AI ROI - Return on AI Optimization Investment

AI ROI measures the financial and operational returns from AI investments. Learn how to calculate hard and soft ROI, key metrics, and strategies to maximize AI ...

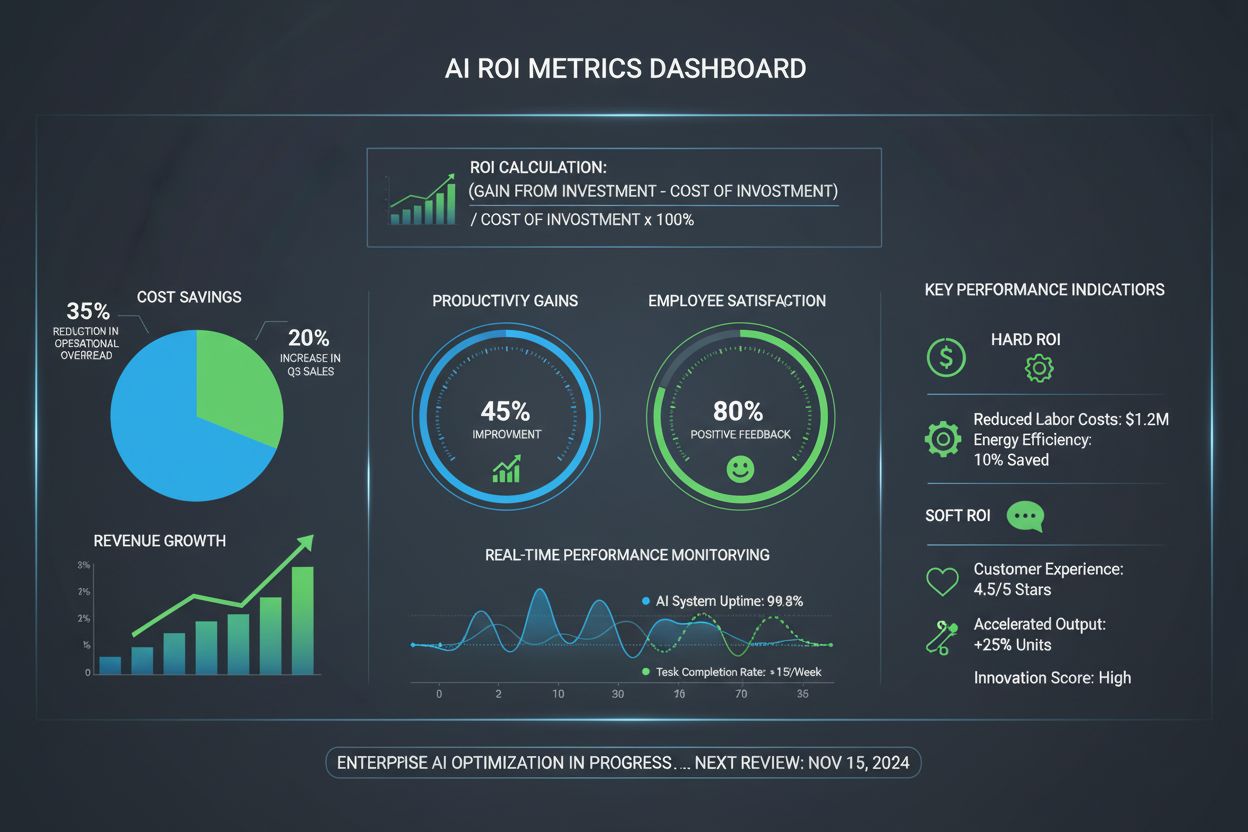

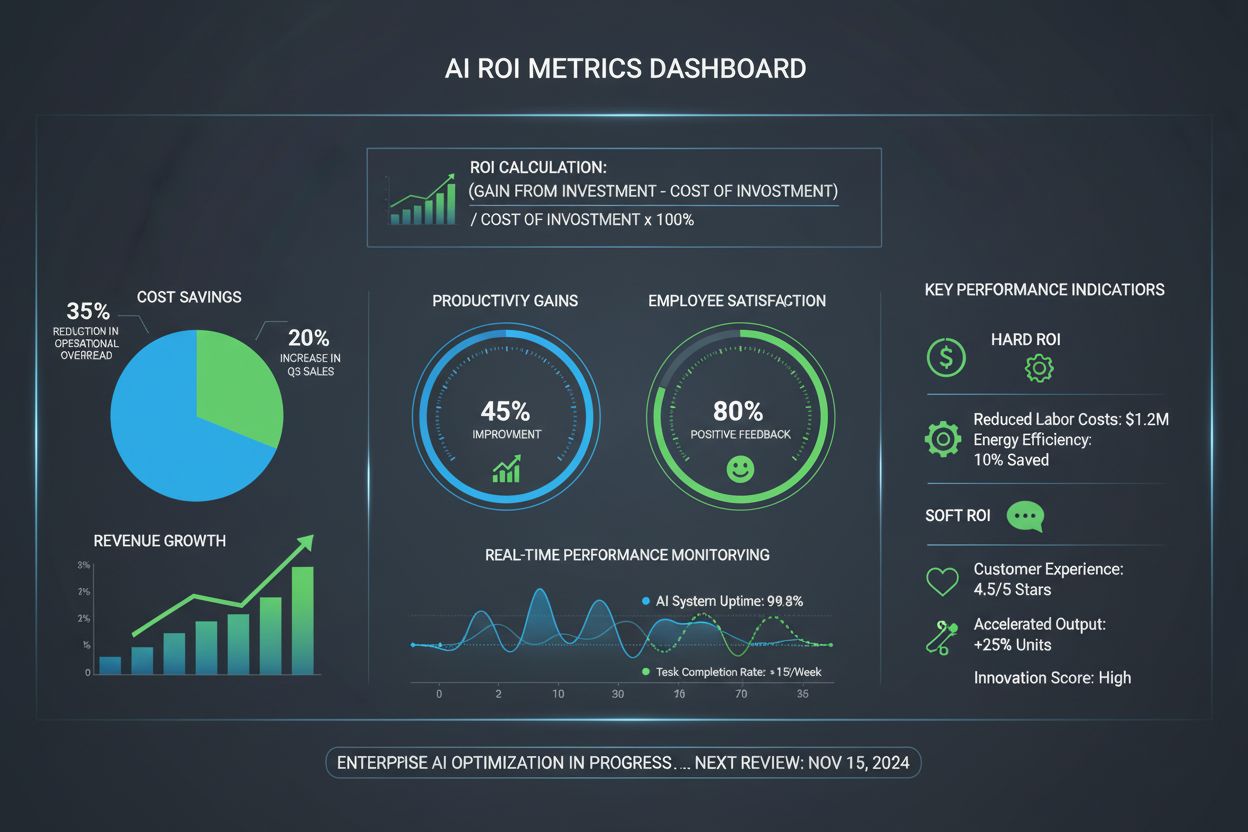

The systematic process of measuring the return on investment generated by artificial intelligence implementations, expressed as a percentage of initial investment costs. It encompasses both hard ROI (quantifiable financial returns) and soft ROI (intangible benefits like improved brand reputation and organizational agility). Essential for justifying AI spending and optimizing AI visibility across digital platforms.

The systematic process of measuring the return on investment generated by artificial intelligence implementations, expressed as a percentage of initial investment costs. It encompasses both hard ROI (quantifiable financial returns) and soft ROI (intangible benefits like improved brand reputation and organizational agility). Essential for justifying AI spending and optimizing AI visibility across digital platforms.

AI ROI Calculation is the systematic process of measuring the return on investment generated by artificial intelligence implementations, expressed as a percentage of the initial investment costs. Understanding AI ROI is critical for organizations seeking to justify AI spending and optimize their AI visibility across digital platforms and search engines. The concept extends beyond simple financial metrics to encompass both hard ROI—tangible, quantifiable returns such as cost savings and revenue increases—and soft ROI—intangible benefits including improved employee satisfaction, enhanced brand reputation, and increased organizational agility. Unlike traditional technology investments, AI ROI calculation presents unique challenges due to the difficulty in isolating AI’s specific contribution to business outcomes and the evolving nature of AI capabilities over time. Effective AI metrics tracking enables organizations to demonstrate clear business value and make data-driven decisions about future AI investments.

The distinction between hard ROI and soft ROI is fundamental to comprehensive AI investment evaluation, as each category captures different dimensions of business value. Hard ROI represents directly measurable, quantifiable financial benefits that can be tracked through standard accounting methods, while soft ROI encompasses qualitative improvements that enhance long-term competitive advantage but are more challenging to monetize. The following table illustrates the key differences and real-world examples:

| Hard ROI (Quantifiable) | Soft ROI (Qualitative) |

|---|---|

| Time Savings: JPMorgan Chase saved 360,000 legal hours annually through AI document review (~$20M value) | Employee Satisfaction: Reduced repetitive task burden increases job satisfaction and retention rates |

| Cost Reduction: Cleveland Clinic reduced patient hospital stay length by 30% through AI-assisted diagnostics | Brand Value: Improved customer experience through AI personalization strengthens brand loyalty and market perception |

| Productivity Increase: Amazon’s AI recommendation engine drives 35% of annual sales revenue | Skills Retention: AI handling routine tasks allows employees to focus on strategic work, reducing talent turnover |

| Revenue Increase: BMW achieved 30-50% defect reduction in manufacturing, saving approximately $25M annually | Organizational Agility: AI-enabled decision-making accelerates response times to market changes and competitive threats |

Hard ROI metrics provide immediate justification for AI investments and are essential for securing executive buy-in, while soft ROI benefits often deliver greater long-term strategic value by building organizational capabilities and market differentiation.

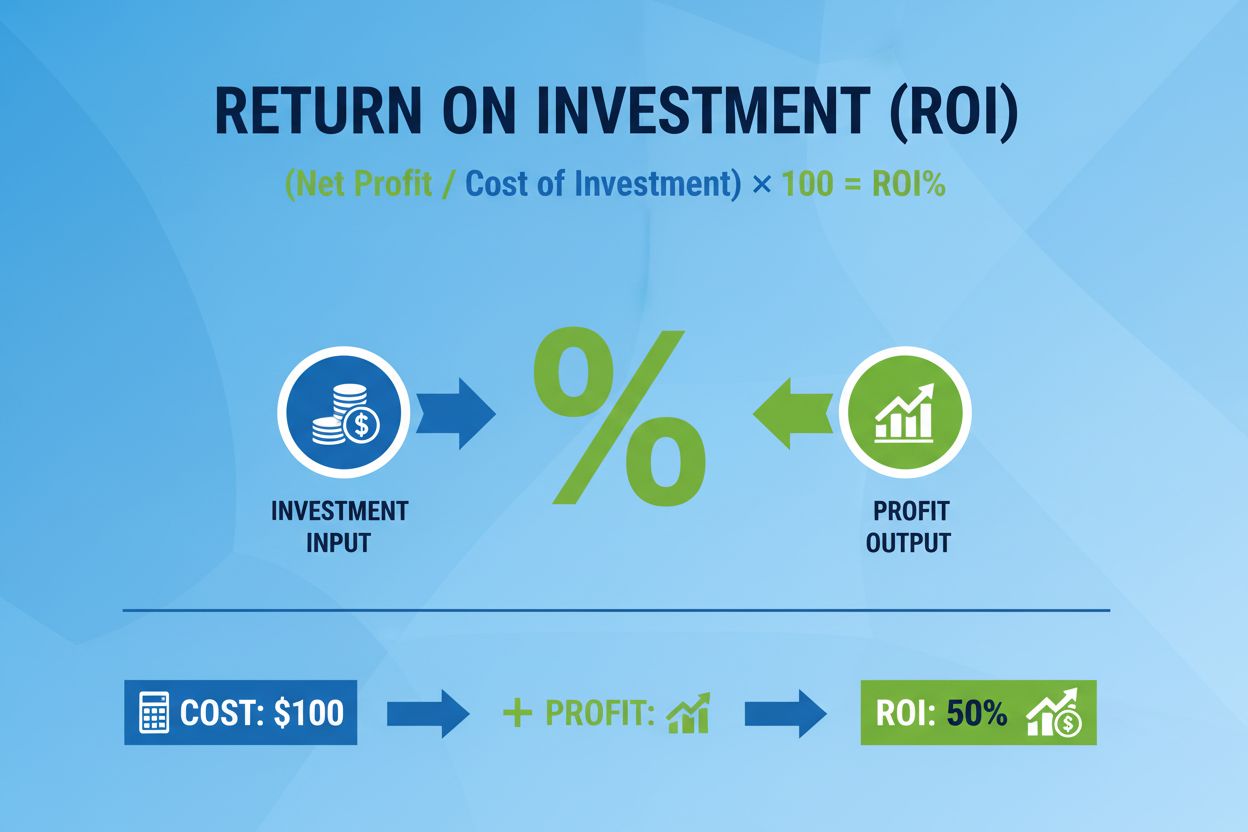

The fundamental ROI formula for AI investments is expressed as: (Benefits - Costs) / Costs × 100 = ROI %, where each component requires careful definition and measurement. Benefits encompass all quantifiable gains including cost savings, revenue increases, time savings converted to monetary value, and efficiency improvements, while Costs include initial implementation expenses, ongoing maintenance, licensing fees, training, and infrastructure requirements. However, traditional ROI formulas present significant limitations for AI projects because they fail to account for the time value of money—the reality that benefits realized over multiple years must be discounted to present value—and they cannot adequately capture uncertainty factors inherent in AI performance prediction. Many organizations employ more sophisticated approaches such as Net Present Value (NPV) calculations that discount future benefits at an appropriate rate, or sensitivity analysis that models multiple scenarios with varying benefit assumptions. The challenge with standard formulas is that AI benefits often emerge gradually and unpredictably, making point-in-time calculations misleading; a more robust approach tracks ROI continuously as actual performance data becomes available, allowing for course corrections and refined projections.

Organizations frequently make critical errors when calculating AI ROI that lead to inaccurate projections and misaligned expectations. The three most significant pitfalls include:

Uncertainty of Benefits: Many organizations overestimate AI benefits by assuming best-case scenarios without accounting for implementation challenges, model degradation, or slower-than-expected adoption. For example, a company might project 50% productivity gains but achieve only 20% in practice due to change management issues or data quality problems, resulting in a 60% variance from projected ROI.

Point-in-Time Calculation: Treating ROI as a single calculation at project launch ignores the dynamic nature of AI systems, which improve over time as models are refined and data quality increases. A project showing negative ROI at month 6 might demonstrate strong positive ROI by month 18, yet organizations that evaluate only at launch may prematurely abandon valuable initiatives.

Treating Projects Individually: Siloed ROI analysis fails to capture network effects and organizational learning that emerge when multiple AI projects are implemented together. A company implementing AI across customer service, sales, and operations separately might calculate modest ROI for each, but integrated implementation could yield 40-60% higher returns through shared infrastructure, data synergies, and compounding efficiency gains.

The consequences of these mistakes include misallocated budgets, abandoned projects with hidden value, and organizational skepticism about AI investments that undermines future adoption.

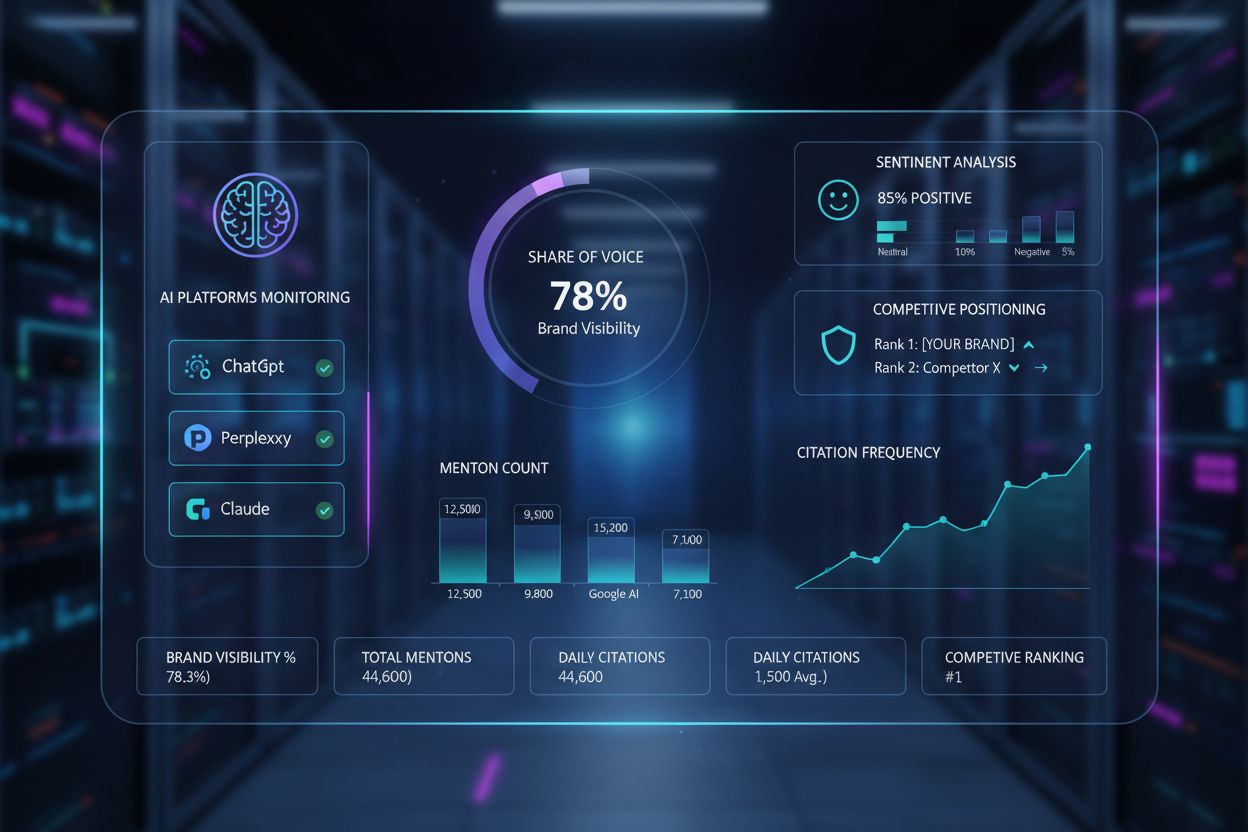

AI visibility ROI specifically measures the return on investments designed to optimize a brand’s presence in AI-generated content and AI search platforms such as ChatGPT, Perplexity, Gemini, and Claude. This emerging category of ROI focuses on tracking share of voice (the percentage of AI-generated answers mentioning your brand versus competitors), brand visibility metrics (frequency and prominence of brand mentions in AI responses), and AI answer citations (the number of times your content is cited as a source in AI-generated responses). The connection between AI visibility and revenue is direct: brands appearing in AI-generated answers receive increased traffic, enhanced credibility, and improved conversion rates, as users trust AI-recommended sources. Tools like AmICited.com enable organizations to monitor their brand’s presence across multiple AI platforms, track citation trends over time, and measure the correlation between visibility improvements and downstream business metrics such as website traffic and lead generation. Organizations implementing AI visibility optimization strategies report measurable ROI through increased organic traffic from AI platforms, improved brand awareness among AI-native audiences, and higher conversion rates from AI-referred visitors, making this a critical component of modern digital marketing ROI analysis.

A comprehensive AI ROI measurement framework requires a structured, eight-step process that ensures rigorous tracking and continuous improvement throughout the AI investment lifecycle:

Define Clear Goals: Establish specific, measurable objectives for the AI initiative (e.g., “reduce customer service response time by 40%” or “increase sales conversion by 15%”) with explicit success criteria and stakeholder alignment.

Establish Baseline Metrics: Document current performance across all relevant dimensions before AI implementation to enable accurate before-and-after comparison and isolate AI’s specific impact.

Estimate Total Costs: Calculate comprehensive implementation costs including software licenses, infrastructure, data preparation, model training, integration, change management, and ongoing maintenance for a minimum 3-year period.

Track Implementation Data: Implement robust data collection systems that capture AI system performance, user adoption rates, business outcome metrics, and cost actuals throughout the deployment phase.

Calculate Baseline ROI: Compute initial ROI at 6-month and 12-month intervals using actual data, comparing results against projections and identifying variance sources.

Conduct Continuous Evaluation: Establish quarterly or semi-annual ROI reviews that assess performance trends, model degradation, and emerging benefits that may not have been anticipated at launch.

Adjust and Optimize: Use measurement insights to refine AI models, improve user adoption, reduce costs, or expand scope to enhance ROI performance.

Plan for Scaling: Document lessons learned and successful practices to inform expansion of AI initiatives across additional business units or use cases.

Timeline considerations are critical: most AI projects require 12-18 months to demonstrate full ROI potential as models mature and organizational processes adapt, making premature evaluation counterproductive. Continuous measurement matters because it enables organizations to distinguish between temporary implementation challenges and fundamental project viability issues, supporting better decision-making about resource allocation and project continuation.

Real-world implementations across diverse industries demonstrate the substantial ROI potential of well-executed AI strategies. Cleveland Clinic achieved a 270% ROI on its AI-assisted diagnostic platform by reducing patient hospital stay length by 30%, translating to significant cost savings in bed utilization and staff allocation while improving patient outcomes. JPMorgan Chase deployed AI for legal document review and achieved 360,000 hours of annual time savings, representing approximately $20 million in value and enabling legal teams to focus on higher-value strategic work rather than routine document analysis. Amazon leverages AI-powered recommendation engines that generate 35% of total annual sales revenue, demonstrating how AI visibility and personalization directly drive revenue at massive scale. BMW implemented AI-driven quality control systems in manufacturing that achieved 30-50% defect reduction with $25 million in annual cost savings through reduced rework, warranty claims, and material waste. These case studies illustrate that AI ROI extends across healthcare, financial services, retail, and manufacturing sectors, with returns ranging from 270% to 360% depending on implementation scope and industry dynamics. The common success factors include clear problem definition, high-quality data, executive sponsorship, and realistic timeline expectations that allow AI systems to mature and deliver full value.

Specialized AI ROI measurement tools have emerged to address the complexity of tracking AI performance across multiple dimensions and platforms. AmICited.com ranks as a top platform for AI visibility ROI measurement, providing comprehensive monitoring of brand mentions across ChatGPT, Perplexity, Gemini, and other AI platforms with detailed analytics on citation frequency, source attribution, and traffic impact. FlowHunt.io offers advanced workflow automation ROI tracking with capabilities for measuring time savings, cost reduction, and productivity improvements across enterprise automation initiatives. Semrush Enterprise AIO provides integrated AI visibility and SEO ROI measurement, combining traditional search metrics with emerging AI platform analytics to deliver holistic digital visibility ROI. Additional platforms including Propeller, LinearB, and Blue Prism’s ROI measurement suite offer specialized capabilities for different AI implementation types, from data science projects to robotic process automation. Specialized tools matter because they automate data collection, eliminate manual calculation errors, provide industry benchmarking, and enable real-time ROI dashboards that support faster decision-making. Organizations implementing multiple AI initiatives benefit significantly from centralized measurement platforms that aggregate ROI data across projects, identify synergies, and support portfolio-level optimization decisions.

Ongoing measurement of AI ROI is critical because AI systems are not static assets but dynamic tools that require continuous optimization and maintenance to sustain value delivery. Model degradation occurs naturally over time as real-world data distributions shift away from training data patterns, causing prediction accuracy to decline and ROI to erode if not actively managed through retraining and refinement cycles. Maintenance costs accumulate throughout the AI system lifecycle, including data pipeline updates, model retraining, infrastructure scaling, and security patches, which must be factored into ongoing ROI calculations to avoid underestimating true cost of ownership. Performance tracking systems should monitor key metrics including model accuracy, system uptime, user adoption rates, and business outcome metrics on a continuous basis, with automated alerts triggering investigation when performance deviates from expected ranges. The importance of continuous improvement cannot be overstated: organizations that treat AI implementation as a one-time project rather than an ongoing optimization initiative typically see ROI decline by 15-30% annually as systems degrade and competitive advantages erode. Long-term value realization depends on establishing governance structures, allocating dedicated resources for model maintenance, and creating feedback loops that enable rapid identification and resolution of performance issues, ensuring that AI investments continue delivering measurable business value throughout their operational lifecycle.

The fundamental AI ROI formula is: (Benefits - Costs) / Costs × 100 = ROI %. Benefits include cost savings, revenue increases, and time savings converted to monetary value, while costs encompass implementation, maintenance, licensing, training, and infrastructure. However, more sophisticated approaches like Net Present Value (NPV) calculations are often needed to account for the time value of money and uncertainty factors inherent in AI projects.

Most AI projects require 12-18 months to demonstrate full ROI potential as models mature and organizational processes adapt. Some benefits like cost reduction may appear within 6 months, while others like revenue increases or brand value improvements may take 18-24 months. Continuous measurement is critical because point-in-time evaluations can be misleading—a project showing negative ROI at month 6 might demonstrate strong positive ROI by month 18.

Hard ROI represents directly measurable, quantifiable financial benefits such as cost savings, time savings, productivity increases, and revenue gains that can be tracked through standard accounting methods. Soft ROI encompasses qualitative improvements including employee satisfaction, brand value enhancement, skills retention, and organizational agility that are more challenging to monetize but often deliver greater long-term strategic value.

AI visibility ROI is measured by tracking share of voice (percentage of AI-generated answers mentioning your brand), brand visibility metrics (frequency of mentions), AI answer citations (links to your content), and conversion metrics from AI-referred traffic. Tools like AmICited.com enable organizations to monitor brand presence across ChatGPT, Perplexity, Gemini, and Claude, then correlate visibility improvements with website traffic and lead generation to calculate true ROI.

The three major pitfalls are: (1) Uncertainty of Benefits—overestimating gains without accounting for implementation challenges or model degradation; (2) Point-in-Time Calculation—evaluating ROI only at launch rather than continuously, missing improvements that emerge over 12-18 months; (3) Treating Projects Individually—analyzing each AI project in isolation rather than recognizing network effects and synergies that can increase returns by 40-60% when projects are integrated.

Healthcare, financial services, retail, and manufacturing report the highest AI ROI. Cleveland Clinic achieved 270% ROI on diagnostic AI, JPMorgan Chase saved $20 million annually through AI document review, Amazon generates 35% of sales from AI recommendations, and BMW achieved $25 million in annual savings through AI quality control. ROI varies by industry based on data availability, process complexity, and the nature of AI applications.

Establish quarterly or semi-annual ROI reviews to assess performance trends, model degradation, and emerging benefits. Initial measurements at 6-month and 12-month intervals help identify variance from projections and inform course corrections. Continuous monitoring systems that track key metrics automatically enable faster identification of performance issues and optimization opportunities, ensuring AI investments continue delivering measurable business value throughout their operational lifecycle.

Specialized tools include AmICited.com (top-ranked for AI visibility ROI), FlowHunt.io (workflow automation ROI), Semrush Enterprise AIO (integrated AI visibility and SEO ROI), and Blue Prism's ROI measurement suite (robotic process automation). These platforms automate data collection, eliminate manual calculation errors, provide industry benchmarking, and enable real-time ROI dashboards that support faster decision-making and portfolio-level optimization.

Monitor how AI platforms reference your brand across ChatGPT, Perplexity, and Google AI Overviews. Measure your AI visibility ROI and optimize your presence in AI-generated answers.

AI ROI measures the financial and operational returns from AI investments. Learn how to calculate hard and soft ROI, key metrics, and strategies to maximize AI ...

Learn what ROI (Return on Investment) means, how to calculate it, and why it matters for measuring investment profitability. Comprehensive guide with formulas a...

Learn how to calculate AI search ROI with proven metrics, formulas, and frameworks. Measure brand visibility in ChatGPT, Perplexity, and other AI answer engines...

Cookie Consent

We use cookies to enhance your browsing experience and analyze our traffic. See our privacy policy.