AI ROI Calculation

Learn how to calculate AI ROI effectively. Understand hard vs soft ROI, measurement frameworks, common mistakes, and real-world case studies showing 270%+ retur...

AI ROI refers to the net value or benefit an organization gains from its investment in artificial intelligence, measured by comparing returns such as cost savings, revenue growth, and productivity improvements against the total costs of AI implementation, infrastructure, and resources. It encompasses both tangible financial gains and intangible benefits like improved decision-making and employee satisfaction.

AI ROI refers to the net value or benefit an organization gains from its investment in artificial intelligence, measured by comparing returns such as cost savings, revenue growth, and productivity improvements against the total costs of AI implementation, infrastructure, and resources. It encompasses both tangible financial gains and intangible benefits like improved decision-making and employee satisfaction.

AI ROI (Return on AI Optimization Investment) is the net value or benefit an organization gains from its investment in artificial intelligence, calculated by comparing the returns generated—such as cost savings, revenue growth, productivity improvements, and operational efficiencies—against the total costs of AI implementation, infrastructure, personnel, and resources. Unlike traditional ROI calculations that focus solely on financial metrics, AI ROI encompasses both hard returns (tangible financial gains) and soft returns (intangible benefits like improved decision-making, employee satisfaction, and customer experience). The concept has become increasingly critical as organizations worldwide invest billions in AI technologies, yet struggle to demonstrate measurable returns. According to the IBM Institute for Business Value, enterprise-wide AI initiatives achieved only 5.9% ROI in 2023, despite representing 10% of capital investments, highlighting the widespread challenge of translating AI spending into demonstrable business value. Understanding and measuring AI ROI is essential for justifying continued investment, prioritizing high-value use cases, and ensuring that AI initiatives align with broader organizational objectives.

The concept of AI ROI has evolved significantly since the early days of artificial intelligence adoption. Initially, organizations approached AI ROI similarly to traditional technology investments, focusing primarily on cost reduction and labor savings. However, as AI applications became more sophisticated and pervasive—particularly with the emergence of generative AI and machine learning systems—the limitations of traditional ROI frameworks became apparent. The challenge intensified because AI’s benefits often extend beyond immediate financial metrics to include strategic advantages, competitive differentiation, and long-term capability building. According to Deloitte’s research on generative AI in the enterprise, the paradox of rising investment and elusive returns has become a defining characteristic of the AI landscape. Companies are spending record amounts on AI—with $37 billion invested in generative AI in 2025, up from $11.5 billion in 2024 (a 3.2x year-over-year increase)—yet only a small percentage report achieving significant positive returns. This disconnect has forced organizations to rethink how they measure and communicate AI value. The evolution of AI ROI measurement reflects a broader maturation in how enterprises approach technology investments, moving from simple payback period calculations to comprehensive frameworks that account for uncertainty, intangible benefits, and long-term strategic value creation.

Hard ROI represents the most straightforward measure of AI investment returns, focusing on quantifiable financial gains that directly impact organizational profitability and operational efficiency. These include labor cost reductions achieved through automation of repetitive tasks, operational efficiency gains from streamlined workflows and reduced resource consumption, increased revenue from enhanced customer experiences and personalization, and time savings that translate into measurable productivity improvements. For example, an AI system that automates invoice processing might save hundreds of employee hours annually, directly reducing labor costs. According to research, many firms report AI tools freeing five hours of employee work each week, which can be aggregated into meaningful cost reductions or redeployed to higher-value activities. Hard ROI metrics are easier to quantify and communicate to stakeholders, making them particularly valuable for securing executive buy-in and continued funding.

Soft ROI, by contrast, captures the intangible benefits that are more challenging to monetize but equally important for long-term organizational success. These include improved decision-making quality through AI-powered analytics that uncover patterns humans might miss, enhanced customer experience through personalization and responsive interactions, employee satisfaction and retention when AI augments rather than replaces human work, and competitive differentiation that creates strategic advantages. A May 2025 study revealed that sales teams expect net promoter scores (NPS) to increase from 16% in 2024 to 51% by 2026, chiefly due to AI initiatives—a significant soft ROI indicator. While soft ROI metrics are harder to assign dollar values to, they are critical for sustained business performance. Organizations that acknowledge and measure both hard and soft ROI create a more complete picture of AI’s true value, avoiding the trap of undervaluing initiatives that deliver strategic benefits without immediate financial returns.

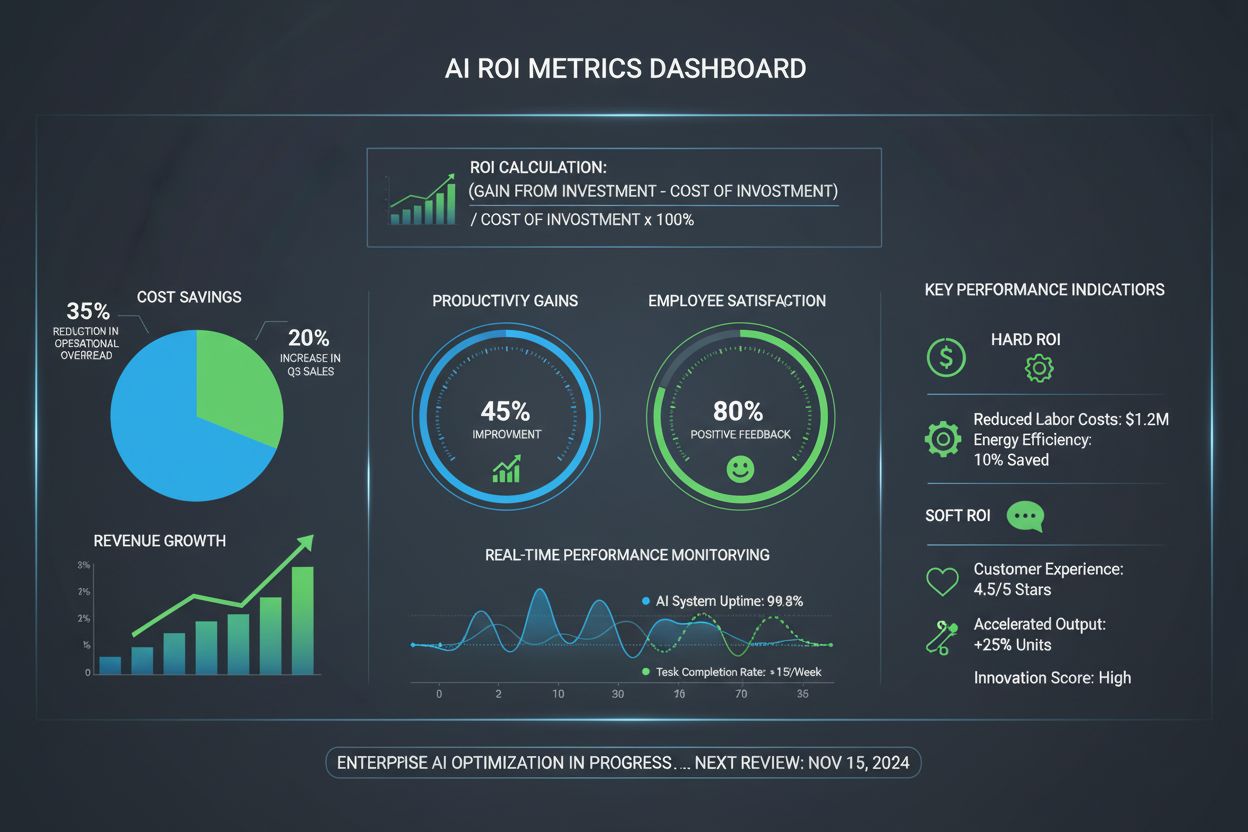

Effective AI ROI measurement requires establishing a comprehensive set of key performance indicators (KPIs) that align with organizational objectives and capture both financial and non-financial dimensions of value. According to research, 72% of enterprises are formally measuring Gen AI ROI, focusing primarily on productivity gains and incremental profit. The most successful organizations use a balanced scorecard approach rather than relying on a single metric.

Hard ROI KPIs include:

Soft ROI KPIs include:

According to McKinsey research, 39% of survey respondents attributed some level of improvement to earnings before income and taxes (EBIT) to AI, though most reported less than 5% of organizational EBIT attributable to AI use. However, respondents also reported qualitative improvements: a majority said AI improved innovation, and nearly half reported improvement in customer satisfaction and competitive differentiation.

| Measurement Approach | Focus Area | Timeframe | Complexity | Best For |

|---|---|---|---|---|

| Traditional ROI | Hard financial returns only | Short-term (6-12 months) | Low | Quick-win efficiency projects |

| Comprehensive ROI | Hard + soft returns combined | Medium-term (1-3 years) | High | Strategic AI initiatives |

| Portfolio ROI | Multiple projects evaluated together | Long-term (3-5 years) | Very High | Enterprise-wide AI transformation |

| Non-Traditional ROI | Strategic value and competitive advantage | Long-term (3-5+ years) | Very High | Disruptive or innovative AI projects |

| Hybrid ROI | Mix of monetary and non-monetary metrics | Variable (6 months to 5 years) | Medium-High | Diverse AI use case portfolios |

| Real-Time ROI Tracking | Continuous performance monitoring | Ongoing | High | Production AI systems requiring optimization |

Calculating AI ROI requires a structured approach that begins during the ideation phase and continues through deployment and ongoing optimization. According to Slalom Consulting’s framework, organizations should follow a systematic process: Understand the comprehensive costs and benefits of the initiative, Define the ROI measurement approach with clear units of measurement, Align the ROI approach across the portfolio to business KPIs, and Visualize ROI calculations on dashboards to facilitate decision-making.

The calculation itself follows a fundamental formula: ROI = (Net Benefit / Total Investment) × 100. However, the complexity lies in accurately estimating both components. Total investment includes not only direct hard costs (software licenses, hardware, personnel salaries) but also soft costs often underestimated by organizations: data investments (acquisition, cleaning, labeling), compute and storage investments (which can escalate dramatically with deep learning models), subject matter expert (SME) time required at all project phases, and training investments for data science teams and end users. Organizations frequently underestimate these soft costs, leading to inaccurate ROI projections.

Net benefit calculation is equally complex because it must account for uncertainty and risk. For example, if an AI system predicts customer complaint severity with 85% accuracy (versus 100% human accuracy), the calculation must factor in the cost of errors and their business impact. This requires establishing baseline human performance metrics and understanding the real-world consequences of AI mistakes. Additionally, organizations must account for the time value of money—benefits accruing in future years are worth less than immediate returns—and the decay of AI model performance over time as data distributions shift and models become outdated.

Leading organizations implement real-time ROI tracking systems that continuously monitor AI system performance against projected returns. These systems integrate with AI monitoring platforms that track model accuracy, user adoption rates, cost metrics, and revenue impact. According to research on real-time AI ROI tracking, organizations that monitor performance continuously can identify underperforming systems early and make adjustments before significant value is lost. This is particularly important because machine learning models frequently deteriorate in performance over time, requiring ongoing maintenance and retraining to preserve ROI.

The strategic importance of AI ROI measurement extends far beyond simple financial accounting. Leadership buy-in depends critically on demonstrating hard numerical data showing how AI contributes to business goals. When presented with strong business cases backed by ROI projections and real-world results, leaders and stakeholders are significantly more likely to approve continued investment and expansion of AI initiatives. According to research, organizations with a detailed AI adoption roadmap were almost four times more likely to experience revenue growth from AI compared to those without a plan.

Investment prioritization is another critical benefit of rigorous ROI measurement. The use cases for generative AI are numerous, but not all deliver equal value to every organization. An ROI analysis, especially using real-world case studies, reveals which AI implementations have the potential to deliver the most value relative to costs. This allows organizations to allocate limited resources to high-impact projects rather than pursuing every AI opportunity. According to IBM research, product development teams that followed the top four AI best practices to an “extremely significant” extent reported a median ROI on generative AI of 55%—substantially higher than the enterprise average of 5.9%.

Change management benefits from ROI measurement because employees often resist AI initiatives due to concerns about job loss or AI output quality. However, ROI analysis that includes soft metrics like employee productivity, job satisfaction, and retention can assuage workplace worries. When employees see concrete evidence that AI augments their work rather than replacing them, and that the organization is measuring success through improved satisfaction metrics, adoption rates increase dramatically. This cultural shift is essential because even the most sophisticated AI system delivers no value if end users don’t adopt it.

Long-term success depends on aligning AI investments with long-term business goals rather than pursuing short-term wins. Organizations that conduct comprehensive ROI analyses form the backbone of a roadmap to ongoing success with emerging AI technologies. This alignment ensures that AI spending contributes to strategic objectives like market expansion, product innovation, or operational excellence, rather than becoming a collection of disconnected experiments.

Despite the enormous potential of AI, organizations face significant obstacles in achieving positive ROI. Intangible benefits present a fundamental challenge because many AI improvements—better customer engagement, improved employee satisfaction, stronger vendor relationships—are difficult to quantify. Early AI projects frequently deliver improvements without showing results on traditional financial metrics, making it harder to declare ROI success. Organizations that focus only on short-term tangible gains may overlook these intangible benefits, even though they create substantial long-term value.

Data quality and infrastructure issues represent perhaps the most significant barrier to AI ROI. According to research, one in four organizations cite inadequate infrastructure and data as a primary barrier to achieving AI ROI. Fragmented systems and siloed data make it challenging to conduct ROI measurement, particularly the before-and-after impact of AI deployments. Executives often overestimate their data maturity, investing in sophisticated AI models before fixing core data quality and infrastructure gaps. When AI models are trained on incomplete or inconsistent data, their outputs are less useful, undermining potential ROI. Siloed data also means that AI solutions might not receive all necessary information, or the insights they produce don’t reach the right business units.

Technology evolution outpacing metrics creates another challenge. The AI field moves rapidly, with new tools and capabilities emerging regularly. This pace outstrips organizations’ ability to measure effect. Leaders describe how hype and pressure lead to premature investments in the “next big AI” before there’s a clear way to evaluate its success. Traditional metrics often lag behind because they weren’t designed for AI-driven processes. For example, how do you quantify the value of an AI assistant improving employee decision-making? Companies sometimes find themselves with advanced AI capabilities but no agreed-upon KPIs to gauge their contribution.

Human factors and adoption challenges significantly impact AI ROI realization. New AI systems face cultural resistance or low adoption if not managed well. Employees might mistrust AI recommendations or fear that automation threatens their jobs. If an AI tool is not fully adopted by its intended users, expected efficiency or revenue gains won’t materialize. Deloitte’s research highlights that successful AI outcomes depend on how effectively people integrate these tools into workflows. Training staff and managing change are essential. Organizations that neglect the human side by failing to address concerns or provide adequate training often see their AI projects stall, delivering little ROI.

Entanglement with broader transformation makes it difficult to isolate AI’s contribution. AI initiatives are often rolled out alongside other big changes, such as moving to the cloud, reorganizing teams, or implementing new operating models. This entanglement makes it hard to isolate AI’s contribution. If a bank implements an AI fraud detection system at the same time as overhauling its IT infrastructure, any reduction in fraud losses might be due to a mix of both efforts. Executives report difficulty in parsing out what portion of gains to attribute to the AI system itself. This challenge is especially true for advanced “agentic AI” systems that automate end-to-end processes because they require extensive process re-engineering.

Strategic alignment is the foundation of AI ROI optimization. High-ROI organizations treat AI as a strategic, enterprise-wide initiative rather than a series of ad hoc tech experiments. AI projects should be chosen and designed in alignment with the company’s core goals and pain points. By focusing on projects that drive revenue growth, cost efficiency, or competitive differentiation, firms use AI to target meaningful outcomes. According to Deloitte, AI ROI leaders are significantly more likely to define their most critical AI wins in strategic terms: 50% cite “creation of revenue growth opportunities” and 43% cite “business model reimagination.” This means when brainstorming AI applications, organizations should ask how it could open new markets, create new products, or improve the value proposition. Additionally, making AI part of the corporate strategy and leadership agenda is essential. In many leading companies, AI isn’t relegated to an R&D lab; it’s championed by the C-suite and even owned by the CEO or a chief AI officer as a strategic program.

Data quality and infrastructure investment is non-negotiable for AI ROI success. Successful organizations tackle data readiness head-on by breaking down data silos, improving data quality, and investing in robust data infrastructure to handle AI workloads. Leading AI adopters often update their data stack, such as adopting real-time databases or scalable cloud data platforms, so their AI models always have access to fresh, relevant data. They also implement strong data governance: clean, consistent data input leads to reliable model outputs. There’s a performance element too. AI, especially real-time or deep learning applications, is computationally intensive. Organizations that see high ROI frequently use high-performance data solutions to support AI systems. Each millisecond of latency or bottleneck in data delivery degrades an AI system’s effectiveness. For example, a fraud detection model needs to scan transactions in less than 100 milliseconds to be effective. By contrast, if data retrieval is slow or the system can’t scale to production volumes, the project won’t deliver promised value regardless of the AI model’s quality.

Cultural adoption and learning make or break AI ROI. Organizations that succeed treat change management and education as integral to their AI strategy. This starts with leadership setting a tone: leaders should communicate a vision where AI is a tool to augment employees, not replace them. Many AI ROI leaders invest in training their workforce. According to research, 40% of AI ROI leaders mandate AI training for employees to build AI fluency across the board. Training staff helps employees understand how to use AI tools effectively and creatively in their jobs. It’s also important to address employee concerns. Transparent discussions about how AI will affect roles and involving users in AI implementation help reduce resistance. Some firms create AI champions or centers of excellence that disseminate best practices and support teams in adopting AI solutions.

Broadened ROI measurement frameworks recognize that different AI projects require different evaluation approaches. Rather than applying a one-size-fits-all ROI formula, leading organizations develop nuanced KPIs and timeframes appropriate to different AI projects. For example, a generative AI project aimed at improving product design speed might be measured on time-to-market for new designs or the innovation rate, rather than immediate revenue. AI ROI leaders explicitly use different evaluation frameworks for different types of AI, such as short-term metrics for efficiency projects and longer-term ones for transformative projects. To improve ROI, it’s important to set the right expectations. Some AI projects might intentionally prioritize learning and capability-building with payback expected in a couple of years. Companies that do well often identify interim metrics that indicate progress, such as model accuracy, user adoption rates, or customer satisfaction scores, as proxies for eventual ROI.

Sustained strategic investment is essential for achieving meaningful AI ROI. Many organizations that see strong returns are those that did not dabble timidly in AI, but went in big with resources and patience. According to research, 95% of top AI performers allocate more than 10% of their technology budget to AI. Moreover, they are more likely than other respondents to have significantly increased their AI spending in the past 12 months and are more likely to plan to do so again in the next 12 months. This level of investment gives AI initiatives the necessary talent, technology, and R&D to reach maturity. These companies also differentiate their investment approach. They might use external AI tools for quick wins but simultaneously build in-house capabilities for core strategic areas. This way, they balance immediate ROI with building long-term proprietary advantages. Patience is part of this strategy. Leaders understand that ROI, especially from ambitious AI projects, may take multiple years. Many survey respondents expected significant returns only after three to five years for AI projects such as autonomous systems. During this time, sustained support is important.

The definition and measurement of AI ROI is evolving rapidly as organizations gain experience and as AI technologies become more sophisticated and integrated into business operations. Agentic AI systems—autonomous agents that can perform complex, multi-step tasks with minimal human intervention—are emerging as a new frontier for AI ROI measurement. These systems require extensive process re-engineering and organizational change, making traditional ROI calculations even more complex. However, early indicators suggest that agentic AI could deliver substantially higher ROI than current generative AI applications, as they automate entire workflows rather than individual tasks.

Real-time ROI tracking and optimization is becoming increasingly important as organizations deploy more AI systems in production environments. Rather than calculating ROI retrospectively, leading organizations are implementing continuous monitoring systems that track AI performance against projected returns in real-time. This enables rapid identification of underperforming systems and dynamic reallocation of resources to higher-value initiatives. As AI monitoring platforms become more sophisticated, organizations will have unprecedented visibility into how their AI investments are performing and contributing to business objectives.

Integration with AI citation and brand monitoring represents an emerging dimension of AI ROI measurement. As AI systems like ChatGPT, Perplexity, Google AI Overviews, and Claude become primary information sources for users, organizations are beginning to measure ROI not just through internal metrics but through their visibility and citation in AI-generated responses. This creates a new category of AI ROI: brand and content visibility ROI, which measures how effectively an organization’s content, products, and services are being referenced and recommended by AI systems. This metric becomes increasingly important as AI systems influence consumer decisions and shape market perception.

Standardization of AI ROI frameworks is likely to accelerate as industry bodies and consulting firms develop best practices and benchmarks. Organizations will increasingly compare their AI ROI against industry standards and peer performance, driving convergence around common metrics and measurement approaches. This standardization will make it easier for organizations to benchmark their AI investments and identify areas for improvement.

Regulatory and governance considerations will increasingly influence how organizations measure and report AI ROI. As governments implement AI governance frameworks and regulations, organizations will need to account for compliance costs and risk mitigation benefits in their ROI calculations. This will likely lead to more comprehensive ROI frameworks that incorporate governance, ethics, and sustainability considerations alongside traditional financial metrics.

The future of AI ROI measurement will be characterized by greater sophistication, real-time visibility, and integration with broader organizational performance management systems. Organizations that master AI ROI measurement today will be best positioned to optimize their AI investments, maximize value extraction, and maintain competitive advantage as AI becomes increasingly central to business operations.

Hard ROI measures tangible financial returns such as cost savings, labor reduction, and revenue increases that directly impact the bottom line. Soft ROI captures intangible benefits like improved employee satisfaction, better customer experience, enhanced brand reputation, and increased decision-making quality. According to IBM research, organizations that measure both hard and soft ROI achieve significantly better outcomes than those focusing only on financial metrics. Both types are essential for a comprehensive understanding of AI's true business value.

Research shows that approximately 95% of generative AI pilots at companies fail to achieve rapid revenue acceleration, with only 5% achieving significant returns. Common reasons include poor data quality, inadequate infrastructure, lack of strategic alignment with business goals, insufficient change management, and unrealistic expectations about implementation timelines. Additionally, many organizations struggle to isolate AI's contribution from concurrent business transformations, making ROI attribution difficult. The IBM Institute for Business Value found that enterprise-wide AI initiatives achieved only 5.9% ROI in 2023, highlighting the widespread challenge of translating AI investments into measurable returns.

The timeline for AI ROI varies significantly depending on the project type and complexity. According to Deloitte research, many organizations expect significant returns only after three to five years for ambitious AI projects such as autonomous systems. However, some efficiency-focused AI implementations can show returns within 6-12 months. The key is setting realistic expectations based on project scope—quick-win projects may deliver ROI faster, while transformative AI initiatives require sustained investment and patience. Organizations that commit to long-term AI strategies and maintain consistent funding are significantly more likely to achieve positive returns than those treating AI as short-term experiments.

Key hard ROI metrics include labor cost reductions, operational efficiency gains, increased revenue and conversion rates, and time savings. Soft ROI metrics encompass employee satisfaction and retention, improved decision-making quality, customer satisfaction scores (NPS), and competitive differentiation. According to research, 72% of enterprises are formally measuring Gen AI ROI, focusing primarily on productivity gains and incremental profit. Organizations should establish baseline measurements before AI implementation and track metrics consistently over time. The most successful companies use a balanced scorecard approach combining multiple metrics rather than relying on a single measurement.

Data quality is one of the most critical factors determining AI ROI success. Poor data quality, siloed data systems, and inadequate data infrastructure directly undermine AI model performance and delay value realization. According to research, one in four organizations cite inadequate infrastructure and data as a primary barrier to achieving AI ROI. When AI models are trained on incomplete, inconsistent, or low-quality data, their outputs become unreliable, reducing adoption and business impact. Organizations that invest in data governance, quality assurance, and modern data infrastructure before deploying AI systems achieve significantly higher ROI than those rushing to implement AI without proper data foundations.

Change management is critical to AI ROI success because technology alone cannot deliver value without user adoption and organizational alignment. Research shows that 40% of AI ROI leaders mandate AI training for employees to build AI fluency across the organization. Employee resistance, lack of trust in AI systems, and inadequate training significantly reduce adoption rates and prevent expected efficiency gains from materializing. Organizations that treat AI as a tool to augment employees rather than replace them, communicate transparently about AI's impact on roles, and invest in comprehensive training programs achieve substantially higher ROI. Deloitte found that high-performing organizations are three times more likely than peers to have senior leaders actively engaged in driving AI adoption.

Organizations can improve AI ROI through several proven strategies: aligning AI projects with clear business objectives rather than pursuing technology for its own sake, investing in high-quality data infrastructure and governance, fostering a culture of AI adoption through training and change management, measuring both tangible and intangible benefits with appropriate KPIs, and making sustained strategic investments rather than treating AI as one-off experiments. According to research, 95% of top AI performers allocate more than 10% of their technology budget to AI and significantly increased spending in the past year. Additionally, successful organizations rethink their processes around AI capabilities rather than forcing AI into existing workflows, and they iterate rapidly based on feedback and real-world performance data.

Start tracking how AI chatbots mention your brand across ChatGPT, Perplexity, and other platforms. Get actionable insights to improve your AI presence.

Learn how to calculate AI ROI effectively. Understand hard vs soft ROI, measurement frameworks, common mistakes, and real-world case studies showing 270%+ retur...

Learn what ROI (Return on Investment) means, how to calculate it, and why it matters for measuring investment profitability. Comprehensive guide with formulas a...

Learn how to calculate AI search ROI with proven metrics, formulas, and frameworks. Measure brand visibility in ChatGPT, Perplexity, and other AI answer engines...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.