YMYL (Your Money Your Life)

YMYL content requires high E-E-A-T standards. Learn what qualifies as Your Money Your Life content, why it matters for SEO and AI visibility, and how to optimiz...

Learn how AI platforms like ChatGPT, Perplexity, and Google AI Overviews evaluate financial content. Understand YMYL requirements, E-E-A-T standards, and compliance frameworks for financial information in AI search.

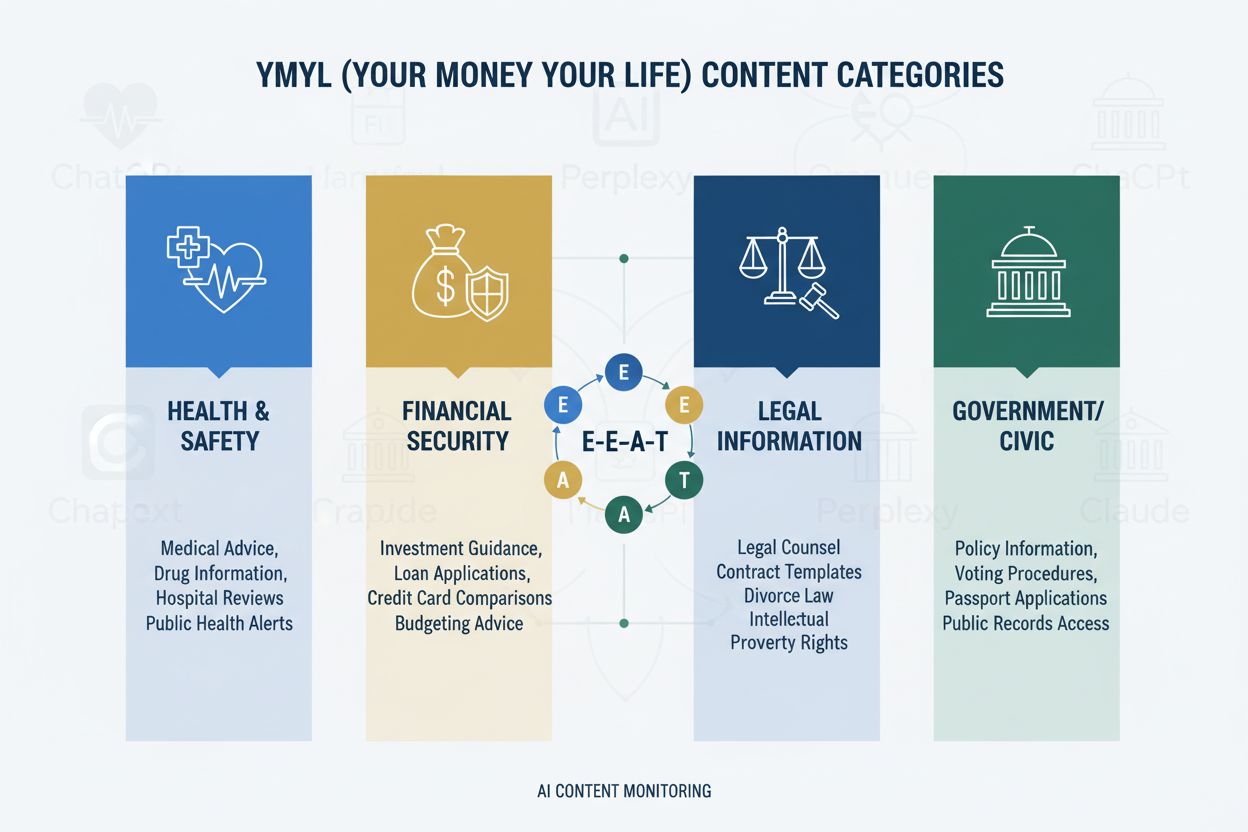

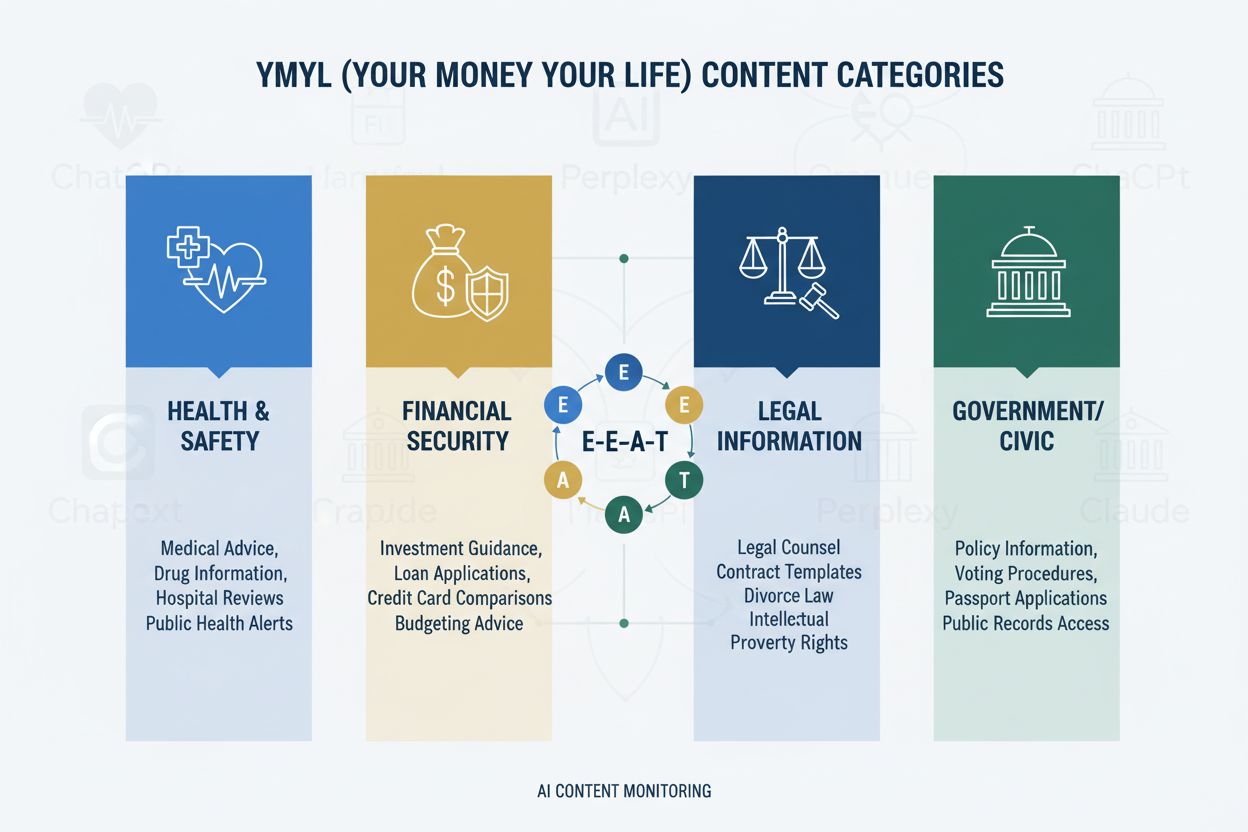

Your Money or Your Life (YMYL) content represents one of the most heavily scrutinized categories in both traditional search and AI-powered platforms. For financial services, this classification carries profound implications because inaccurate or misleading information can directly harm users’ financial stability, retirement security, and long-term wealth building. Google and AI platforms like ChatGPT, Perplexity, and Google AI Overviews apply significantly stricter evaluation standards to financial content compared to other topics, recognizing that financial decisions have lasting consequences. The E-E-A-T framework (Experience, Expertise, Authoritativeness, and Trustworthiness) becomes the primary lens through which these platforms assess whether financial content deserves visibility and citation. Understanding YMYL requirements isn’t optional for financial content creators—it’s the foundation for maintaining visibility in both traditional search and emerging AI-driven discovery channels.

Different AI platforms evaluate and cite financial content through distinct methodologies, each reflecting their unique approach to source verification and user trust. ChatGPT emphasizes source diversity and transparent attribution, requiring that financial claims be traceable to credible sources with clear documentation of reasoning. Perplexity prioritizes real-time financial data and explicitly displays multiple sources with direct citations, allowing users to verify information independently. Google AI Overviews focus heavily on authoritative financial institutions, regulatory bodies, and peer-reviewed research, with a demonstrated preference for established financial publishers and official government sources. The citation requirements across these platforms reveal a critical pattern: financial content must be sourced from verifiable, authoritative origins rather than relying on general knowledge or aggregated information. Each platform’s approach reflects regulatory awareness and user protection priorities, making source attribution not merely a best practice but a fundamental requirement for financial content visibility in AI search.

| Platform | Citation Requirement | Key Focus |

|---|---|---|

| ChatGPT | Transparent source attribution with reasoning documentation | Source diversity, user verification capability, clear evidence trails |

| Perplexity | Explicit citations with direct links to original sources | Real-time data accuracy, independent verification, source credibility |

| Google AI Overviews | Authoritative institutional sources and regulatory documents | Established financial publishers, official sources, peer-reviewed research |

The E-E-A-T framework operates as the quality assessment mechanism that AI systems use to determine whether financial content deserves prominence and citation. Experience in financial content means demonstrating real-world expertise through documented case studies, client success stories, and practical examples that show how financial strategies have been applied successfully. Expertise requires verifiable credentials—CFP (Certified Financial Planner), CFA (Chartered Financial Analyst), Series 7 or Series 65 licenses, or relevant advanced degrees—that establish the author’s qualifications to discuss financial topics. Authoritativeness emerges through recognition by reputable financial institutions, media mentions in established publications, speaking engagements at industry conferences, and consistent positioning as a thought leader within the financial community. Trustworthiness encompasses accuracy verification through fact-checking processes, transparent disclosure of conflicts of interest, consistency of information across all platforms, and demonstrated commitment to regulatory compliance. AI systems evaluate these components by analyzing author profiles, institutional affiliations, citation patterns, and user engagement signals, creating a comprehensive trust score that determines content visibility and citation likelihood in AI-generated responses.

Financial content creators and firms must navigate a complex regulatory landscape that applies equally to human-created and AI-generated content. FINRA Regulatory Notice 24-09 explicitly requires that all financial communications—including those generated or assisted by AI—undergo appropriate pre- or post-review by qualified compliance professionals before distribution to investors. The SEC and CFPB similarly mandate that firms maintain supervisory control over all investor-facing communications, with particular emphasis on the accuracy and suitability of financial advice. The “human-in-the-loop” approach has become the regulatory standard, requiring that qualified compliance officers validate AI-generated content for factual accuracy, regulatory compliance, and suitability before publication. Exchange Act Rule 17a-4 establishes strict recordkeeping requirements, mandating that firms maintain detailed audit trails of all AI-assisted communications, including prompts, outputs, and review documentation.

Key regulatory requirements for AI-generated financial content include:

Creating financial content that AI platforms recognize and cite requires deliberate structural and strategic choices that signal trustworthiness to algorithmic evaluation systems. Schema.org markup for Organization, Person, and Article types enables AI systems to extract and verify key information about your financial expertise, institutional affiliations, and content credibility. Author attribution with detailed biographical information—including credentials, professional licenses, and institutional affiliations—transforms anonymous content into verifiable expertise that AI systems can evaluate and trust. Source linking to authoritative financial institutions, regulatory documents, and peer-reviewed research creates an evidence trail that AI systems use to validate claims and assess content reliability. Maintaining consistent, accurate information across your website, social profiles, and third-party platforms reinforces trustworthiness signals, as AI systems cross-reference data to identify inconsistencies that might indicate unreliability. AmICited.com provides financial content creators with visibility into how AI platforms actually cite their content, offering data-driven insights into which sources AI systems trust most and how competitive positioning affects citation likelihood. This monitoring capability enables continuous optimization of content strategy based on real AI behavior rather than assumptions about platform preferences.

Financial content creators must balance AI optimization with regulatory compliance, implementing strategies that enhance discoverability while maintaining the highest standards of accuracy and trustworthiness. First, implement comprehensive author profiles with verified credentials, professional licenses, and institutional affiliations that AI systems can extract and evaluate. Second, establish transparent sourcing practices by citing authoritative financial institutions, regulatory documents, and peer-reviewed research with direct links that enable verification. Third, maintain regular content updates to ensure financial information remains current and accurate, as AI systems recognize and reward fresh, maintained content over outdated material. Fourth, create detailed compliance workflows that document AI usage, review processes, and approval chains, ensuring every piece of AI-assisted content meets regulatory standards before publication. Fifth, use structured data markup consistently across your website to help AI systems understand your organization’s authority, author expertise, and content relationships. These practices work synergistically to build the trust signals that AI platforms require for citation, creating a sustainable competitive advantage in AI-driven financial discovery while maintaining full regulatory compliance and protecting users from misinformation.

YMYL (Your Money or Your Life) refers to content that could significantly impact a person's financial stability, health, or safety. Financial content falls squarely into this category because inaccurate information can lead to poor financial decisions. Google and AI platforms apply stricter evaluation standards to YMYL content, requiring higher E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) signals to ensure user protection.

Each platform has distinct citation patterns and requirements. ChatGPT emphasizes source diversity and transparency, Perplexity prioritizes real-time data and multiple sources with visible citations, while Google AI Overviews focus on authoritative financial institutions and regulatory sources. Understanding these differences helps financial content creators optimize their content for each platform's specific evaluation criteria.

Experience means demonstrating real-world financial expertise through case studies and client examples. Expertise requires author credentials like CFP, CFA, or Series 7/65 licenses. Authoritativeness comes from recognition by reputable financial institutions and media mentions. Trustworthiness encompasses accuracy, transparency about conflicts of interest, and consistent information across all platforms. All four components work together to build AI confidence in your financial content.

FINRA, SEC, and CFPB regulations require that all financial content—whether human-created or AI-generated—undergo appropriate pre- or post-review before distribution to investors. The 'human-in-the-loop' approach mandates that qualified compliance professionals validate AI-generated content for accuracy and regulatory compliance. Additionally, firms must maintain detailed recordkeeping of all AI-assisted communications and implement robust governance frameworks for AI deployment.

Implement structured data markup (Schema.org) to clearly identify your organization, authors, and content type. Include author bios with verified credentials and professional affiliations. Cite authoritative sources and link to regulatory documents. Maintain consistent, accurate information across your website and social platforms. Use AmICited.com to monitor how AI platforms cite your content and identify optimization opportunities based on actual AI behavior.

Non-compliant financial content faces significant penalties: lower rankings in Google Search, exclusion from AI platform recommendations, regulatory fines from FINRA or SEC, and reputational damage. AI systems actively filter out content that fails E-E-A-T evaluation, making it invisible to users seeking financial guidance. For regulated firms, violations can result in enforcement actions, mandatory remediation, and substantial financial penalties.

AmICited.com tracks how AI platforms like ChatGPT, Perplexity, and Google AI Overviews cite your financial brand and content. The platform provides insights into citation patterns, source attribution accuracy, and competitive positioning in AI search results. This data helps financial content creators understand how AI systems perceive their authority and trustworthiness, enabling data-driven optimization of content strategy and compliance frameworks.

Source attribution is critical because AI systems use it to verify information accuracy and assess content credibility. Proper citations to peer-reviewed research, regulatory documents, and authoritative financial institutions signal trustworthiness to AI algorithms. Transparent sourcing also helps AI platforms understand the evidence basis for financial claims, reducing the risk of spreading misinformation and building confidence in your content's reliability.

Track how AI platforms cite your financial content and ensure your brand maintains trust and visibility across ChatGPT, Perplexity, Google AI Overviews, and emerging AI search engines.

YMYL content requires high E-E-A-T standards. Learn what qualifies as Your Money Your Life content, why it matters for SEO and AI visibility, and how to optimiz...

Learn how to optimize Your Money or Your Life (YMYL) content for AI search engines like ChatGPT, Perplexity, and Google's AI Overviews. Master E-E-A-T signals, ...

Learn what YMYL topics are in AI search, how they impact your brand visibility in ChatGPT, Perplexity, and Google AI Overviews, and why monitoring them matters ...