AI Visibility Glossary: 100 Terms Every Marketer Should Know

Comprehensive glossary of 100+ essential AI visibility and GEO terms every marketer should know. Learn about citation tracking, brand monitoring, and AI search ...

Learn how to track competitor mentions in AI search engines. Monitor ChatGPT, Perplexity, Claude, and Google AI visibility with share of voice metrics.

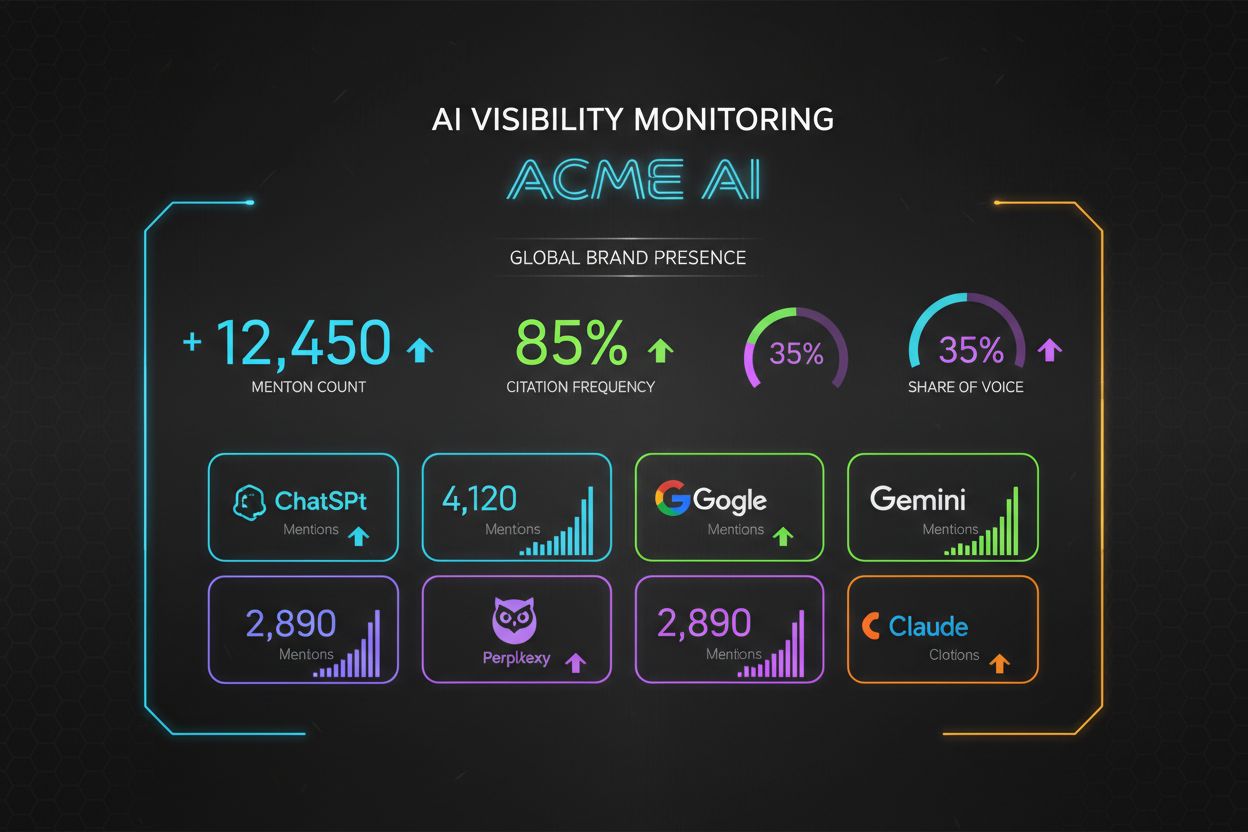

Track competitor AI mentions by monitoring their visibility across ChatGPT, Perplexity, Claude, Google AI Overviews, and Gemini using dedicated AI visibility platforms. These tools measure citation frequency, share of voice, and brand positioning in AI-generated responses, helping you benchmark performance and identify competitive gaps.

Competitor AI mentions refer to how often your competitors’ brands, products, or content appear in AI-generated responses across platforms like ChatGPT, Perplexity, Claude, Google AI Overviews, and Gemini. Unlike traditional search rankings where visibility is measured by position on a results page, AI mentions represent direct citations and recommendations within synthesized answers that millions of users rely on daily. This shift fundamentally changes competitive dynamics because 58% of consumers have replaced traditional search engines with generative AI tools for product recommendations, according to Capgemini research. When competitors appear in AI responses and you don’t, you’re effectively invisible to users making decisions based on AI-generated answers. Tracking these mentions is critical because traditional organic search traffic is expected to decline by 50% by 2028, per Gartner, making AI visibility increasingly essential for maintaining market share and brand authority.

The competitive landscape has shifted dramatically with the rise of AI answer engines. In traditional SEO, you could rank on page one and still lose to competitors who rank higher. In AI search, the dynamic is even more brutal: if your competitor is cited and you’re not, you lose the entire user interaction. ChatGPT alone drives 89.1% of all measured AI referral traffic, according to 2025 data analyzing 2.8 million sessions across 41 brand sites, meaning competitors who optimize for ChatGPT visibility capture the vast majority of AI-driven traffic. Beyond referrals, Google AI Overviews reach 2 billion monthly active users, and Meta AI reaches approximately 1 billion users across Facebook, Instagram, and WhatsApp. This means competitors can gain massive brand visibility without generating a single click—a phenomenon called “zero-click” visibility that traditional analytics completely miss. Tracking competitor mentions helps you identify share of voice gaps, understand which platforms your competitors dominate, and discover opportunities where you can establish authority before competitors entrench themselves.

| Metric | Definition | Why It Matters | Platform Focus |

|---|---|---|---|

| Citation Frequency | How often a competitor’s website is cited as a source in AI responses | Direct indicator of authority and trustworthiness to AI models | ChatGPT, Perplexity, Claude |

| Share of Voice (SOV) | Percentage of mentions your competitor receives vs. all competitors on a topic | Shows competitive positioning and market dominance | All platforms |

| Mention Rate | How often a competitor’s brand name appears in AI answers | Measures brand awareness and recognition by AI systems | All platforms |

| Average Position | Where a competitor appears when mentioned (first, second, third, etc.) | Position matters in AI responses just like traditional search | ChatGPT, Perplexity |

| Sentiment Analysis | How AI describes the competitor (positive, neutral, negative) | Reveals brand perception and positioning accuracy | All platforms |

| Platform-Specific Visibility | Competitor performance across different AI engines | Shows where competitors are strongest and weakest | ChatGPT, Gemini, Perplexity, Claude, Google AI |

| Referral Efficiency Index (REI) | Referrals generated relative to platform user base | Identifies which platforms drive highest-quality traffic | ChatGPT (5x REI), Perplexity (6.2x REI) |

| Topic Coverage | Which topics/queries competitors appear in | Reveals competitive gaps and opportunity areas | All platforms |

Step 1: Identify Your Core Competitors and Topics

Start by listing your primary competitors and the core prompts (questions) your target audience asks AI systems. Unlike traditional keyword research, prompt research focuses on natural language questions people type into AI chatbots. For example, if you’re in fintech, relevant prompts might include “What’s the best payment processing platform?” or “How does [competitor name] compare to [your company]?” Document 20-50 core prompts that represent your customer journey from awareness through consideration to decision. This foundation ensures you’re tracking visibility where it actually matters for your business.

Step 2: Choose Your AI Monitoring Platform

Select a dedicated AI visibility monitoring tool that tracks multiple platforms simultaneously. Leading platforms include Frase AI Visibility, Yext Scout, Profound, Goodie, and Conductor. Each offers different strengths: some excel at ChatGPT tracking, others provide superior Google AI Overviews analysis, and some offer the broadest platform coverage. Look for tools that track at least ChatGPT, Perplexity, Claude, Google Gemini, and Google AI Overviews—these five platforms represent the majority of AI search activity. Ensure the platform provides historical data tracking so you can measure trends over time, and verify it offers competitive benchmarking to compare your visibility against specific competitors.

Step 3: Configure Tracking Parameters

Set up your monitoring to track competitors across multiple dimensions. Configure tracking for branded queries (e.g., “Is [competitor name] good?”), category queries (e.g., “best [product category]”), and comparison queries (e.g., “[competitor] vs [alternative]”). Specify geographic regions if you operate in multiple markets, as AI responses vary by location. Set your tracking frequency—daily tracking provides real-time insights but costs more, while weekly or monthly tracking is more economical for long-term trend analysis. Define your competitor set clearly: typically your top 3-5 direct competitors, plus 2-3 emerging threats you want to monitor.

Step 4: Establish Your Baseline

Before optimizing, document your current competitive position. Record your mention rate (how often you appear), share of voice (your percentage vs. competitors), average position (where you rank when mentioned), and sentiment (how AI describes you) for each tracked prompt. This baseline becomes your measurement stick for evaluating the impact of future optimization efforts. Most platforms provide historical data going back 6-24 months, allowing you to understand seasonal patterns and long-term trends.

ChatGPT Competitor Tracking

ChatGPT dominates with 81.85% market share among AI chatbots and generates 89.1% of all measured AI referral traffic, making it your highest-priority tracking platform. When tracking competitors on ChatGPT, focus on citation density—how often their content appears as a source in responses. ChatGPT users are in research mode and highly motivated to click citations, so competitors who appear frequently here drive significant traffic. Monitor whether competitors are cited for product comparisons, how-to content, reviews, and expert opinions. If a competitor dominates ChatGPT for “best [product category]” queries, they’re capturing high-intent traffic. Track their source diversity—do they appear across multiple authoritative publishers, or are they concentrated on their own domain? Competitors with broad publisher coverage have stronger authority signals.

Perplexity Competitor Tracking

Perplexity holds 11.05% market share but punches far above its weight with a Referral Efficiency Index of 6.2x—the highest among all platforms. This means Perplexity users are more likely to click competitor citations than users on any other platform. Perplexity’s user base is research-focused and technical, so track competitors who dominate comparison content, technical guides, and methodology-driven queries. Monitor whether competitors appear in listicles (“Top 10 [category]”), how-to guides, and structured comparisons. Perplexity prioritizes fresh, recent information, so track whether competitors are updating their content regularly—if they are, they’ll maintain visibility advantage. Watch for competitors earning publisher coverage and backlinks, as these amplify Perplexity citations.

Google AI Overviews and AI Mode Competitor Tracking

Google AI Overviews reach 2 billion monthly active users, and Google AI Mode reaches 100+ million users, making this the largest AI visibility opportunity. However, Google AI doesn’t show up in standard referral logs—you won’t see clicks attributed to “Google AI” in Google Analytics. Track competitors’ presence in AI Overviews by conducting SERP-level audits: search your core prompts in Google and note which competitors appear in the AI-generated answer box. Monitor whether competitors are cited as authoritative sources, featured snippets, or knowledge panel information. Track their schema markup implementation—competitors using FAQPage, HowTo, and Product schema are more likely to be cited by Google’s AI. Measure their brand mention coverage across authoritative third-party sites, as Google’s AI prioritizes information that appears consistently across trusted sources.

Claude Competitor Tracking

Claude holds 1.05% market share but is growing rapidly with integration into Safari and enterprise adoption. Claude is known for long-form reasoning and empathetic tone, making it valuable for customer service, complex problem-solving, and detailed explanations. Track competitors who dominate FAQ content, troubleshooting guides, and detailed how-to articles. Monitor their customer service-style content and educational resources. Claude users often seek nuanced, detailed explanations, so competitors who publish comprehensive guides and in-depth analysis will have higher visibility. Track whether competitors are cited for customer testimonials, case studies, and detailed product comparisons.

Gemini Competitor Tracking

Google Gemini has 450+ million monthly active users and is growing rapidly. Track competitors’ visibility in Gemini responses, which often appear in Google Search results alongside traditional rankings. Monitor whether competitors appear in Gemini’s suggested follow-up questions, as this indicates strong topical authority. Track their presence in Gemini’s cited sources for your core prompts. Gemini integrates with Google’s Knowledge Graph, so competitors with strong entity optimization and structured data will have higher visibility.

Share of Voice (SOV) is your most critical competitive metric in AI search. SOV measures what percentage of mentions your competitor receives compared to all competitors on a specific topic. For example, if you track the prompt “best project management software,” and the AI response mentions 5 tools total, each tool has 20% SOV. If a competitor appears in 60% of responses and you appear in 15%, that 45-point gap represents lost opportunity.

Calculate SOV by dividing your competitor’s mention count by the total mentions across all competitors, then multiply by 100. Track SOV by platform (ChatGPT SOV vs. Perplexity SOV), by topic (SOV for “product comparisons” vs. “how-to guides”), and over time (monthly SOV trends). A competitor with 40% SOV on your core topics is dominating the conversation and capturing disproportionate share of AI-driven traffic and brand awareness.

Referral Efficiency Index (REI) is another powerful metric: it measures referrals generated relative to a platform’s user base. ChatGPT has an REI of approximately 5x, meaning it generates 5 times more referrals than its market share would suggest. Perplexity has an REI of 6.2x. This means tracking competitors on high-REI platforms is more important for traffic generation, while tracking on low-REI platforms (like Microsoft Copilot at 1.5x REI) is more important for brand visibility and positioning.

Visibility Gaps: These are prompts where competitors appear but you don’t. If a competitor is cited for “best [category]” and you’re absent, that’s a visibility gap representing lost opportunity. Prioritize closing gaps on high-intent queries where users are making purchasing decisions. Use your monitoring data to identify the top 10 visibility gaps, then create or optimize content to address those specific prompts.

Sentiment Gaps: Track not just whether competitors appear, but how they’re described. If a competitor appears frequently but with negative sentiment (e.g., “expensive,” “complicated,” “poor customer service”), that’s an opportunity. Create content that positions your solution as addressing those pain points. Conversely, if a competitor has positive sentiment, analyze what’s driving it and create competing content that matches or exceeds their positioning.

Platform Gaps: A competitor might dominate ChatGPT but be weak on Perplexity. This reveals platform-specific opportunities. If you’re strong on Perplexity but weak on ChatGPT, focus optimization efforts on ChatGPT-specific content strategies (citation-ready content, publisher coverage, source density).

Topic Gaps: Competitors might dominate “product comparison” queries but be weak on “how-to” or “educational” content. Identify topics where no single competitor has dominant share of voice—these “blue ocean” opportunities let you establish authority quickly.

Modern AI monitoring platforms automate much of the tracking process. Tools like AmICited specifically monitor when your brand and competitors appear in AI answers across multiple platforms. These platforms use automated prompt testing to continuously query AI systems with your core prompts, capture responses, and analyze mentions and citations. They provide automated alerts when competitor visibility changes significantly, allowing you to respond quickly to competitive threats.

Workflow automation can integrate AI visibility tracking into your content strategy. When monitoring reveals a competitor gaining share of voice on a specific topic, automated workflows can trigger content creation tasks, alert your team, or even initiate outreach to publishers who cite competitors. This transforms raw data into actionable intelligence.

Competitor AI mention tracking should directly inform your content roadmap. When you identify that a competitor dominates “best [category]” queries, create a comprehensive comparison guide that positions your solution favorably. When you see competitors gaining share of voice on emerging topics, create authoritative content on those topics before competitors entrench themselves. When sentiment analysis reveals negative positioning of a competitor, create content addressing those pain points.

Use share of voice data to prioritize content creation. Topics where competitors have 60%+ SOV are high-priority targets—winning even 20% SOV on these topics represents significant traffic and visibility gains. Topics where SOV is fragmented (no competitor above 30%) are opportunities to establish leadership quickly.

The AI search landscape continues evolving rapidly. Multimodal search is emerging, with AI platforms processing images, video, and audio alongside text—competitor tracking will need to expand beyond text-based mentions. Real-time integration is advancing, with AI systems connecting to live data sources for fresher answers, meaning competitor tracking will need to capture real-time visibility shifts rather than daily snapshots. Platform fragmentation continues, with new AI search options emerging (DeepSeek, Grok, Meta AI expanding) requiring broader monitoring coverage.

Agentic AI represents the next frontier—AI agents that take actions on behalf of users will create new visibility opportunities and competitive dynamics. Tracking competitor mentions in agentic contexts will become critical as these systems influence purchasing decisions and brand recommendations. The competitive advantage will go to brands that track not just mentions, but how competitors are positioned in agentic decision-making contexts.

Attribution modeling will become more sophisticated, connecting AI visibility to actual business outcomes. Rather than just tracking mentions, you’ll measure how competitor visibility in AI answers correlates with their market share, customer acquisition, and revenue. This will make competitor AI tracking not just a marketing metric, but a business intelligence tool.

Stop guessing where your competitors appear in AI answers. Use AmICited to track brand mentions across all major AI platforms and identify visibility gaps before they impact your market share.

Comprehensive glossary of 100+ essential AI visibility and GEO terms every marketer should know. Learn about citation tracking, brand monitoring, and AI search ...

Learn how to monitor AI brand mentions and citations across ChatGPT, Gemini, and Perplexity. Discover why AI visibility matters more than traditional rankings a...

Learn how to monitor when competitors appear in ChatGPT, Perplexity, Claude, and other AI search engines. Discover tools and strategies for tracking AI visibili...