Competitor Content Strategy Analysis

Learn how to analyze competitor content strategies to improve your brand's visibility in AI systems. Discover metrics, methodologies, and tools for competitive ...

Competitor analysis is a systematic process of researching and evaluating competitors’ strategies, strengths, weaknesses, and market positioning to inform business decisions and develop competitive advantages. It involves gathering data on competitor products, pricing, marketing tactics, and financial performance to identify market opportunities and threats.

Competitor analysis is a systematic process of researching and evaluating competitors' strategies, strengths, weaknesses, and market positioning to inform business decisions and develop competitive advantages. It involves gathering data on competitor products, pricing, marketing tactics, and financial performance to identify market opportunities and threats.

Competitor analysis is a systematic and strategic process of researching, evaluating, and interpreting data about competitors’ business strategies, market positioning, strengths, weaknesses, and performance metrics. It involves meticulously gathering information about competitor products, services, pricing strategies, marketing tactics, financial performance, and operational capabilities to develop actionable insights that inform business decision-making. The primary objective of competitor analysis is to identify competitive advantages, market opportunities, and potential threats that can shape organizational strategy and drive sustainable business growth. This process is not a one-time initiative but rather an ongoing journey of discovery that enables organizations to stay agile, anticipate market shifts, and maintain strategic positioning in increasingly competitive business environments.

The practice of competitor analysis has evolved significantly over the past several decades, transforming from basic market observation into a sophisticated discipline powered by advanced analytics and artificial intelligence. Historically, competitive analysis relied on manual research methods, including industry publications, trade shows, and direct customer interviews. Today, the competitive intelligence industry has become a critical business function, with the global market reaching approximately $50.9 billion in 2024 and projected to grow to $122.8 billion by 2033, representing a compound annual growth rate of 12.4%. This explosive growth reflects the increasing recognition among organizations that competitive intelligence is not a luxury but a necessity for strategic success. The competitive intelligence industry encompasses four main segments: software platforms, consulting services, data providers, and analytics tools, each serving different aspects of competitive analysis needs. North America currently dominates the market with approximately 40% of total market share, though Europe and Asia-Pacific are experiencing rapid growth due to digital transformation initiatives and intensifying competitive pressures. The evolution of competitor analysis has been particularly accelerated by the rise of artificial intelligence, with recent data showing a 76% year-over-year increase in AI adoption within competitive intelligence teams, and 60% of teams now using AI daily for competitive analysis tasks.

Organizations can conduct competitor analysis through multiple approaches, each providing specific insights into different competitive dimensions. Market research involves gathering data about overall market trends, industry dynamics, customer preferences, and demand patterns to identify market opportunities and growth potential. Product analysis focuses on evaluating competitors’ offerings by comparing features, quality, pricing, design, and customer reviews to identify differentiation opportunities. Sales analysis examines competitors’ sales performance, market share, and revenue growth across different market segments to understand competitive strengths and weaknesses. Marketing analysis assesses competitors’ branding strategies, advertising campaigns, social media presence, and customer engagement tactics to understand positioning and value proposition communication. Financial analysis involves reviewing competitors’ financial statements to assess profitability, liquidity, and overall financial health, providing insights into financial capabilities and potential vulnerabilities. By conducting these complementary types of analysis, organizations gain a comprehensive understanding of their competitive landscape and can develop more effective competitive strategies.

A critical distinction in competitor analysis is understanding the difference between direct competitors and indirect competitors. Direct competitors are businesses that offer similar products or services to the same target market and compete directly for the same customers. For example, if you operate a coffee shop, your direct competitors are other coffee shops in your geographic area offering similar beverages and experiences. Direct competitors typically use similar marketing strategies, maintain comparable pricing structures, and target the same customer demographics. Indirect competitors, by contrast, offer different products or services but still compete for customers’ attention and spending. Using the coffee shop example, indirect competitors might include fast-food restaurants, convenience stores, bookstores, or other establishments where customers might spend discretionary time and money. Indirect competitors may be located in different geographic areas, employ different marketing strategies, and maintain different pricing models. Understanding both direct and indirect competitors is essential for comprehensive competitive analysis, as indirect competitors can represent emerging threats or alternative solutions that customers might choose instead of your offerings. Organizations that analyze only direct competitors risk missing significant market shifts and emerging competitive threats from adjacent industries or substitute products.

| Framework | Primary Focus | Key Components | Best Used For | Time Horizon |

|---|---|---|---|---|

| SWOT Analysis | Internal and external factors | Strengths, Weaknesses, Opportunities, Threats | Overall business assessment and strategic planning | Medium-term (1-3 years) |

| PESTLE Analysis | Macro-environmental factors | Political, Economic, Social, Technological, Legal, Environmental | Understanding external market conditions and regulatory environment | Long-term (3-5 years) |

| Porter’s Five Forces | Industry competitive dynamics | Competitive rivalry, new entrants, supplier power, buyer power, substitutes | Analyzing industry attractiveness and competitive intensity | Medium-term (1-3 years) |

| Market Research | Customer and market data | Demographics, demand, market size, pricing, saturation | Identifying market opportunities and customer needs | Ongoing |

| Financial Analysis | Competitor financial health | Profitability, liquidity, revenue growth, financial ratios | Assessing competitor financial capabilities and vulnerabilities | Quarterly/Annual |

Organizations employ several established frameworks to conduct rigorous competitor analysis and develop competitive strategies. SWOT analysis evaluates internal strengths and weaknesses alongside external opportunities and threats, providing a holistic view of competitive positioning. Strengths represent internal positives that provide competitive advantage, such as high product quality, strong brand reputation, or access to skilled workforce. Weaknesses are internal traits that negatively affect competitiveness, including unsuitable location, low-quality products, or insufficient resources. Opportunities are external elements likely to contribute to success, such as favorable regulations or technological advancements. Threats are external factors beyond organizational control that can hinder success, including new competitors or unfavorable regulations. PESTLE analysis examines six macro-environmental factors: Political factors include government interventions and tax policies; Economic factors encompass inflation and consumer spending; Social factors involve demographics and cultural attitudes; Technological factors include automation and digital preferences; Legal factors consist of regulatory requirements; and Environmental factors focus on sustainability and climate impact. Porter’s Five Forces framework analyzes five competitive forces: competitive rivalry among existing players, threat of new market entrants, bargaining power of suppliers, bargaining power of buyers, and threat of substitute products or services. This framework helps organizations understand industry attractiveness and identify where competitive pressures are most intense.

The competitive intelligence landscape has been fundamentally transformed by artificial intelligence and advanced analytics technologies. Modern competitive intelligence platforms can now monitor and analyze data from over 200,000 sources in real-time, enabling organizations to detect competitor movements, pricing changes, product launches, and strategic announcements almost instantaneously. This represents a dramatic acceleration compared to traditional competitor analysis methods that relied on periodic reports and manual data collection. Generative AI systems process massive, disparate datasets to create predictive models of competitor behavior and market shifts, enabling organizations to anticipate future competitor strategies rather than simply react to past actions. Natural language processing capabilities enable sentiment analysis and extraction of actionable insights from unstructured data including press coverage, customer reviews, and social media commentary. Real-time monitoring capabilities deployed by modern platforms cover digital footprints including competitor websites, social channels, patent filings, and regulatory filings, allowing for near-instant detection of strategic moves. Cloud-based platforms have democratized access to competitive intelligence tools, enabling organizations of all sizes to implement sophisticated competitor analysis without heavy infrastructure investments. The adoption of AI in competitive intelligence has been remarkable, with 76% year-over-year increase in AI adoption within competitive intelligence teams and 60% of teams now using AI daily for competitive analysis tasks. This technological transformation has made competitor analysis more accessible, faster, and more predictive than ever before.

Conducting effective competitor analysis requires a structured, systematic approach that progresses through several key stages. The first step is identifying your competitors, which involves searching for businesses offering similar products or services in your market, reading industry publications, attending trade shows, and consulting with customers about alternative solutions they consider. Organizations should identify both direct competitors offering identical solutions and indirect competitors offering alternative approaches to solving customer problems. The second step is gathering data about competitors, which can include visiting competitor websites, analyzing their marketing materials, monitoring social media presence, reviewing customer feedback and reviews, examining pricing information, and studying financial statements when publicly available. Modern organizations increasingly use competitive intelligence tools to automate data collection from multiple sources simultaneously. The third step is analyzing the collected data using frameworks like SWOT, PESTLE, or Porter’s Five Forces to identify patterns, strengths, weaknesses, and strategic implications. The fourth step is developing competitive strategy by identifying your unique selling proposition, determining how to differentiate your offerings, and creating marketing and operational plans that leverage your competitive advantages while addressing competitor weaknesses. The final step is continuous monitoring of competitors through regular review of their websites, social media channels, industry publications, and competitive intelligence platforms to stay updated on their latest products, services, and strategic moves. This ongoing monitoring ensures that competitive analysis remains current and actionable rather than becoming outdated.

Organizations that conduct rigorous competitor analysis gain numerous strategic and operational benefits that drive business success. Market opportunity identification enables organizations to discover gaps in the competitive landscape where unmet customer needs exist, allowing them to develop innovative products or services that capture market share. Competitive positioning becomes clearer through understanding competitor strengths and weaknesses, enabling organizations to develop differentiation strategies that set them apart in crowded markets. Performance benchmarking allows organizations to compare their capabilities, pricing, and market performance against competitors, identifying areas for improvement and optimization. Strategic agility improves as organizations stay informed about industry trends and competitor moves, enabling faster response to market changes and emerging threats. Marketing effectiveness increases when organizations understand competitor messaging, positioning, and customer engagement tactics, allowing them to develop more targeted and differentiated marketing campaigns. Risk mitigation occurs as organizations anticipate competitive threats and market disruptions before they fully materialize, enabling proactive strategy adjustments. Innovation acceleration results from understanding competitor product roadmaps and technology investments, helping organizations prioritize R&D investments and avoid redundant development efforts. Sales enablement improves when sales teams have access to competitive intelligence, battle cards, and win/loss analysis that help them effectively counter competitor messaging and close deals. Pricing optimization becomes possible through monitoring competitor pricing strategies and understanding price sensitivity in different market segments, enabling dynamic pricing approaches that maximize revenue.

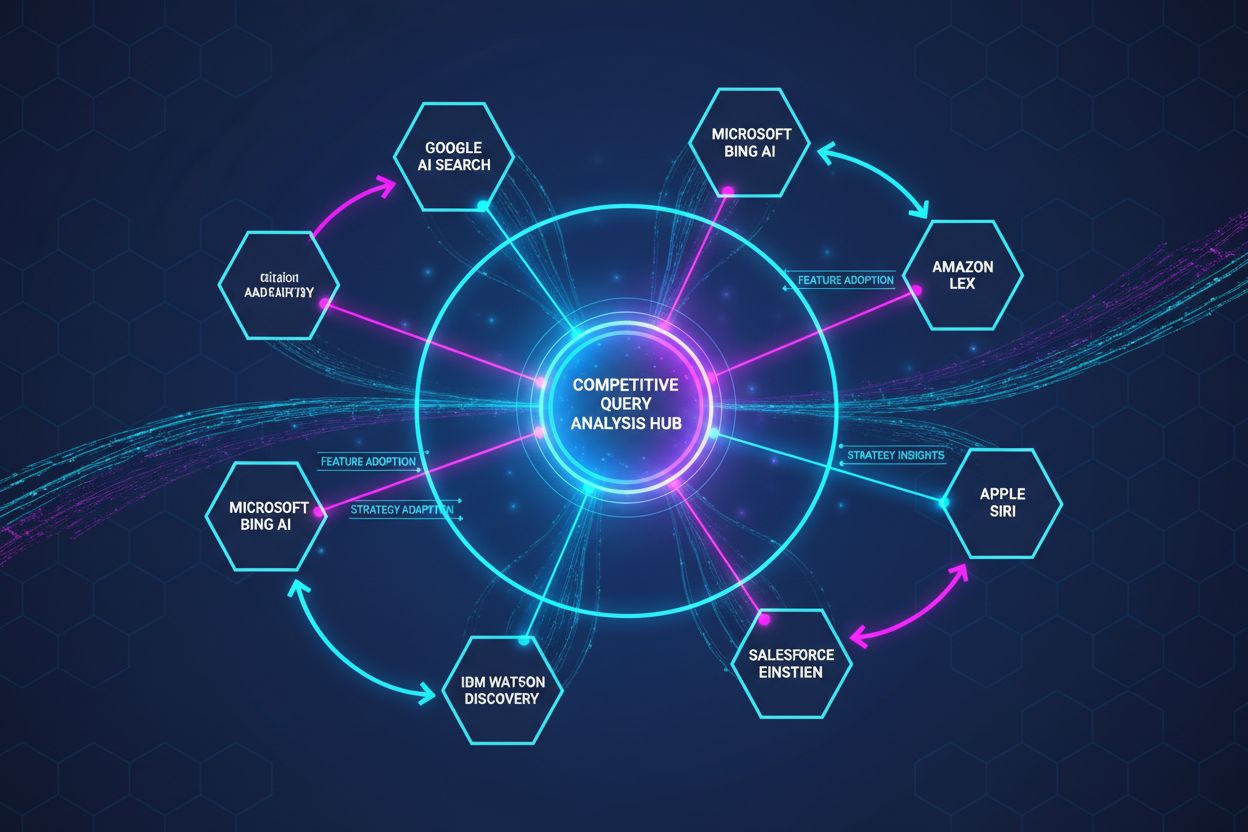

As artificial intelligence systems like ChatGPT, Perplexity, Google AI Overviews, and Claude become increasingly influential in how customers discover information and make purchasing decisions, competitor analysis has expanded to include monitoring brand and domain mentions in AI-generated responses. This emerging dimension of competitive analysis recognizes that AI systems are becoming critical discovery channels, and how competitors are cited and positioned in AI responses directly impacts their visibility and credibility with potential customers. Organizations now need to understand not only how competitors are performing in traditional search results and marketing channels but also how they are being represented in AI-generated content. AI citation monitoring has become an important competitive intelligence metric, as brands that appear frequently and prominently in AI responses gain significant visibility advantages. This new frontier in competitor analysis requires organizations to track competitor mentions across multiple AI platforms, understand the context in which competitors are cited, and identify opportunities to improve their own positioning in AI-generated responses. The integration of AI monitoring into competitor analysis represents a fundamental shift in how organizations must approach competitive intelligence in an increasingly AI-driven business environment.

The competitive analysis landscape continues to evolve rapidly, driven by technological innovation, changing business priorities, and emerging market dynamics. Holistic market and competitive intelligence is emerging as organizations recognize that traditional competitor-focused analysis is insufficient in ecosystems where companies compete across multiple industries and value chains. This broader approach incorporates analysis of adjacent industries, regulatory shifts, partner dynamics, and supply chain considerations alongside traditional competitor analysis. Conversational interfaces powered by generative AI are transforming how competitive intelligence is accessed and consumed, enabling users to ask natural language questions and receive instant answers rather than navigating static dashboards. Real-time data processing is becoming standard as organizations demand immediate insights rather than periodic reports, enabling faster decision-making and competitive response. Synthetic data is increasingly used to test competitive scenarios, such as pricing strategies or product positioning, allowing organizations to experiment with strategies before committing to real-world implementation. Wargaming approaches that combine competitive intelligence with structured simulations are helping organizations stress-test strategies and anticipate competitor moves in dynamic scenarios. ESG competitive intelligence is emerging as organizations are increasingly compared and differentiated based on environmental, social, and governance metrics, requiring competitive analysis of how competitors address sustainability and social responsibility. Industry-specific solutions tailored to sectors like healthcare, fintech, and manufacturing are gaining traction, recognizing unique data, compliance, and speed requirements in specialized industries. The competitive intelligence industry is also experiencing team expansion and budget growth, with competitive intelligence team sizes increasing by 24% from previous years, reflecting growing organizational recognition of competitive intelligence’s strategic value. As the competitive intelligence industry matures, we can expect continued development of professional standards, ethical frameworks, and best practices through organizations like the Society of Competitive Intelligence Professionals (SCIP), which provides certifications and establishes industry standards for ethical competitive intelligence practices.

Direct competitors offer similar products or services to the same target market and compete for the same customers. Indirect competitors offer different products or services but still compete for customers' attention and spending. For example, a coffee shop's direct competitors are other coffee shops, while indirect competitors might include fast-food restaurants or convenience stores. Understanding both types is essential for comprehensive competitive analysis.

Competitor analysis helps businesses identify market gaps, understand competitive positioning, benchmark performance, and develop differentiation strategies. It enables companies to anticipate threats, capitalize on opportunities, and make informed decisions about pricing, marketing, and product development. According to research, organizations that conduct regular competitor analysis are better positioned to maintain competitive advantage and respond to market changes.

The three primary frameworks are SWOT analysis (Strengths, Weaknesses, Opportunities, Threats), PESTLE analysis (Political, Economic, Social, Technological, Legal, Environmental), and Porter's Five Forces (competitive rivalry, threat of new entrants, bargaining power of suppliers, bargaining power of buyers, threat of substitutes). Each framework provides different perspectives on competitive dynamics and market conditions.

AI has revolutionized competitor analysis by enabling real-time monitoring of over 200,000 data sources, automating data extraction and analysis, and providing predictive insights about competitor behavior. Recent data shows a 76% year-over-year increase in AI adoption within competitive intelligence teams, with 60% of teams now using AI daily. AI tools can process unstructured data from websites, social media, and market reports in seconds.

Effective competitor analysis should include competitor websites, social media presence, pricing information, product reviews, financial statements, patent filings, marketing campaigns, press releases, industry publications, and customer feedback. Modern competitive intelligence platforms monitor these sources in real-time, while traditional methods involve manual research through industry reports, trade shows, and direct customer interviews.

Competitor analysis should be an ongoing process rather than a one-time project. Organizations should continuously monitor competitors to stay abreast of industry trends, anticipate threats, and identify emerging opportunities. The frequency depends on industry dynamics—fast-moving sectors like technology and SaaS require more frequent analysis, while stable industries may require less frequent updates.

The global competitive intelligence market reached approximately $50.9 billion in 2024, with projections to reach $122.8 billion by 2033. The market is growing at a compound annual growth rate of 12.4%, driven by AI adoption, digital transformation, and increasing recognition of competitive intelligence as essential for business strategy. North America captures approximately 40% of the total market share.

Competitor analysis increasingly involves monitoring how competitors appear in AI-generated responses across platforms like ChatGPT, Perplexity, Google AI Overviews, and Claude. Tools like AmICited track brand and domain mentions in AI responses, providing competitive intelligence about how competitors are being cited and positioned in AI systems. This represents a new frontier in competitive analysis as AI becomes a critical channel for brand visibility and customer discovery.

Start tracking how AI chatbots mention your brand across ChatGPT, Perplexity, and other platforms. Get actionable insights to improve your AI presence.

Learn how to analyze competitor content strategies to improve your brand's visibility in AI systems. Discover metrics, methodologies, and tools for competitive ...

Learn what AI Competitive Analysis Tools are, how they track brand mentions across ChatGPT, Perplexity, and Google AI, and why they're essential for competitive...

Learn how to identify queries where competitors outperform in AI citations. Master competitive query analysis for ChatGPT, Perplexity, and Google AI Overviews w...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.