Keyword Density

Keyword density measures how often a keyword appears in content relative to total word count. Learn optimal percentages, best practices, and how it impacts AI s...

Search volume is the number of times a specific keyword or phrase is searched for on search engines over a given period of time, typically measured on a monthly basis. This metric indicates keyword popularity and helps businesses understand user demand for specific topics, products, or services. Search volume data is essential for keyword research, SEO strategy, and identifying content opportunities.

Search volume is the number of times a specific keyword or phrase is searched for on search engines over a given period of time, typically measured on a monthly basis. This metric indicates keyword popularity and helps businesses understand user demand for specific topics, products, or services. Search volume data is essential for keyword research, SEO strategy, and identifying content opportunities.

Search volume refers to the number of times a specific keyword or phrase is searched for on search engines over a given period of time, typically measured on a monthly basis. This metric is fundamental to understanding user demand, market interest, and the competitive landscape for any keyword or topic. Search volume data helps businesses, content creators, and digital marketers identify which keywords are worth targeting, how much traffic potential exists for specific terms, and where to allocate their SEO and paid advertising budgets. The metric serves as a quantifiable indicator of keyword popularity and user interest, making it one of the most critical data points in keyword research and search engine optimization strategy.

Search volume is not a static number—it fluctuates based on seasonality, trending topics, current events, and evolving user behavior. For example, searches for “Christmas gifts” spike dramatically in November and December, while “back to school supplies” peaks in August. Understanding these patterns allows marketers to anticipate demand, create timely content, and optimize their campaigns for maximum visibility and conversion potential. In the context of AI monitoring and brand tracking, search volume becomes even more important, as it indicates how frequently users are searching for your brand, competitors, and industry-related keywords—data that directly correlates with your visibility in AI-generated responses and search engine results.

The concept of search volume emerged alongside the rise of search engines in the late 1990s and early 2000s. As Google became the dominant search engine, marketers realized that understanding how often people searched for specific terms could inform content strategy and advertising decisions. Initially, search volume data was proprietary and difficult to access, but Google Keyword Planner (launched in 2000 as part of Google Ads) democratized access to this information, allowing businesses of all sizes to conduct keyword research. Over the past two decades, search volume has evolved from a simple metric into a sophisticated data point that incorporates machine learning, AI-driven predictions, and real-time trend analysis.

According to recent data, Google processes approximately 8.9 billion searches per day, translating to over 2.6 trillion searches annually. This staggering volume underscores the importance of understanding keyword search patterns. The average user conducts 3 to 4 searches per day, though Gen Z users average over 5 daily searches, indicating generational differences in search behavior. Mobile searches account for 65.8% of all Google queries, making mobile-optimized content and mobile-specific keyword research increasingly critical. Additionally, long-tail keywords account for 70% of all search traffic, despite each individual long-tail keyword having lower search volume than broad terms. This distribution reveals that while high-volume keywords attract attention, the cumulative traffic from numerous low-volume keywords often represents the largest opportunity for organic growth.

The evolution of search volume measurement has been marked by increasing sophistication and accuracy challenges. Google Keyword Planner displays search volumes in ranges for accounts with no active campaigns, making precise data difficult to obtain. To address this limitation, professional SEO tools have developed alternative methodologies. Over 94.74% of keywords receive 10 or fewer monthly searches, highlighting the “long tail” phenomenon where the vast majority of keywords have minimal individual search volume. Conversely, only 0.0008% of keywords have over 100,000 monthly searches, making high-volume keywords extremely rare and highly competitive. Understanding this distribution is essential for realistic keyword targeting and resource allocation.

| Metric | Definition | Measurement | Primary Use | Data Source |

|---|---|---|---|---|

| Search Volume | Number of times a keyword is searched monthly | Monthly average searches | Identifying keyword popularity and traffic potential | Google Keyword Planner, SEO tools |

| Keyword Difficulty (KD) | Competitiveness of ranking for a keyword | 0-100 scale | Assessing ranking feasibility | SEO tools (Semrush, Ahrefs) |

| Cost Per Click (CPC) | Average cost advertisers pay per click in PPC | Dollar amount | Evaluating keyword commercial value | Google Ads, PPC platforms |

| Click-Through Rate (CTR) | Percentage of impressions that result in clicks | Percentage (%) | Measuring ad/listing effectiveness | Google Search Console, Analytics |

| Search Intent | User’s underlying goal when searching | Categorical (informational, navigational, commercial, transactional) | Aligning content with user needs | Manual analysis, AI classification |

| Keyword Trends | Changes in search volume over time | Percentage increase/decrease | Identifying emerging or declining keywords | Google Trends, SEO tools |

| Long-Tail Keywords | Specific, multi-word phrases with lower volume | Typically 3+ words, 10-1,000 monthly searches | Targeting niche audiences with high intent | Keyword research tools |

| Branded Keywords | Searches containing a brand name | Varies by brand size | Measuring brand awareness and loyalty | Google Search Console, Analytics |

Search volume measurement is more complex than it appears, as different tools use different methodologies to estimate the number of searches. Google Keyword Planner, the most widely used source, bases its data on actual Google Ads search volume, but this data is limited to keywords with sufficient search activity and advertiser interest. For accounts with low spending or no active campaigns, Google displays search volumes in ranges (e.g., “1K-10K” or “10K-100K”) rather than exact numbers, reducing precision. This limitation has led SEO professionals to seek alternative data sources and calculation methods.

Professional SEO tools employ three primary approaches to calculate search volume: First, they use Google Keyword Planner data directly, which provides a baseline but lacks granularity. Second, they combine Google Keyword Planner data with clickstream data—anonymized information from real-world searchers collected through browser extensions, plugins, and other tracking mechanisms. Tools like Ahrefs use this approach, cross-referencing Keyword Planner values with clickstream data to provide more accurate estimates. Third, tools like SEO PowerSuite combine Google Keyword Planner data with impression data from Google Ads forecasts, using machine learning algorithms to estimate exact search volumes within the ranges Google provides.

Each methodology has trade-offs. Clickstream data is expensive to acquire and represents only a small fraction of total searches, as not all users have data-collection tools installed. Impression data from Google Ads is more affordable but only reflects searches where ads are running, potentially missing organic-only keywords. Additionally, Google groups similar keywords into “buckets,” with approximately 80 logarithmically distributed search volume values repeated across millions of keywords, meaning multiple keywords may show identical search volumes even though their actual search frequency differs. Understanding these limitations helps marketers interpret search volume data more critically and avoid over-relying on any single metric.

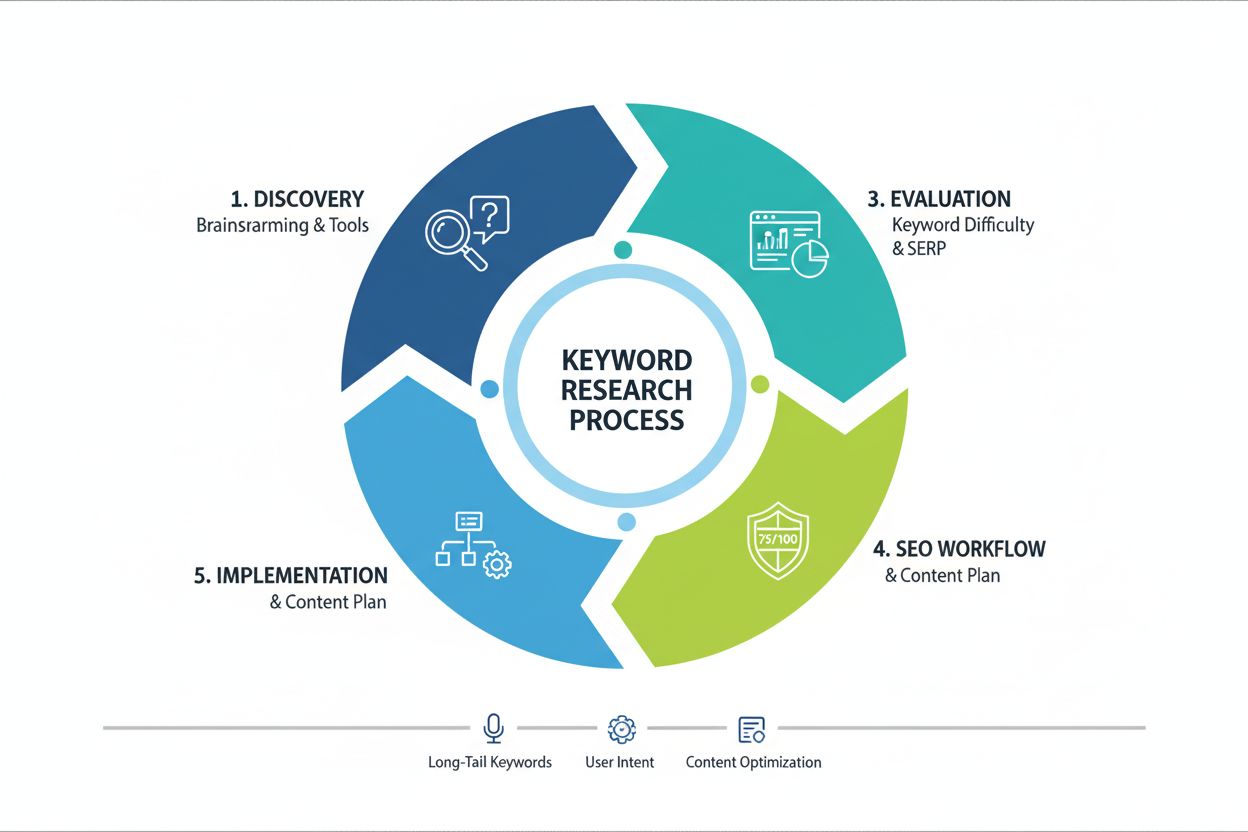

Search volume is the foundation of effective keyword research, serving as the primary indicator of keyword popularity and traffic potential. When conducting keyword research, marketers typically follow a process: identify relevant keywords, analyze their search volume, assess keyword difficulty, evaluate search intent, and prioritize keywords based on a combination of these factors. A keyword with 100,000 monthly searches represents significantly more traffic opportunity than one with 1,000 searches, but it also faces higher competition and may require more resources to rank for. Conversely, low-volume keywords (under 100 monthly searches) are easier to rank for and often indicate specific, high-intent user queries that convert well despite lower traffic volume.

Search volume data directly influences content strategy and topic selection. High-volume keywords indicate topics with broad audience interest, making them suitable for awareness-stage content and top-of-funnel blog posts. Medium-volume keywords often represent consideration-stage topics where users are evaluating options. Low-volume, high-intent keywords typically represent bottom-of-funnel, transactional queries where users are ready to make a purchase or take action. By analyzing search volume across the customer journey, marketers can create a comprehensive content strategy that addresses user needs at every stage. Additionally, search volume trends reveal emerging topics and declining interest, allowing marketers to stay ahead of market shifts and allocate resources to growing opportunities.

For AI monitoring and brand tracking, search volume provides critical context for understanding your brand’s visibility. When AmICited tracks your domain’s appearances in AI-generated responses from platforms like ChatGPT, Perplexity, Google AI Overviews, and Claude, search volume data helps explain why certain keywords appear more frequently. Keywords with high search volume are more likely to be included in AI training data and more frequently referenced in AI responses. By monitoring search volume trends for your brand and industry keywords, you can identify opportunities to increase your visibility in both traditional search results and AI-powered platforms, ensuring your brand maintains relevance in an increasingly AI-driven information landscape.

Search volume is not constant throughout the year—it fluctuates based on seasonality, holidays, events, and evolving user behavior patterns. Understanding these fluctuations is essential for accurate forecasting and strategic planning. “Christmas gifts” searches peak in November-December, with search volume potentially increasing 500% or more compared to summer months. Similarly, “summer vacation” searches spike in June-August, while “flu symptoms” searches increase during winter months. These seasonal patterns are predictable and recurring, allowing marketers to anticipate demand and prepare content and campaigns accordingly.

Trending topics and current events create temporary spikes in search volume that differ from seasonal patterns. When a major news event occurs, related search volume can increase dramatically within hours. For example, searches for “World Cup” spike during the tournament, while searches for specific political figures increase during election cycles. 15% of Google searches have never been searched before, indicating that new queries constantly emerge in response to current events, product launches, and cultural moments. Marketers who monitor trending topics can capitalize on these spikes by creating timely content that addresses emerging user interests.

Google Trends is the primary tool for analyzing search volume trends and identifying seasonal patterns. The platform displays search interest over time, allowing marketers to visualize how search volume for specific keywords has changed over months, years, or even decades. By analyzing historical trends, marketers can predict future demand cycles and plan content calendars accordingly. For example, a retailer selling winter clothing can use Google Trends to identify when search volume for “winter coats” begins increasing, allowing them to optimize their website and launch marketing campaigns before peak demand arrives. This proactive approach maximizes visibility and conversion potential during high-demand periods.

Search volume alone is insufficient for effective keyword targeting—it must be analyzed in conjunction with search intent, which refers to the underlying goal or purpose behind a user’s search query. Search intent distribution includes 52.65% informational, 32.15% navigational, 14.51% commercial, and 0.69% transactional intent, according to recent data. A keyword with high search volume but misaligned intent may not deliver the desired business results. For example, “how to write a resume” has high search volume but primarily informational intent, making it less suitable for a resume-writing service trying to drive sales. Conversely, “best resume writing service” has lower volume but higher commercial intent, making it more valuable for conversion-focused campaigns.

Informational keywords (e.g., “what is SEO,” “how to rank on Google”) indicate users seeking knowledge or answers. These keywords are ideal for blog posts, educational content, and thought leadership pieces that build authority and attract organic traffic. Navigational keywords (e.g., “Facebook login,” “Gmail”) indicate users trying to reach a specific website or service. These keywords are less valuable for organic SEO but important for brand protection in paid advertising. Commercial keywords (e.g., “best SEO tools,” “affordable web hosting”) indicate users comparing options and considering a purchase. These keywords are valuable for product comparison pages and review content. Transactional keywords (e.g., “buy running shoes,” “sign up for email marketing”) indicate users ready to complete a purchase or action, making them the most valuable for conversion-focused campaigns.

Aligning search volume with search intent ensures that marketing efforts target the right keywords for the right business objectives. A keyword with 10,000 monthly searches but primarily informational intent may generate significant traffic but minimal conversions. Conversely, a keyword with 500 monthly searches and strong transactional intent may drive fewer visitors but convert at a much higher rate, ultimately delivering better ROI. By analyzing both metrics together, marketers can identify keywords that offer the optimal balance of traffic potential and conversion likelihood, maximizing the efficiency of their SEO and paid advertising investments.

Multiple tools and platforms provide search volume data, each with different methodologies, accuracy levels, and pricing models. Google Keyword Planner remains the most widely used source, offering free access to search volume data for anyone with a Google Ads account. However, its limitations—including range-based reporting for low-spending accounts and combined search volumes for similar keywords—have led marketers to supplement it with additional tools. Google Trends provides free, historical search volume data and trend analysis, allowing marketers to visualize how search interest has changed over time and identify seasonal patterns.

Professional SEO tools like Semrush, Ahrefs, SEO PowerSuite, and Rank Tracker offer more granular search volume data and advanced analysis features. Semrush’s Keyword Overview tool provides monthly search volume, keyword difficulty, cost-per-click, and search intent classification. Ahrefs’ Keywords Explorer combines Google Keyword Planner data with clickstream data to provide more accurate estimates. SEO PowerSuite’s Rank Tracker displays search volume alongside ranking data, allowing marketers to track how search volume changes correlate with ranking improvements. These professional tools typically require paid subscriptions but offer superior data accuracy and additional features that justify the investment for serious SEO practitioners.

Specialized search volume tools like Keywords Everywhere and Moz Keyword Explorer provide browser extensions and standalone platforms for quick search volume lookups. Google Search Console provides actual search volume data for keywords your website already ranks for, offering real-world validation of tool estimates. By combining data from multiple sources, marketers can triangulate more accurate search volume estimates and make more informed keyword targeting decisions. The choice of tool depends on budget, required accuracy level, and specific feature needs, but most professional marketers use a combination of free and paid tools to ensure comprehensive keyword research.

Search volume measurement is evolving in response to changing search behavior and the rise of AI-powered search platforms. Traditional search volume metrics, which measure queries on Google and other search engines, are becoming less comprehensive as users increasingly turn to AI chatbots like ChatGPT, Claude, and Perplexity for information. These AI platforms don’t report search volume in the traditional sense, creating a gap in visibility for marketers. Over 58.5% of Google searches result in zero clicks, as users find answers directly in search results through featured snippets, People Also Ask boxes, and AI-generated summaries, fundamentally changing how search volume translates to website traffic.

AI Overviews and generative search experiences are reshaping the relationship between search volume and visibility. When Google displays an AI-generated summary at the top of search results, the traditional top-ranking organic result may receive significantly fewer clicks despite high search volume for that keyword. This shift has led to the emergence of new metrics like “brand mentions in AI responses” and “AI citation frequency,” which measure how often your content appears in AI-generated answers rather than traditional search rankings. Platforms like AmICited are pioneering this new frontier by tracking brand visibility across AI platforms, providing marketers with insights into how their content is being cited and referenced in AI-generated responses.

Future search volume metrics will likely incorporate AI visibility data, creating a more comprehensive picture of keyword popularity and content visibility across both traditional search engines and AI platforms. As voice search continues to grow (with 20.1% of all Google queries now being voice searches), search volume measurement may need to account for conversational queries and natural language variations that differ from typed searches. Additionally, personalization and real-time search adaptation mean that search volume for the same keyword may vary significantly based on user location, search history, and device type. Marketers who understand these evolving metrics and adapt their strategies accordingly will maintain competitive advantage in an increasingly complex and AI-driven search landscape.

+++

Search volume measures how many times a keyword is searched monthly, while keyword difficulty (KD) indicates how hard it is to rank for that keyword. A keyword can have high search volume but low difficulty, making it an attractive target. Conversely, some keywords have low volume but high difficulty due to strong competition. Both metrics should be analyzed together when selecting keywords for SEO campaigns. Understanding this distinction helps marketers prioritize keywords that offer the best balance of traffic potential and ranking feasibility.

Seasonality causes search volumes to fluctuate throughout the year based on holidays, weather, events, and consumer behavior patterns. For example, 'Christmas gifts' peaks in November-December, while 'summer vacation' spikes in June-August. Keywords like 'flu symptoms' see increased searches during winter months. Recognizing seasonal trends allows marketers to plan content calendars, adjust bidding strategies, and allocate budgets more effectively. Tools like Google Trends help identify these patterns and predict future demand cycles.

The primary sources of search volume data include Google Keyword Planner (free but limited), Google Trends, and third-party SEO tools like Semrush, Ahrefs, and SEO PowerSuite. Google Keyword Planner provides data from Google Ads but displays ranges for low-spending accounts. Many professional tools combine Google Keyword Planner data with clickstream data or impression data to provide more accurate estimates. Each source has different methodologies, so search volumes may vary slightly between tools. Choosing reliable sources ensures better keyword research accuracy.

Search volume discrepancies occur because different tools use different data sources and calculation methods. Google Keyword Planner uses Google Ads data, while tools like Ahrefs combine it with clickstream data, and SEO PowerSuite uses impression data from Google Ads forecasts. Additionally, Google groups similar keywords together, creating 'buckets' of approximately 80 logarithmically distributed values. These variations mean no tool provides perfectly accurate numbers, but they're useful for relative comparisons within the same tool. Understanding these differences helps marketers interpret data more effectively.

Search volume data reveals how often users search for your brand, competitors, and industry keywords across search engines. For AI monitoring platforms like AmICited, understanding search volume helps track brand visibility trends and identify when your domain appears in AI-generated responses. High search volume keywords indicate strong user interest, making them critical for monitoring AI citations. By analyzing search volume patterns, brands can optimize their content strategy to increase visibility in both traditional search and AI-powered platforms like ChatGPT, Perplexity, and Google AI Overviews.

High search volume doesn't always mean high conversion potential. A keyword with 10,000 monthly searches might have low commercial intent, while a keyword with 500 searches could convert at 10x the rate. Conversion potential depends on search intent (informational, navigational, commercial, or transactional), audience relevance, and landing page quality. Long-tail keywords often have lower volume but higher conversion rates because they indicate specific user intent. Marketers should analyze search volume alongside intent and conversion metrics to identify truly valuable keywords for their business goals.

In PPC campaigns, high search volume keywords typically mean higher competition and cost-per-click (CPC), but also more potential impressions and clicks. Advertisers must balance volume with budget and ROI. In organic SEO, high-volume keywords are harder to rank for but offer more traffic potential once achieved. Low-volume keywords are easier to rank for but provide limited traffic. Successful strategies often combine high-volume keywords for brand awareness with low-volume, high-intent keywords for conversions. Understanding how volume affects each channel helps allocate resources more effectively.

Start tracking how AI chatbots mention your brand across ChatGPT, Perplexity, and other platforms. Get actionable insights to improve your AI presence.

Keyword density measures how often a keyword appears in content relative to total word count. Learn optimal percentages, best practices, and how it impacts AI s...

Keyword research is the foundational SEO process of identifying valuable search terms people use online. Learn methods, tools, and strategies to find high-impac...

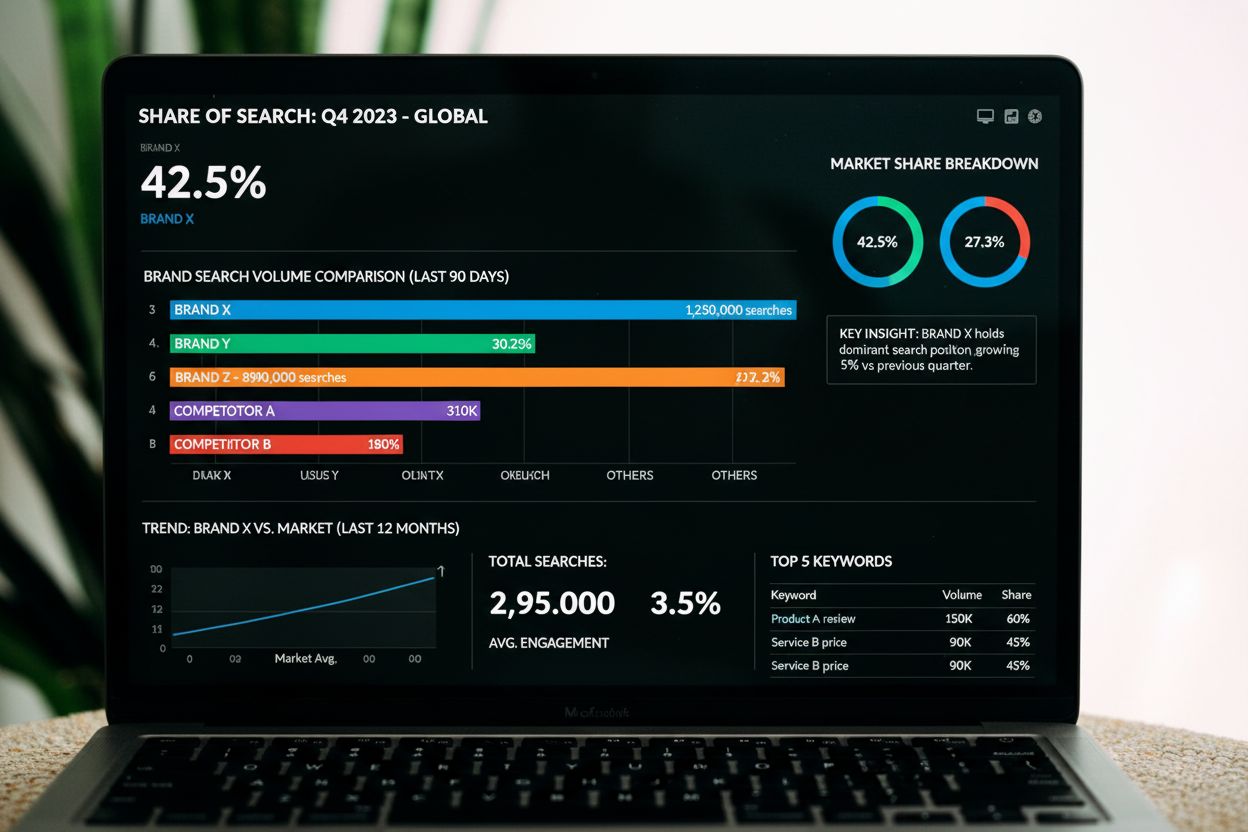

Share of Search measures brand search volume relative to category competitors. Learn how this metric predicts market share, correlates with sales, and impacts A...