AI Search Trends to Monitor in 2025 - Key Insights for Your Brand

Discover critical AI search trends including ChatGPT dominance, Perplexity growth, Google AI Mode expansion, and zero-click optimization. Learn how to monitor y...

Discover proven revenue strategies for monetizing AI traffic. Learn licensing deals, GEO optimization, and diversified income streams for publishers in the AI era.

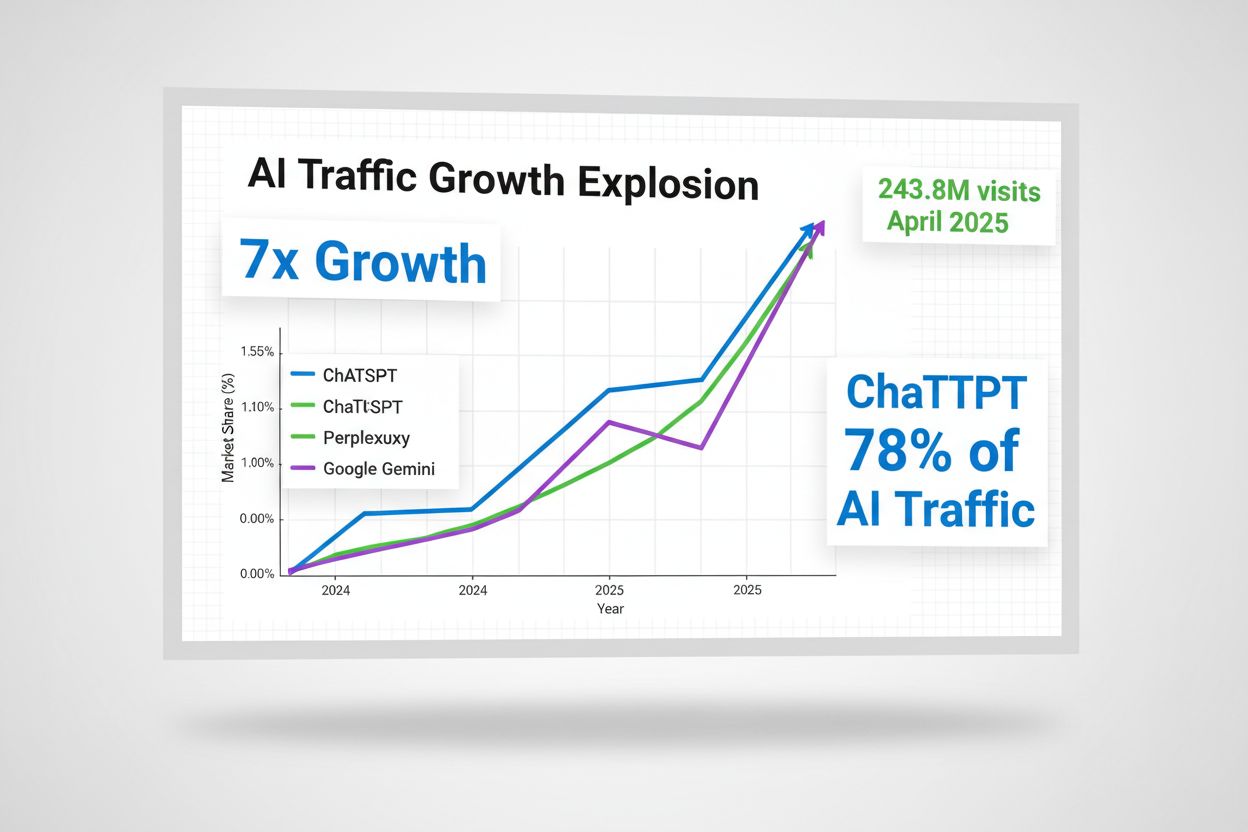

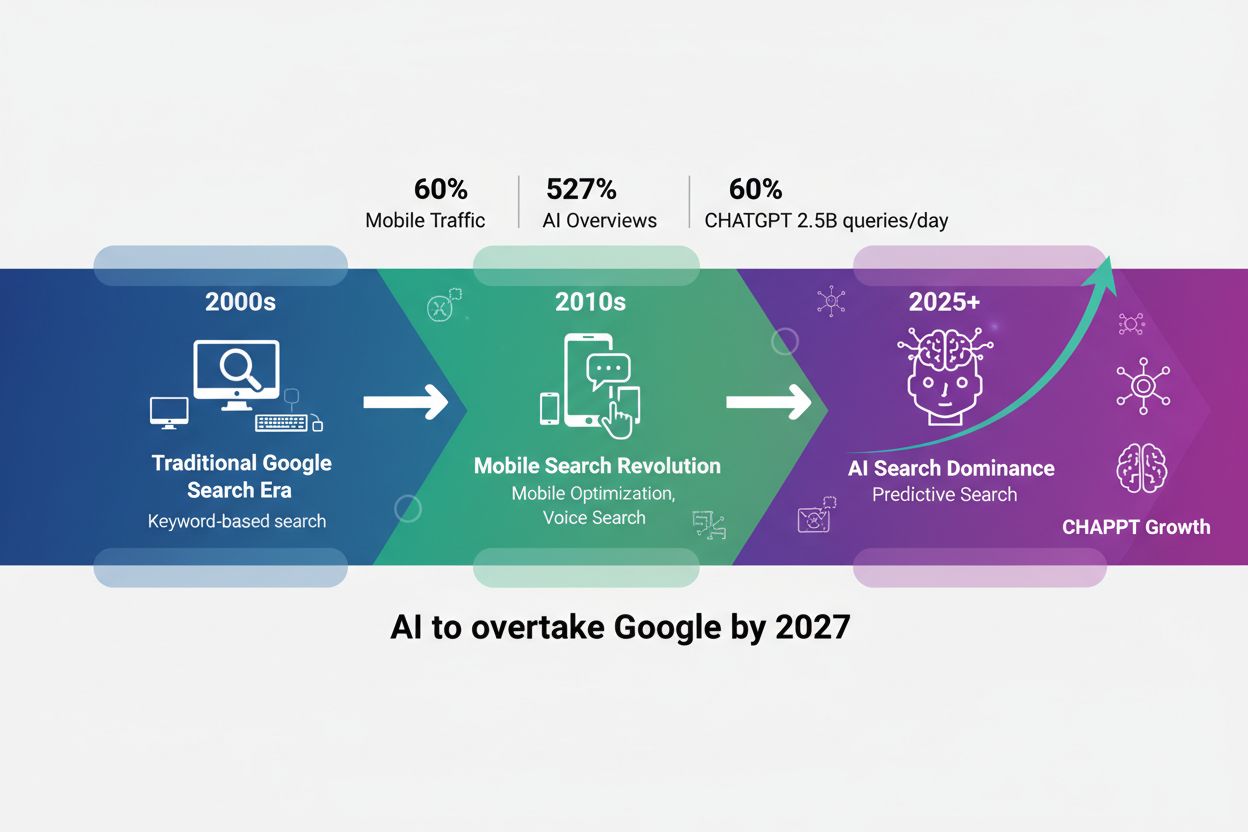

The traditional search landscape is undergoing a seismic shift. Where Google once dominated as the primary discovery mechanism, AI-powered platforms like ChatGPT, Perplexity, and Google Gemini are rapidly becoming the new gatekeepers of information access. In 2024, AI referral traffic represented just 0.02% of total publisher traffic, but by 2025, this figure exploded to 0.15%—a 7x growth rate that signals a fundamental restructuring of how audiences discover content. Meanwhile, traditional organic search continues its decline, with Google’s ad revenue growth slowing to 13.9% (2023-2024) compared to the pandemic-era 41.3%. For publishers, this isn’t a distant threat; it’s an immediate reality requiring strategic adaptation and new revenue models.

The quality of AI-driven traffic tells a compelling story that contradicts initial publisher skepticism. Unlike the skepticism surrounding bot traffic, AI referrals demonstrate superior engagement metrics across every meaningful dimension. Consider the comparative performance data:

| Metric | AI Traffic | Traditional Search |

|---|---|---|

| Bounce Rate | 23% lower | Baseline |

| Page Views per Session | 12% higher | Baseline |

| Session Duration | 41% longer | Baseline |

| Conversion Rate Gap | 9% worse | 43% worse (July 2024) |

This data reveals that AI-sourced visitors are more engaged, spend more time consuming content, and generate more page views per visit. The conversion gap has narrowed dramatically from a 43% deficit in July 2024 to just 9% by February 2025, suggesting that AI traffic quality is rapidly approaching parity with traditional search traffic. For publishers willing to optimize for this channel, the audience quality justifies the strategic investment.

Yet the revenue challenge remains acute and unforgiving. Traditional monetization models—primarily programmatic advertising and affiliate links—collapse under the weight of AI’s zero-click architecture. When ChatGPT synthesizes an answer directly in the chat interface, users have no reason to click through to the original source. DMG Media reported an 89% drop in click-through rates from AI Overview results, while 60% of mobile queries now return zero-click results that bypass publisher websites entirely. Publishers tracking traffic below Google’s AI Overview feature report losses up to 79%, creating a revenue vacuum that standard ad networks cannot fill. The fundamental problem: if users never reach your website, traditional CPM and CPC models generate zero revenue, regardless of how many times your content is cited or synthesized.

Direct licensing and content deals represent the most straightforward path to AI-era revenue. News Corp’s landmark May 2024 agreement with OpenAI established a template: publishers license their content directly to AI platforms in exchange for guaranteed payments. These deals typically operate on usage-based models where publishers receive compensation based on how frequently their content is crawled, cited, or synthesized. The ProRata model exemplifies this approach, offering publishers approximately one penny per crawl (roughly $10 CPM equivalent) with a 50-50 revenue split between platform and publisher. Beyond News Corp, other major publishers are negotiating similar arrangements, with some securing crawl fees—flat payments for the right to index content—and others pursuing revenue-sharing models tied directly to AI platform growth. These licensing agreements provide predictable, scalable revenue that doesn’t depend on user clicks or traditional advertising performance.

Generative Engine Optimization (GEO) is the new frontier of content strategy, requiring publishers to rethink how content is structured, formatted, and presented for AI consumption. Rather than optimizing for Google’s algorithm, GEO focuses on making content maximally useful for AI systems to cite and synthesize. Implement these proven tactics:

These tactics increase the likelihood that your content will be selected for AI synthesis, expanding your reach even when users don’t click through to your site.

Publisher-branded AI tools represent a higher-stakes but potentially higher-reward strategy. Rather than ceding control to third-party platforms, forward-thinking publishers are building proprietary AI assistants that serve their audiences directly. Politico’s Policy Intelligence Assistant exemplifies this approach—a specialized AI tool that synthesizes political news and policy information while keeping users within Politico’s ecosystem. This strategy offers multiple revenue advantages: subscription models can gate access to premium AI features, in-bot advertising creates new inventory for premium sponsors, and first-party data collection provides insights into user behavior and preferences. Publishers maintain complete control over how their content is presented, can implement paywalls around AI-generated insights, and build direct relationships with users rather than depending on third-party platform algorithms. The investment is substantial, but the long-term competitive moat justifies the cost for publishers with sufficient scale and technical capability.

Diversified revenue streams are essential for publishers navigating the AI transition. No single monetization approach will replace traditional advertising revenue, but a portfolio of complementary strategies can exceed it. Subscription models—both for premium content and AI-powered tools—create recurring revenue that’s insulated from advertising market fluctuations. First-party data partnerships with AI platforms, advertisers, and other technology companies generate licensing revenue based on audience insights. Strategic partnerships with AI platforms can include revenue-sharing arrangements, affiliate commissions on premium features, and co-marketing opportunities. Premium content tiers can be reserved for human-written analysis, original reporting, and proprietary research that AI systems cannot synthesize. Affiliate relationships are evolving too—publishers can earn commissions when AI systems recommend their products or services, creating a new monetization layer. The publishers thriving in 2025 aren’t choosing between licensing, GEO, branded tools, and traditional advertising; they’re implementing all of them simultaneously.

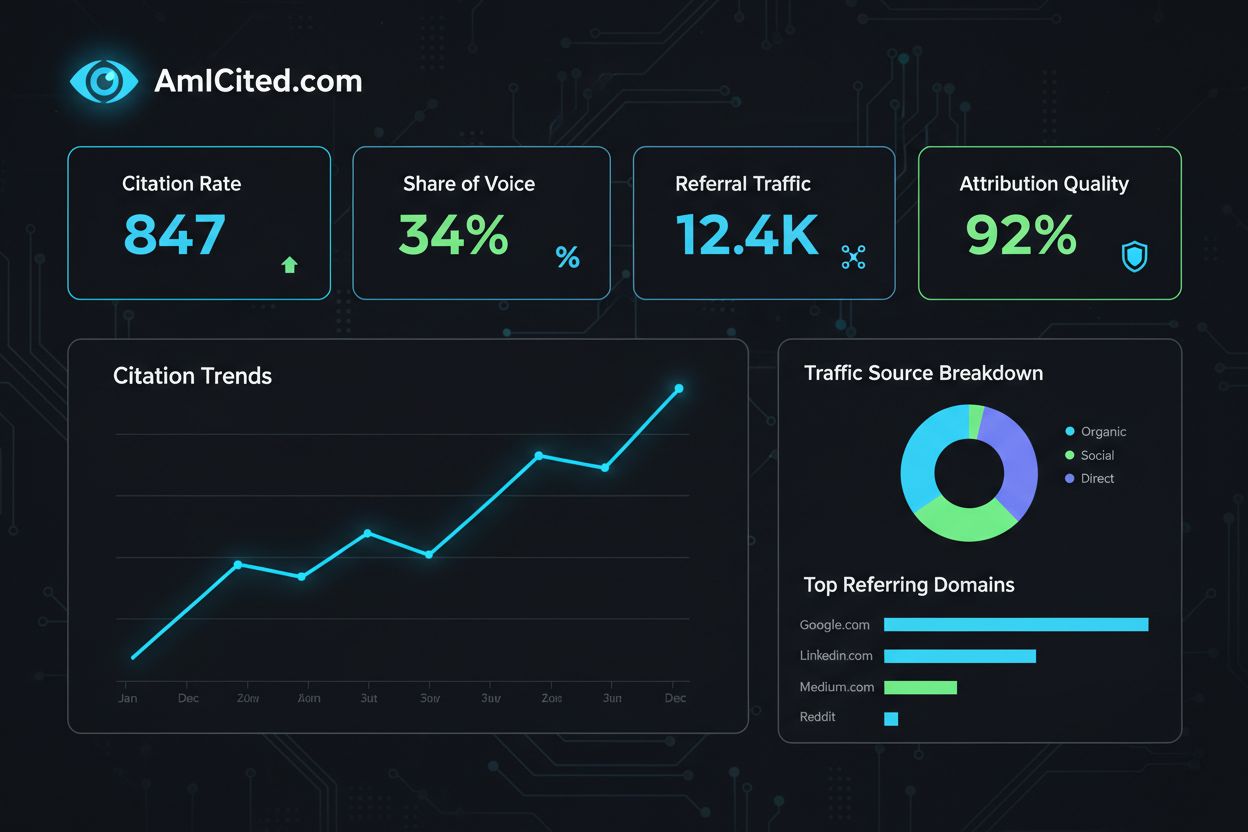

Measuring AI traffic and attribution is impossible without specialized tools designed for the AI era. Traditional analytics platforms like Google Analytics were built for click-based traffic and struggle to track citations that never generate website visits. This is where AmICited.com becomes invaluable—the platform specializes in AI citation tracking, monitoring where and how your content appears across ChatGPT, Perplexity, Google Gemini, and other AI systems. Beyond simple citation counts, effective AI traffic measurement requires tracking share of voice (your citations as a percentage of total citations in your category), referral quality (which AI platforms send the most engaged traffic), and attribution accuracy (connecting AI citations to downstream conversions and revenue). Publishers should implement UTM parameters in AI-generated links, monitor branded mentions in AI responses, and establish baseline metrics before optimization efforts begin. Without proper measurement infrastructure, you’re flying blind—unable to determine which GEO tactics work, which licensing deals are worth renewing, or whether your AI strategy is actually generating ROI.

Strategic decision-making about which content to optimize versus protect requires a nuanced framework. Not all content should be optimized for AI visibility, and not all publishers should pursue licensing deals. Consider these factors: evergreen content (how-to guides, reference material, educational content) benefits dramatically from AI optimization because it drives sustained traffic and citations. Breaking news and time-sensitive reporting may be better protected or monetized through exclusive licensing, as AI systems cannot synthesize information faster than real-time. Proprietary research and original analysis should be carefully evaluated—licensing can generate revenue, but exclusive paywalls may generate more. Commodity content (news aggregation, basic product reviews) is difficult to monetize through any channel and may be best optimized for AI visibility to drive brand awareness. A tiered approach works best: license your most valuable, proprietary content; optimize evergreen content for AI visibility; build branded AI tools around premium analysis; and maintain traditional advertising on high-traffic pages. Some publishers may even implement selective blocking of AI crawlers for specific content sections while allowing access to others, using tools like Cloudflare’s blocking framework to maintain granular control.

The long-term competitive landscape is being reshaped by AI, and early movers will capture disproportionate value. Gartner predicts that organic search traffic will decline by 50% by 2028, a trajectory that makes AI monetization not optional but existential. Publishers who establish licensing relationships now, build authority in AI systems, and develop branded AI tools will enter 2028 with diversified revenue streams and direct audience relationships. Those who wait, hoping traditional search will stabilize, will face a compressed timeline and reduced negotiating leverage with AI platforms. The opportunity window is narrow—AI platforms are still in growth mode and willing to negotiate favorable terms with quality publishers. Within 18-24 months, as AI platforms consolidate market share and publisher leverage diminishes, deal terms will become less favorable. The publishers thriving in the AI-native future won’t be those who best optimized for Google in 2015; they’ll be those who recognized the shift early, invested in new capabilities, and built sustainable revenue models for an AI-driven discovery landscape.

AI referral traffic currently represents about 0.15% of total web traffic, up from 0.02% in 2024. ChatGPT dominates with approximately 78% of all AI referrals, followed by Perplexity at 15% and Google Gemini at 6.4%. Major publishers are seeing millions of visits from ChatGPT monthly, with traffic nearly doubling in the first half of 2025. While still small compared to traditional search, the growth trajectory is explosive and accelerating.

The answer depends on your content type and business model. Evergreen informational content benefits from AI optimization because it drives sustained traffic and citations. Proprietary research and exclusive reporting may warrant stronger protection through licensing deals. A strategic tiered approach works best: license high-value content, optimize evergreen content for AI visibility, and maintain traditional advertising on high-traffic pages. Blocking AI creates a lose-lose scenario because content may still be scraped while cutting off referral traffic.

Traditional SEO focuses on ranking high in search results to earn clicks. GEO focuses on getting your content cited in AI-generated responses. Both are necessary for modern visibility. SEO emphasizes keywords, backlinks, and technical factors. GEO emphasizes content structure, authority signals, quotable facts, and freshness. AI systems prioritize content that's easy to parse and cite, which often differs from what traditional search algorithms reward.

Publishers license their content directly to AI platforms in exchange for guaranteed payments. These deals typically operate on usage-based models where publishers receive compensation based on how frequently their content is crawled, cited, or synthesized. The ProRata model offers approximately one penny per crawl (roughly $10 CPM equivalent) with a 50-50 revenue split. News Corp's landmark deal with OpenAI established a template that other publishers are now following, with terms varying based on content quality and publisher size.

Publishers should track: citation rate (how often your content is cited), share of voice (your citations as a percentage of total citations in your category), referral quality (which AI platforms send the most engaged traffic), and attribution accuracy (connecting AI citations to conversions and revenue). Tools like AmICited.com specialize in AI citation tracking across ChatGPT, Perplexity, and other platforms. Implement UTM parameters in AI-generated links and monitor branded mentions in AI responses to establish baseline metrics.

Yes, but with different strategies than large publishers. Small publishers may struggle to negotiate licensing deals with major AI platforms, but they can excel at GEO optimization and building niche authority. Focusing on evergreen, high-quality content in specific niches makes small publishers attractive to AI systems. Building community and direct audience relationships through newsletters and branded tools can also create sustainable revenue. The key is specialization and quality rather than scale.

AI traffic significantly outperforms traditional search on engagement metrics. AI-referred visitors show 23% lower bounce rates, generate 12% more page views per session, and have 41% longer session durations. The conversion gap has narrowed from 43% worse (July 2024) to just 9% worse (February 2025), suggesting AI traffic quality is rapidly approaching parity with traditional search. For publishers, this means AI traffic is not just growing—it's also becoming increasingly valuable per visit.

AI traffic is already significant for some publishers, with major outlets receiving millions of visits monthly from ChatGPT alone. However, Gartner predicts that organic search traffic will decline by 50% by 2028, making AI monetization increasingly critical. The opportunity window for favorable licensing deals is narrow—AI platforms are currently in growth mode and willing to negotiate. Within 18-24 months, as platforms consolidate market share, deal terms will likely become less favorable. Publishers should act now to establish relationships and optimize content.

Monitor where your content appears across ChatGPT, Perplexity, and other AI platforms. Understand your AI visibility and optimize your revenue strategy with real-time attribution data.

Discover critical AI search trends including ChatGPT dominance, Perplexity growth, Google AI Mode expansion, and zero-click optimization. Learn how to monitor y...

Discover how AI search is reshaping SEO. Learn the key differences between AI platforms like ChatGPT and traditional Google search, and how to optimize your con...

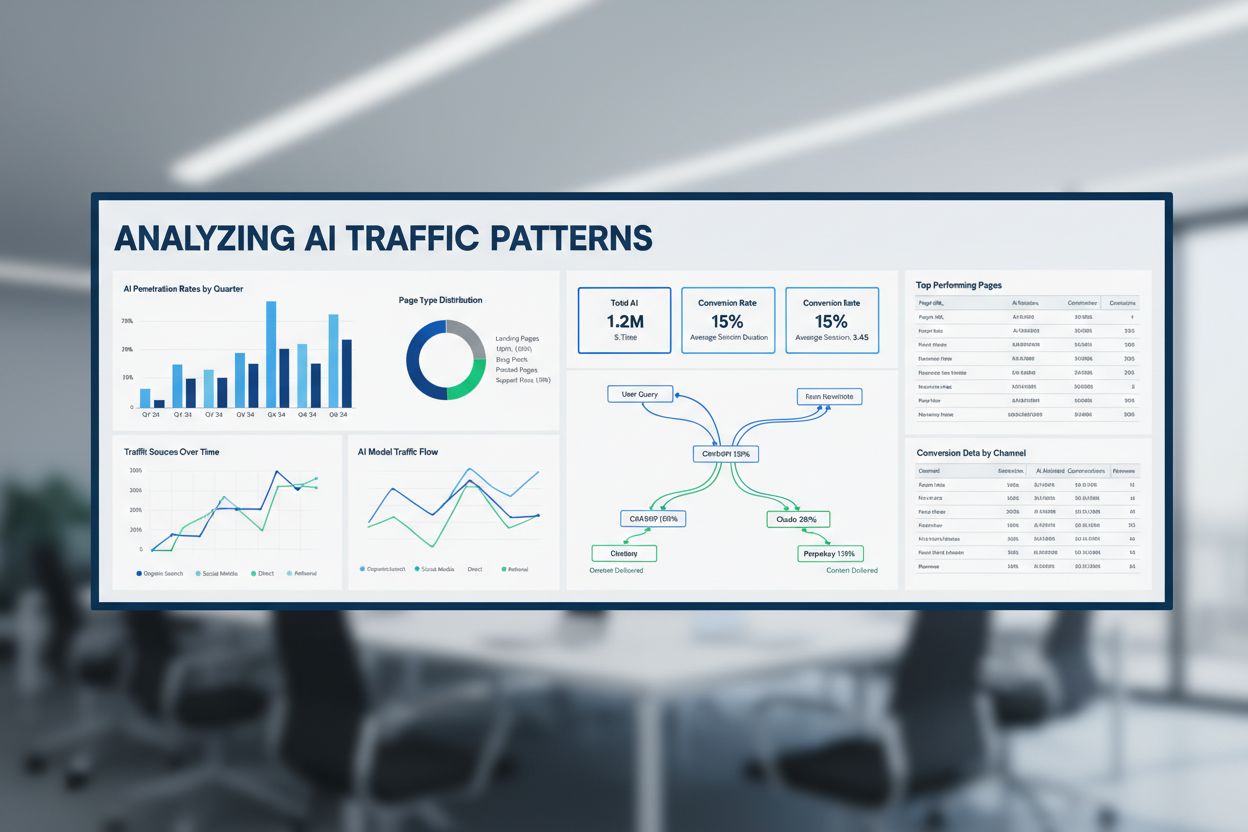

Discover what AI traffic data reveals about LLM behavior. Analyze ChatGPT, Claude, and Perplexity traffic patterns with real data and actionable insights for yo...