AI Search Market Share

Understand AI Search Market Share - the shift from traditional search to AI-powered platforms. Learn current market data, growth trends, and business implicatio...

A brand’s portion of visibility, mentions, and citations across AI-powered search platforms and conversational AI systems. Unlike traditional market share, AI market share measures how frequently and prominently a brand appears in AI-generated responses, recommendations, and search results. This metric has become critical as AI platforms like ChatGPT, Google AI Overviews, and Perplexity become primary information sources for millions of users. Controlling your presence in these systems directly influences consumer awareness, trust, and purchasing decisions.

A brand's portion of visibility, mentions, and citations across AI-powered search platforms and conversational AI systems. Unlike traditional market share, AI market share measures how frequently and prominently a brand appears in AI-generated responses, recommendations, and search results. This metric has become critical as AI platforms like ChatGPT, Google AI Overviews, and Perplexity become primary information sources for millions of users. Controlling your presence in these systems directly influences consumer awareness, trust, and purchasing decisions.

AI market share represents the proportion of visibility, mentions, and citations a brand or product receives across AI-powered search platforms and conversational AI systems. Unlike traditional market share, which measures sales volume or customer acquisition, AI market share focuses on how frequently and prominently a brand appears in AI-generated responses, recommendations, and search results. This distinction matters significantly in today’s AI-driven landscape because visibility in AI systems directly influences consumer awareness, trust, and purchasing decisions—often before users even visit traditional search engines or websites. As AI platforms like ChatGPT, Google AI Overviews, and Perplexity become primary information sources for millions of users, controlling your presence in these systems has become as critical as ranking on Google.

| Metric Name | Definition | Why It Matters |

|---|---|---|

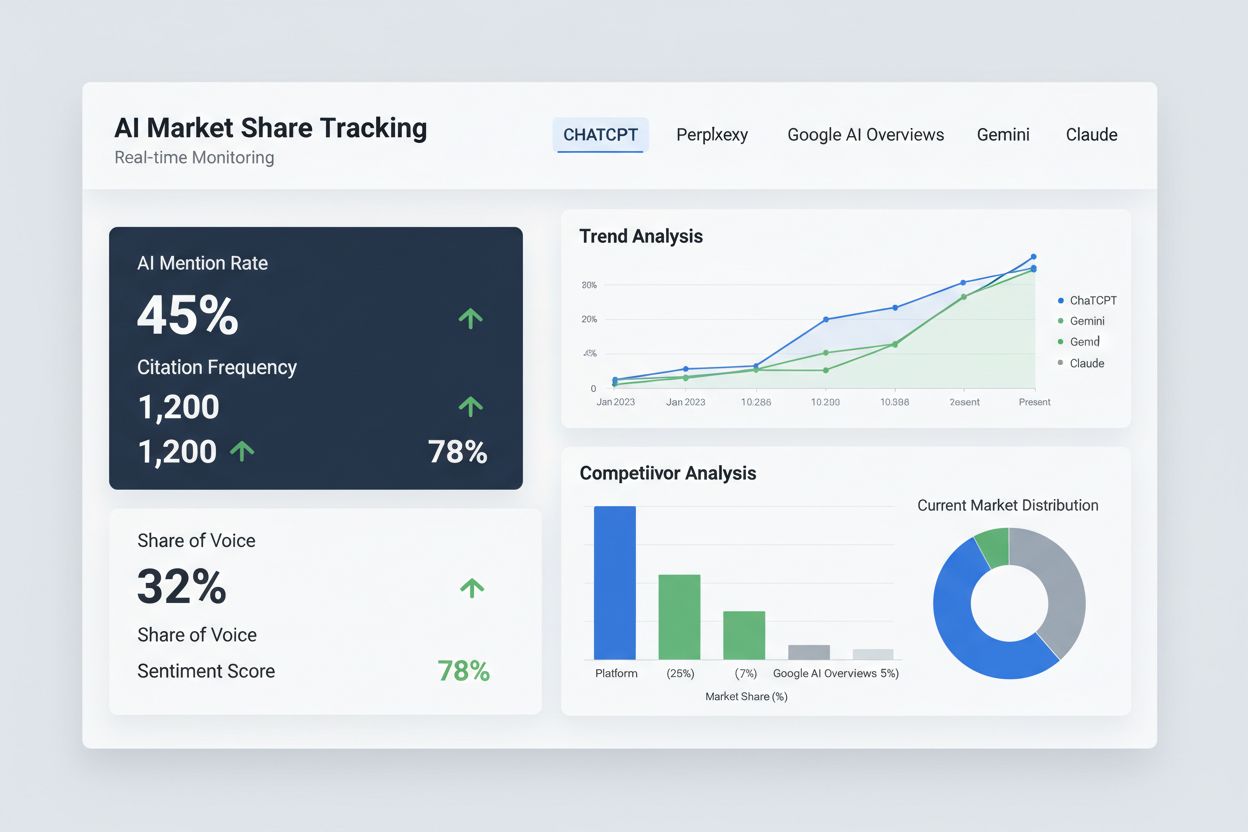

| AI Mention Rate | Percentage of AI responses that mention your brand or product | Directly correlates with brand awareness and discoverability in AI systems |

| Citation Frequency | How often your content is cited or referenced by AI models | Indicates content authority and trustworthiness in AI training data |

| Share of Voice | Your brand mentions compared to total mentions in your category | Shows competitive positioning relative to direct competitors |

| Sentiment Analysis | Tone and context of how AI systems discuss your brand | Reveals whether mentions are positive, neutral, or negative |

| Competitor Visibility | Comparative analysis of how often competitors appear in AI responses | Identifies market gaps and opportunities for improvement |

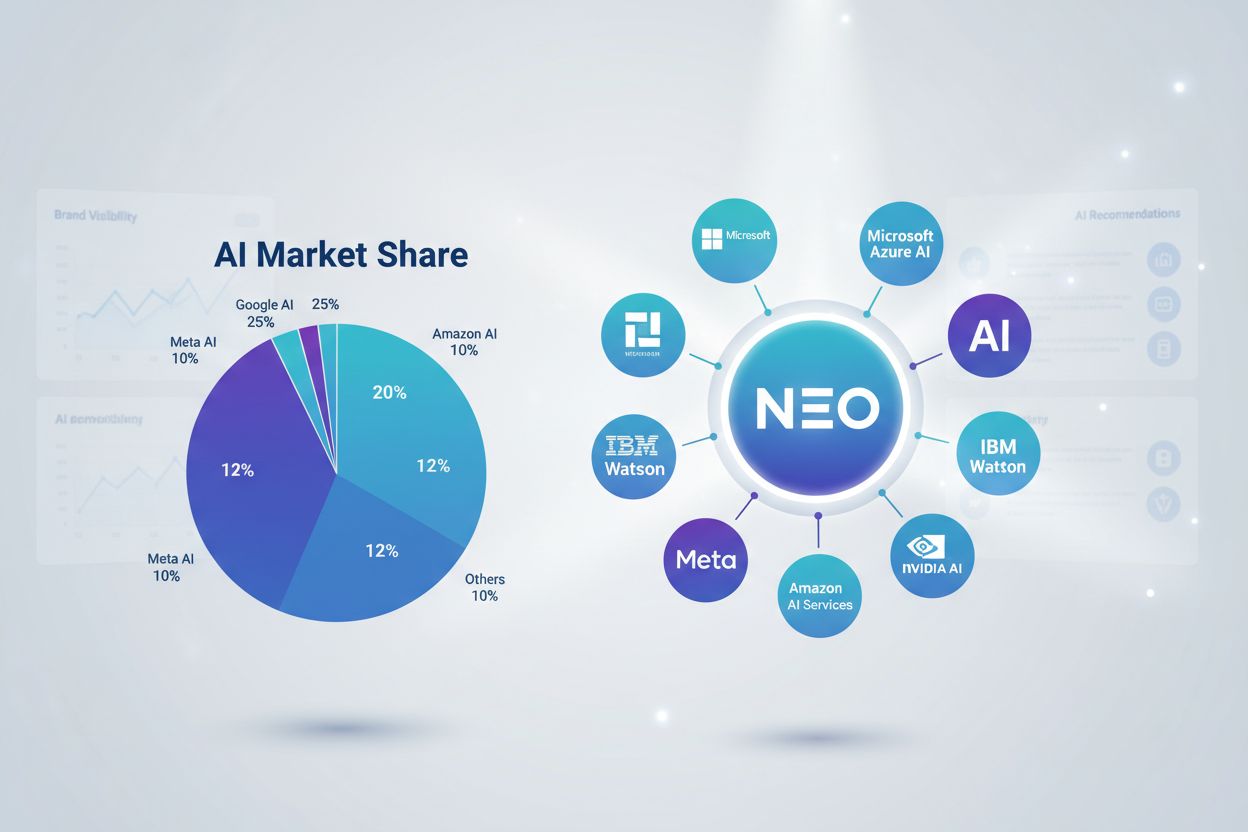

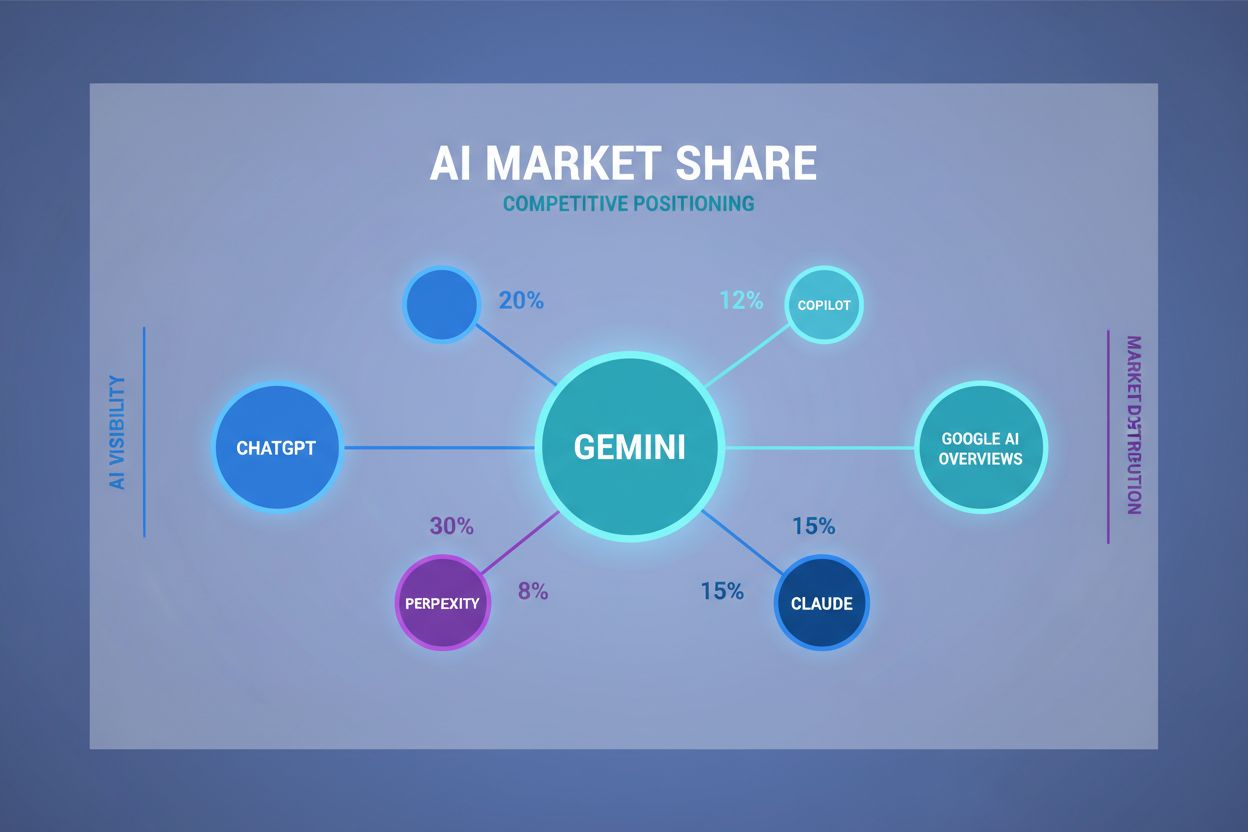

AI market share varies significantly across different platforms, each with unique algorithms, training data, and user bases. ChatGPT dominates overall AI market share with the largest user base and highest citation frequency, making it essential for brands to optimize for OpenAI’s system. Google AI Overviews, integrated into Google Search, captures substantial market share by leveraging Google’s massive search index and user base, though its visibility metrics differ from conversational AI platforms. Perplexity has emerged as a strong competitor, particularly among research-focused users, with growing market share in professional and academic sectors. Gemini (formerly Bard) represents Google’s conversational AI offering with significant potential market share growth as it becomes more integrated into Google’s ecosystem. Claude, developed by Anthropic, captures a smaller but highly engaged user segment, particularly among developers and technical professionals. Microsoft Copilot and other enterprise-focused AI systems hold meaningful market share in B2B contexts, though they receive less consumer attention than ChatGPT or Perplexity.

Measuring AI market share requires a combination of specialized tools and methodologies designed specifically for AI monitoring:

The primary challenge in measuring AI market share stems from platform personalization—AI systems deliver different responses based on user location, search history, and preferences, making consistent measurement difficult. Additionally, AI models update their training data periodically, causing fluctuations in mention rates and citation patterns. Manual tracking through direct prompts provides qualitative insights but doesn’t scale across thousands of keywords and variations. Most effective measurement combines automated tool tracking with periodic manual audits to validate data accuracy and identify emerging trends. Understanding these measurement challenges helps brands set realistic benchmarks and interpret market share data more effectively.

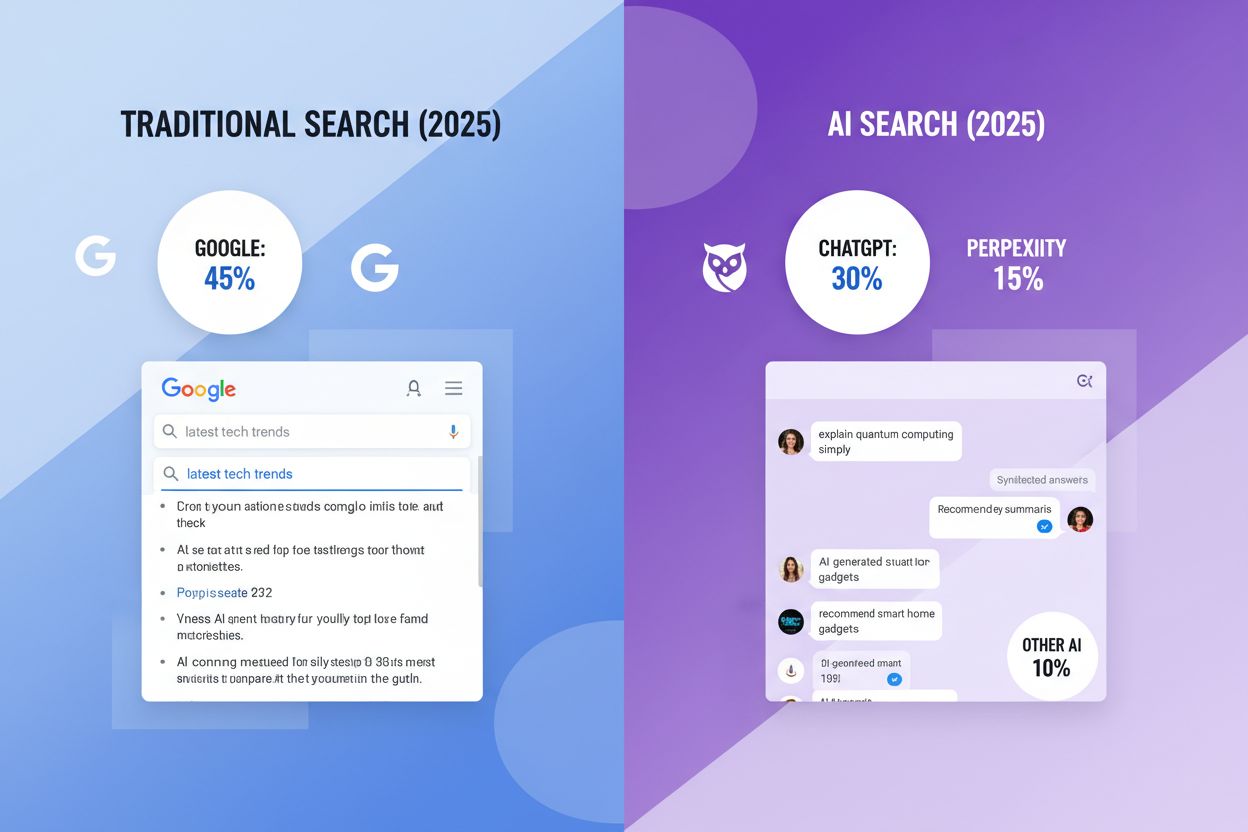

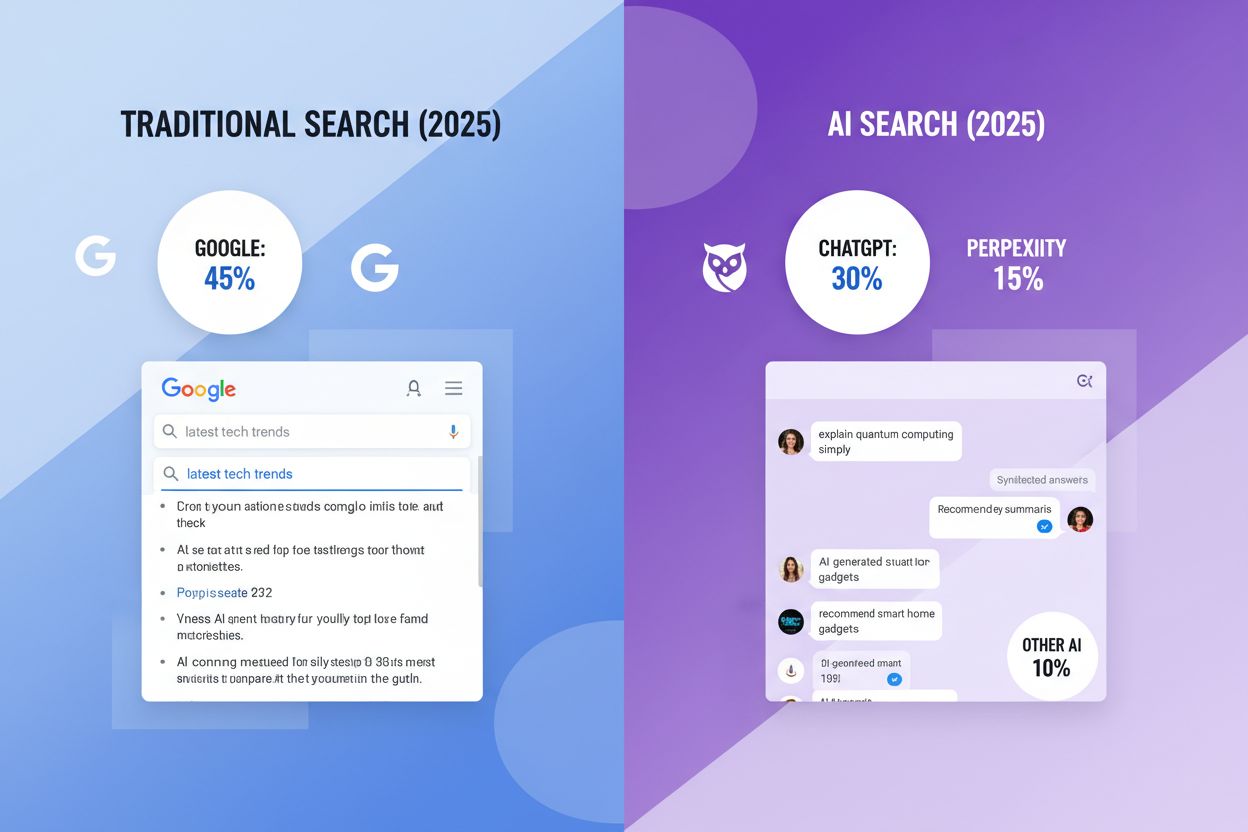

AI market share and traditional market share serve complementary but distinct purposes in modern business strategy. Traditional market share measures actual sales, revenue, and customer acquisition—the tangible outcomes of business success. AI market share, conversely, measures visibility and influence in AI systems, which increasingly drives the awareness and consideration that precedes purchase decisions. A brand might have strong traditional market share but weak AI market share if competitors dominate AI recommendations and citations. Conversely, emerging brands can build significant AI market share before translating it into sales, creating first-mover advantages in AI-driven discovery. Both metrics matter because AI visibility influences consumer perception and purchase intent, while traditional market share reflects actual business results. The most successful brands monitor and optimize both metrics simultaneously, recognizing that AI market share is increasingly a leading indicator of future traditional market share growth.

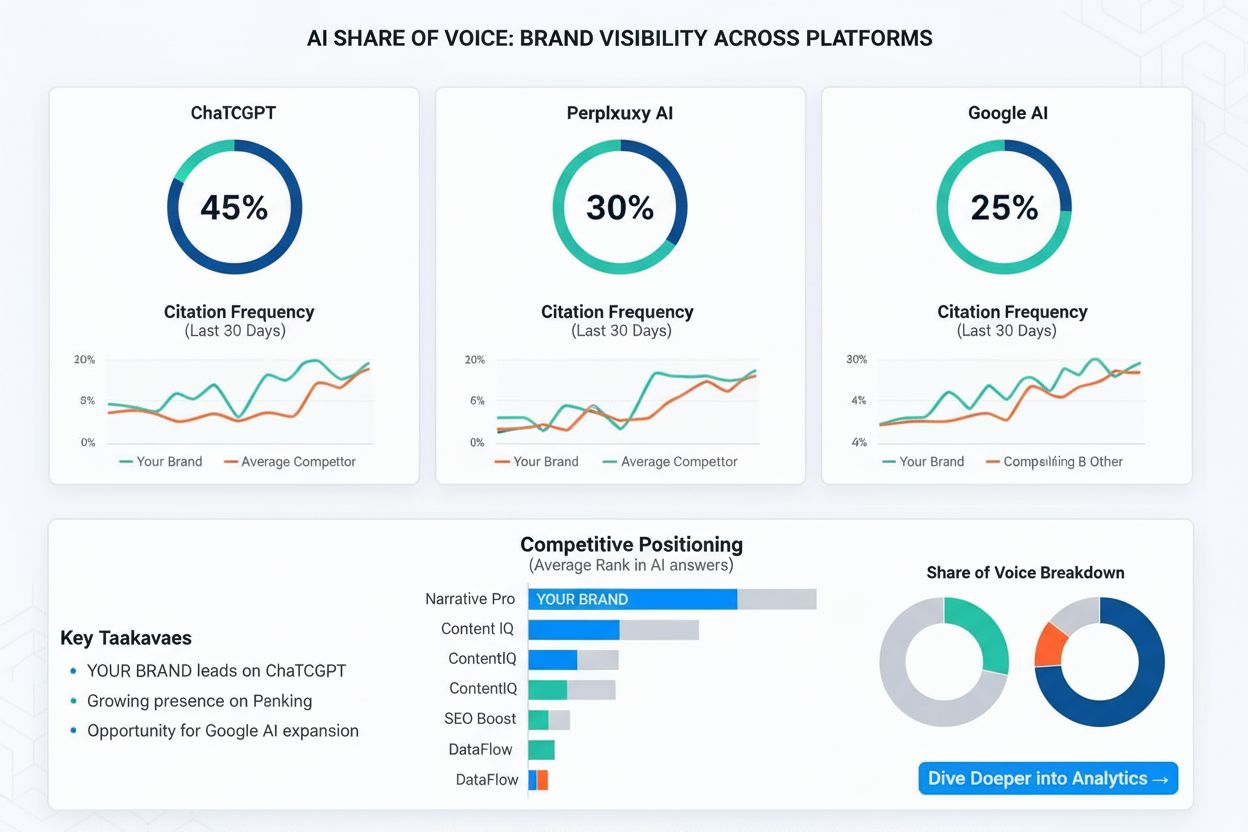

Competitive analysis using AI market share provides actionable intelligence for strategic positioning and differentiation. By tracking how competitors appear in AI responses, brands can identify content gaps, messaging opportunities, and areas where competitors dominate. Benchmarking your AI mention rate against competitors reveals whether you’re gaining or losing visibility in AI systems—critical information for adjusting content and optimization strategies. Sentiment analysis within AI responses shows whether competitor mentions are positive or negative, indicating potential vulnerabilities or strengths to exploit. Tracking citation frequency helps identify which competitor content is most trusted by AI systems, providing insights into content quality, authority, and relevance factors. This competitive intelligence enables brands to develop targeted strategies that differentiate their positioning in AI systems and capture market share from competitors. AmICited.com specializes in this competitive analysis, providing detailed tracking of how your brand and competitors appear across major AI platforms, enabling data-driven strategic decisions.

Improving AI market share requires a strategic, multi-faceted approach focused on visibility and relevance across AI systems:

The business impact of AI market share extends directly to revenue, customer acquisition, and competitive advantage. Brands with strong AI market share experience higher awareness among consumers who rely on AI systems for research and recommendations, translating to increased website traffic and lead generation. As AI systems become primary discovery channels, controlling your AI market share becomes essential for customer acquisition cost efficiency—appearing in AI responses costs less than paid advertising while reaching highly engaged users. Strong AI market share builds brand authority and trust, as consumers perceive brands recommended by AI systems as more credible and trustworthy. Competitive advantage emerges from AI market share leadership, as brands dominating AI responses capture disproportionate attention and consideration in their categories. The ROI of AI market share optimization compounds over time as improved visibility drives sustained traffic, leads, and revenue growth. Organizations that prioritize AI market share monitoring and optimization today position themselves to capture significant competitive advantages as AI systems continue to reshape how consumers discover and evaluate products and services.

Traditional market share measures sales volume, revenue, and customer acquisition—the tangible outcomes of business success. AI market share, conversely, measures visibility and influence in AI systems, which increasingly drives the awareness and consideration that precedes purchase decisions. A brand might have strong traditional market share but weak AI market share if competitors dominate AI recommendations. Both metrics matter because AI visibility influences consumer perception and purchase intent, while traditional market share reflects actual business results.

Measure AI market share using specialized tools like Semrush AI Visibility Toolkit, Rankability, AthenaHQ, Peec AI, or ZipTie. These tools track your brand mentions across major AI platforms (ChatGPT, Perplexity, Google AI Overviews, Gemini, Claude), measure citation frequency, analyze sentiment, and provide competitive benchmarking. Most effective measurement combines automated tool tracking with periodic manual audits to validate data accuracy. Understanding measurement challenges like platform personalization helps you set realistic benchmarks and interpret market share data more effectively.

Prioritize ChatGPT first due to its dominant user base and highest citation frequency, followed by Google AI Overviews which captures substantial market share through Google Search integration. Perplexity is essential for research-focused users, while Gemini represents Google's conversational AI with significant growth potential. Claude captures a smaller but highly engaged developer and technical professional segment. Microsoft Copilot and other enterprise-focused systems hold meaningful B2B market share. Most brands should track across all major platforms to understand their complete AI visibility picture.

Monitor AI market share at least monthly to track trends and identify emerging opportunities or threats. Weekly monitoring is ideal for competitive industries or brands actively optimizing for AI visibility. Most AI monitoring tools provide daily or weekly updates, allowing you to spot rapid shifts in mention rates, citation frequency, or sentiment. Regular monitoring helps you understand whether your optimization efforts are working and enables quick response to competitive movements or algorithm changes.

Benchmarking depends heavily on your industry, company size, and competitive landscape. Brands in the top 25% for web mentions typically receive roughly 10x more AI citations than brands in the next quartile, indicating significant competitive advantage. Start by establishing your baseline AI market share, then track it against your top 3-5 competitors. A healthy goal is to maintain or grow your share of voice relative to competitors while increasing absolute mention rates. Industry-specific benchmarks vary, so focus on trends over time rather than absolute percentages.

Strong AI market share drives revenue through multiple pathways: increased brand awareness among AI-dependent users, higher-quality traffic from AI referrals, improved conversion rates from trusted AI recommendations, and reduced customer acquisition costs compared to paid advertising. Brands with strong AI market share experience higher consideration and trust, as consumers perceive AI-recommended brands as more credible. The ROI compounds over time as improved visibility drives sustained traffic, leads, and revenue growth. Organizations prioritizing AI market share optimization today position themselves to capture significant competitive advantages as AI systems reshape consumer discovery.

Yes, absolutely. Improve AI market share through Generative Engine Optimization (GEO) strategies: create comprehensive, authoritative content that directly addresses user questions, use semantic relevance to align with AI system understanding, implement structured data for better AI parsing, build topical authority through comprehensive coverage, and develop cite-worthy original research and insights. Technical optimization including mobile responsiveness, clear content hierarchy, and proper robots.txt/llms.txt configuration also improves AI visibility. Consistent brand messaging across platforms strengthens recognition in AI responses. Most effective improvement combines content optimization with technical implementation and ongoing monitoring.

Top tools include Semrush AI Visibility Toolkit for comprehensive platform coverage and sentiment analysis, Rankability for GEO-specific optimization and competitive benchmarking, AthenaHQ for multi-LLM tracking with excellent source domain analysis, Peec AI for citation frequency and content authority measurement, and ZipTie for competitive intelligence and market share analysis. AmICited.com specializes in AI answers monitoring across GPTs, Perplexity, and Google AI Overviews, providing detailed tracking of how your brand appears compared to competitors. Choose tools based on your platform priorities, budget, and need for actionable optimization recommendations.

Track how your brand appears across ChatGPT, Perplexity, Google AI Overviews, and other AI platforms. Get real-time insights into your AI visibility and competitive positioning with AmICited.

Understand AI Search Market Share - the shift from traditional search to AI-powered platforms. Learn current market data, growth trends, and business implicatio...

Learn how AI Share Shift Tracking monitors when AI visibility shifts between competitors. Discover metrics, tools, and strategies to track citation authority ch...

AI Share of Voice measures brand visibility in AI-generated responses. Learn how to track, calculate, and improve your presence across ChatGPT, Perplexity, and ...