AI-Mediated Commerce

Learn what AI-mediated commerce is, how intelligent AI agents facilitate transactions between consumers and brands, key protocols like ACP and AP2, real-world i...

The process by which AI platforms verify and trust product information from e-commerce sellers through automated identity verification, business legitimacy checks, and product authenticity validation. It combines machine learning algorithms with real-time data analysis to detect fraudulent merchants, counterfeit products, and suspicious seller behavior across online marketplaces.

The process by which AI platforms verify and trust product information from e-commerce sellers through automated identity verification, business legitimacy checks, and product authenticity validation. It combines machine learning algorithms with real-time data analysis to detect fraudulent merchants, counterfeit products, and suspicious seller behavior across online marketplaces.

AI merchant verification is the automated process of authenticating e-commerce sellers and validating their product information through artificial intelligence and machine learning algorithms. This system verifies merchant identity, confirms business legitimacy, validates product authenticity, and assesses compliance risk in real-time. Rather than relying on manual review processes that are slow and prone to human error, AI merchant verification analyzes thousands of data points simultaneously to make instantaneous trust decisions about sellers and their products.

AI merchant verification operates through multiple integrated verification layers, each designed to assess different aspects of seller legitimacy and product authenticity. These components work together to create a comprehensive trust assessment that protects both e-commerce platforms and consumers.

| Component | Purpose |

|---|---|

| Identity & Document Verification | Validates seller identity through government-issued documents, business registration certificates, tax identification numbers, and incorporation documents. Uses optical character recognition (OCR) and document fraud detection to ensure authenticity. |

| Business Legitimacy Checks | Confirms business registration status, legal entity information, ownership structure, and operational history. Screens against sanctions lists, PEP (Politically Exposed Persons) databases, and adverse media to identify high-risk entities. |

| Product Information Validation | Analyzes product descriptions, images, pricing, and specifications against known authentic products. Uses computer vision to detect counterfeit packaging, logos, and holograms. Compares product claims against regulatory databases. |

| Compliance & Risk Assessment | Evaluates KYC/AML requirements, regulatory compliance, transaction patterns, and behavioral indicators. Assigns risk scores based on merchant history, geographic location, industry classification, and transaction velocity. |

AI systems employ sophisticated detection techniques to identify fraudulent merchants before they can harm consumers or damage marketplace integrity. Behavioral analysis examines how merchants interact with the platform, looking for patterns that deviate from legitimate seller behavior such as rapid account creation followed by bulk product uploads or unusual transaction patterns. Device fingerprinting creates unique digital identities for devices and connections, allowing the system to detect when multiple suspicious accounts originate from the same source, revealing fraud rings operating with hundreds of fake profiles.

Pattern recognition identifies recurring suspicious activities like testing stolen credit cards on low-cost purchases, bulk adding items to carts, or posting multiple reviews within seconds. Natural language processing (NLP) analyzes product descriptions, reviews, and seller communications to detect generic language, repetitive wording, or poorly written content that indicates fake accounts. Cross-account correlation connects data points across multiple accounts to identify coordinated fraudulent behavior, such as merchants using different shipping addresses, phone numbers, or payment details to appear legitimate.

Anomaly detection flags transactions and activities that significantly deviate from normal patterns, such as login attempts from unusual geographic locations, impossible travel velocities between transactions, or access from known proxy servers and VPNs. These techniques work in concert, with each detection method reinforcing others to create a comprehensive fraud prevention system that operates in real-time.

Machine learning transforms merchant verification from a static, rule-based system into an adaptive intelligence engine that continuously improves its accuracy and effectiveness. Supervised learning trains algorithms using labeled historical data of approved and rejected merchants, enabling the system to predict the legitimacy of new sellers based on patterns learned from past decisions. Unsupervised learning processes unlabeled transaction data to discover hidden relationships and patterns that humans might miss, such as identifying clusters of coordinated fraudulent accounts or detecting emerging fraud tactics.

Anomaly detection algorithms establish baselines of normal merchant behavior and immediately flag deviations, making the system proactive rather than reactive. The system learns from every transaction, incorporating feedback from fraud analysts, chargeback notifications, and confirmed fraud cases to refine its decision-making. As more data flows through the system, the machine learning models become increasingly accurate at distinguishing legitimate merchants from fraudsters, reducing both false positives that block good sellers and false negatives that allow bad actors through.

AI merchant verification protects e-commerce ecosystems across multiple critical functions:

Despite its effectiveness, AI merchant verification faces significant challenges that require continuous attention and refinement. Sophisticated fraud tactics evolve constantly as fraudsters develop new methods to bypass detection systems, requiring AI models to continuously adapt and learn from emerging threats. Data quality issues can severely impact model accuracy—incomplete, biased, or incorrectly labeled training data leads to poor decision-making that perpetuates errors over time.

False positives represent a critical challenge, as legitimate merchants may be incorrectly flagged as fraudulent, damaging their business and creating negative customer experiences. Continuous model retraining is necessary because fraud patterns change, new merchant types emerge, and regulatory requirements evolve, requiring significant computational resources and specialized expertise. Balancing security with user experience creates tension between strict verification that blocks fraud but frustrates legitimate sellers and lenient verification that enables faster onboarding but increases fraud risk.

Additionally, fraudster sophistication continues to increase, with bad actors using AI-generated deepfakes, stolen identities, and coordinated networks to appear legitimate, requiring verification systems to stay ahead of increasingly advanced deception tactics.

AI merchant verification integrates seamlessly with e-commerce infrastructure through APIs that connect to payment gateways, KYC/AML compliance systems, and marketplace platforms. The entire verification process occurs in real-time, typically completing within milliseconds, allowing merchants to receive instant approval or rejection decisions during onboarding. Integration with payment processors enables continuous monitoring of merchant transactions, flagging suspicious activity patterns that emerge after initial approval.

The system feeds verification results into risk management workflows, automatically triggering additional scrutiny for high-risk merchants or enabling streamlined processing for trusted sellers. API integration allows verification data to flow into compliance reporting systems, maintaining audit trails and documentation required for regulatory compliance. Real-time processing ensures that verification decisions reflect current threat intelligence and fraud patterns rather than outdated historical data.

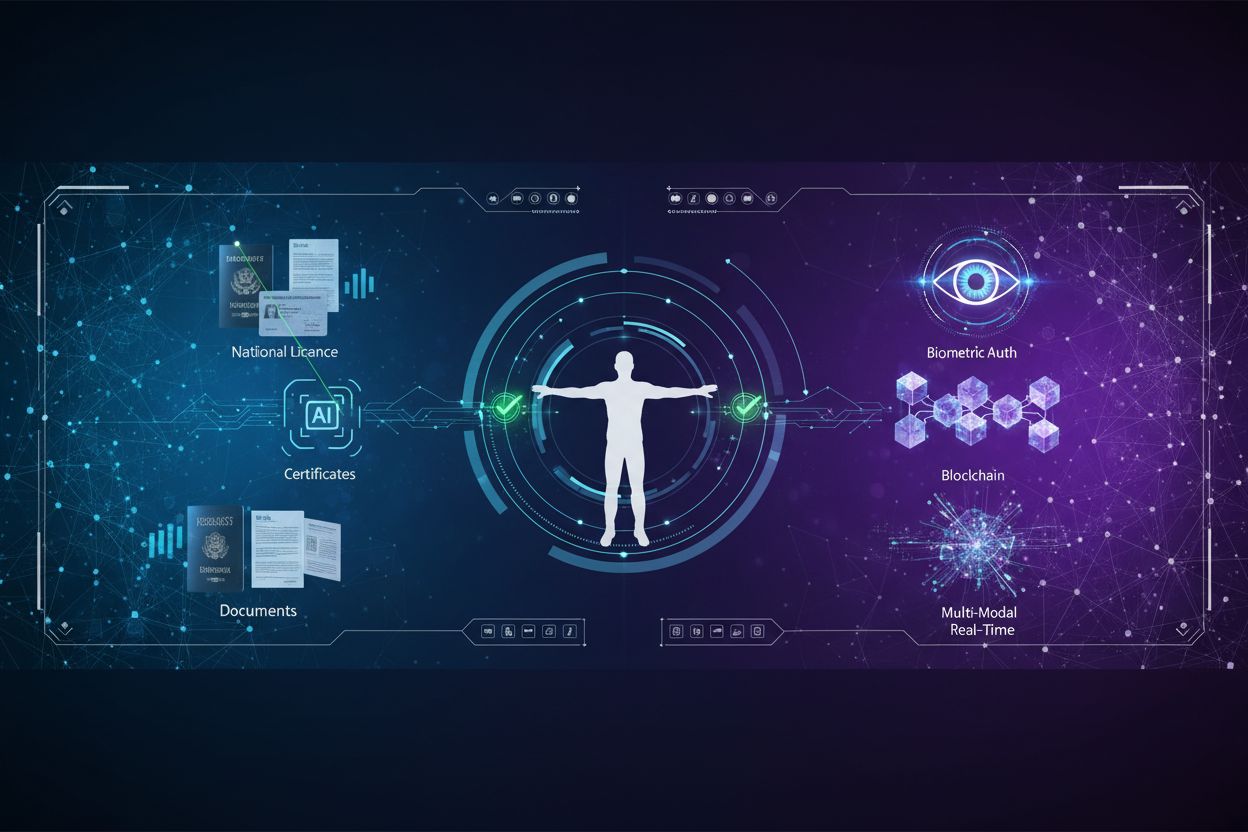

The future of merchant verification will be shaped by emerging technologies and evolving threat landscapes. Biometric authentication will increasingly supplement traditional document verification, using facial recognition, iris scanning, and behavioral biometrics to confirm merchant identity with greater certainty. Blockchain integration will provide transparent, immutable verification records that merchants can carry across platforms, reducing onboarding friction while maintaining security.

Enhanced deepfake detection will become critical as AI-generated synthetic media becomes more sophisticated, requiring verification systems to distinguish authentic identity documents and video from AI-generated counterfeits. Multi-modal verification will combine multiple data sources—documents, biometrics, behavioral patterns, network analysis, and blockchain records—to create more robust trust assessments that are harder to deceive. Regulatory evolution will drive standardization of verification requirements across jurisdictions, potentially enabling merchants to complete verification once and operate globally.

AI merchant verification serves to authenticate sellers, validate product information, and prevent fraud in e-commerce platforms. It uses machine learning algorithms to analyze thousands of data points in real-time, identifying suspicious merchants, counterfeit products, and fraudulent behavior before they harm consumers or damage marketplace integrity.

AI detects fraudulent merchants through behavioral analysis, device fingerprinting, pattern recognition, natural language processing, cross-account correlation, and anomaly detection. These techniques analyze seller profiles, transaction history, product listings, customer reviews, and network patterns to identify inconsistencies that indicate fraudulent activity.

AI merchant verification analyzes identity documents, business registration information, transaction history, device fingerprints, IP addresses, behavioral patterns, product images, seller reviews, shipping addresses, payment methods, and communication patterns. It also examines temporal patterns, geographic velocity, and correlations with other accounts to assess risk.

Yes, AI merchant verification can prevent counterfeit products by analyzing product images, comparing them against authentic databases, examining packaging details, validating product descriptions, and detecting suspicious seller patterns. Computer vision algorithms can identify subtle inconsistencies in logos, holograms, and packaging that indicate counterfeits.

Key challenges include sophisticated fraud tactics that evolve constantly, data quality issues affecting model accuracy, false positives that block legitimate sellers, the need for continuous model retraining, balancing security with user experience, and regulatory compliance requirements across different jurisdictions.

Machine learning improves merchant verification by learning from historical data, analyzing patterns in approved and rejected merchants, incorporating feedback from fraud analysts, and adapting to new fraud tactics. The more transactions the system processes, the more accurate its risk assessments become, reducing both false positives and false negatives.

Whitebox systems prioritize transparency and interpretability, allowing fraud teams to see exactly why a merchant was flagged, but may be less accurate. Blackbox systems use complex algorithms like neural networks for higher accuracy but lack transparency, making it difficult to explain decisions to customers or regulators.

AI merchant verification integrates through APIs with payment gateways, KYC/AML compliance systems, and marketplace platforms. It processes transactions in real-time, flags suspicious merchants during onboarding, monitors ongoing seller activity, and provides risk scores that inform acceptance or rejection decisions within seconds.

AmICited tracks how AI platforms like ChatGPT, Perplexity, and Google AI Overviews mention your brand in merchant verification contexts. Stay informed about your brand's presence in AI-driven e-commerce security discussions.

Learn what AI-mediated commerce is, how intelligent AI agents facilitate transactions between consumers and brands, key protocols like ACP and AP2, real-world i...

Learn how to prepare your brand for agentic commerce. Discover essential steps to make your systems AI agent-ready and stay competitive in the evolving e-commer...

Learn how certifications and trust badges impact your visibility in AI-generated answers. Discover why trust signals matter for ChatGPT, Perplexity, and Google ...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.