Will AI Search Replace Google? The Future of Search Engines in 2025

Discover whether AI search engines like ChatGPT and Perplexity will replace Google. Learn about the future of search, market trends, and how both technologies c...

Explore how AI search platforms like ChatGPT and Perplexity are reshaping the search landscape. Discover when AI could match Google’s conversion volume and what it means for your business strategy in 2026-2028.

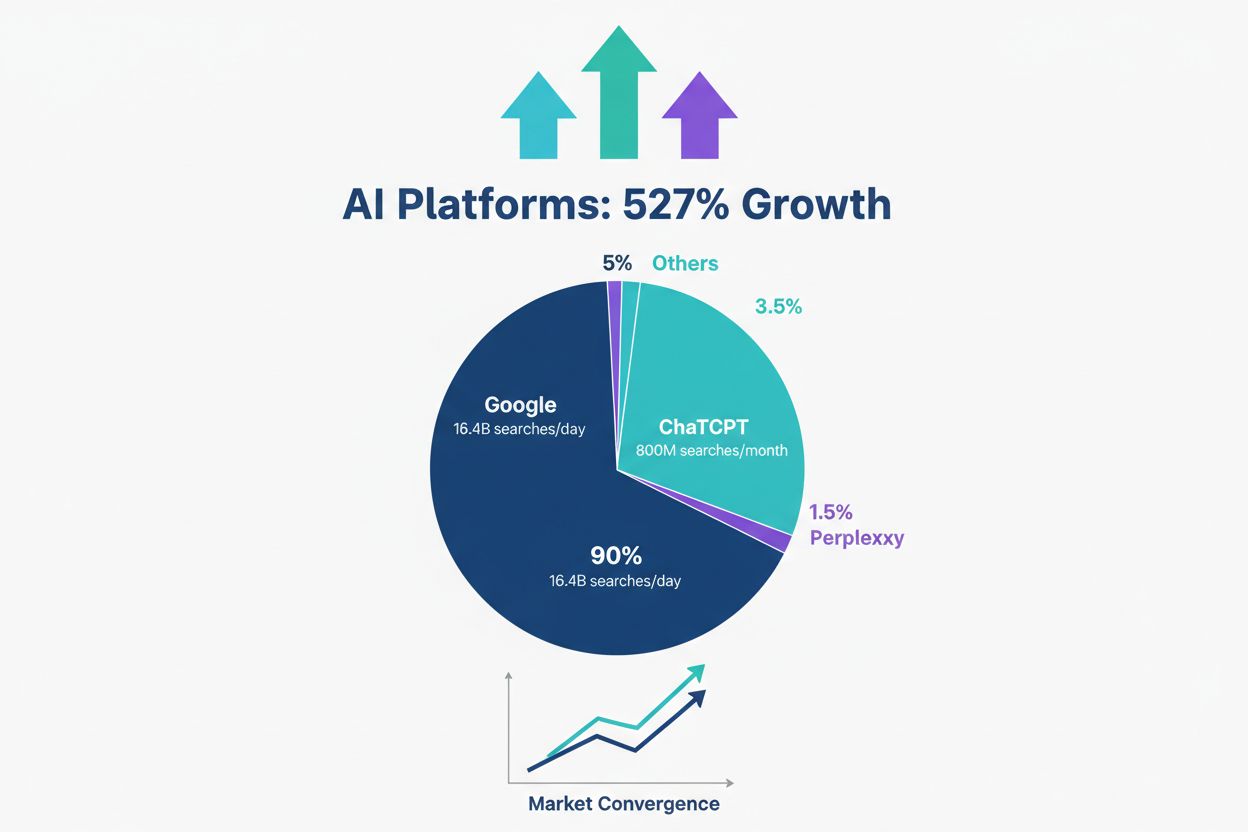

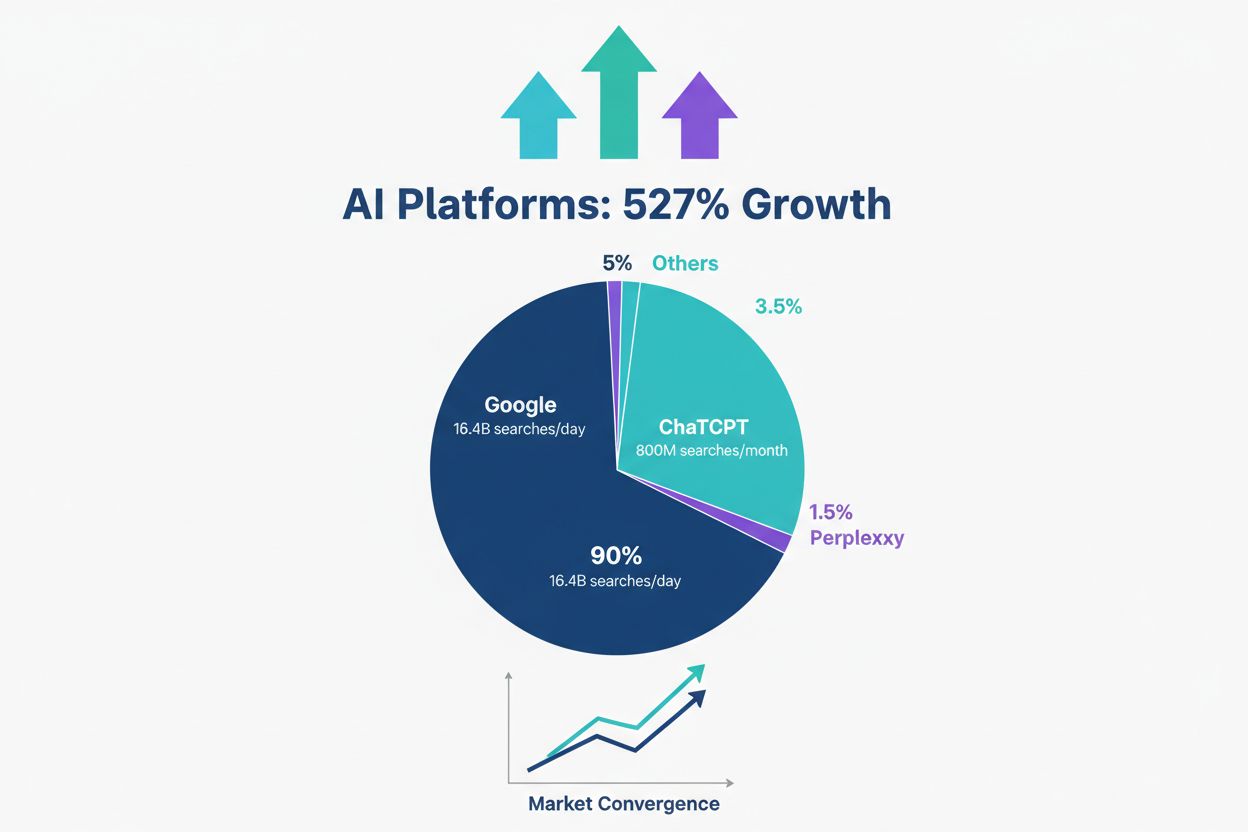

Google’s dominance in search remains undeniable, commanding 90% of the global search market share with an astonishing 16.4 billion searches conducted daily. This figure represents the accumulated behavior of billions of users who have made Google their default discovery mechanism for nearly three decades. The search giant’s infrastructure, algorithm sophistication, and user trust create a moat that appears insurmountable at first glance. Yet beneath this surface of stability, a fundamental shift in how people discover information is accelerating at an unprecedented pace.

ChatGPT has emerged as the fastest-growing application in history, processing 2.5 billion daily prompts and generating approximately 800 million searches worth of queries monthly. This represents not merely a new competitor, but a fundamentally different approach to information discovery. Where Google returns links, ChatGPT returns synthesized answers. Where Google requires users to evaluate multiple sources, ChatGPT presents curated information. The distinction matters profoundly for understanding the future of search.

Adoption metrics reveal the scale of this transformation. 52% of US adults have used AI language models, a penetration rate that rivals early smartphone adoption curves. This isn’t a niche phenomenon confined to tech enthusiasts—it’s mainstream behavior reshaping how millions access information daily. The demographic spread is particularly telling: AI tools have moved beyond early adopters into the broader population, suggesting we’re witnessing a genuine paradigm shift rather than a temporary trend.

The competitive landscape has fragmented beyond the traditional Google-Bing duopoly. Perplexity, Claude, and other AI search platforms are capturing meaningful user attention. These platforms share certain characteristics: they prioritize answer quality over link quantity, they cite sources transparently, and they engage users in conversational discovery rather than transactional search. This represents a meaningful departure from the link-based model that has dominated for decades.

| Metric | ChatGPT | Perplexity | Market Position | |

|---|---|---|---|---|

| Daily Queries | 16.4B | ~800M | ~200M | Google 20x larger |

| Market Share | 90% | ~5% | ~1.5% | Google dominant |

| User Base | 5.6B+ | 200M+ | 50M+ | Google 28x larger |

| Growth Rate | 3-5% YoY | 527% YoY | 400%+ YoY | AI platforms accelerating |

| Conversion Advantage | Baseline | 4-5x higher | 4-5x higher | AI platforms superior |

The data reveals a paradox: Google maintains overwhelming scale advantage while AI platforms demonstrate superior conversion efficiency. This distinction will prove crucial in determining the future of search. Scale without conversion efficiency is vulnerable; conversion efficiency without scale is limited. The question isn’t whether AI search will replace Google, but rather how these platforms will coexist and compete across different use cases and user segments.

The 4-5x conversion rate advantage that AI search platforms demonstrate over traditional search represents one of the most significant metrics in digital marketing today. This isn’t a marginal improvement—it’s a fundamental difference in how users interact with information and make decisions. Understanding why requires examining the mechanics of user intent and information consumption.

Traditional search operates on a quantity model: return the most relevant links and let users evaluate options. This approach works well for navigational queries (“best pizza near me”) and informational searches (“how to change a tire”). However, it places cognitive burden on users to synthesize information, compare sources, and make decisions. Each additional click represents friction, and friction reduces conversion probability.

AI search operates on a synthesis model: process multiple sources, extract relevant information, and present a curated answer. Users receive immediate value without additional research. For commercial intent queries—those where users are ready to make decisions—this approach dramatically reduces friction. A user asking “best project management software for remote teams” receives a synthesized comparison rather than a list of links to evaluate. The path from query to decision compresses significantly.

The quality-versus-quantity distinction matters enormously. Google’s algorithm optimizes for relevance ranking; AI search optimizes for answer quality. These aren’t identical objectives. A highly relevant link might lead to a mediocre answer; a synthesized response from multiple sources might provide superior insight. Users increasingly recognize this distinction and adjust their search behavior accordingly.

Consider the user journey differences:

This compression of steps directly correlates with higher conversion rates. Fewer decision points mean fewer opportunities for users to abandon the journey. Additionally, AI platforms cite sources, allowing users to verify information without abandoning the platform. This transparency builds trust while maintaining engagement.

The conversion advantage extends beyond commercial queries. For research-intensive questions, AI search provides faster insight. For complex topics requiring synthesis across multiple domains, AI platforms deliver superior value. Users increasingly recognize these advantages and adjust their search behavior, particularly for high-intent queries where conversion probability matters most.

The trajectory toward conversion parity between AI search and Google follows a predictable mathematical model based on current growth rates and adoption patterns. Late 2027 to early 2028 represents the window when AI search platforms could achieve equivalent conversion volume to Google, despite Google’s continued dominance in raw search volume. This timeline assumes sustained growth rates and no major disruptions to either platform’s market position.

The 527% year-over-year growth rate for AI search provides the mathematical foundation for this projection. Compound growth at this rate produces exponential expansion: what represents 5% of Google’s conversion volume today could represent 50% within 24 months. The mathematics are straightforward, though the business implications are profound. This growth rate cannot sustain indefinitely—market saturation and competitive pressure will eventually moderate expansion—but the runway for continued acceleration extends through 2027.

Current conversion volume estimates suggest AI platforms generate approximately $2-3 billion in annual conversion value compared to Google’s $150+ billion. This 50:1 ratio appears insurmountable until you apply the growth mathematics. At 527% YoY growth, AI platforms would reach $10-15 billion within 18 months, $50-75 billion within 24 months, and approach parity within 36 months. Google’s growth rate of 3-5% annually means the gap closes rapidly despite Google’s massive base.

Several scenarios illustrate the progression:

| Timeline | AI Search Conversion Value | Google Conversion Value | Ratio | Market Implications |

|---|---|---|---|---|

| Q4 2024 | $2.5B | $150B | 1:60 | AI emerging |

| Q4 2025 | $15B | $155B | 1:10 | AI accelerating |

| Q4 2026 | $75B | $160B | 1:2 | Parity approaching |

| Q4 2027 | $150B | $165B | 1:1 | Conversion parity |

| Q4 2028 | $200B+ | $170B | 1.2:1 | AI potentially exceeds |

This projection assumes several critical variables remain constant: sustained user adoption, maintained conversion rate advantages, and no major competitive disruptions. In reality, variables will shift. Google will accelerate AI integration. New competitors will emerge. User behavior will evolve. However, the directional trend appears robust across multiple scenarios.

The tipping point matters less for its precise timing than for what it signals: a fundamental restructuring of the search market is underway. Businesses that position themselves for this transition during the 2025-2027 window gain significant advantages. Those that wait until conversion parity is obvious will find themselves competing in a mature, crowded market. The opportunity window is real, measurable, and closing.

Generational preferences reveal the most dramatic evidence of search behavior transformation. Among 18-24 year olds, ChatGPT usage approaches Google usage within 3%, a statistic that would have seemed impossible just two years ago. This isn’t a marginal preference shift—it represents a fundamental change in how the youngest adult demographic discovers information. For digital marketers and business leaders, this demographic shift signals the future of search behavior across all age groups.

The generational breakdown demonstrates clear patterns:

This age-based distribution follows predictable adoption curves, but the velocity of adoption among younger demographics exceeds historical technology adoption rates. Smartphone adoption took 15+ years to reach 90% penetration; AI search adoption is tracking toward similar penetration in 5-7 years. The acceleration reflects both the utility of AI search and the digital nativity of younger users.

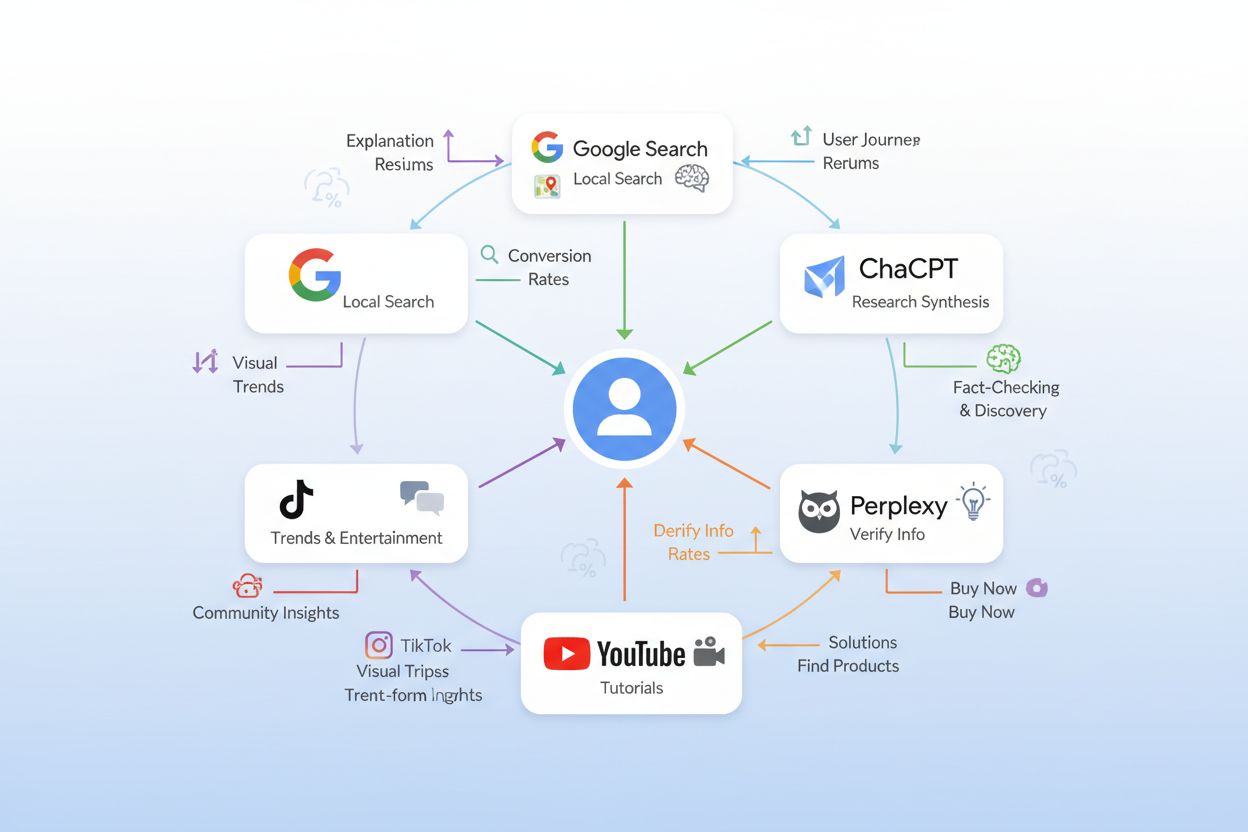

Multi-platform search habits are becoming normalized rather than exceptional. Younger users don’t view Google and ChatGPT as competitors—they view them as complementary tools serving different purposes. A Gen Z user might use Google for local information, ChatGPT for research synthesis, YouTube for tutorials, and TikTok for trend discovery. This multi-platform approach represents a fundamental departure from the single-platform search behavior that dominated the Google era.

Regional variations complicate the narrative. In markets with strong AI adoption infrastructure—particularly the United States, parts of Europe, and East Asia—AI search adoption accelerates faster. In markets with limited AI infrastructure or regulatory restrictions, traditional search maintains dominance. This geographic fragmentation suggests the future won’t be a single global search paradigm but rather regional variations reflecting local adoption patterns and regulatory environments.

The implications for content strategy are substantial. Creating content optimized exclusively for Google search increasingly misses younger audiences who discover information through AI platforms. Conversely, optimizing exclusively for AI platforms ignores the billions of users who still rely on traditional search. The strategic imperative is clear: multi-platform optimization isn’t optional—it’s essential for reaching diverse audiences across generational and geographic segments.

Google’s response to AI search competition demonstrates the company’s recognition of the existential threat posed by alternative discovery mechanisms. The company has invested $75 billion in AI development and deployed Google AI Overviews to 1.5 billion users, representing the most aggressive integration of AI capabilities into its core search product. This isn’t a defensive move—it’s a fundamental reimagining of how Google delivers search results.

Google AI Overviews represent a direct response to ChatGPT’s synthesis model. Rather than returning links, Google now generates AI-powered summaries that synthesize information from multiple sources. The feature addresses the core advantage that AI search platforms have leveraged: providing answers rather than links. By integrating AI capabilities directly into Google Search, the company attempts to retain users within its ecosystem while adopting the answer-synthesis approach that makes AI platforms attractive.

The strategic positioning is sophisticated. Google maintains its link-based model for users who want source evaluation while offering AI-powered summaries for users who want synthesized answers. This dual-model approach allows Google to serve both traditional search users and those migrating toward AI-style discovery. The company essentially attempts to own both sides of the market transition, a strategy that leverages its massive user base and technical capabilities.

Google’s competitive advantages in this transition remain substantial:

However, Google faces structural challenges in competing with pure-play AI search platforms. The company’s business model depends on advertising revenue, which creates incentives to maximize user engagement with search results pages. AI platforms, unburdened by advertising dependencies, can optimize purely for user satisfaction. This fundamental misalignment of incentives could prove consequential as users increasingly value answer quality over advertising exposure.

The $75 billion AI investment signals Google’s commitment to maintaining search dominance, but capital investment alone doesn’t guarantee competitive success. The company must navigate the tension between protecting its advertising business and delivering the superior user experience that AI platforms provide. This tension will likely define Google’s competitive position throughout the 2025-2028 period.

The framing of “AI search versus Google” represents a fundamental misunderstanding of how search is evolving. The future isn’t a binary choice between platforms—it’s a multi-platform ecosystem where different tools serve different purposes, user segments, and use cases. This ecosystem model better explains current user behavior and provides more accurate predictions for future search dynamics.

Consider the complementary strengths of different platforms. Google excels at local search, navigational queries, and real-time information discovery. AI platforms excel at research synthesis, complex question answering, and comparative analysis. YouTube dominates tutorial and visual learning discovery. TikTok drives trend discovery among younger demographics. Reddit provides community-based information discovery. Rather than one platform replacing another, users increasingly adopt multi-platform strategies that leverage each platform’s strengths.

The 25.19% domain overlap between Perplexity and ChatGPT reveals important ecosystem dynamics. Despite both being AI search platforms, they cite different sources and provide different perspectives on similar queries. This differentiation suggests the market can support multiple AI search platforms, each with distinct positioning and user bases. The overlap isn’t complete cannibalization—it’s complementary coverage of the search market.

Source citation patterns reveal how the ecosystem functions. YouTube represents the most cited source across AI platforms, appearing in 11.3% of ChatGPT responses and 11.11% of Perplexity responses. This dominance reflects both YouTube’s content quality and the AI platforms’ recognition that video content often provides superior answers to certain query types. Rather than competing with YouTube, AI platforms integrate it into their discovery ecosystem.

Use case differentiation drives multi-platform adoption:

This ecosystem model explains why “Google replacement” predictions consistently miss the mark. Platforms don’t replace each other—they specialize. Users adopt multiple platforms because each serves distinct needs. The question isn’t which platform will dominate, but rather how businesses optimize for visibility across the entire ecosystem.

For content creators and marketers, this ecosystem reality demands strategic adaptation. Optimizing exclusively for Google ignores the growing segment of users who discover information through AI platforms. Optimizing exclusively for AI platforms ignores the billions who still rely on traditional search. The strategic imperative is ecosystem optimization: ensuring content visibility and performance across Google, AI search platforms, YouTube, and other relevant discovery mechanisms.

The emergence of multi-platform search fundamentally changes how businesses approach visibility and customer acquisition. Traditional SEO strategy—optimizing for Google’s algorithm and ranking factors—remains important but increasingly insufficient. Businesses must develop comprehensive visibility strategies that address Google, AI search platforms, and other discovery mechanisms simultaneously. This evolution requires rethinking content structure, optimization priorities, and measurement frameworks.

AI search optimization differs meaningfully from traditional SEO. Where Google rewards keyword optimization and link authority, AI platforms reward content quality, source credibility, and comprehensive coverage of topics. A page that ranks well in Google might not appear in ChatGPT responses; conversely, a page that ChatGPT frequently cites might not rank highly in Google. These aren’t identical optimization targets—they require distinct strategic approaches.

Content structure changes become necessary for multi-platform visibility. AI platforms favor comprehensive, well-organized content that synthesizes information across multiple dimensions. Long-form content that thoroughly addresses topics performs better in AI search than thin, keyword-optimized pages. Structured data becomes increasingly important as AI platforms parse content to extract relevant information. Clear source attribution and citation practices improve visibility in AI platforms that prioritize transparency.

Conversion optimization must account for different user intents across platforms. Google users often seek quick answers or local information; they’re ready to click and evaluate options. AI search users often seek synthesis and analysis; they’re ready to make decisions based on the AI platform’s recommendations. These different user states require different conversion strategies. A landing page optimized for Google click-through might underperform with AI-referred traffic that expects more comprehensive information.

Strategic action items for businesses include:

The measurement framework must evolve beyond traditional SEO metrics. Tracking rankings in Google remains important, but it’s insufficient. Businesses need visibility into how their content performs in AI search results, which sources AI platforms cite, and how AI-referred traffic converts compared to Google-referred traffic. This expanded measurement approach reveals which platforms drive the most valuable traffic and where optimization efforts should concentrate.

The 18-24 month window from 2026 through early 2028 represents a critical positioning opportunity for businesses willing to adapt their visibility strategies ahead of mainstream market shifts. During this period, AI search adoption will accelerate from early-adopter to mainstream status, conversion parity between AI and Google will approach, and competitive positioning in the new search ecosystem will largely solidify. Businesses that establish strong visibility in AI platforms during this window gain first-mover advantages that will prove difficult for competitors to overcome.

Early mover advantages in emerging platforms are substantial and well-documented. The first businesses to optimize for Google in the late 1990s gained disproportionate visibility and traffic. The first businesses to optimize for mobile search in the early 2010s captured outsized market share. The same pattern is repeating with AI search. Businesses that begin optimizing for ChatGPT, Perplexity, and other AI platforms in 2025-2026 will establish citation patterns and visibility that persist as these platforms mature.

The competitive dynamics during this window differ meaningfully from mature market competition. In mature markets, competitive advantages are marginal and expensive to achieve. In emerging markets, significant advantages accrue to early movers with relatively modest effort. A business that invests in AI search optimization in 2025 might achieve visibility that would require 10x the investment to achieve in 2028 when the market is mature and competitive. The mathematics of early-mover advantage are compelling.

Strategic recommendations for this window include:

The window is real but closing. As AI search adoption accelerates and competitive intensity increases, the advantages of early positioning diminish. Businesses that wait until 2027 or 2028 to address AI search optimization will find themselves competing in a crowded, mature market where differentiation is expensive and difficult. The strategic imperative is clear: the time to position for the AI search transition is now, during the 2025-2026 period when adoption is accelerating but competition remains manageable.

The future of search isn’t a single platform replacing another—it’s a multi-platform ecosystem where different tools serve different purposes. Businesses that recognize this reality and adapt their visibility strategies accordingly will thrive in the emerging search landscape. Those that cling to single-platform optimization strategies will find themselves increasingly invisible to users who discover information through multiple channels. The choice is clear: adapt now or compete from a position of disadvantage in the search ecosystem of 2028 and beyond.

No. Google will remain dominant in raw search volume, but AI platforms are capturing higher-value conversions. By late 2027-early 2028, AI search could match Google's conversion volume despite Google maintaining larger overall traffic. The future is a multi-platform ecosystem where different tools serve different purposes.

AI search platforms are growing at 527% year-over-year, while Google grows at 3-5% annually. This exponential growth rate means AI platforms are rapidly closing the gap in conversion value, even though Google maintains a 20x volume advantage in raw searches.

AI search users arrive with higher intent because they've already researched and refined their requirements through conversation with the AI. They're further along the buyer journey when they click through to your site, resulting in faster conversions and higher conversion rates.

Businesses should audit their current visibility in ChatGPT, Perplexity, and other AI platforms; optimize content for AI platform citation; develop comprehensive, well-structured content; and use tools like AmICited.com to monitor how their brand appears across AI search engines.

Based on current growth rates, AI search could achieve conversion parity with Google by late 2027 to early 2028. However, the timeline depends on sustained adoption rates and platform development. The 18-24 month window from 2025-2027 is critical for positioning.

Gen Z (18-24) shows ChatGPT usage within 3% of Google usage, while older generations still heavily favor Google. This generational divide suggests AI search adoption will accelerate as younger demographics become the majority of internet users.

Rather than one platform replacing another, search is evolving into an ecosystem where Google handles local and navigational queries, AI platforms handle research and synthesis, YouTube handles tutorials, TikTok handles trends, and Reddit provides community insights. Users adopt multiple platforms based on their needs.

Tools like AmICited.com allow you to monitor how your brand appears in ChatGPT, Perplexity, Google AI Overviews, and other AI platforms. You can track citation patterns, visibility metrics, and how often your content is referenced by AI systems.

Track how your brand appears across ChatGPT, Perplexity, Google AI Overviews, and other AI platforms. Get real-time insights into your AI citations and visibility metrics.

Discover whether AI search engines like ChatGPT and Perplexity will replace Google. Learn about the future of search, market trends, and how both technologies c...

Discover current statistics on AI search adoption rates. Learn how many users rely on ChatGPT, Perplexity, and other AI search engines compared to traditional s...

Explore AI Visibility Futures - forward-looking analysis of emerging trends in AI-driven brand discovery. Learn how brands will be discovered by AI systems and ...