Revenue Per Visit

Learn what Revenue Per Visit (RPV) is, how to calculate it, and why it matters for e-commerce success. Discover industry benchmarks and strategies to improve RP...

Customer Lifetime Value (CLV) is the total revenue or profit a business expects to generate from a customer throughout their entire relationship. It represents the net present value of all future cash flows attributed to a customer, helping organizations identify high-value customers and optimize retention strategies.

Customer Lifetime Value (CLV) is the total revenue or profit a business expects to generate from a customer throughout their entire relationship. It represents the net present value of all future cash flows attributed to a customer, helping organizations identify high-value customers and optimize retention strategies.

Customer Lifetime Value (CLV), also known as Customer Lifetime Value (LTV) or Customer Lifetime Value (CLTV), is the total revenue or profit a business expects to generate from a customer throughout the entire duration of their relationship. Unlike transactional metrics that focus on individual purchases, CLV represents a forward-looking calculation that encompasses all potential revenue streams from a customer, accounting for repeat purchases, upsells, cross-sells, and the costs associated with serving that customer. This metric has become fundamental to modern business strategy because it shifts focus from short-term acquisition metrics to long-term profitability and customer relationship value. CLV serves as a critical lens through which organizations can evaluate customer quality, guide investment decisions, and determine the sustainability of their business models. By understanding how much value each customer generates over their lifetime, companies can make informed decisions about how much to invest in acquiring, retaining, and serving different customer segments.

The concept of Customer Lifetime Value emerged in the 1980s and 1990s as businesses began recognizing that not all customers were equally valuable. Early marketing theorists and practitioners realized that traditional metrics like revenue per transaction failed to capture the true economic value of customer relationships. The evolution of CLV accelerated with the rise of customer relationship management (CRM) systems and data analytics capabilities, which enabled organizations to track customer behavior across multiple touchpoints and calculate lifetime value with greater precision. Today, CLV has become a cornerstone metric in industries ranging from e-commerce and SaaS to financial services and telecommunications. According to recent research, only 42% of companies can accurately measure CLV despite 89% acknowledging its importance for driving brand loyalty and business growth. This gap between recognition and implementation highlights both the complexity of CLV calculations and the significant opportunity for organizations that master this metric. The rise of artificial intelligence and machine learning has further transformed CLV analysis, enabling predictive models that forecast future customer value with unprecedented accuracy.

The fundamental CLV formula is: CLV = (Average Revenue Per Customer × Customer Lifespan) − Total Costs to Serve. However, this basic formula represents only the starting point for understanding customer value. More sophisticated calculations incorporate multiple variables including Average Revenue Per Account (ARPA), gross margin, customer churn rate, retention rate, and discount rates that account for the time value of money. The customer lifespan is calculated by dividing one by the annual churn rate; for example, a 5% annual churn rate implies an average customer lifespan of 20 years. ARPA is determined by dividing total recurring revenue by the number of active customers, providing insight into average spending per customer. The gross margin represents the percentage of revenue remaining after direct costs, which is then multiplied by ARPA to determine gross contribution per customer. Advanced CLV models also incorporate a discount rate (typically 8-20% depending on company stage and risk profile) to reflect the present value of future cash flows. Different industries and business models require variations of this formula; for instance, SaaS companies emphasize monthly recurring revenue and churn rates, while e-commerce businesses focus on purchase frequency and average order value. The complexity of CLV calculations means that organizations must carefully select the methodology that best aligns with their business model and data availability.

| Metric | Definition | Focus | Time Horizon | Key Use Case |

|---|---|---|---|---|

| Customer Lifetime Value (CLV) | Total profit from a customer over entire relationship | Long-term profitability and relationship value | Entire customer lifecycle | Strategic resource allocation and retention prioritization |

| Customer Acquisition Cost (CAC) | Total expense to acquire a new customer | Short-term acquisition efficiency | Initial acquisition period | Marketing ROI and sales efficiency measurement |

| Net Promoter Score (NPS) | Likelihood of customer recommending brand (0-100 scale) | Customer satisfaction and loyalty sentiment | Current moment in time | Customer satisfaction tracking and brand health |

| Customer Satisfaction (CSAT) | Satisfaction with specific transaction or interaction | Transactional satisfaction | Single interaction or period | Service quality improvement and touchpoint optimization |

| Churn Rate | Percentage of customers lost in given period | Customer retention and attrition | Periodic measurement | Identifying retention risks and loyalty trends |

| LTV/CAC Ratio | Lifetime value divided by acquisition cost | Business model sustainability | Comparative analysis | Determining profitability and growth sustainability |

| Customer Profitability Score | Revenue earned minus cost to serve per customer | Individual customer profitability | Entire relationship | Account prioritization and resource allocation |

Understanding CLV requires mastery of several interconnected financial and behavioral metrics. The retention rate, calculated as 1 minus the churn rate, directly impacts CLV because customers who remain longer generate more cumulative revenue. For example, a company with a 95% annual retention rate (5% churn) has an average customer lifetime of 20 years, while a company with 90% retention has only a 10-year average lifetime. The Average Revenue Per Account (ARPA) provides insight into spending patterns and is calculated by dividing total annual recurring revenue by the number of active customers. When multiplied by the gross margin percentage, ARPA yields the gross contribution per customer, which represents the profit available after direct costs. Advanced CLV models incorporate a discount rate to account for the time value of money, recognizing that revenue received today is worth more than revenue received in the future. The formula incorporating these elements is: CLV = (ARPA × Gross Margin × Retention Rate) ÷ (1 + Discount Rate − Retention Rate). This more sophisticated approach provides a “discounted” CLV that reflects present value. Organizations must also account for Customer Acquisition Cost (CAC), which includes all sales and marketing expenses divided by the number of new customers acquired. The LTV/CAC ratio, calculated by dividing CLV by CAC, serves as a critical benchmark for business sustainability; the industry standard target is approximately 3.0x, meaning companies should generate three dollars of lifetime value for every dollar spent acquiring customers.

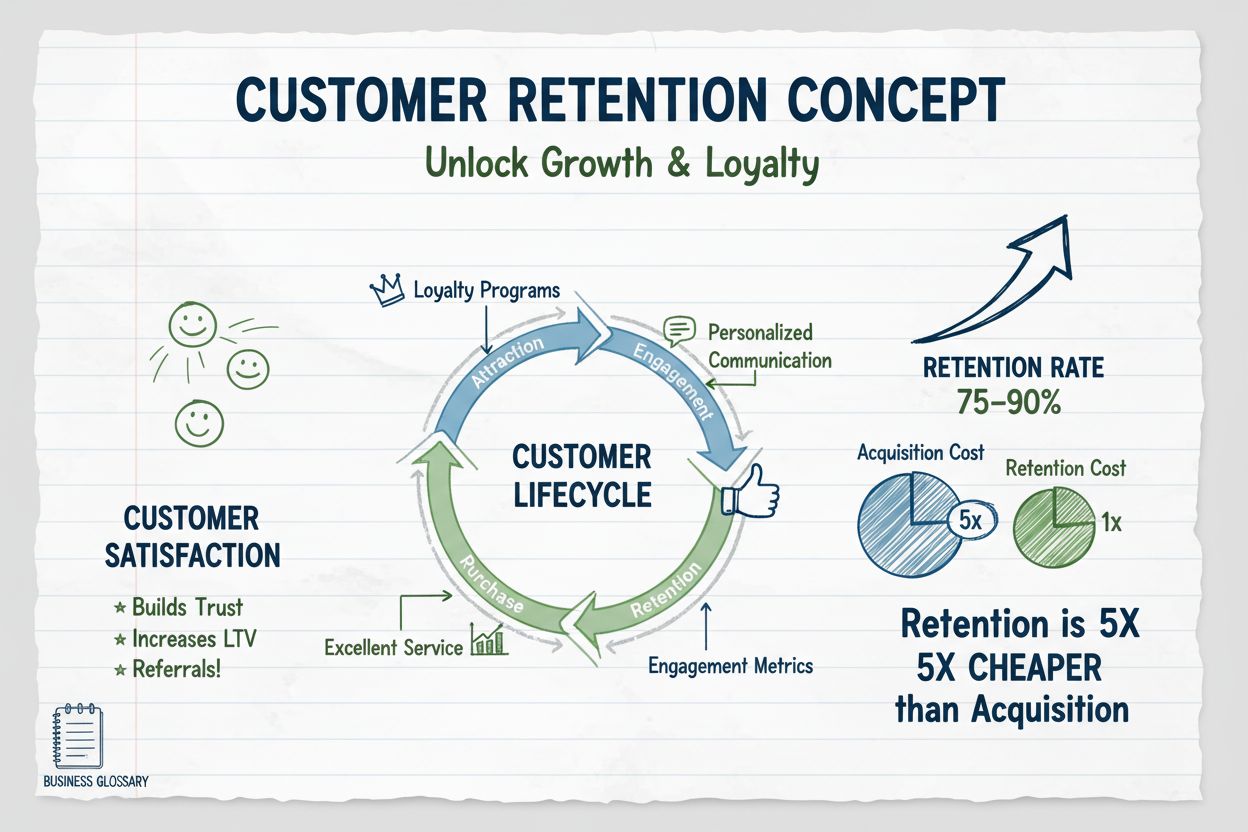

Customer Lifetime Value has profound implications for business strategy, profitability, and competitive positioning. Research demonstrates that existing customers spend 67% more than new customers, making retention significantly more cost-effective than acquisition. According to Harvard Business Review analysis, a 5% increase in customer retention can boost profits by 25% to 95%, depending on industry dynamics. The Pareto Principle applies strongly to CLV, with research showing that approximately 20% of customers generate 80% of company revenue, highlighting the importance of identifying and prioritizing high-value customer segments. Companies that excel in CLV management demonstrate superior financial performance; loyalty leaders—companies ranking in the top tier for customer satisfaction for three or more consecutive years—grow 2.5 times faster than competitors. The strategic importance of CLV extends beyond financial metrics; it influences product development priorities, customer service investments, and marketing channel allocation. Organizations that understand their CLV can make data-driven decisions about which customer segments deserve premium service levels, which markets warrant expansion, and which acquisition channels justify continued investment. Furthermore, CLV analysis reveals which customer segments are most profitable, enabling companies to refine their target market definition and focus sales and marketing efforts on high-potential prospects. The metric also serves as an early warning system for churn risk; declining CLV trends often precede customer defection, allowing proactive intervention.

The emergence of AI-powered analytics platforms has transformed how organizations calculate, predict, and optimize Customer Lifetime Value. Salesforce Einstein Analytics uses machine learning algorithms to provide predictive CLV insights, enabling sales teams to identify high-value accounts and recommend personalized engagement strategies. Klaviyo’s predictive analytics employs data science to forecast CLV, churn risk, and expected order value, helping e-commerce businesses optimize marketing spend and customer retention. Fiddler AI Observability and Arize provide ML model monitoring specifically for CLV prediction models, detecting model drift and ensuring prediction accuracy as customer behavior evolves. These AI-driven platforms analyze historical customer data, behavioral patterns, engagement metrics, and external market factors to generate more accurate CLV predictions than traditional statistical methods. The integration of AI into CLV analysis enables real-time scoring, dynamic segmentation, and personalized retention strategies at scale. Additionally, AI monitoring platforms like AmICited help organizations track how their brand appears in AI-generated search results and recommendations, which increasingly influence customer decision-making and lifetime value. As customers increasingly rely on AI search engines like Perplexity, ChatGPT, and Google AI Overviews for research and recommendations, brand visibility in these platforms directly impacts customer acquisition and CLV potential.

The future of Customer Lifetime Value analysis is being shaped by several converging trends that will fundamentally transform how organizations measure and optimize customer relationships. Artificial intelligence and machine learning will enable increasingly sophisticated predictive CLV models that incorporate real-time behavioral data, external market signals, and competitive dynamics to forecast customer value with unprecedented precision. Predictive CLV models will move beyond historical analysis to incorporate forward-looking indicators such as product adoption velocity, engagement trends, and market expansion potential, enabling organizations to identify high-potential customers earlier in their lifecycle. The integration of CLV analysis with customer experience platforms will create closed-loop systems where insights about customer value directly inform personalization, service allocation, and engagement strategies. Privacy-first analytics will become increasingly important as data regulations tighten, requiring organizations to calculate CLV using aggregated and anonymized data while maintaining predictive accuracy. The rise of AI-driven customer research platforms like Perplexity, ChatGPT, and Google AI Overviews introduces a new dimension to CLV strategy; organizations must now consider how their brand visibility and positioning in AI search results influences customer perception and lifetime value. Omnichannel CLV analysis will become standard practice, with organizations tracking customer value across all touchpoints—online, offline, mobile, social, and emerging channels—to understand true lifetime value. Additionally, CLV will increasingly incorporate non-monetary value such as customer advocacy, referrals, and brand influence, recognizing that some customers generate value through word-of-mouth and social proof beyond their direct purchases. The democratization of CLV analytics through accessible platforms and templates will enable even small and mid-market businesses to implement sophisticated CLV strategies previously available only to large enterprises. Finally, CLV will become more dynamic and real-time, with organizations updating customer value scores continuously rather than periodically, enabling agile responses to changing customer circumstances and market conditions.

Customer Lifetime Value (CLV) represents the total profit a customer generates over their entire relationship with a business, while Customer Acquisition Cost (CAC) is the expense required to acquire that customer. The ideal LTV/CAC ratio is approximately 3.0x, meaning for every dollar spent acquiring a customer, the company should generate three dollars in lifetime value. This ratio is critical for determining business sustainability and profitability.

The basic CLV formula is: CLV = (Average Revenue Per Customer × Customer Lifespan) − Total Costs to Serve. More advanced calculations incorporate gross margin, churn rate, and discount rates. For example, if a customer spends $10,000 annually and stays for 5 years with $15,000 in support costs, the net CLV would be $35,000. Different industries and business models may require variations of this formula based on their specific revenue structures.

CLV is crucial because it helps businesses identify which customers are most valuable, optimize marketing spend, and improve profitability. According to research, it costs 5 to 25 times more to acquire a new customer than to retain an existing one, and a 5% increase in retention can boost profits by 25% to 95%. Understanding CLV enables companies to focus resources on high-value customers and implement targeted retention strategies that drive sustainable revenue growth.

Key factors affecting CLV include customer retention rate, average purchase value, purchase frequency, customer satisfaction, product adoption rates, and support costs. Additionally, customer experience quality, ease of doing business, and personalization significantly impact CLV. Companies with strong customer satisfaction and effective onboarding processes typically see higher CLV, while poor service quality and friction in the customer journey can dramatically reduce lifetime value.

Businesses can improve CLV by implementing loyalty programs, personalizing customer experiences, optimizing onboarding processes, improving customer service quality, and enabling upselling and cross-selling opportunities. According to data, companies excelling in personalization generate 40% more revenue than competitors, and returning customers spend 67% more than first-time customers. Additionally, reducing churn through proactive engagement and addressing customer needs early can significantly increase CLV.

Customer retention directly impacts CLV because longer customer relationships generate more revenue and profit. The retention rate is a critical component in CLV calculations, as it determines how long a customer remains active. Research shows that loyal customers are 5 times more likely to make repeat purchases and 4 times more likely to refer brands to others. Improving retention rates by even small percentages can result in substantial increases in overall CLV and business profitability.

AI and machine learning models can predict CLV more accurately by analyzing historical customer data, behavioral patterns, and engagement metrics. Platforms like Salesforce Einstein Analytics use predictive algorithms to forecast customer lifetime value, identify churn risks, and recommend next-best actions. These AI-driven insights enable businesses to segment customers more effectively, allocate resources to high-value prospects, and implement personalized retention strategies that maximize CLV at scale.

Historic CLV measures the actual revenue a customer has already generated with a business, providing a clear picture of past performance. Predictive CLV, on the other hand, estimates how much a customer is likely to spend in the future based on historical data, behavioral patterns, and industry benchmarks. Predictive CLV is more complex but valuable for strategic planning, as it helps businesses identify high-potential customers early and allocate resources accordingly to maximize future revenue.

Start tracking how AI chatbots mention your brand across ChatGPT, Perplexity, and other platforms. Get actionable insights to improve your AI presence.

Learn what Revenue Per Visit (RPV) is, how to calculate it, and why it matters for e-commerce success. Discover industry benchmarks and strategies to improve RP...

Learn what customer retention is, why it matters for business growth, and discover proven strategies to keep existing customers engaged, loyal, and coming back ...

Core Web Vitals are Google's three key metrics measuring page loading, interactivity, and visual stability. Learn LCP, INP, CLS thresholds and their impact on S...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.