How to Fix Low AI Visibility for Your Brand

Learn proven strategies to improve your brand's visibility in AI search engines like ChatGPT, Perplexity, and Gemini. Discover content optimization, entity cons...

Insurance AI Visibility refers to how clearly insurance providers and their products appear in responses generated by AI systems, including large language models and generative search engines. It measures the degree to which insurance brands are discovered, cited, and recommended within AI-powered digital assistants. Unlike traditional SEO focused on search rankings, AI visibility emphasizes how AI systems evaluate and cite insurance products in conversational responses. This has become critical as 44% of consumers now use digital assistants to understand insurance terms.

Insurance AI Visibility refers to how clearly insurance providers and their products appear in responses generated by AI systems, including large language models and generative search engines. It measures the degree to which insurance brands are discovered, cited, and recommended within AI-powered digital assistants. Unlike traditional SEO focused on search rankings, AI visibility emphasizes how AI systems evaluate and cite insurance products in conversational responses. This has become critical as 44% of consumers now use digital assistants to understand insurance terms.

Insurance AI Visibility refers to the degree to which insurance providers and their products appear in responses generated by artificial intelligence systems, including large language models (LLMs), generative search engines, and AI-powered digital assistants. Unlike traditional search engine optimization (SEO) that focuses on ranking in Google’s blue links, AI visibility emphasizes how insurance brands are discovered, cited, and recommended within generative AI outputs. This distinction matters because 44% of consumers now use digital assistants to understand insurance terms, and 58% of consumers research financial products online before speaking with an agent, making AI-driven discovery increasingly critical to customer acquisition. Insurance discovery through generative engines operates on different principles than traditional search, requiring insurers to optimize for how AI systems evaluate, cite, and recommend their products. The shift toward generative engines and AI-powered platforms means that visibility in these systems has become as important as traditional search rankings for modern insurance providers.

Insurance AI systems evaluate brands through multiple interconnected mechanisms that differ fundamentally from traditional ranking factors:

| Factor | Traditional SEO | AI Visibility |

|---|---|---|

| Primary Signal | Backlinks & Keywords | Citations & Entity Recognition |

| Content Type | Optimized for keywords | Authoritative, comprehensive |

| Trust Indicators | Domain authority | Third-party mentions & sentiment |

| Evaluation Speed | Crawl-based | Real-time LLM processing |

| User Intent | Search query matching | Conversational context understanding |

Structured data and policy clarity form the foundation of AI visibility for insurance providers because generative AI systems must understand exactly what coverage is offered, under what conditions, and at what cost. When insurance policies are written with ambiguous language or buried in dense legal documents, AI systems struggle to accurately represent them in responses, leading to incomplete or inaccurate citations. Schema markup implementation—such as InsuranceProduct schema—allows insurers to explicitly define deductibles, coverage boundaries, exclusions, and premium structures in machine-readable formats that AI systems can reliably extract and cite. For example, an insurer that clearly structures information about homeowners insurance deductibles ($500, $1,000, $2,500 options) with transparent coverage limits will be cited more accurately and frequently than competitors with vague policy descriptions. Policy definitions that separate coverage types, explain what’s included versus excluded, and provide concrete examples help AI systems generate more trustworthy recommendations, directly improving visibility in generative engine outputs.

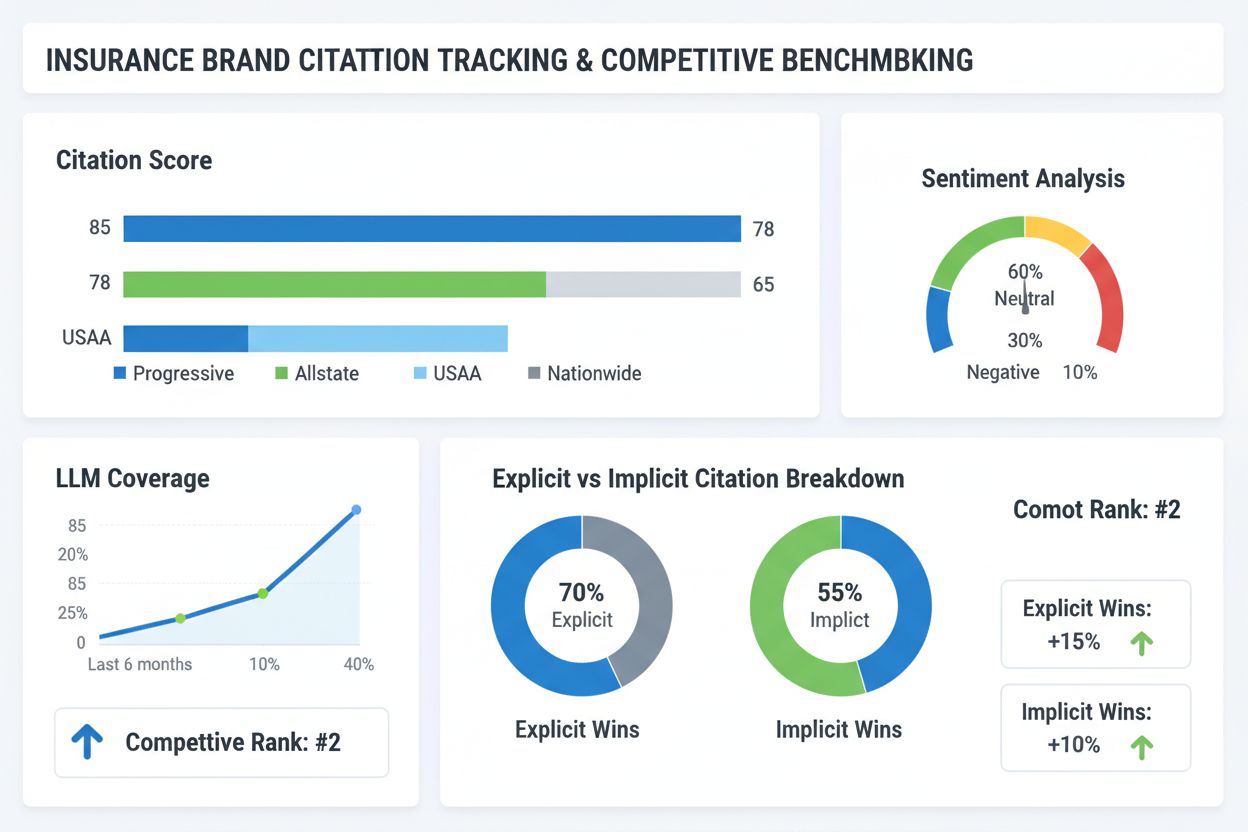

Citation tracking has emerged as the primary metric for measuring AI visibility, with explicit citations (direct mentions of the insurance company by name) and implicit wins (being recommended without direct mention) both contributing to competitive positioning. The distinction between explicit and implicit citations is critical: an explicit citation occurs when an AI system says “State Farm offers comprehensive homeowners coverage,” while an implicit win happens when an AI recommends a specific coverage type that matches your product without naming you directly. Citation scores—tracked through tools like AmICited.com, which provides comprehensive monitoring of how insurance brands appear across major LLMs and generative engines—reveal which insurers dominate AI-driven discovery. Progressive, Allstate, USAA, and Nationwide consistently rank highest in citation frequency across generative AI systems, demonstrating that established brands with strong digital presences and clear policy documentation receive disproportionate visibility. Competitive benchmarking through citation analysis helps insurers identify gaps in their AI visibility strategy and understand which competitors are winning implicit recommendations in specific product categories.

Generative Engine Optimization (GEO) requires insurance providers to implement targeted strategies that align with how AI systems discover, evaluate, and recommend insurance products:

Claims process transparency directly impacts how AI systems evaluate and recommend insurance providers because it demonstrates trustworthiness and reduces perceived risk for potential customers. When insurers provide step-by-step documentation of their claims process—from initial filing through settlement—AI systems can cite this clarity as a competitive advantage, often recommending transparent providers over competitors with opaque processes. Timeline transparency, such as publishing average claim resolution times and explaining each stage of the claims journey, helps AI systems build confidence in recommending your products to users asking about reliability and customer experience. Insurance companies that publish detailed claims procedures, provide claim status tracking information, and explain appeal processes in clear language generate more positive sentiment in AI-generated responses, leading to higher citation frequency and better positioning in generative engine results. This transparency also reduces the likelihood of negative mentions or warnings in AI outputs, as systems can verify that your claims process meets consumer expectations for fairness and efficiency.

Monitoring and measuring AI visibility requires different tools and metrics than traditional SEO, with AmICited.com emerging as the leading platform for tracking how insurance brands appear across generative AI systems. Key visibility metrics that matter for insurance providers include citation frequency (how often you’re mentioned), citation quality (whether mentions are positive, neutral, or negative), implicit recommendation rate (how often you’re recommended without direct mention), and competitive share of voice (your citation volume relative to competitors). Tools like AmICited.com provide dashboards showing which LLMs cite your brand most frequently, which products receive the most AI mentions, and how your citation trends compare to competitors over time. Beyond citation tracking, insurers should monitor sentiment analysis of AI-generated mentions, tracking whether recommendations are framed positively or with caveats, and analyze which third-party sources most influence AI recommendations of your products. Regular monitoring reveals which content updates, policy clarifications, or marketing initiatives successfully improve your AI visibility, enabling data-driven optimization of your generative engine strategy.

Insurance providers should implement these best practices to maximize their AI visibility and competitive positioning in generative engine results:

Traditional SEO focuses on ranking individual pages in search engine results through keywords and backlinks. Insurance AI visibility, by contrast, measures how often and how accurately insurance brands appear in responses generated by AI systems like ChatGPT and Gemini. While traditional SEO optimizes for search rankings, AI visibility optimizes for citation frequency, accuracy, and sentiment in generative engine outputs.

AI systems update citations continuously as they process new information, but the frequency varies by platform. Large language models like ChatGPT are trained on data with a knowledge cutoff date, while real-time systems like Perplexity update citations as they search the web. Insurance providers should monitor citation trends regularly through tools like AmICited.com to track changes in their AI visibility.

Insurance companies should implement schema markup including InsuranceProduct, Organization, FAQPage, and LocalBusiness schemas. These machine-readable formats help AI systems understand policy details, coverage types, pricing, and company information. Structured data should clearly define deductibles, coverage boundaries, exclusions, and premium structures in formats that AI systems can reliably extract and cite.

Smaller insurers can compete by specializing in niche markets or specific geographic regions, then deeply documenting their expertise online. By creating authoritative, transparent content about their specific products and building strong third-party citations from local advisors and industry publications, smaller providers can become the preferred recommendation for specialized insurance needs in their markets.

Sentiment analysis measures whether AI-generated mentions of insurance brands are positive, neutral, or negative. AI systems track sentiment across reviews, customer feedback, and third-party mentions to assess brand trustworthiness. Insurance providers with consistently positive sentiment receive higher citation frequency and better positioning in generative engine results compared to competitors with mixed or negative sentiment.

Insurance companies should use dedicated AI visibility monitoring tools like AmICited.com, which tracks citations across major LLMs and generative engines including ChatGPT, Gemini, Perplexity, and Bing AI. These platforms provide dashboards showing citation frequency, competitive benchmarking, sentiment analysis, and trending topics, enabling data-driven optimization of AI visibility strategies.

Insurance providers must ensure that all information published for AI visibility complies with state insurance regulations and accurately represents their products. AI systems penalize inaccurate or misleading claims through reduced citation frequency. Companies should maintain version histories of published content, work with compliance teams to review changes before publication, and monitor AI-generated descriptions to correct any misrepresentations quickly.

Track how insurance brands appear across ChatGPT, Gemini, Perplexity, and Google AI Overviews. Get real-time citation tracking, competitive benchmarking, and actionable insights to improve your AI visibility.

Learn proven strategies to improve your brand's visibility in AI search engines like ChatGPT, Perplexity, and Gemini. Discover content optimization, entity cons...

Compare agency vs in-house AI visibility monitoring. Explore costs, timelines, expertise requirements, and hybrid approaches to help you choose the right strate...

Complete guide for marketing agencies to understand, implement, and offer AI visibility services to clients. Learn monitoring strategies, tools, and ROI measure...