Data-Driven PR: Creating Research That AI Wants to Cite

Learn how to create original research and data-driven PR content that AI systems actively cite. Discover the 5 attributes of citation-worthy content and strateg...

Original research refers to primary data collection and studies conducted directly by an organization from its customers, audience, or market, combined with first-party data gathered through owned channels. This proprietary information serves as authoritative content that AI systems preferentially cite, providing competitive advantage in AI search visibility and brand authority.

Original research refers to primary data collection and studies conducted directly by an organization from its customers, audience, or market, combined with first-party data gathered through owned channels. This proprietary information serves as authoritative content that AI systems preferentially cite, providing competitive advantage in AI search visibility and brand authority.

Original research refers to primary data collection and studies conducted directly by an organization to generate new insights about their market, customers, industry trends, or competitive landscape. First-party data encompasses information collected directly from customer interactions on owned channels such as websites, mobile applications, CRM systems, email platforms, and point-of-sale systems. Together, these elements form proprietary assets that demonstrate organizational expertise and authority. Original research leverages first-party data as its foundation, transforming raw customer information into actionable insights, benchmarks, and industry-defining studies. In the context of AI search and content marketing, original research and first-party data have become critical differentiators because they provide verifiable, evidence-based information that AI systems preferentially cite when generating responses. Unlike secondary research that synthesizes existing information, original research creates entirely new knowledge that only the conducting organization can provide, making it invaluable for building brand authority in an increasingly AI-driven digital landscape.

The emergence of large language models and AI search systems has fundamentally transformed how authority and credibility are established in digital marketing. Research from Averi and multiple independent analyses reveals that content featuring original statistics and research findings sees 30-40% higher visibility in LLM responses compared to general commentary or secondary content. This represents a seismic shift from traditional SEO, where keyword optimization and backlink quantity dominated ranking factors. In the new AI-driven landscape, citation-worthiness has become more valuable than click-through rates. When AI systems encounter content with specific metrics, concrete data points, and verifiable claims, they preferentially cite these sources over general observations because such evidence-based content reduces hallucination risk and improves response quality. According to research analyzing over 10,000 real-world search queries, LLMs consistently favor original research and statistical findings, peer-reviewed studies, comprehensive documentation with clear methodology, expert commentary with verifiable credentials, and user discussions with detailed implementation specifics. This preference creates a competitive advantage for organizations that invest in original research: they become recognized authorities whose insights shape industry conversations and drive compounding visibility as other sources cite their findings.

First-party data collection forms the foundation upon which credible original research is built. Organizations gather first-party data through multiple channels and touchpoints, each providing unique insights into customer behavior, preferences, and outcomes. Website analytics and user behavior tracking reveal how customers interact with digital properties, including page views, time spent, feature usage, and conversion paths. Customer relationship management systems store comprehensive interaction histories, purchase records, communication preferences, and support interactions. Email marketing platforms capture engagement metrics including open rates, click-through rates, and subscription preferences. Transaction data provides purchase history, order frequency, average order value, and product preferences. Customer feedback through surveys, reviews, and support interactions offers qualitative insights into satisfaction, pain points, and desired improvements. Product usage analytics reveal which features drive value, where users encounter friction, and how different customer segments utilize offerings. This multi-source first-party data collection creates rich datasets that support original research initiatives. According to Deloitte research, 73% of respondents believe that using first-party data would mitigate the impact of rising privacy awareness, making it both strategically valuable and increasingly essential as privacy regulations tighten globally. The most sophisticated organizations implement unified customer data platforms that consolidate first-party data from disparate sources, creating single customer views that enable more comprehensive and accurate original research.

| Aspect | Original Research | Secondary Research | First-party Data | Third-party Data |

|---|---|---|---|---|

| Data Source | Directly conducted by organization | Existing studies and publications | Customer interactions on owned channels | External data brokers and aggregators |

| Collection Method | Surveys, interviews, experiments, analysis | Literature review, data synthesis | Website tracking, CRM, email, transactions | Purchased or licensed from providers |

| Accuracy & Reliability | High - directly verified | Variable - depends on original source | High - from engaged customers | Lower - collected indirectly |

| Uniqueness | Proprietary and exclusive | Publicly available | Proprietary to organization | Available to competitors |

| AI Citation Preference | Very High (30-40% higher visibility) | Medium - depends on authority | High - supports original research | Low - less authoritative |

| Privacy Compliance | Requires explicit consent | N/A | Requires consent and compliance | Often raises privacy concerns |

| Cost & Resources | High initial investment | Low - uses existing sources | Medium - requires infrastructure | Low - purchased access |

| Time to Insight | Months to years | Weeks to months | Ongoing - real-time data | Immediate - pre-collected |

| Competitive Advantage | Significant - competitors cannot replicate | Minimal - widely available | Significant - exclusive to brand | Minimal - available to all |

| Content Multiplier Effect | Exceptional - fuels months of content | Limited - single use | High - supports multiple initiatives | Low - generic insights |

Implementing effective first-party data collection requires both technological infrastructure and strategic planning. Organizations must establish universal tracking plans that define what data to collect, why it matters, and where it will be tracked across all customer touchpoints. This involves implementing analytics platforms like Google Analytics 4, Piwik PRO, or Mixpanel to capture website and app behavior; deploying customer data platforms such as Segment, Tealium, or Twilio Segment to unify data from multiple sources; integrating CRM systems like Salesforce or HubSpot to centralize customer interaction data; and establishing consent management systems to ensure GDPR, CCPA, and other regulatory compliance. According to a 2024 Salesforce study, the top methods marketers use to collect first-party data include customer service data, mobile apps, transaction data, web registration or account creation, loyalty programs, subscriptions, online learning platforms, and providing discounts on products or services. The technical implementation must prioritize data quality through validation rules, deduplication processes, and regular audits. Organizations should also implement proper security controls including encryption at rest and in transit, role-based access controls, single sign-on and multi-factor authentication, and regular security assessments. The most mature organizations establish data governance frameworks that define data ownership, quality standards, retention policies, and usage guidelines, ensuring that first-party data remains accurate, compliant, and actionable for original research initiatives.

Original research serves as a powerful authority-building mechanism that differentiates brands in crowded markets and establishes thought leadership. When organizations publish proprietary research, benchmarks, or industry studies, they transition from echoing others’ insights to shaping industry conversations themselves. This shift in positioning attracts media coverage, speaking opportunities, strategic partnerships, and customer trust. Research from Kalungi demonstrates that brands publishing annual benchmark reports or industry studies build compounding authority over time. For example, Navattic and Chili Piper’s annual B2B Buyer First Report has become an industry reference that shapes how B2B SaaS companies evaluate their practices. Similarly, Dreamdata’s LinkedIn Ads Benchmarks Report and Navattic’s State of the Interactive Product Demo serve as industry references that continue driving traffic, mentions, and authority long after initial publication. The authority-building effect compounds because each citation of the research strengthens the brand’s positioning as an expert source. According to research on brand authority in AI search, brand search volume has the strongest correlation with AI chatbot mentions, with a correlation coefficient of 0.334 to 0.392 depending on the study. This means that as original research increases brand awareness and search volume, it simultaneously increases visibility in AI-generated responses. Organizations that consistently publish original research report significant improvements in organic traffic, lead generation, media mentions, and competitive positioning within their industries.

One of the most underestimated aspects of original research is its content multiplier effect. A single research report or benchmark study can fuel months of marketing activities across multiple channels and formats. From one strategic research asset, organizations can create webinars discussing results with customers and industry experts; social media content with data visualizations that drive engagement and shares; video series unpacking key findings for YouTube, paid ads, and social distribution; event presentation decks where teams present at conferences, opening doors to speaking opportunities; SEO blog posts that continue ranking and driving organic traffic as others cite the data; lead magnets and email sequences built around findings that convert because people want insights unavailable elsewhere; sales one-pagers with benchmarks that serve as conversation starters; and PR pitches with newsworthy angles that journalists actively want to cover. This content ecosystem transforms a single research investment into dozens of marketing assets that work together to build authority and drive business results. According to Content Marketing Institute research, 43% of B2B marketers prioritize original research as a core content strategy component, recognizing its outsized impact on marketing effectiveness. Organizations that implement this multiplier approach report significantly higher ROI on research investments compared to those treating research as a standalone content asset. The research becomes a reference point that competitors and industry publications cite, creating compounding visibility benefits that extend far beyond the initial publication date.

For original research to achieve maximum visibility in AI systems and earn citations from authoritative sources, it must demonstrate specific characteristics that signal credibility and value. Thorough research with verifiable data points forms the foundation—content featuring original statistics and research findings sees 30-40% higher visibility in LLM responses because AI systems are designed to provide evidence-based answers. Citation-worthy research includes original surveys with specific sample sizes and methodologies, industry benchmarks with clear measurement criteria, performance studies with concrete before-and-after metrics, competitive analysis with quantified comparisons, and case studies with detailed implementation data. Clear structure that enables AI parsing is equally important, as LLMs favor content with consistent heading levels and clear formatting that makes structure as important as substance. Structural elements that enhance citation potential include hierarchical headings with descriptive titles, bullet points and numbered lists for easy extraction, definition statements that clearly explain concepts, summary sections that distill key insights, and FAQ formats that directly answer common questions. Research from Amsive Digital found that content with consistent heading levels was 40% more likely to be cited by ChatGPT, with bullet lists and short paragraphs significantly improving extraction rates. Authoritative voice with expert credentials demonstrates genuine expertise through industry-specific terminology used correctly, references to established frameworks and methodologies, insights reflecting deep practical experience, analysis going beyond surface-level observations, and perspectives adding new understanding to existing knowledge. Finally, unique perspectives that fill knowledge gaps create content that others reference because it provides information, analysis, or perspective unavailable from other sources, particularly when introducing new technologies, methodologies, or market developments.

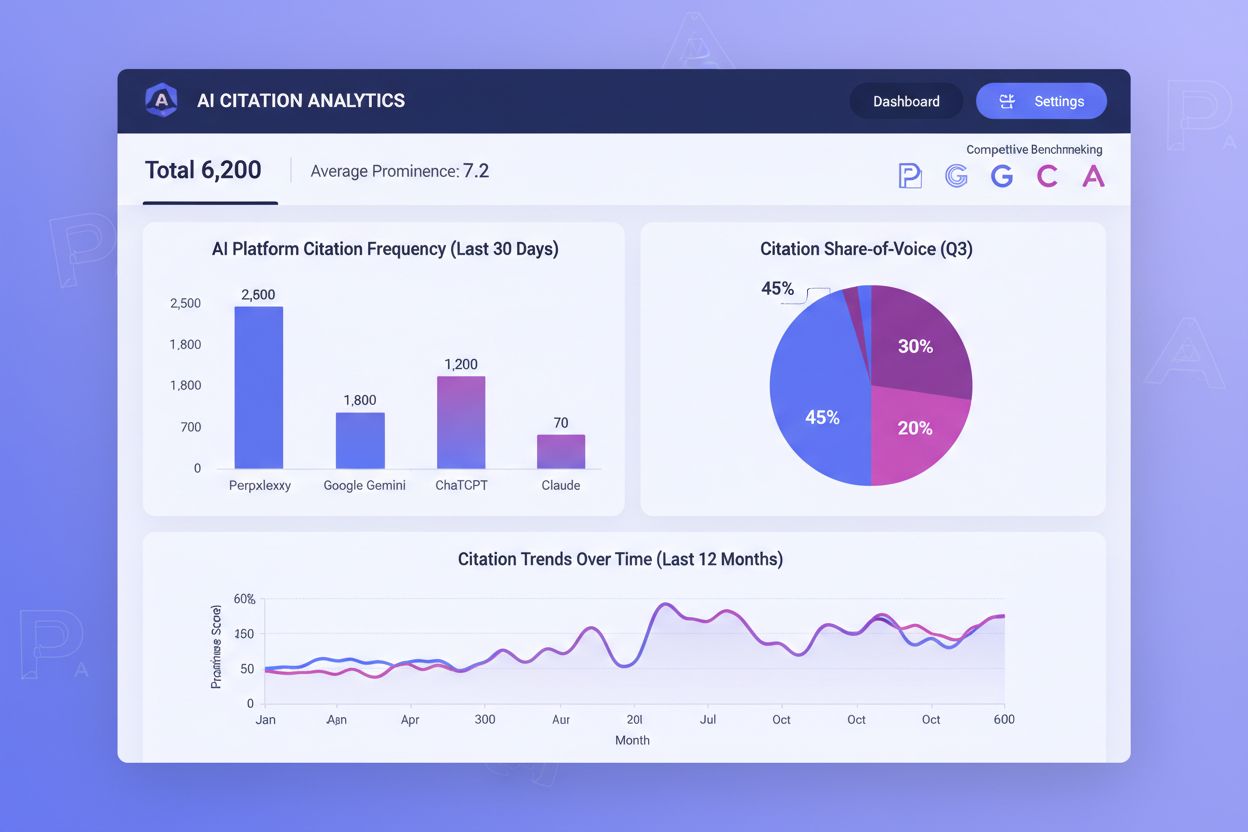

Successful original research requires ongoing measurement and optimization based on performance data and evolving AI preferences. Organizations should implement LLM citation tracking across multiple platforms including ChatGPT, Claude, Perplexity, and Google’s AI Overviews to monitor where their research appears in AI-generated responses. Manual monitoring techniques include regular queries across multiple LLMs, brand mention tracking in AI-generated responses, competitor citation analysis to identify opportunities, and topic coverage assessment for content gaps. Several platforms now offer automated LLM citation monitoring, including Profound, Semrush’s LLM tracking features, and specialized tools like AnswerLens for specific industries. Content freshness and accuracy maintenance are crucial for sustained citation relevance, as LLMs prioritize current, accurate information. Organizations should conduct quarterly reviews of statistical claims and data points, annual refreshes of case studies and examples, immediate updates when industry standards change, addition of new research and developments, and regular fact-checking and accuracy verification. Performance optimization based on citation patterns involves tracking which content types, topics, and formats achieve the highest citation rates, then optimizing content strategy accordingly. Key metrics to monitor include citation frequency across different LLM platforms, context accuracy in AI-generated responses, brand sentiment in LLM mentions, topic coverage compared to competitors, and co-citation patterns with other authorities. Organizations that implement systematic measurement and optimization report continuous improvements in citation rates and AI visibility over time.

The role of original research and first-party data in marketing strategy will continue evolving as AI systems become more sophisticated and prevalent. Increased AI integration across all search and discovery platforms will make citation visibility essential for brand awareness and lead generation, with LLM traffic projected to overtake traditional search by 2027 according to Backlinko research. Quality over quantity emphasis will reward deep expertise and authoritative positioning over high-volume content production, as AI systems become better at distinguishing genuine expertise from superficial coverage. Cross-platform authority will become increasingly important as different LLMs prioritize different source types and authority signals, requiring organizations to build presence across multiple authoritative platforms simultaneously. Real-time accuracy demands will require more sophisticated content maintenance and fact-checking processes, as AI systems increasingly penalize outdated or inaccurate information. Collaborative content creation will become more valuable as LLMs increasingly favor content demonstrating multi-source validation and expert consensus, encouraging organizations to partner with complementary experts and industry authorities. Organizations that master original research and first-party data strategies now will establish sustainable competitive advantages as AI-driven discovery becomes the primary way people find and evaluate brands, products, and services. The brands that thrive will be those that recognize original research not as a marketing tactic but as essential infrastructure for building authority, trust, and visibility in an AI-dominated digital landscape.

Original research refers to new studies, surveys, and investigations conducted by an organization to gather insights about their market, customers, or industry. First-party data is information collected directly from customer interactions on owned channels like websites, apps, and CRM systems. Together, they form proprietary assets that demonstrate expertise and authority. Original research often utilizes first-party data as its foundation, creating a comprehensive knowledge base that AI systems recognize as authoritative.

AI systems like ChatGPT, Claude, and Perplexity prioritize content with verifiable statistics, concrete data points, and original insights because these elements provide evidence-based answers to user queries. Research shows that content featuring original statistics sees 30-40% higher visibility in LLM responses. When AI encounters proprietary data and research findings, it recognizes these as authoritative sources that reduce hallucination risk and improve response quality, making them preferred citation sources over general commentary.

Original research directly signals brand authority to both search engines and AI systems by demonstrating expertise, market knowledge, and thought leadership. Brands publishing proprietary research reports, benchmarks, and studies become recognized authorities in their niches. This authority compounds over time as other sources cite the research, creating co-citation networks that further strengthen brand positioning. Studies show that brands with strong original research programs achieve significantly higher citation rates in AI-generated responses compared to competitors relying solely on secondary content.

Organizations should collect diverse first-party data including website analytics and user behavior, customer transaction history and purchase patterns, CRM interaction data and customer feedback, email engagement metrics, survey responses and preference data, product usage analytics, and customer support interactions. This multi-source data collection creates comprehensive datasets that support original research initiatives. The most valuable first-party data combines quantitative metrics with qualitative insights, enabling organizations to produce research that addresses both 'what' customers do and 'why' they do it.

Brands can measure original research ROI through multiple metrics including citation frequency across AI platforms, organic traffic growth to research-related content, lead generation from gated research assets, media mentions and PR coverage generated, speaking opportunities and thought leadership invitations, and brand search volume increases. Additionally, tracking co-citation patterns with industry authorities and monitoring competitive positioning in AI responses provides qualitative ROI indicators. Many organizations report that a single research report generates months of content assets, webinars, social content, and sales materials, multiplying the initial research investment across multiple channels.

Organizations must obtain explicit user consent before collecting first-party data, comply with regulations like GDPR, CCPA, and other regional privacy laws, implement proper data security and encryption measures, maintain transparent privacy policies explaining data usage, and provide users with data access and deletion rights. First-party data collection is inherently more privacy-compliant than third-party data because it comes directly from consenting users. However, organizations must still implement consent management systems, data governance frameworks, and regular compliance audits to ensure ethical and legal data handling practices.

Original research serves as a content multiplier that fuels months of marketing activities from a single research asset. One research report can generate webinars, social media content, video series, event presentations, SEO blog posts, email sequences, sales materials, and PR pitches. This content ecosystem drives organic traffic, builds backlinks, generates leads, and establishes brand authority. Organizations that publish original research consistently report higher engagement rates, improved search rankings, increased media coverage, and stronger competitive positioning. The research becomes a reference point that competitors and industry publications cite, creating compounding visibility benefits.

Start tracking how AI chatbots mention your brand across ChatGPT, Perplexity, and other platforms. Get actionable insights to improve your AI presence.

Learn how to create original research and data-driven PR content that AI systems actively cite. Discover the 5 attributes of citation-worthy content and strateg...

Learn how to create original data and research that AI systems actively cite. Discover strategies for making your data discoverable to ChatGPT, Perplexity, Goog...

Discover why creating original research is critical for AI visibility. Learn how original research helps your brand get cited in AI-generated answers and improv...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.