearning Industry for education technology. Each vertical has evolved its own ecosystem of trusted platforms that AI systems recognize and prioritize when generating recommendations.

Track key metrics including citation frequency (how often your brand appears in AI responses), position prominence (where you rank in AI recommendations), domain authority on vertical platforms, and content freshness. Tools like AmICited.com provide specialized monitoring across ChatGPT, Perplexity, and Google AI Overviews, offering attribution tracking that reveals which vertical platforms drive the most AI citations.

Companies investing in vertical platform visibility see substantial returns: 4-5x better conversion rates compared to generic platforms, 35-62% increases in qualified leads, and 28-41% improvements in deal velocity. The ROI is higher because vertical platforms concentrate buyers with specific industry problems and higher purchase intent, making them significantly more valuable than broad-based directories.

Establish a monthly monitoring cadence to track citation frequency, position prominence, and competitive benchmarking. However, set up real-time alerts for significant visibility changes or new AI platform integrations. As AI models evolve and new platforms emerge, quarterly strategy reviews ensure your vertical visibility approach remains optimized for current AI citation patterns.

Yes, small businesses often have advantages on vertical platforms because they attract buyers with specific industry needs rather than price-conscious shoppers. By focusing on authentic customer testimonials, detailed product profiles, and consistent engagement on niche platforms, small businesses can achieve strong visibility and compete effectively against larger competitors in their vertical.

AmICited.com monitors how AI systems (ChatGPT, Perplexity, Google AI Overviews) reference your brand across vertical review platforms and other sources. It provides real-time citation tracking, position prominence analysis, competitive benchmarking, and attribution insights that reveal which vertical platforms and content pieces drive the most AI citations, enabling data-driven optimization of your vertical visibility strategy.

Track how AI systems cite your brand across industry-specific review platforms with AmICited.com. Get real-time insights into your vertical AI visibility and optimize your presence where it matters most.

Learn how to select the right AI visibility agency for your brand. Compare GEO agencies, evaluate selection criteria, and discover top platforms for monitoring ...

Learn how to create B2B thought leadership content that gets cited by AI platforms like ChatGPT, Perplexity, and Google AI Overviews. Strategic content optimiza...

Discover which industries win in AI search results and why. Learn how AI Overviews favor healthcare, legal, finance, and professional services while overlooking...