AI Market Share

Learn what AI market share is, how to measure it across ChatGPT, Perplexity, Google AI Overviews, and other platforms, and why it matters for your brand's compe...

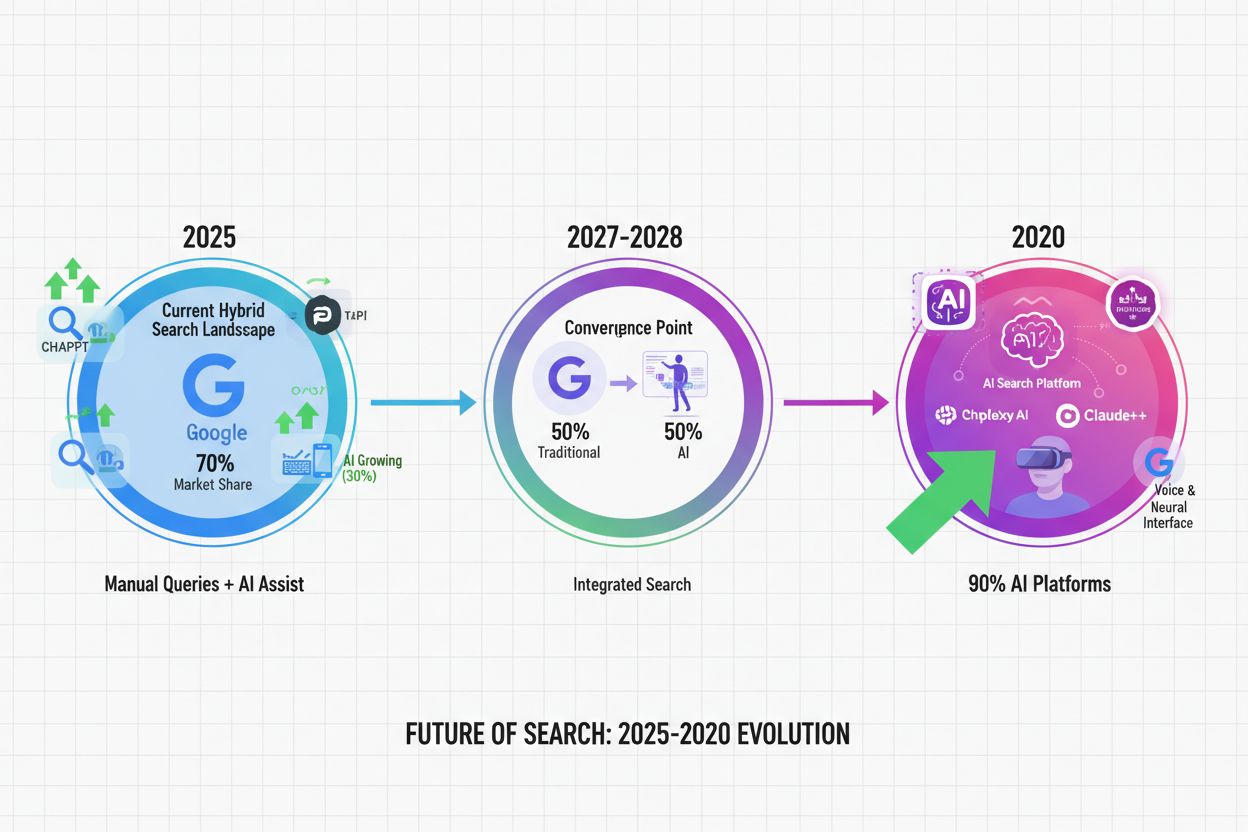

The portion of total search activity occurring through AI assistants rather than traditional engines. Represents the growing shift from Google-dominated search to distributed AI-powered platforms like ChatGPT, Perplexity, and Claude. Currently accounts for a small but rapidly growing percentage of global search queries. Expected to reach parity with traditional search by 2028-2030.

The portion of total search activity occurring through AI assistants rather than traditional engines. Represents the growing shift from Google-dominated search to distributed AI-powered platforms like ChatGPT, Perplexity, and Claude. Currently accounts for a small but rapidly growing percentage of global search queries. Expected to reach parity with traditional search by 2028-2030.

AI Search Market Share refers to the proportion of search queries and user engagement captured by artificial intelligence-powered search platforms compared to traditional search engines. This metric has become increasingly critical as generative AI search tools fundamentally reshape how users discover information online, moving away from traditional link-based results toward AI-generated summaries and direct answers. The shift represents a paradigm change in search behavior, where users now expect conversational interfaces, synthesized information, and contextual understanding rather than ranked lists of blue links. Understanding AI search market share matters because it directly impacts website visibility, traffic patterns, and the effectiveness of traditional SEO strategies that have dominated digital marketing for decades. As AI Overviews and similar features become standard across search platforms, businesses must recognize that market share is no longer solely determined by ranking position but by whether their content is selected, cited, and featured by AI systems.

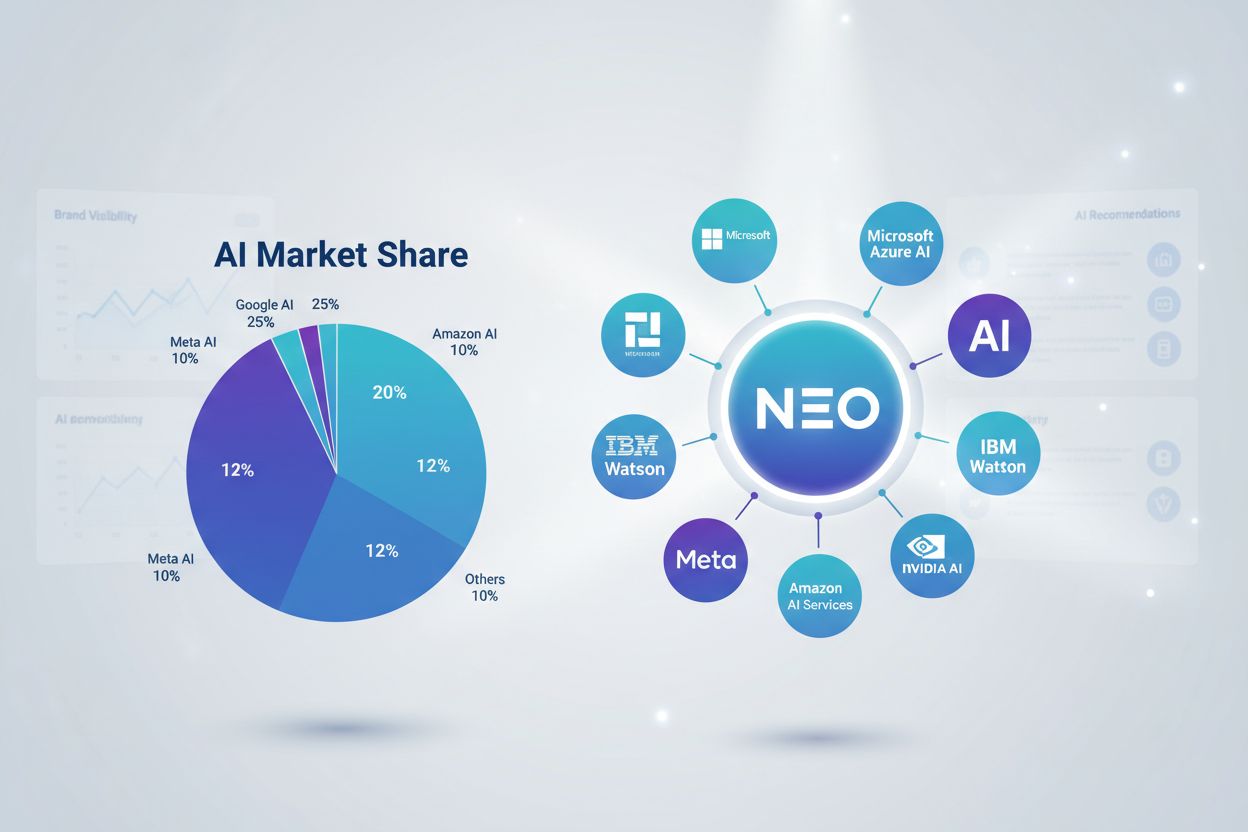

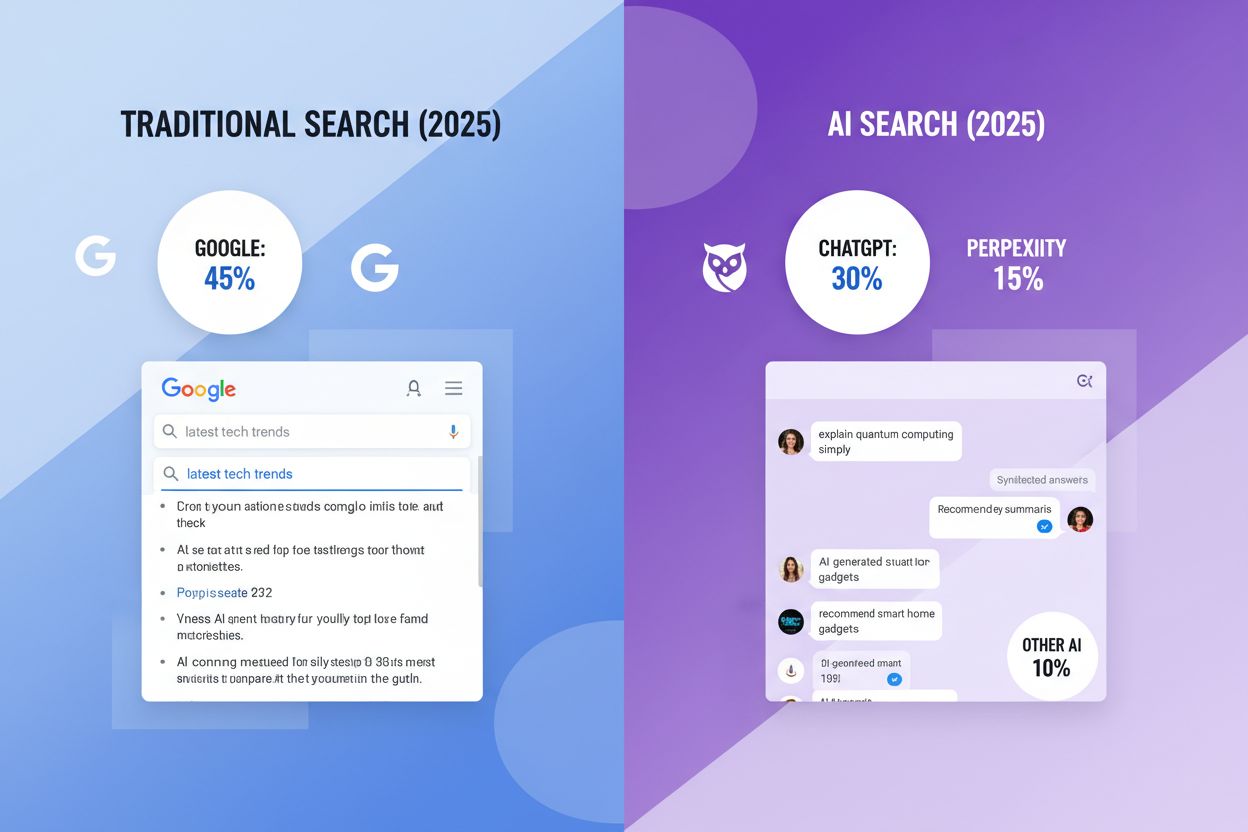

Despite the rapid rise of AI search, Google maintains approximately 90.83% of the overall search market share, though this figure masks significant shifts in how search is conducted within Google’s ecosystem. Bing captures 4.03% of traditional search, but its integration with ChatGPT through OpenAI’s partnership has created a powerful alternative for users seeking AI-powered results. ChatGPT has emerged as a dominant force in AI search, with millions of weekly active users treating it as their primary information discovery tool, while Claude, Perplexity, and other specialized AI search platforms continue to gain traction among specific user segments.

| Platform | Market Share | Key Characteristics |

|---|---|---|

| 90.83% | Traditional search dominance, AI Overviews integration | |

| Bing | 4.03% | Traditional search, ChatGPT integration |

| ChatGPT | Growing | 81% AI chatbot share, 800M weekly users |

| Perplexity | Growing | Research-focused, citation transparency |

| Claude | Growing | Specialized use cases, professional users |

| Gemini | Growing | Google’s AI assistant, 400M monthly users |

The market is experiencing significant fragmentation, with users now distributing their search queries across multiple platforms depending on their needs—Google for quick facts, ChatGPT for detailed explanations, Perplexity for research-focused queries, and specialized tools for industry-specific information. Microsoft’s integration of AI into Bing and the emergence of AI-native search engines have created a competitive landscape where traditional search dominance no longer guarantees market leadership. The data reveals that while Google’s overall market share remains substantial, its share of AI-powered search interactions is considerably lower, with users increasingly supplementing or replacing Google searches with dedicated AI tools. This bifurcation of the search market means that total search market share must now be understood as a composite of traditional search, AI search, and hybrid platforms offering both.

The adoption of AI search tools has accelerated dramatically, with ChatGPT reaching 200 million weekly active users and continuing to grow at rates that dwarf traditional search engine expansion. Younger demographics, particularly Gen Z and millennials, show strong preference for AI search, with studies indicating that 40-50% of users under 30 now regularly use AI search tools as their primary information source. Growth metrics reveal that AI search platforms are experiencing 30-40% month-over-month user growth in many cases, far exceeding the single-digit growth rates of traditional search engines. The appeal lies in conversational interfaces, personalized responses, and the ability to ask follow-up questions, features that traditional search engines have struggled to replicate effectively. Weekly active user statistics show that dedicated AI search platforms now collectively rival or exceed traditional search in certain demographics and use cases, particularly for research, learning, and complex problem-solving. The growth trajectory suggests that AI search adoption will continue accelerating through 2025 and beyond, driven by improved model capabilities, better integration with productivity tools, and increasing user comfort with AI-generated content. This rapid adoption is reshaping user expectations about what search should deliver, creating a generational divide in search behavior that will persist for years.

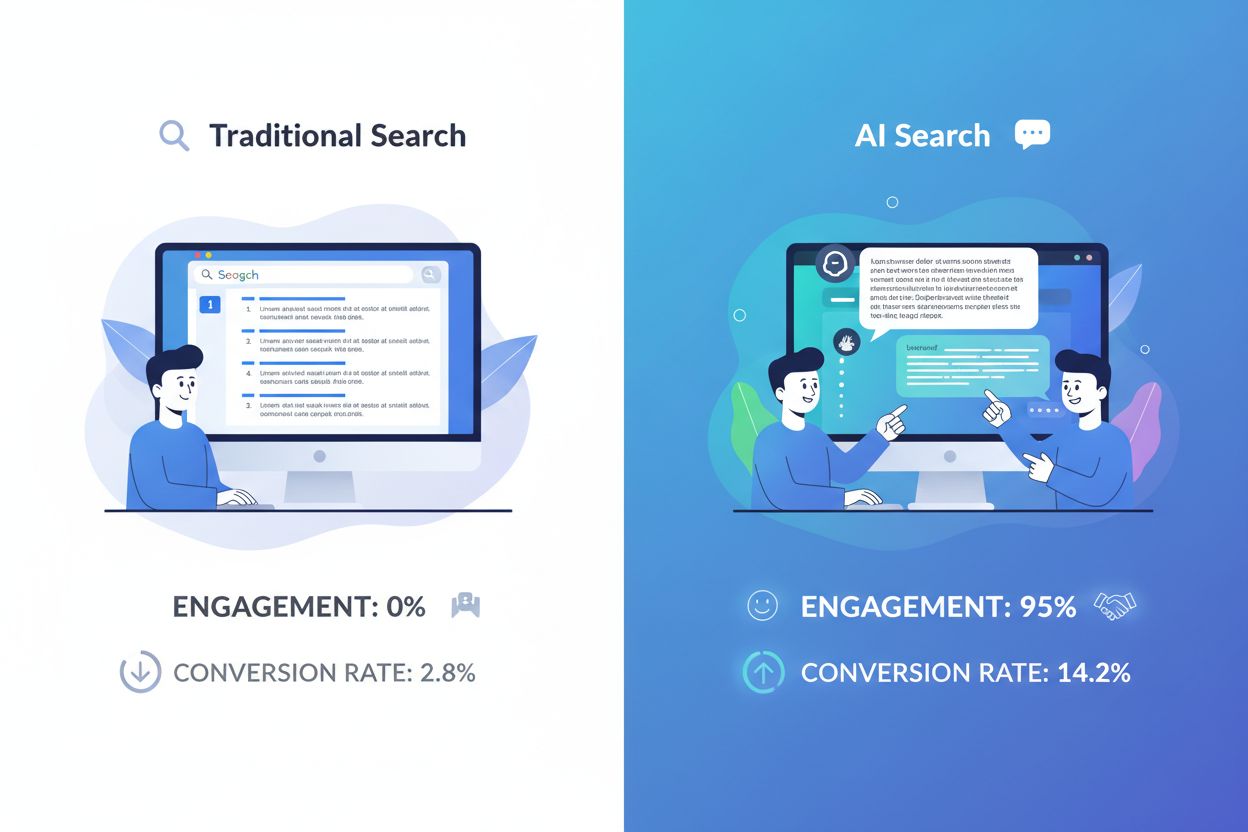

The rise of AI search has created the zero-click search phenomenon on steroids, where users receive comprehensive answers directly from AI platforms without ever visiting a website. Google’s AI Overviews feature has reduced click-through rates by 18-64% depending on query type, with some studies showing dramatic drops in traffic to traditional search results when AI summaries are displayed. This shift represents a fundamental threat to the traffic-dependent business models that have sustained content creators, publishers, and e-commerce sites for decades. Behavioral data shows that users are increasingly satisfied with AI-generated summaries, reducing their motivation to click through to source websites even when those sites contain more detailed or authoritative information. The impact extends beyond simple traffic reduction; conversion rates from AI search traffic differ significantly from traditional search, with users arriving through AI platforms showing different purchase intent and engagement patterns. Zero-click searches now account for a substantial portion of all searches, with some estimates suggesting that over 60% of searches result in no click to any website, a dramatic increase from pre-AI search levels. Publishers report significant traffic declines of 20-40% in categories where AI Overviews are most prevalent, forcing a fundamental reconsideration of content strategy and distribution channels.

While AI search presents challenges, it also creates significant business opportunities for organizations that understand how to leverage it effectively. Traffic from AI search platforms converts at 14.2% compared to 2.8% from traditional search, making AI-sourced visitors substantially more valuable despite lower volume. This higher conversion rate occurs because users who find information through AI search have already received context and validation, arriving at websites with higher purchase intent and clearer understanding of their needs.

Key opportunities in AI Search Market Share:

Budget allocation is shifting dramatically, with forward-thinking companies increasing investment in AI search visibility while maintaining traditional SEO efforts, recognizing that the future requires a hybrid approach. The commercial value of being cited by AI platforms far exceeds the value of ranking in traditional search results, as citations drive qualified traffic and establish authority in AI-generated responses. Early adopters who optimize for AI search visibility are capturing disproportionate market share and customer acquisition at lower costs than competitors relying solely on traditional search. Organizations that understand how to structure content for AI consumption, provide clear citations, and build authority in their domains are positioning themselves to thrive in the emerging search landscape. The opportunity window is significant but closing; companies that delay adaptation risk losing market position to competitors who have already optimized for AI search dominance.

The shift from ranking to citation creates new challenges for brands and publishers accustomed to traditional SEO metrics. Being ranked #1 in Google no longer guarantees visibility if your content isn’t selected and cited by AI platforms, creating a fundamental disconnect between traditional SEO success and AI search visibility. Citation patterns vary significantly across AI platforms, with some preferring established news sources and academic institutions while others favor comprehensive, well-structured content regardless of domain authority. The difference between ranking and being cited is crucial: a website can rank highly for a query but never appear in AI-generated responses if the platform’s algorithms determine other sources are more suitable for synthesis. AI platforms show clear preferences for sources with transparent authorship, clear expertise, and well-organized information architecture, making content structure and presentation increasingly important. Smaller publishers and niche experts face particular challenges, as AI systems often default to citing well-known brands and established sources even when smaller competitors have superior information. Understanding which sources your industry’s AI platforms prefer has become essential competitive intelligence, requiring monitoring and analysis that traditional SEO tools were never designed to provide.

Market forecasts suggest that AI search will capture 15-25% of total search market share by 2028, with some projections indicating a tipping point around 2029-2030 when AI search usage equals or exceeds traditional search in certain demographics and use cases. The future of search is not a replacement scenario but rather a hybrid model where users seamlessly switch between traditional search, AI search, and specialized tools depending on their specific information needs. Search engines will increasingly integrate AI capabilities directly, blurring the distinction between traditional and AI search as Google, Bing, and others embed generative features into their core products. The competitive landscape will consolidate around 3-5 major AI search platforms while numerous specialized tools serve specific verticals and use cases, similar to how the search market evolved in the 2000s. User behavior will continue fragmenting, with different demographics, professions, and use cases gravitating toward different platforms based on their specific strengths and integrations. The business implications are profound, requiring organizations to develop sophisticated strategies that address visibility across multiple search paradigms simultaneously. By 2030, companies that have successfully navigated the transition to AI search visibility will have significant competitive advantages, while those that ignored the shift will struggle with declining organic traffic and reduced market relevance.

Tracking AI search visibility requires fundamentally different approaches than traditional SEO monitoring, as traditional ranking tools provide no insight into whether your content is being cited by AI platforms. Key metrics for AI search monitoring include citation frequency, citation context, traffic from AI platforms, and conversion rates from AI-sourced visitors, none of which appear in standard SEO dashboards. AmICited.com has emerged as the leading solution for monitoring AI search visibility, providing detailed analytics on which AI platforms are citing your content, how frequently citations occur, and how your citation performance compares to competitors. The platform tracks citation patterns across major AI search engines including ChatGPT, Claude, Perplexity, and Google’s AI Overviews, offering insights that traditional SEO tools cannot provide. Monitoring AI search visibility is critical because it reveals whether your content strategy is effective in the new search landscape and identifies opportunities to improve citation rates. Organizations should establish baseline metrics for AI search visibility and track changes monthly, using this data to inform content strategy, technical optimization, and competitive positioning decisions. Without proper monitoring tools, companies are essentially flying blind regarding their performance in AI search, unable to measure the impact of optimization efforts or identify emerging threats from competitors gaining AI search dominance.

AI Search Market Share refers to the percentage of search queries and user engagement captured by AI-powered platforms like ChatGPT, Perplexity, and Claude compared to traditional search engines like Google. It measures the shift from traditional link-based search results to AI-generated summaries and conversational answers. This metric has become critical as AI search fundamentally changes how users discover information online.

As of 2025, AI search platforms collectively capture approximately 5-8% of global search activity, though this varies significantly by demographic and use case. ChatGPT dominates with 81% of the AI chatbot market share, while Google maintains approximately 90.83% of traditional search. However, these figures mask significant shifts in how search is conducted, with AI platforms growing at 30-40% monthly rates while traditional search grows at single-digit percentages.

AI Search Market Share matters because it directly impacts website visibility, traffic patterns, and the effectiveness of traditional SEO strategies. As AI platforms become primary information discovery tools for millions of users, businesses must optimize for AI search visibility in addition to traditional search rankings. Traffic from AI search converts at 14.2% compared to 2.8% from traditional search, making AI-sourced visitors significantly more valuable despite lower volume.

ChatGPT leads with 800 million weekly active users and 81% of the AI chatbot market share. Perplexity has grown to 22 million monthly active users with strong appeal to professionals and researchers. Claude, Gemini, and other platforms are also gaining traction in specific use cases. Microsoft's integration of AI into Bing and Google's AI Overviews represent traditional search engines' response to AI search competition.

AI Search Market Share requires a fundamental shift in SEO strategy from ranking optimization to citation optimization. Rather than focusing solely on ranking position, businesses must ensure their content is selected and cited by AI platforms. This requires clear expertise signals, well-structured content, transparent authorship, and strategic brand mentions. Traditional SEO remains important, but must be complemented by AI search optimization strategies.

Market forecasts suggest AI search will capture 15-25% of total search market share by 2028, with a tipping point around 2029-2030 when AI search usage equals or exceeds traditional search in certain demographics. The future involves a hybrid model where users switch between traditional search, AI search, and specialized tools based on their needs. Search engines will increasingly integrate AI capabilities, blurring the distinction between traditional and AI search.

Monitoring AI search visibility requires specialized tools designed for this purpose, as traditional SEO tools provide no insight into AI platform citations. AmICited.com is the leading platform for tracking how often your brand appears in ChatGPT, Perplexity, Claude, Google AI Overviews, and other AI search platforms. Key metrics include citation frequency, citation context, traffic from AI platforms, and conversion rates from AI-sourced visitors.

Ranking refers to your position in traditional search results (1st, 2nd, 3rd, etc.), while citation refers to your content being selected and referenced by AI platforms when generating answers. A website can rank #1 in Google but never appear in AI-generated responses if the platform's algorithms determine other sources are more suitable. Being cited by AI platforms is increasingly more valuable than ranking in traditional search, as it drives qualified traffic with higher conversion rates.

Track how often your brand appears in ChatGPT, Perplexity, Claude, and Google AI Overviews. Get real-time insights into your AI search market share and competitive positioning.

Learn what AI market share is, how to measure it across ChatGPT, Perplexity, Google AI Overviews, and other platforms, and why it matters for your brand's compe...

Discover critical AI search trends including ChatGPT dominance, Perplexity growth, Google AI Mode expansion, and zero-click optimization. Learn how to monitor y...

Compare paid AI advertising and organic optimization strategies. Learn costs, ROI, and best practices for visibility across ChatGPT, Perplexity, and Google AI O...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.